Filed Pursuant to Rule 424(b)(5)

Registration File No. 333-219932

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of securities to be registered

|

|

Amount

to be

registered

|

|

Maximum

Offering Price

Per Share (1)

|

|

Maximum

Aggregate

Offering Price (1)

|

|

Amount of

registration fee (2)

|

|

Common Stock, par value $0.01 per share

|

|

8,000,000

|

|

$26.40

|

|

$211,200,000

|

|

$26,294.40

|

|

|

|

|

|

(1)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended (the “Securities Act”). The price per share and aggregate

offering price are based on the average of the high and low sale prices reported on the New York Stock Exchange for shares of common stock of the registrant on October 5, 2017.

|

|

(2)

|

Calculated in accordance with Rule 457(r) of the Securities Act.

|

P R O S P E C T U

S S U P P L E M E N T

(To prospectus dated August 11, 2017)

8,000,000 Shares

Matador Resources Company

Common Stock

We are selling

8,000,000 shares of our common stock. The underwriters have agreed to purchase our common stock from us at a price of $26.09 per share, which will result in approximately $208.7 million of proceeds to us (before offering expenses). The underwriters

may offer shares of our common stock from time to time for sale in one or more transactions on the New York Stock Exchange (“NYSE”), in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing

at the time of sale, at prices related to prevailing market prices or at negotiated prices. See “Underwriting.”

Our common

stock is traded on the NYSE under the symbol “MTDR.” On October 4, 2017, the last sale price of our common stock as reported on the NYSE was $27.32 per share.

Investing in our common stock involves a high degree of risk. See “

Risk Factors

” beginning on page

S-4 of this prospectus supplement and on page 1 of the accompanying prospectus.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on October 10, 2017.

Joint Book-Running Managers

BMO Capital Markets

Scotia Howard Weil

The date of this

prospectus supplement is October 4, 2017.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information contained in this prospectus supplement, the accompanying prospectus

and the documents we have incorporated by reference into this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

You should not assume that the information contained in this prospectus supplement or the accompanying prospectus, as well as the information we previously filed with the Securities and Exchange Commission (the “SEC”) that is incorporated

by reference in this prospectus, is accurate as of any date other than its respective date.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement and the information incorporated by reference herein, which, among

other things, describes the specific terms of this offering. The second part is the accompanying prospectus and the information incorporated by reference therein, which, among other things, gives more general information, some of which may not apply

to this offering. Generally, when we refer to this prospectus, we are referring to both this prospectus supplement and the accompanying prospectus. If any information varies between this prospectus supplement and the accompanying prospectus, you

should rely on the information in this prospectus supplement.

Additional information about us, including our financial statements and the

notes thereto, is incorporated in this prospectus by reference to certain of our filings with the SEC. You are urged to read carefully this prospectus and the information incorporated by reference in this prospectus, including the risk factors and

other cautionary statements described under the heading “Risk Factors” included elsewhere in this prospectus and in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2016 before investing in our

common stock. See “Where You Can Find More Information” in this prospectus supplement.

S-ii

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the

public over the Internet at the SEC’s web site at http://www.sec.gov and at our website at http://www.matadorresources.com. You may also read and copy any document we file with the SEC at the SEC’s public reference room at 100 F Street,

NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room and its copy charges.

We are incorporating by reference in this prospectus the information we file with the SEC, which means that we can disclose important

information to you by referring you to those documents. The information incorporated by reference in this prospectus is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede

this information. We incorporate by reference the documents listed below and any future filings made with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (excluding

any information furnished pursuant to Item 2.02 or Item 7.01 on any Current Report on Form 8-K):

|

|

•

|

|

Our Annual Report on Form 10-K for the year ended December 31, 2016, as filed with the SEC on March 1, 2017;

|

|

|

•

|

|

Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2017, as filed with the SEC on May 5, 2017, and June 30, 2017, as filed with the SEC on August 7, 2017;

|

|

|

•

|

|

Our Current Reports on Form 8-K, as filed with the SEC on January 9, 2017, February 21, 2017, February 24, 2017, March 9, 2017, May 4, 2017, June 6, 2017 and

July 19, 2017; and

|

|

|

•

|

|

Description of our capital stock contained in our registration statement on Form 8-A filed with the SEC on January 27, 2012.

|

Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for all purposes to the

extent that a statement contained in this prospectus or in any other subsequently filed document which is also incorporated, or deemed to be incorporated by reference, modifies or supersedes such statement. Any statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You may request a copy of any of the

documents summarized or incorporated by reference in this prospectus, at no cost, by writing or telephoning us at the following address and phone number:

Matador Resources Company Attention: Corporate Secretary One Lincoln Centre 5400 LBJ Freeway, Suite 1500 Dallas, Texas 75240 (972) 371-5200

S-iii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus supplement and the documents incorporated by reference herein constitute “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. Additionally, forward-looking statements may be made orally or in press

releases, conferences, reports, on our website or otherwise, in the future, by us or on our behalf. Such statements are generally identifiable by the terminology used such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecasted,” “hypothetical,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“should” or other similar words, although not all forward-looking statements contain such identifying words.

By their very

nature, forward-looking statements require us to make assumptions that may not materialize or that may not be accurate. Forward-looking statements are subject to known and unknown risks and uncertainties and other factors that may cause actual

results, levels of activity and achievements to differ materially from those expressed or implied by such statements. Such factors include, among others: general economic conditions, changes in oil, natural gas and natural gas liquids prices and the

demand for oil, natural gas and natural gas liquids, the success of our drilling program, the timing and amount of planned capital expenditures, the sufficiency of our cash flow from operations together with available borrowing capacity under our

credit agreement, uncertainties in estimating proved reserves and forecasting production results, operational factors affecting the commencement or maintenance of producing wells, the condition of the capital markets generally, as well as our

ability to access them, the proximity to our properties and capacity of transportation facilities, availability of acquisitions, our ability to integrate acquisitions with our business, weather and environmental conditions, uncertainties regarding

environmental regulations or litigation and other legal or regulatory developments affecting our business, and the other factors discussed below and elsewhere in this prospectus supplement and in other documents that we file with or furnish to the

