Phillips 66 Announces New $3 Billion Share Repurchase Program and Quarterly Dividend

October 09 2017 - 8:15AM

Business Wire

The board of directors of Phillips 66 (NYSE: PSX) has approved a

new $3 billion share repurchase program that increases the

company’s total authorization for share repurchases to $12 billion

since the third quarter of 2012. The board also declared a

quarterly dividend of 70 cents per share on Phillips 66 common

stock. The dividend is payable on Dec. 1, 2017, to shareholders of

record as of the close of business on Nov. 17, 2017.

“Returning capital to our shareholders, through a competitive,

secure and growing dividend, reinforced with share repurchases, is

a strategic priority for us,” said Greg Garland, chairman and CEO

of Phillips 66. “We have demonstrated this with seven increases to

our quarterly dividend rate and through our share repurchase

programs. We believe our financial discipline, underpinned by

prudent capital allocation, is fundamental to value creation and

has enabled us to return over $15 billion to shareholders since

2012, through dividends, share repurchases and share

exchanges.”

The total shares repurchased and exchanged to date represent

over 20 percent of the shares outstanding at the formation of the

company. Under the new share repurchase program, shares will be

repurchased from time to time in the open market at the company’s

discretion, subject to market conditions and other factors, and in

accordance with applicable regulatory requirements. The company may

commence, suspend or discontinue purchases of common stock under

this authorization at any time or periodically without prior

notice. Shares of stock repurchased will be held as treasury

shares.

About Phillips 66

Phillips 66 is a diversified energy manufacturing and logistics

company. With a portfolio of Midstream, Chemicals, Refining, and

Marketing and Specialties businesses, the company processes,

transports, stores and markets fuels and products globally.

Phillips 66 Partners, the company's master limited partnership, is

an integral asset in the portfolio. Headquartered in Houston, the

company has 14,600 employees committed to safety and operating

excellence. Phillips 66 had $52 billion of assets as of

June 30, 2017. For more information, visit www.phillips66.com

or follow us on Twitter @Phillips66Co.

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE

"SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This news release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbors

created thereby. Words and phrases such as “is anticipated,” “is

estimated,” “is expected,” “is planned,” “is scheduled,” “is

targeted,” “believes,” “continues,” “intends,” “will,” “would,”

“objectives,” “goals,” “projects,” “efforts,” “strategies” and

similar expressions are used to identify such forward-looking

statements. However, the absence of these words does not mean that

a statement is not forward-looking. Forward-looking statements

relating to Phillips 66’s operations (including joint venture

operations) are based on management’s expectations, estimates and

projections about the company, its interests and the energy

industry in general on the date this news release was prepared.

These statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are

difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in such

forward-looking statements. Factors that could cause actual results

or events to differ materially from those described in the

forward-looking statements include fluctuations in NGL, crude oil,

and natural gas prices, and petrochemical and refining margins;

unexpected changes in costs for constructing, modifying or

operating our facilities; unexpected difficulties in manufacturing,

refining or transporting our products; lack of, or disruptions in,

adequate and reliable transportation for our NGL, crude oil,

natural gas, and refined products; potential liability from

litigation or for remedial actions, including removal and

reclamation obligations under environmental regulations; limited

access to capital or significantly higher cost of capital related

to illiquidity or uncertainty in the domestic or international

financial markets; and other economic, business, competitive and/or

regulatory factors affecting Phillips 66’s businesses generally as

set forth in our filings with the Securities and Exchange

Commission. Phillips 66 is under no obligation (and expressly

disclaims any such obligation) to update or alter its

forward-looking statements, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171009005502/en/

Phillips 66Jeff Dietert, 832-765-2297

(investors)jeff.dietert@p66.comorRosy Zuklic, 832-765-2297

(investors)rosy.zuklic@p66.comorC.W. Mallon, 832-765-2297

(investors)c.w.mallon@p66.comorDennis Nuss, 832-765-1850

(media)dennis.h.nuss@p66.com

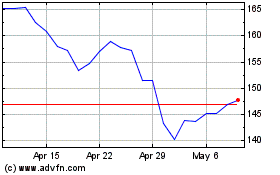

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

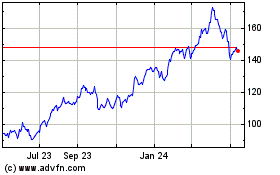

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Apr 2023 to Apr 2024