EZCORP Announces Strategic Acquisition of 112 Pawn Stores in Latin America

October 09 2017 - 7:05AM

EZCORP, Inc. (NASDAQ:EZPW), a leading provider of pawn loans in the

United States and Mexico, today announced its further expansion

into Latin America. The company has acquired GuatePrenda –

MaxiEfectivo (“GPMX”), a business that owns and operates 112 pawn

stores located in Guatemala (72 stores), El Salvador (17 stores),

Honduras (12 stores) and Peru (11 stores). With this acquisition,

EZCORP now has a total of 871 pawn stores, including 513 in the

U.S. and 358 in Latin America.

GPMX was founded in 2002 as a gold jewelry pawn business. After

growing to around 20 stores in Guatemala, it expanded its

operations to El Salvador in 2005 and opened its first stores in

Honduras and Peru in 2009. In 2013, GPMX began offering

general merchandise pawn loans in addition to jewelry loans. GPMX

has almost 700 employees throughout the four countries.

Stuart Grimshaw, EZCORP Chief Executive Officer, stated:

“The GPMX acquisition is our largest pawn acquisition to date in

terms of store count. It significantly expands our store base into

Latin American countries outside of Mexico and will be immediately

accretive to our earnings. With a high-quality management team in

place and the opportunity to implement EZCORP’s systems and best

practices, GPMX provides a platform for significant further growth

in the region.

“The existing GPMX business is very attractive, with an average

per store pawn loan balance higher than our existing stores in

Mexico or the Latin American stores of our major competitor. And we

see opportunities to grow the business through the expansion of

general merchandise pawn loan and retail activities, the opening of

new stores in attractive and under-penetrated markets, and the

pursuit of complementary acquisitions.

“We have been very pleased with the market leading growth we are

delivering in Mexico, and we expect this acquisition to provide

similar opportunities for further growth and earnings accretion in

some very attractive markets.”

EZCORP paid $53.4 million in cash at closing, with an additional

$2.25 million to be paid contingent upon the performance of the

business. At the time of acquisition, GPMX had $6.6 million of

indebtedness owed to affiliates of the seller, and that debt will

be repaid as promptly as practicable after the closing. The

definitive acquisition agreement was entered into on October 4,

2017, and the closing occurred on October 6, 2017.

Additional information about the terms of the transaction can be

found in EZCORP’s Current Report on Form 8-K, which the company

expects to file on October 10, 2017.

CONFERENCE CALL

EZCORP will host a conference call on Monday, October 9, 2017,

at 7:30am Central Time to discuss the acquisition of GPMX announced

today and the restructured notes receivable repayment arrangement

with AlphaCredit announced on October 3, 2017. Analysts and

institutional investors may participate on the conference call by

dialing (833) 231-8256, Conference ID: 96254134, international

dialing (647) 689-4550. The conference call will be webcast

simultaneously to the public through this link:

http://investors.ezcorp.com/. A replay of the conference call will

be available online at http://investors.ezcorp.com/ shortly

after the call.

ABOUT EZCORP

EZCORP is a leading provider of pawn loans in the United States

and Latin America. We also sell merchandise, primarily collateral

forfeited from pawn lending operations and used merchandise

purchased from customers. EZCORP is a member of the Russell

2000 Index, S&P SmallCap 600 Index, S&P 1000 Index and

Nasdaq Composite Index.

FORWARD LOOKING STATEMENTS

This announcement contains certain forward-looking statements

regarding the company’s strategy, initiatives and expected

performance. These statements are based on the company’s current

expectations as to the outcome and timing of future events. All

statements, other than statements of historical facts, including

all statements regarding the company's strategy, initiatives and

future performance, that address activities or results that the

company plans, expects, believes, projects, estimates or

anticipates, will, should or may occur in the future, including

future financial or operating results, are forward-looking

statements. Actual results for future periods may differ materially

from those expressed or implied by these forward-looking statements

due to a number of uncertainties and other factors, including

operating risks, liquidity risks, legislative or regulatory

developments, market factors or current or future litigation. For a

discussion of these and other factors affecting the company’s

business and prospects, see the company’s annual, quarterly and

other reports filed with the Securities and Exchange Commission.

The company undertakes no obligation to update or revise

forward-looking statements to reflect changed assumptions, the

occurrence of unanticipated events or changes to future operating

results over time.

Contact:

Jeff ChristensenVice President, Investor RelationsEmail:

jeff_christensen@ezcorp.comPhone: (512) 437-3545

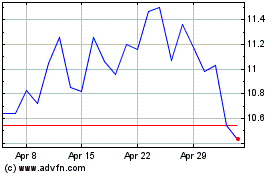

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

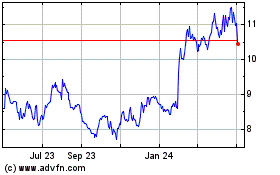

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Apr 2023 to Apr 2024