Current Report Filing (8-k)

October 05 2017 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 2, 2017

Potbelly Corporation

(Exact name of registrant as specified in its charter)

Commission

File Number:

001-36104

|

|

|

|

|

Delaware

|

|

36-4466837

|

|

(State or other jurisdiction

of incorporation)

|

|

(IRS Employer

Identification No.)

|

111 N. Canal Street, Suite 850

Chicago, Illinois 60606

(Address of principal executive offices, including zip code)

(312)

951-0600

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicated by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of

the Securities Exchange Act of

1934 (§240.12b-2 of

this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On October 2, 2017, Potbelly

Corporation (the “Company”) entered into a settlement agreement (the “Settlement Agreement”) with Ancora Advisors, LLC, Ancora Catalyst Fund LP, Merlin Partners LP and Frederick DiSanto (collectively, the “Ancora

Parties”).

Under the Settlement Agreement, the Company agreed to appoint Joseph Boehm to its Board of Directors until the

Company’s 2018 Annual Meeting of Stockholders (the “2018 Annual Meeting”) and to include Mr. Boehm (or his replacement, selected in accordance with the Settlement Agreement) in the Company’s slate of nominees for election at

the 2018 Annual Meeting. In accordance with the Settlement Agreement, the Ancora Parties have agreed to cause the resignation of Mr. Boehm from the Company’s Board in the event the Ancora Parties’ ownership of the Company’s

outstanding common stock falls below 3%.

The Settlement Agreement is effective until the later of thirty calendar days prior to the last

day of the advance notice deadline set forth in the Company’s

by-laws

for the 2019 Annual Meeting of Stockholders (the “2019 Annual Meeting”) or thirty calendar days following the last day that

Mr. Boehm (or any replacement) remains on the Board (the “Standstill Period”). During the Standstill Period, the Ancora Parties have agreed to not, among other things, acquire additional shares of the Company’s common stock if

they would then beneficially own more than 9.9% of the Company’s common stock, participate in any solicitation of proxies that is inconsistent with Company’s recommendations or proposals, propose or participate in any change of control of

the Company (though the Ancora Parties would be allowed to sell or tender their shares and otherwise receive consideration, pursuant to any such transaction and to vote on any transaction in their sole discretion), present any stockholder proposal

at a stockholder meeting or institute or participate in any litigation against Company or any of its current or former directors or officers.

The foregoing description of the Settlement Agreement is qualified in its entirety by reference to the full text of the Settlement Agreement,

which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On October 3, 2017, the Company’s Board of Directors increased the size of the Board to eight members and appointed Mr. Joseph

Boehm, 31, to its Board of Directors in connection with the Settlement Agreement described above in Item 1.01. Mr. Boehm will serve an initial term until the 2018 Annual Meeting. Mr. Boehm was also appointed to the Company’s

Nominating and Corporate Governance Committee and Strategic Review Committee. Mr. Boehm is currently the Director, Alternatives Portfolio Manager of Ancora Advisors LLC.

Since the beginning of the last fiscal year, there have been no related party transactions between the Company and Mr. Boehm that would

be reportable under Item 404(a) of Regulation

S-K.

Mr. Boehm will receive compensation as a

non-employee

director under the Company’s director compensation

plan. The Director Compensation Plan is filed as Exhibit 10.1 to the Company’s Current Report on Form

8-K,

filed with the Securities and Exchange Commission on August 11, 2017. Mr. Boehm will be

indemnified by the Company pursuant to the Company’s Seventh Amended and Restated Certificate of Incorporation and Amended and Restated

By-laws

for actions associated with being a director. In addition,

the Company will enter into an indemnification agreement with Mr. Boehm, which provides for indemnification to the fullest extent permitted under Delaware law. The indemnification agreement is substantially identical to the form of agreement

filed as Exhibit 10.17 to the Company’s Form

S-1

(File

No. 333-190893)

filed August 29, 2013.

On October 5, 2017, the Company released a press release announcing the matters addressed above. A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: October 5, 2017

|

|

|

|

Potbelly Corporation

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Michael Coyne

|

|

|

|

|

|

Name:

|

|

Michael Coyne

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer and Interim Chief Executive Officer

|

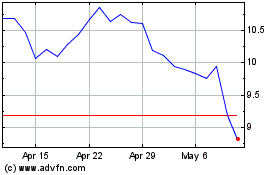

Potbelly (NASDAQ:PBPB)

Historical Stock Chart

From Mar 2024 to Apr 2024

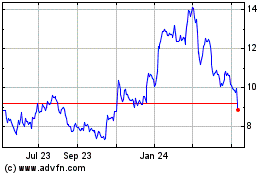

Potbelly (NASDAQ:PBPB)

Historical Stock Chart

From Apr 2023 to Apr 2024