SEC, all of which are difficult to predict. Forward-looking statements may include statements about:

|

|

•

|

|

our cash flows and liquidity;

|

|

|

•

|

|

our financial strategy, budget, projections and operating results;

|

|

|

•

|

|

our oil and natural gas realized prices;

|

|

|

•

|

|

the timing and amount of future production of oil and natural gas;

|

|

|

•

|

|

the availability of drilling and production equipment;

|

|

|

•

|

|

the availability of oil field labor;

|

|

|

•

|

|

the amount, nature and timing of capital expenditures, including future exploration and development costs;

|

|

|

•

|

|

the availability and terms of capital;

|

|

|

•

|

|

our ability to negotiate and consummate acquisition and divestiture opportunities;

|

|

|

•

|

|

government regulation and taxation of the oil and natural gas industry;

|

|

|

•

|

|

our marketing of oil and natural gas;

|

|

|

•

|

|

our exploitation projects or property acquisitions;

|

|

|

•

|

|

the integration of acquisitions with our business;

|

S-iv

|

|

•

|

|

our ability and the ability of our midstream joint venture to construct and operate midstream facilities, including the expansion of our Black River cryogenic natural gas processing plant and the drilling of additional

salt water disposal wells;

|

|

|

•

|

|

the ability of our midstream joint venture to attract third-party volumes;

|

|

|

•

|

|

our costs of exploiting and developing our properties and conducting other operations;

|

|

|

•

|

|

general economic conditions;

|

|

|

•

|

|

competition in the oil and natural gas industry, including in both the exploration and production and midstream segments;

|

|

|

•

|

|

the effectiveness of our risk management and hedging activities;

|

|

|

•

|

|

environmental liabilities;

|

|

|

•

|

|

counterparty credit risk;

|

|

|

•

|

|

developments in oil-producing and natural gas-producing countries;

|

|

|

•

|

|

our future operating results;

|

|

|

•

|

|

estimated future reserves and the present value thereof;

|

|

|

•

|

|

our plans, objectives, expectations and intentions contained in this prospectus that are not historical; and

|

|

|

•

|

|

other factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2016 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2017 and June 30, 2017.

|

Although we believe that the expectations conveyed by the forward-looking statements are reasonable based on information

available to us on the date such forward-looking statements were made, no assurances can be given as to future results, levels of activity, achievements or financial condition.

You should not place undue reliance on any forward-looking statement and should recognize that the statements are predictions of future

results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described above, as well as others not now

anticipated. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are interdependent upon other factors. The foregoing statements are not exclusive and further information

concerning us, including factors that potentially could materially affect our financial results, may emerge from time to time. We do not intend to update forward-looking statements to reflect actual results or changes in factors or assumptions

affecting such forward-looking statements, except as required by law, including the securities laws of the United States and the rules and regulations of the SEC.

S-v

SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus supplement, the accompanying prospectus and in

the documents incorporated by reference in this prospectus supplement and does not contain all the information you will need in making your investment decision. You should read carefully this entire prospectus supplement, the accompanying prospectus

and the documents incorporated by reference in this prospectus supplement. See “Where You Can Find More Information.”

In

this prospectus supplement, references to “we,” “our” or the “Company” refer to Matador Resources Company and its subsidiaries as a whole (unless the context indicates otherwise) and references to “Matador”

refer solely to Matador Resources Company.

The Company

We are an independent energy company founded in July 2003 and engaged in the exploration, development, production and acquisition of oil and

natural gas resources in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. Our current operations are focused primarily on the oil and liquids-rich portion of the Wolfcamp and Bone Spring plays in the

Delaware Basin in Southeast New Mexico and West Texas. We also operate in the Eagle Ford shale play in South Texas and the Haynesville shale and Cotton Valley plays in Northwest Louisiana and East Texas. Additionally, we conduct midstream

operations, primarily through our midstream joint venture, San Mateo Midstream, LLC (“San Mateo”), in support of our exploration, development and production operations and provide natural gas processing, natural gas, oil and salt water

gathering services and salt water disposal services to third parties on a limited basis.

Recent Developments

Operations Update

At the beginning of

the fourth quarter of 2017, we were operating five drilling rigs that were drilling oil and natural gas wells in the Delaware Basin—one rig was drilling in our Wolf/Jackson Trust asset area in Loving County, Texas, three rigs were drilling in

our Rustler Breaks asset area in Eddy County, New Mexico and one rig was drilling in our Ranger asset area in Lea County, New Mexico. We expect to continue operating these five drilling rigs to drill oil and natural gas wells in the Delaware Basin

for the remainder of 2017 and into 2018. In addition, late in the third quarter of 2017, we elected to have a sixth rig, which had recently finished drilling San Mateo’s second salt water disposal well in the Rustler Breaks asset area, begin

drilling San Mateo’s third salt water disposal well in this asset area. We expect to continue operating this rig to drill two additional salt water disposal wells in the Rustler Breaks asset area, which would bring San Mateo’s salt water

disposal well count in the Rustler Breaks asset area to five by mid-2018. Following the completion of these salt water disposal wells, depending on realized oil and natural gas prices, our oil and natural gas hedging profile and other factors, we

may elect to use this sixth rig to drill additional oil and natural gas wells or release it without penalty.

Although we experienced

minor operational interruptions associated primarily with our central and eastern Eagle Ford operations related to the impact of Hurricane Harvey in South Texas, these interruptions had minimal impact on our overall oil and natural gas operations

and production during the third quarter of 2017. Further, we experienced minimal impact to our primary operations and production in the Delaware Basin resulting from the effects of Hurricane Harvey. As a result of the minimal hurricane impact and

our continued strong operational performance, we anticipate that we will exceed our previously disclosed expectations for total production during the third quarter of 2017.

At October 3, 2017, we had no borrowings outstanding and $0.8 million in outstanding letters of credit pursuant to our revolving credit

facility.

S-1

Recent Acreage Acquisitions and Midstream Development

We have continued to add to and improve our Delaware Basin acreage position throughout 2017. From January 1 through September 30, 2017, we

acquired approximately 27,600 gross (18,200 net) acres of both leasehold and mineral interests in the Delaware Basin in and around our existing acreage positions. These acquisitions include new leasing activities, acquisitions of interests from both

mineral and working interest owners in units that we operate or expect to operate and acreage trades or term assignments with other operators. During the third quarter of 2017, we acquired approximately 5,300 gross (3,400 net) acres in the Delaware

Basin, including approximately 850 net acres of federal leasehold administered by the U.S. Bureau of Land Management (“BLM”). The BLM leases are located near our existing acreage in our Rustler Breaks, Antelope Ridge and Ranger asset

areas, with one of the leases within one of our existing producing units at Rustler Breaks. Each of these BLM leases has a 10-year primary term and a 12.5% royalty interest. From January 1 through September 30, 2017, we have incurred capital

expenditures of approximately $179 million to acquire this additional 18,200 net acres of both leasehold and mineral interests, and associated production, in the Delaware Basin.

As of October 3, 2017, we had entered into agreements to acquire an additional 9,800 gross (6,600 net) acres in the Delaware Basin in and

around our existing acreage positions, subject to customary due diligence and closing conditions (the “Acreage Acquisitions”). When closed, these transactions are expected to bring our total 2017 leasehold and mineral interest acquisitions

in the Delaware Basin to approximately 37,400 gross (24,800 net) acres. We expect to close these pending transactions by mid-November 2017, incurring capital expenditures of approximately $38 million.

