TCI Subsidiary, Southern Properties Capital, Reports Significant Progress on its Windmill Farms Development

October 05 2017 - 8:00AM

Business Wire

Southern Properties Capital (SPC), a subsidiary of

Transcontinental Realty Investors Inc., (NYSE: TCI) a

Dallas-based real estate investment company, announced today

several recent successes at its Windmill Farms property.

This press release features multimedia. View

the full release here:

http://www.businesswire.com/news/home/20171005005210/en/

The entrance to Southern Properties

Capital’s owned and developed Windmill Farms in Forney, Texas

(Photo: Business Wire)

Windmill Farms is a gorgeous master-planned community east of

Dallas, in Forney, Texas. Located just past I-635, off Hwy 80, this

family-friendly setting is conveniently located near all the fine

dining, shopping, and entertainment that the heart of Dallas has to

offer. This neighborhood also rewards homeowners with endless

amenities including expansive swimming pools, playgrounds, ponds,

picnic areas, and highly acclaimed schools. Windmill Farms combines

the excitement of Dallas and the small-town relaxed feel of

Forney.

Southern Properties recently sold its newest completed 148 lot

subdivision to LGI Homes and Oakdale Homes. Utility installation is

also underway for another 175 lot subdivision sold to LGI Homes,

Oakdale Homes, and Megatel Homes, all based in Texas. To

accommodate this new development, SPC has completed an expansion of

the community’s sanitary plant that exceeds all proposed new

environmental standards. Design plans for an additional community

center with a swimming pool and public meeting space are almost

completed. This will be the third such facility at Windmill

Farms.

“Windmill Farms is a perfect example of our organization’s

strategic vision, coupled with our development capabilities,”

commented Daniel J. Moos, Southern Properties’ President and CEO.

“There are currently over 2,000 existing homes at Windmill Farms,

and we’ve started grading an additional subdivision with 250

lots.”

Moos continued, “Future plans call for an additional 5,000 homes

along with retail, additional schools, townhomes, and apartments;

further showcasing our ability to maximize the potential of our

existing assets, while continuing to expand our current

footprint.”

Southern Properties Capital operates primarily in Texas and

specializes in Class A multifamily assets in emerging markets

throughout the Southern United States, corresponding with both

sustainable and viable economic growth activity. The issuing entity

is backed by over 3,000 multi-family units (out of a total of

approximately 8,000 owned and operated by TCI), as well as over 1.5

million square feet office buildings in Texas. The company has

already used funds to acquire additional multi-family assets within

its strategic footprint, and expects significant expansion by

continuing to utilize the Israeli bond platform.

Transcontinental Realty Investors

(www.transconrealty-invest.com) maintains a strong emphasis on

creating greater shareholder value through acquisition, financing,

operation, developing, and sale of real estate across every

geographic region in the United States. A New York Stock Exchange

company, Transcontinental is traded under the symbol "TCI".

Transcontinental produces revenue through the professional

management of apartments, office buildings, warehouses, and retail

centers that are "undervalued" or "underperforming" at the time of

acquisition. Value is added under Transcontinental ownership, and

the properties are repositioned into higher classifications through

physical improvements and improved management. Transcontinental

also develops new properties, such as luxury apartment homes

principally on land it owns or acquires.

Southern Properties Capital LTD, a British Virgin Islands

corporation (“Southern”) is an indirect subsidiary

of Transcontinental Realty Investors Inc., (NYSE: TCI), a

Dallas-based real estate investment company. 85% of the company’s

properties are located in Texas; where management has intimate

familiarity with sub-markets and unique access to off-market deals.

Southern is committed to developing and managing multifamily assets

in areas with sustainable and viable economic growth; with a focus

on Class A HUD eligible assets that further achieve the company’s

growth strategy; which includes offering and sale of nonconvertible

Series A Bonds with the Tel Aviv Stock Exchange LTD (the “TASE”).

On February 14, 2017, Southern commenced the institutional tender

of the Debentures and has accepted application for 276 million

Israeli, new Shekels (approximately $73,651,065 USD, based on the

exchange rate of 3.7474 Shekels to the U.S. Dollar effective

February 14, 2017) in both institutional and public tenders, at an

annual interest rate averaging approximately 7.38% (seven year

term). Southern Properties has the intentions of continuing to do

future offerings, using these funds for growing the portfolio.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171005005210/en/

Pillar Income Asset ManagementChris Childress,

469-522-4275press@pillarincome.com

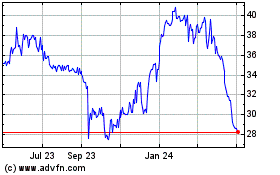

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024