Following the closing of these transactions, we expect to hold approximately 201,100 gross (115,700 net) leasehold and mineral acres,

comprised of 112,200 net leasehold acres and 3,500 net mineral acres, in the Delaware Basin, primarily in Lea and Eddy Counties, New Mexico and Loving County, Texas. The distribution of this acreage position among our various asset areas is shown in

the table below.

|

|

|

|

|

|

|

|

|

|

|

Asset Area

|

|

Gross Acres

|

|

|

Net Acres

|

|

|

Ranger (Lea County, NM)

|

|

|

30,100

|

|

|

|

16,500

|

|

|

Arrowhead (Eddy County, NM)

|

|

|

57,200

|

|

|

|

23,500

|

|

|

Rustler Breaks (Eddy County, NM)

|

|

|

40,300

|

|

|

|

21,400

|

|

|

Antelope Ridge (Lea County, NM)

|

|

|

12,100

|

|

|

|

8,900

|

|

|

Wolf and Jackson Trust (Loving County, TX)

|

|

|

13,600

|

|

|

|

9,300

|

|

|

Twin Lakes (Lea County, NM)

|

|

|

46,300

|

|

|

|

34,900

|

|

|

Other

|

|

|

1,500

|

|

|

|

1,200

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

201,100

|

|

|

|

115,700

|

|

|

|

|

|

|

|

|

|

|

|

In addition, San Mateo currently has a number of midstream initiatives in the Delaware Basin that are either

in progress or that it expects to begin by the end of the first quarter of 2018 (the “Midstream Development”). The Midstream Development includes (1) the ongoing expansion of the Black River cryogenic natural gas processing plant to an

inlet capacity of 260 MMcf of natural gas per day, which San Mateo expects to be online in the first quarter of 2018, (2) four additional salt water disposal wells and associated facilities and third-party connections in the Rustler Breaks asset

area and (3) additional buildout of San Mateo’s gathering systems in the Wolf and Rustler Breaks asset areas, primarily consisting of expansion of the oil gathering system in the Wolf asset area and the buildout of an oil gathering system in

the Rustler Breaks asset area. We expect to incur between $60 and $70 million in capital expenditures relating to the Midstream Development, which reflects our 51% share of San Mateo’s capital expenditures relating to the Midstream Development.

Due to the acceleration of certain projects constituting the Midstream Development, we expect to incur approximately $7.5 million of capital expenditures in 2017 in addition to our previously disclosed midstream capital expenditure budget.

S-2

The Offering

|

Issuer

|

Matador Resources Company

|

|

Common Stock Offered

|

8,000,000 shares

|

|

Common Stock to be Outstanding after the Offering

1

|

108,439,595 shares

|

|

Use of Proceeds

|

We expect to receive net proceeds of approximately $208.1 million from this offering, after deducting underwriting discounts and estimated offering expenses. We intend to use the net proceeds from this offering to fund the aggregate purchase

price for the Acreage Acquisitions and the capital expenditures related to the Midstream Development and for general corporate purposes, including to fund a portion of our future capital expenditures. Pending such uses, we intend to invest the funds

in short-term marketable securities. See “Use of Proceeds.”

|

|

Risk Factors

|

Investing in our common stock involves substantial risks. You should carefully consider the risk factors set forth in the section entitled “Risk Factors” and the other information contained in this prospectus supplement and the

accompanying prospectus and the documents incorporated by reference herein, prior to making an investment in our common stock.

|

|

1

|

Based on 100,439,595 shares outstanding as of September 30, 2017, and excludes 3,261,516 shares issuable pursuant to the exercise of outstanding stock options and the vesting and delivery of restricted stock units.

|

S-3

RISK FACTORS

Any investment in our common stock involves a high degree of risk. In addition to the risks described below, you should also carefully read

all of the other information included in this prospectus supplement, the accompanying prospectus and the documents we have incorporated by reference into this prospectus supplement in evaluating an investment in our common stock. See “Where You

Can Find More Information.” If any of the described risks actually were to occur, our business, financial condition, results of operations and cash flows could be materially adversely affected. In that event, the trading price of our common

stock could decline, and you may lose all or part of your investment in our common stock.

The risks described below and

incorporated by reference herein are not the only ones facing the Company. Additional risks not presently known to us or that we currently deem immaterial individually or in the aggregate may also impair our business operations.

This prospectus supplement and documents incorporated by reference herein also contain forward-looking statements that involve risks and

uncertainties, some of which are described in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. Our actual results could differ materially from those anticipated in these forward-looking

statements as a result of various factors, including the risks and uncertainties faced by us described below or incorporated by reference in this prospectus supplement and the accompanying prospectus. See “Cautionary Statement Regarding

Forward-Looking Statements.”

Risks Related to our Common Stock

The price of our common stock has fluctuated substantially and may fluctuate substantially in the future.

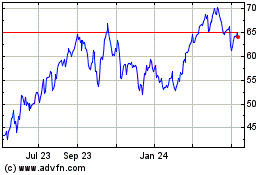

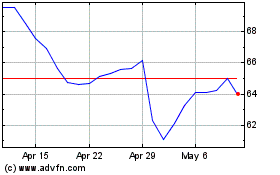

Our stock price has experienced volatility and could vary significantly as a result of a number of factors. Since January 1, 2017, our

stock price has fluctuated between a high of $28.51 and a low of $20.13. In addition, the trading volume of our common stock may continue to fluctuate and cause significant price variations to occur. In the event of a drop in the market price of our

common stock, you could lose a substantial part or all of your investment in our common stock. In addition, the stock markets in general have experienced extreme volatility that has often been unrelated to the operating performance of particular

companies. These broad market fluctuations may adversely affect the trading price of our common stock.

Factors that could affect our

stock price or result in fluctuations in the market price or trading volume of our common stock include:

|

|

•

|

|

our actual or anticipated operating and financial performance and drilling locations, including oil and natural gas reserves estimates;

|

|

|

•

|

|

quarterly variations in the rate of growth of our financial indicators, such as net income per share, net income and cash flows, or those of companies that are perceived to be similar to us;

|

|

|

•

|

|

changes in revenue, cash flows or earnings estimates or publication of reports by equity research analysts;

|

|

|

•

|

|

speculation in the press or investment community;

|

|

|

•

|

|

announcement or consummation of acquisitions or dispositions by us;

|

|

|

•

|

|

public reaction to our press releases, announcements and filings with the SEC;

|

|

|

•

|

|

sales of our common stock by us or shareholders, or the perception that such sales may occur;

|

|

|

•

|

|

general financial market conditions and oil and natural gas industry market conditions, including fluctuations in the price of oil, natural gas and natural gas liquids;

|

S-4

|

|

•

|

|

the realization of any of the risk factors presented in this prospectus supplement or in our Annual Report on Form 10-K for the year ended December 31, 2016;

|

|

|

•

|

|

the recruitment or departure of key personnel;

|

|

|

•

|

|

commencement of or involvement in litigation;

|

|

|

•

|

|

the success of our exploration and development operations, and the marketing of any oil, natural gas and natural gas liquids we produce;

|

|

|

•

|

|

changes in market valuations of companies similar to ours; and

|

|

|

•

|

|

domestic and international economic, legal and regulatory factors unrelated to our performance.

|

If we

fail to maintain effective internal control over financial reporting in the future, our ability to accurately report our financial results could be adversely affected.

As a public company with listed equity securities, we are required to comply with laws, regulations and requirements, certain corporate

governance provisions of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), related regulations of the SEC and the requirements of the NYSE. Complying with these statutes, regulations and requirements is difficult and occupies a

significant amount of time of our board of directors and management and has significantly increased our costs and expenses.

Pursuant to

the Sarbanes-Oxley Act, we are required to maintain internal controls over financial reporting. Our efforts to maintain our internal controls may not be successful, and we may be unable to maintain effective controls over our financial processes and

reporting in the future and comply with the certification and reporting obligations under Sections 302 and 404 of the Sarbanes-Oxley Act. Our management does not expect that our internal controls and disclosure controls will prevent all possible

errors or all fraud. Further, our remediation efforts may not enable us to avoid material weaknesses in the future. Any failure to maintain effective controls could result in material misstatements that are not prevented or detected and corrected on

a timely basis, which could potentially subject us to sanction or investigation by the SEC, the NYSE or other regulatory authorities. Ineffective internal controls could also cause investors to lose confidence in our reported financial information

and adversely affect our business and our stock price.

We do not presently intend to pay any cash dividends on or repurchase any shares of our

common stock.

We do not presently intend to pay any cash dividends on or repurchase any shares of our common stock. Any payment of

future dividends will be at the discretion of our board of directors and will depend on, among other things, our earnings, financial condition, capital requirements, level of indebtedness, statutory and contractual restrictions applicable to the

payment of dividends and other considerations that our board of directors deems relevant. Cash dividend payments in the future may only be made out of legally available funds and, if we experience substantial losses, such funds may not be available.

In addition, certain covenants in our revolving credit facility and the indenture governing our outstanding senior notes may limit our ability to pay dividends or repurchase shares of our common stock. Accordingly, you may have to sell some or all

of your common stock in order to generate cash flow from your investment, and there is no guarantee that the price of our common stock will exceed the price you paid.

Future sales of shares of our common stock by existing shareholders and future offerings of our common stock by us could depress the price of our common

stock.

The market price of our common stock could decline as a result of sales of a large number of shares of our common stock in

the market, including equity or debt securities convertible into common stock, and the perception that these sales could occur may also depress the market price of our common stock. If our existing shareholders sell, or indicate an intent to sell,

substantial amounts of our common stock in the public market, the trading price of our common stock could decline significantly. Sales of our common stock may make it more

S-5

difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate. These sales could also cause our stock price to decrease and make it more difficult for

you to sell shares of our common stock.

We may also sell or issue additional shares of common stock or equity or debt securities

convertible into common stock in public or private offerings or in connection with acquisitions. We cannot predict the size of future issuances of our common stock or convertible securities or the effect, if any, that future issuances and sales of

shares of our common stock or convertible securities would have on the market price of our common stock.

Provisions of our certificate of

formation, bylaws and Texas law may have anti-takeover effects that could prevent a change in control even if it might be beneficial to our shareholders.

Our certificate of formation and bylaws contain certain provisions that may discourage, delay or prevent a merger or acquisition that our

shareholders may consider favorable. These provisions include:

|

|

•

|

|

authorization for our board of directors to issue preferred stock without shareholder approval;

|

|

|

•

|

|

a classified board of directors so that not all members of our board of directors are elected at one time;

|

|

|

•

|

|

the prohibition of cumulative voting in the election of directors; and

|

|

|

•

|

|

a limitation on the ability of shareholders to call special meetings to those owning at least 25% of our outstanding shares of common stock.

|

Provisions of Texas law may also discourage, delay or prevent someone from acquiring or merging with us, which may cause the market price of

our common stock to decline. Under Texas law, a shareholder who beneficially owns more than 20% of our voting stock, or an affiliated shareholder, cannot acquire us for a period of three years from the date this person became an affiliated

shareholder, unless various conditions are met, such as approval of the transaction by our board of directors before this person became an affiliated shareholder or approval of the holders of at least two-thirds of our outstanding voting shares not

beneficially owned by the affiliated shareholder.

Our directors and executive officers own a significant percentage of our common stock, which

could give them influence in corporate transactions and other matters, and the interests of our directors and executive officers could differ from other shareholders.

As of September 30, 2017, our directors and executive officers beneficially owned approximately 11% of our outstanding common stock. These

shareholders could influence or control to some degree the outcome of matters requiring a shareholder vote, including the election of directors, the adoption of any amendment to our certificate of formation or bylaws and the approval of mergers and

other significant corporate transactions. Their influence or control of the Company may have the effect of delaying or preventing a change of control of the Company and may adversely affect the voting and other rights of other shareholders. In

addition, due to their ownership interest in our common stock, our directors and executive officers may be able to remain entrenched in their positions.

Our board of directors can authorize the issuance of preferred stock, which could diminish the rights of holders of our common stock and make a change

of control of the Company more difficult even if it might benefit our shareholders.

Our board of directors is authorized to issue

shares of preferred stock in one or more series and to fix the voting powers, preferences and other rights and limitations of the preferred stock. Accordingly, we may issue shares of preferred stock with a preference over our common stock with

respect to dividends or distributions on liquidation or dissolution, or that may otherwise adversely affect the voting or other rights of the holders of common stock.

S-6

Issuances of preferred stock, depending upon the rights, preferences and designations of the

preferred stock, may have the effect of delaying, deterring or preventing a change of control of the Company, even if that change of control might benefit our shareholders.

S-7

USE OF PROCEEDS

We expect to receive net proceeds of approximately $208.1 million from this offering, after deducting underwriting discounts and estimated

offering expenses. We intend to use the net proceeds from this offering to fund the aggregate purchase price for the Acreage Acquisitions and the capital expenditures related to the Midstream Development and for general corporate purposes, including

to fund a portion of our future capital expenditures. Pending such uses, we intend to invest the funds in short-term marketable securities.

S-8

CAPITALIZATION

The following table sets forth our cash and consolidated capitalization at June 30, 2017:

|

|

•

|

|

on a historical basis; and

|

|

|

•

|

|

on an as adjusted basis, giving effect to the completion of this offering and our application of the estimated net proceeds thereof as described in “Use of Proceeds.”

|

The following table is unaudited and should be read together with “Use of Proceeds,” the discussion under the heading

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Quarterly Report on Form 10-Q for the period ended June 30, 2017 and the related notes thereto included or incorporated by

reference in this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

At June 30, 2017

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

(In thousands, except for shares)

|

|

|

|

|

|

|

|

Cash

(1)

|

|

$

|

131,466

|

|

|

$

|

339,586

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt (including current maturities):

|

|

|

|

|

|

|

|

|

|

Revolving credit facility

(2)

|

|

$

|

—

|

|

|

$

|

—

|

|

|

6.875% Senior Notes due 2023

(3)

|

|

|

575,000

|

|

|

|

575,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total long-term debt:

|

|

|

575,000

|

|

|

|

575,000

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock—$0.01 par value

(4)

|

|

|

1,004

|

|

|

|

1,084

|

|

|

Additional paid-in capital

|

|

|

1,453,341

|

|

|

|

1,661,381

|

|

|

Retained deficit

|

|

|

(563,858

|

)

|

|

|

(563,858

|

)

|

|

Treasury stock, at cost, 74,904 shares

|

|

|

(745

|

)

|

|

|

(745

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Matador Resources Company shareholders’ equity

|

|

$

|

889,742

|

|

|

$

|

1,097,862

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

1,464,742

|

|

|

$

|

1,672,862

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Excludes approximately $15 million of restricted cash held by our less than wholly-owned subsidiaries.

|

|

(2)

|

As of June 30, 2017, the borrowing base under our revolving credit facility was $450 million with an elected borrowing commitment of $400 million. As of October 3, 2017, we had no borrowings and approximately

$0.8 million of letters of credit outstanding under our revolving credit facility, and approximately $399.2 million remained available for additional borrowing.

|

|

(3)

|

Amounts are reflected at principal amount and exclude unamortized debt issuance costs of approximately $6.9 million on $400 million of our 6.875% Senior Notes due 2023 issued on April 14, 2015 and unamortized

issue premium less debt issuance costs of approximately $5.9 million on $175 million of our 6.875% Senior Notes due 2023 issued on December 9, 2016, the remainder of which will be amortized over the life of such notes.

|

|

(4)

|

As of June 30, 2017, we had 160,000,000 shares authorized, 100,399,756 shares issued and 100,324,852 shares outstanding.

|

S-9

PRICE RANGE OF COMMON STOCK

On February 2, 2012, our common stock began trading on the NYSE under the symbol “MTDR.” The following table shows, for the

periods indicated, the high and low reported sale price per share for our common stock, as reported on the NYSE.

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

High

|

|

|

Low

|

|

|

March 31, 2015

|

|

$

|

25.08

|

|

|

$

|

18.28

|

|

|

June 30, 2015

|

|

$

|

29.90

|

|

|

$

|

22.01

|

|

|

September 30, 2015

|

|

$

|

26.07

|

|

|

$

|

19.08

|

|

|

December 31, 2015

|

|

$

|

28.25

|

|

|

$

|

18.87

|

|

|

March 31, 2016

|

|

$

|

20.94

|

|

|

$

|

11.13

|

|

|

June 30, 2016

|

|

$

|

25.54

|

|

|

$

|

18.03

|

|

|

September 30, 2016

|

|

$

|

24.71

|

|

|

$

|

18.56

|

|

|

December 31, 2016

|

|

$

|

27.71

|

|

|

$

|

20.45

|

|

|

March 31, 2017

|

|

$

|

28.51

|

|

|

$

|

21.15

|

|

|

June 30, 2017

|

|

$

|

24.71

|

|

|

$

|

20.13

|

|

|

September 30, 2017

|

|

$

|

27.78

|

|

|

$

|

20.52

|

|

|

December 31, 2017 (through October 4, 2017)

|

|

$

|

27.88

|

|

|

$

|

26.34

|

|

On October 4, 2017, the last sale price of our common stock as reported on the NYSE was $27.32 per share. As

of September 30, 2017, there were approximately 300 holders of record of our common stock.

DIVIDEND

POLICY

We do not anticipate declaring or paying any cash dividends to holders of our common stock in the foreseeable future. We

currently intend to retain future earnings to finance the expansion of our business. Our future dividend policy is within the discretion of our board of directors and will depend upon various factors, including our results of operations, financial

condition, capital requirements and investment opportunities. In addition, certain covenants in our revolving credit facility and the indenture governing our senior notes may limit our ability to pay dividends on our common stock.

S-10

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS FOR

NON-U.S. HOLDERS

The following discussion describes certain material United States federal income tax considerations and, to a

limited extent, United States federal estate tax considerations relating to the purchase, ownership and disposition of our common stock. Except where noted, this summary deals only with common stock that is held as a “capital asset”

(generally, property held for investment) by a non-U.S. holder (as defined below).

A “non-U.S. holder” means a beneficial owner

of our common stock that, for United States federal income tax purposes, is an individual, corporation (or any other entity treated as a corporation for United States federal income tax purposes), estate or trust and is not any of the following:

|

|

•

|

|

an individual citizen or resident of the United States, including without limitation an alien individual who is a lawful permanent resident of the United States or who meets the “substantial presence” test

under Section 7701(b) of the Internal Revenue Code of 1986, as amended, which we refer to as the “Code”;

|

|

|

•

|

|

a corporation (or any other entity treated as a corporation for United States federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

|

|

|

•

|

|

an estate, the income of which is subject to United States federal income taxation regardless of its source; or

|

|

|

•

|

|

a trust if (1) its administration is subject to the primary supervision of a court within the United States and one or more United States persons have the authority to control all substantial decisions of the trust

or (2) it has a valid election in effect under applicable United States Treasury regulations to be treated as a United States person.

|

This summary is based upon provisions of the Code and Treasury regulations, administrative rulings (including published positions of the

Internal Revenue Service (“IRS”)) and judicial decisions, all as in effect on the date of this prospectus supplement. Those authorities are subject to change or differing interpretation, perhaps with retroactive effect, so as to result in

United States federal income and estate tax consequences different from those summarized below. The President has proposed significant changes to U.S. federal income tax laws, and Congress is currently considering these and other tax reform

proposals. As a result, there may be future changes in U.S. federal income tax laws that may have adverse tax consequences on the purchase, ownership and disposition of our common stock and the value of our tax assets and may result in materially

different tax consequences than as described herein. This summary does not address all aspects of United States federal income and estate taxation and does not deal with foreign, state, local, gift or alternative minimum tax or other tax

considerations that may be relevant to non-U.S. holders in light of their personal circumstances. In addition, this summary does not address tax considerations applicable to investors that may be subject to special treatment under the United States

federal income tax laws such as (without limitation):

|

|

•

|

|

United States expatriates and certain former citizens or long-term residents of the United States;

|

|

|

•

|

|

shareholders that hold our common stock as part of a straddle, appreciated financial position, synthetic security, hedge, conversion transaction, constructive sale or other integrated investment, risk reduction

transaction or other arrangement involving more than one position;

|

|

|

•

|

|

shareholders that acquired our common stock through the exercise of employee stock options or otherwise as compensation for services, or through a tax-qualified retirement plan;

|

|

|

•

|

|

shareholders that are partnerships or entities treated as partnerships for United States federal income tax purposes, or other pass-through entities, and owners thereof;

|

|

|

•

|

|

financial institutions and banks;

|

S-11

|

|

•

|

|

persons that hold in excess of 5% of our common stock;

|

|

|

•

|

|

qualified foreign pension funds (or any entities all of the interests of which are held by a qualified foreign pension fund);

|

|

|

•

|

|

“controlled foreign corporations,” “passive foreign investment companies” and corporations that accumulate earnings to avoid United States federal income tax;

|

|

|

•

|

|

real estate investment trusts and regulated investment companies;

|

|

|

•

|

|

tax-exempt entities or other tax-deferred accounts;

|

|

|

•

|

|

governmental organizations;

|

|

|

•

|

|

broker-dealers or dealers in securities or foreign currencies;

|

|

|

•

|

|

traders in securities that use the mark-to-market method of accounting for United States federal income tax purposes; and

|

|

|

•

|

|

shareholders who hold shares of our common stock other than as a capital asset within the meaning of Section 1221 of the Code.

|

If a partnership (including an entity or arrangement treated as a partnership for United States federal income tax purposes) holds our common

stock, the tax treatment of a partner generally will depend upon the status of the partner and the activities of the partnership. If you are a partner of a partnership (including an entity or arrangement treated as a partnership for United States

federal income tax purposes) holding our common stock, you should consult your tax advisor regarding the United States federal income tax consequences of the purchase, ownership and disposition of our common stock by such partnership.

Moreover, this discussion does not address any aspect of non-income taxation (except to a limited extent under the heading “U.S. Federal

Estate Tax” below), any state, local or non-U.S. taxation or the effect of any tax treaty. No ruling has or will be obtained from the IRS regarding any U.S. federal tax consequences relating to the purchase, ownership or disposition of shares

of our common stock. As a result, no assurance can be given that the IRS will not assert, or that a court will not sustain, a position contrary to the conclusions set forth below. We have not sought, nor will we seek, any ruling from the IRS with

respect to the statements made and the conclusions reached in the following summary, and there can be no assurance that the IRS or a court will agree with such statements and conclusions.

THIS DISCUSSION IS NOT A SUBSTITUTE FOR AN INDIVIDUAL ANALYSIS OF THE TAX CONSEQUENCES RELATING TO AN INVESTMENT IN SHARES OF OUR COMMON

STOCK. INVESTORS CONSIDERING THE PURCHASE OF OUR COMMON STOCK SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE UNITED STATES FEDERAL INCOME AND ESTATE TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES

ARISING UNDER THE UNITED STATES FEDERAL GIFT TAX LAWS OR THE LAWS OF ANY STATE, LOCAL OR FOREIGN TAXING JURISDICTION OR ANY APPLICABLE TAX TREATY.

Distributions

We do not anticipate

declaring or paying any cash dividends to holders of our common stock in the foreseeable future. However, if we do make distributions on our common stock, such distributions will generally be treated as dividends for United States federal income tax

purposes to the extent paid from our current or accumulated earnings and profits, as determined under the Code. To the extent such distributions exceed our current and accumulated earnings and profits, such excess will constitute a return of capital

and will first reduce the non-U.S. holder’s adjusted tax basis in our common stock, but not below zero, and then will be treated as gain from the sale of our common stock (see “Gain on Disposition of Common Stock” below). Except as

S-12

described in the discussion below under the headings “Information Reporting and Backup Withholding” and “Foreign Account Tax Compliance,” dividends paid in respect of shares

of our common stock to a non-U.S. holder generally will be subject to withholding of United States federal income tax at a rate of 30%, or such lower rate as may be specified under an applicable income tax treaty. In order to receive a reduced

treaty rate, a non-U.S. holder must provide the applicable withholding agent with IRS Form W-8BEN or IRS

Form W-8BEN-E

(or applicable successor form) properly

certifying eligibility for the reduced rate.

Dividends paid to a non-U.S. holder that are effectively connected with the conduct of a

trade or business by the non-U.S. holder in the United States (and, if required by an applicable income tax treaty, are attributable to a United States permanent establishment or fixed base of the non-U.S. holder) generally will be exempt from the

withholding tax described above (provided that certain certification requirements described below are satisfied) and instead will be subject to United States federal income tax on a net income basis at the regular graduated United States federal

income tax rates in the same manner as if the non-U.S. holder were a United States person as defined under the Code. In order to obtain this exemption from withholding tax, a non-U.S. holder must provide the applicable withholding agent with an IRS

Form W-8ECI (or applicable successor form) properly certifying eligibility for such exemption. Any such effectively connected dividends received by a foreign corporation may be subject to an additional “branch profits tax” at a rate of 30%

or such lower rate as may be specified by an applicable income tax treaty.

A non-U.S. holder of our common stock may obtain a refund of

any amounts withheld under these rules in excess of the non-U.S. holder’s actual U.S. federal income tax liability (e.g., if the non-U.S. holder is eligible for a reduced rate of United States tax under an applicable income tax treaty) if an

appropriate claim for refund is timely filed with the IRS.

Gain on Disposition of Common Stock

Subject to the discussions below under “Information Reporting and Backup Withholding” and “Foreign Account Tax Compliance,”

a non-U.S. holder generally will not be subject to United States federal income tax on any gain realized upon the sale, exchange or other taxable disposition of shares of our common stock unless:

|

|

•

|

|

the gain is effectively connected with the conduct of a trade or business by the non-U.S. holder in the United States (and, if required by an applicable income tax treaty, is attributable to a United States permanent

establishment or fixed base of the non-U.S. holder);

|

|

|

•

|

|

the non-U.S. holder is an individual who is present in the United States for 183 days or more in the taxable year of that disposition, and certain other conditions are met; or

|

|

|

•

|

|

our common stock constitutes a “United States real property interest” by reason of our status as a “United States real property holding corporation” (“USRPHC”) for United States federal

income tax purposes at any time within the shorter of the five-year period ending on the date of the disposition or the non-U.S. holder’s holding period for shares of our common stock.

|

A non-U.S. holder who has gain that is described in the first bullet point immediately above will generally be subject to tax on the net gain

derived from the disposition at graduated United States federal income tax rates generally applicable to U.S. persons. If the non-U.S. Holder is taxable as a corporation for U.S. federal income tax purposes, such gain will be included in effectively

connected earnings and profits, which (after adjustment for certain items) may be subject to a branch profits tax at a rate of 30% (or such lower rate as is specified by an applicable tax treaty).

A non-U.S. holder who meets the requirements described in the second bullet point immediately above will be subject to a flat 30% tax (or

lower applicable income tax treaty rate) on the gain derived from the disposition, which may be offset by United States source capital losses, even though the individual is not considered a resident of the United States.

S-13

With respect to our status as a USRPHC, we believe that we currently are, and expect to remain

for the foreseeable future, a USRPHC for United States federal income tax purposes (and the remainder of this discussion assumes we are and will be a USRPHC). However, as long as our common stock is “regularly traded on an established

securities market,” a non-U.S. holder will be taxed on gain recognized on the sale, exchange or other taxable disposition of our common stock as a result of our status as a USRPHC only if the non-U.S. holder actually or constructively holds or

held more than 5% of our issued and outstanding common stock at any time during the five-year period ending on the date of disposition or, if shorter, during the entire period the non-U.S. holder has held our common stock. If our common stock were

not considered to be regularly traded on an established securities market, all non-U.S. holders would be subject to United States federal income tax on a sale, exchange or other taxable disposition of our common stock at the rates generally

applicable to U.S. persons, and a 15% withholding tax would apply to the gross proceeds from the sale of our common stock by a non-U.S. holder.

Non-U.S. holders should consult their tax advisors with respect to the application of the foregoing rules to their ownership and disposition

of our common stock.

U.S. Federal Estate Tax

An individual non-U.S. holder who is treated as the owner of, or has made certain lifetime transfers of, an interest in our common stock may be

required to include the value of the stock in the individual’s gross estate for United States federal estate tax purposes and may be subject to United States federal estate tax unless an applicable estate tax treaty provides otherwise.

Information Reporting and Backup Withholding

Generally, we must report to the IRS and to each non-U.S. holder the amount of any dividends paid to such non-U.S. holder and any tax withheld

with respect to such dividends, regardless of whether withholding was required. Copies of the information returns reporting such dividends and withholding also may be made available to the tax authorities in the country in which the non-U.S. holder

resides under the provisions of an applicable tax treaty.

A non-U.S. holder may be subject to backup withholding for dividends paid to

such holder unless such holder certifies on IRS Form W-8BEN, W-8BEN-E or W-8ECI (or another appropriate form) that it is a non-U.S. holder (and the payor does not have actual knowledge or reason to know that such holder is a United States person as

defined under the Code), or such holder otherwise establishes an exemption.

Information reporting and, depending on the circumstances,

backup withholding may apply to the proceeds of a sale of shares of our common stock by a non-U.S. holder within the United States or conducted through certain United States-related financial intermediaries, unless the beneficial owner certifies on

IRS

Form W-8BEN,

W-8BEN-E or W-8ECI (or another appropriate form) that it is a non-U.S. holder (and the withholding agent does not have actual knowledge or reason to know that the beneficial owner is a

United States person as defined under the Code), or such owner otherwise establishes an exemption.

Backup withholding is not an

additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a non-U.S. holder’s United States federal income tax liability provided the required information is timely furnished to the

IRS.

Foreign Account Tax Compliance

Sections 1471 through 1474 of the Code, and the U.S. Treasury regulations and administrative guidance issued thereunder (such Sections commonly

referred to as the Foreign Account Tax Compliance Act (“FATCA”)), impose a 30% withholding tax on any dividends paid on our common stock and on the gross

S-14

proceeds from a disposition of our common stock (if such disposition occurs after December 31, 2018), in each case if paid to a “foreign financial institution” or a

“non-financial foreign entity” (each as defined in the Code) (including, in some cases, when such foreign financial institution or entity is acting as an intermediary), unless (i) in the case of a foreign financial institution, such

institution enters into an agreement with the United States government to withhold on certain payments, and to collect and provide to the United States tax authorities substantial information regarding United States account holders of such

institution (which includes certain equity and debt holders of such institution, as well as certain account holders that are non-U.S. entities with United States owners), (ii) in the case of a non-financial foreign entity, such entity certifies

that it does not have any “substantial United States owners” (as defined in the Code) or provides the applicable withholding agent with a certification (generally on an IRS Form W-8BEN-E) identifying the direct and indirect substantial

United States owners of the entity, or (iii) the foreign financial institution or nonfinancial foreign entity otherwise qualifies for an exemption from these rules and provides appropriate documentation (such as an IRS Form W-8BEN-E). Under

certain circumstances, a holder of our common stock might be eligible for refunds or credits of such taxes. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing these

rules may be subject to different rules.

The rules under FATCA are complex. Prospective investors are encouraged to consult their tax

advisors regarding the possible implications of FATCA on an investment in our common stock.

THE FOREGOING DISCUSSION IS FOR GENERAL

INFORMATION ONLY AND SHOULD NOT BE VIEWED AS TAX ADVICE. INVESTORS CONSIDERING THE PURCHASE OF OUR COMMON STOCK ARE URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF THE UNITED STATES FEDERAL INCOME AND ESTATE TAX LAWS TO THEIR

PARTICULAR SITUATIONS AND THE APPLICABILITY AND EFFECT OF UNITED STATES FEDERAL GIFT TAX LAWS, STATE, LOCAL OR FOREIGN TAX LAWS AND TREATIES.

Certain ERISA Considerations

The common

stock may be purchased and held by an employee benefit plan, an individual retirement account or other plan, which we refer to as a “Plan,” subject to Title I of the Employee Retirement Income Security Act of 1974, as amended, which we

refer to as “ERISA,” Section 4975 of the Code and/or other similar laws. A fiduciary of a Plan subject to ERISA, Section 4975 of the Code and/or such other laws must determine that the purchase and holding of the common stock is

consistent with its fiduciary duties. The fiduciary of a Plan subject to ERISA, as well as any other prospective investor subject to Section 4975 of the Code or any similar law, must also determine that its purchase and holding of the common

stock does not result in a non-exempt prohibited transaction as provided under Sections 406 and 408 of ERISA or Section 4975 of the Code or similar law. Each purchaser and transferee of the common stock who is subject to ERISA,

Section 4975 of the Code and/ or a similar law will be deemed to have represented by its acquisition and holding of the common stock that such acquisition and holding does not constitute or give rise to a non-exempt prohibited transaction under

ERISA, Section 4975 of the Code or any similar law.

S-15

UNDERWRITING

BMO Capital Markets Corp. is acting as the representative of the underwriters named below. Under the terms of an underwriting agreement, which

we will file as an exhibit to our current report on Form 8-K and incorporate by reference in this prospectus supplement and the accompanying base prospectus, each of the underwriters named below has severally agreed to purchase from us the shares of

our common stock shown opposite its name below.

|

|

|

|

|

|

|

Underwriter

|

|

Shares of

Common Stock

|

|

|

BMO Capital Markets Corp.

|

|

|

7,200,000

|

|

|

Scotia Capital (USA) Inc.

|

|

|

800,000

|

|

|

|

|

|

|

|

|

Total

|

|

|

8,000,000

|

|

|

|

|

|

|

|

The underwriting agreement provides that the obligations of the underwriters to purchase the shares included

in this offering are subject to approval of legal matters by counsel and to other conditions.

Discounts and Expenses

The underwriters propose to offer the shares of common stock offered hereby from time to time for sale in one or more transactions on the New

York Stock Exchange, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices, subject to receipt of

acceptance by it and subject to its right to reject any order in whole or in part. The underwriters may effect such transactions by selling the shares to or through dealers and such dealers may receive compensation in the form of discounts,

concessions or commissions from the underwriters and/or purchasers of shares for whom they may act as agents or to whom they may sell as principal. The difference between the price at which the underwriters purchase shares and the price at which the

underwriters resell such shares may be deemed underwriting compensation.

The expenses of this offering that are payable by us are

estimated to be $0.6 million, exclusive of underwriting discounts. We have also agreed to reimburse the underwriters for certain of their expenses in an amount up to $10,000 as set forth in the underwriting agreement.

Lock-Up Agreements

We, our executive

officers and our directors are subject to lock-up agreements with the underwriters, that prohibit during the period ending 60 days after the date of the final prospectus related to this offering (the “lockup period”):

|

|

•

|

|

directly or indirectly, selling, offering, contracting or granting any option to sell or short sell, granting any option, right or warrant to purchase, pledging, transferring, establishing an open “put equivalent

position,” lending or otherwise disposing of any shares of our common stock, options, rights or warrants to acquire shares of our common stock, or securities exchangeable or exercisable for or convertible into shares of our common stock;

|

|

|

•

|

|

entering into any swap or other arrangement that transfers, in whole or in part, the economic consequences of the ownership of our common stock;

|

|

|

•

|

|

filing a registration statement with respect to our common stock, options or warrants to acquire our common stock or securities exchangeable or exercisable for or convertible into our common stock; or

|

|

|

•

|

|

publicly announcing an intention to do any of the foregoing.

|

S-16

These agreements also apply to any sale of locked up shares upon exercise of any options to

purchase shares of common stock and are subject to certain exceptions, including:

|

|

•

|

|

sales of common stock to the underwriters in this offering;

|

|

|

•

|

|

the award of options or other purchase rights or shares of our common stock pursuant to our employee benefits plans;

|

|

|

•

|

|

issuances of shares of common stock or securities convertible into or exercisable or exchangeable for shares of common stock pursuant to the exercise of warrants, options or other convertible or exchangeable securities,

including shares of convertible preferred stock, in each case which are outstanding on the date hereof; and

|

|

|

•

|

|

filing with the SEC a registration statement under the Securities Act on Form S-8 with respect to securities issued pursuant to an employee benefit plan.

|

Notwithstanding the foregoing, our executive officers and directors will be permitted to:

|

|

•

|

|

abide by any obligations regarding shares of common stock or any security convertible into common stock under any existing pledge, margin account or similar agreement, including, but not limited to, sales and transfers

of such securities;

|

|

|

•

|

|

transfer shares of common stock or any security convertible into common stock as a bona fide gift;

|

|

|

•

|

|

transfer shares of common stock or any security convertible into common stock to family members or a trust established for the benefit of family members;

|

|

|

•

|

|

transfer shares of common stock or any security convertible into common stock to entities where the party to the lockup is the beneficial owner of all shares of common stock or our other securities held by the entity;

|

|

|

•

|

|

receive shares of common stock upon the exercise of an option or warrant or in connection with the vesting of restricted stock or restricted stock units; and

|

|

|

•

|

|

transfer shares of common stock to the Company in a transaction exempt from Section 16(b) of the Exchange Act solely in connection with the payment of taxes due in connection with any such exercise or vesting.

|

It is a pre-condition to any such permitted transfer that the transferee executes and delivers to the representative a

lock-up agreement in form and substance similar to the transferor’s agreement with the representative.

The representative may

consent in its sole discretion to a release of the transfer restrictions in the lock-up agreements. When determining whether or not to release shares of common stock from lock-up agreements, the representative will consider, among other factors, the

shareholders’ reasons for requesting the release, the number of shares of common stock for which the release is being requested and market conditions at the time. However, the representative has informed us that, as of the date of this

prospectus, there are no agreements between it and any party that would allow such party to transfer any shares of common stock, nor does it have any intention at this time of releasing any of the shares of common stock subject to the lock-up

agreements, prior to the expiration of the lock-up period.

We have agreed not to file any registration statement with respect to our

common stock or other equity securities (other than on Form S-8 as described above), and our directors, officers and other holders of our equity securities will waive all registration rights with respect to this offering.

S-17

Indemnification

We have agreed to indemnify the underwriters against liabilities under the Securities Act, or contribute to payments that the underwriters may

be required to make in that respect.

Listing

Our common stock is listed on the New York Stock Exchange under the symbol “MTDR.”

Stabilization

In connection with this

offering, the underwriters may engage in stabilizing transactions, short sales, syndicate covering transactions and penalty bids in accordance with Regulation M under the Exchange Act.

|

|

•

|

|

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum.

|

|

|

•

|

|

Short sales involve sales by an underwriter of our common stock in excess of the number of shares of common stock such underwriter is obligated to purchase, which creates a syndicate short position. The short position

may be either a covered short position or a naked short position. In a covered short position, the number of shares of common stock over-allotted by an underwriter is not greater than the number of shares of common stock it may purchase in its

option to purchase additional shares. In a naked short position, the number of shares of common stock involved is greater than the number of shares of common stock in an underwriter’s option to purchase additional shares. The underwriters may

close out any short position by either exercising their option and/or purchasing common stock in the open market.

|

|

|

•

|

|

Syndicate covering transactions involve purchases of shares of our common stock in the open market after the distribution has been completed in order to cover syndicate short positions. In determining the source of

common stock to close out the short position, the underwriters will consider, among other things, the price of our common stock available for purchase in the open market as compared to the price at which it may purchase shares of our common stock

through its option. If the underwriters sell more shares of our common stock than could be covered by its option to purchase additional shares, which we refer to in this prospectus as a naked short position, the position can only be closed out by

buying shares of our common stock in the open market. A naked short position is more likely to be created if the underwriters are concerned that there could be downward pressure on the price of our common stock in the open market after pricing that