Filed Pursuant to Rule 424(b)(5)

Registration No. 333-210875

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 11,

2016)

TEJON RANCH CO.

Up to

4,173,067 Shares

of Common Stock Issuable Upon Exercise of Rights

to Subscribe for Such Shares at $18.00 per Share

We are distributing, at no charge, to holders of our common stock transferable subscription rights to purchase up to 4,173,067 shares of our

common stock. We refer to this offering as the “rights offering.” In this rights offering, you will receive one subscription right for every one share of common stock owned at 5:00 p.m., New York time, on October 4, 2017, the record

date.

Each whole subscription right will entitle you to purchase 0.20 shares of our common stock at a subscription price of $18.00 per

share, which we refer to as the “basic subscription privilege.” The per share subscription price was determined by a committee of our board of directors after a review of recent historical trading prices of our common stock and the closing

sales price of our common stock on September 15, 2017, the last trading day prior to the announcement of the subscription price. We will not issue fractional shares of common stock in the rights offering, and holders will only be entitled to

purchase a whole number of shares of common stock, rounded down to the nearest whole number a holder would otherwise be entitled to purchase.

If you fully exercise your basic subscription privilege and other stockholders do not fully exercise their basic subscription privileges, you

may also exercise an over-subscription privilege to purchase a portion of the unsubscribed shares at the same subscription price of $18.00 per share, subject to certain limitations. Additionally, if there are not enough shares to honor all

over-subscription requests, we may, at our discretion, issue up to an additional 833,333 shares, which we refer to as the “over-allotment shares,” to honor over-subscription requests. To the extent you properly exercise your

over-subscription privilege for an amount of shares that exceeds the number of the unsubscribed shares and, if applicable, over-allotment shares available to you, any excess subscription payment received by the subscription agent will be returned

promptly, without interest or penalty. If all of the rights are exercised, assuming no over-allotment shares are issued, the total purchase price of the shares offered in the rights offering would be approximately $75.0 million. If the rights

offering is over-subscribed and we issue all of the over-allotment shares, the total purchase price of the shares offered in the rights offering would be $90.0 million.

We are not entering into any standby purchase agreement or similar agreement with respect to the purchase of any shares of our common stock not

subscribed for through the basic subscription privilege or the over-subscription privilege. Therefore, there is no certainty that any shares will be purchased pursuant to the rights offering and there is no minimum purchase requirement as a

condition to accepting subscriptions.

The subscription rights will expire void and worthless if they are not exercised by 5:00 p.m., New

York time, on October 27, 2017, unless we extend the rights offering period. However, our board of directors reserves the right to cancel the rights offering at any time, for any reason. If the rights offering is cancelled, all subscription

payments received by the subscription agent will be returned promptly.

The subscription rights are transferable and have been admitted for

trading and currently trade on the New York Stock Exchange under the symbol “TRC RT”; however, we cannot assure you that a market for the rights will develop. Shares of our common stock are, and we expect that the shares of common stock to

be issued in the rights offering will be, traded on the New York Stock Exchange under the symbol “TRC.” The last reported sales price of our common stock on the New York Stock Exchange on October 4, 2017, the last practicable date before

the filing of this prospectus supplement, was $20.53. We urge you to obtain a current market price for the shares of our common stock before making any determination with respect to the exercise of your rights.

You should carefully consider whether to exercise your subscription rights before the expiration of the rights offering. All exercises of

subscription rights are irrevocable. Our board of directors is making no recommendation regarding your exercise of the subscription rights.

This is not an underwritten offering. The shares of common stock are being offered directly by us without the services of an underwriter or

selling agent.

Exercising the rights and investing in our common stock involves a high degree of risk. We urge you to carefully read the section entitled

“

Risk Factors

” beginning on page S-7 of this prospectus supplement, the section entitled “Risk Factors” in our Annual Report on Form

10-K

for the year ended

December 31, 2016 and all other information included or incorporated herein by reference in this prospectus supplement in its entirety before you decide whether to exercise your rights.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

Aggregate

|

|

|

Subscription Price

|

|

$

|

18.00

|

|

|

$

|

75,115,202

|

(1)

|

|

Estimated Expenses

1

|

|

$

|

0.08

|

|

|

$

|

350,000

|

|

|

Net Proceeds to Us

|

|

$

|

17.92

|

|

|

$

|

74,765,202

|

|

|

(1)

|

Assumes the rights offering is fully subscribed, but no over-allotment shares are issued.

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

on the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

As a result of the

terms of this offering, stockholders who do not fully exercise their rights will own, upon completion of this offering, a smaller percentage of our shares of common stock than otherwise would be the case had they fully exercised their rights. See

“Risk Factors—When the rights offering is completed, your ownership interest will be diluted if you do not exercise your subscription rights” in this prospectus supplement for more information.

If you have any questions or need further information about this rights offering, please call Georgeson LLC, our information agent for the

rights offering,

1-888-565-5190

(toll free).

The date of

this prospectus supplement is October 4, 2017

|

1

|

NTD: Estimated expenses will be limited, and primarily related to the Georgeson engagement.

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form

S-3

that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration, or continuous offering, process. Under this shelf registration process, we may, from time to

time, offer and sell common stock, preferred stock, warrants or debt securities in one or more offerings with a maximum aggregate offering price of $200,000,000. The document we use to offer securities is divided into two parts. The first part is

this prospectus supplement, which describes the specific terms of the offering and also updates and supplements information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the

accompanying prospectus. The second part is the accompanying prospectus, which provides you with a general description of the securities we may offer from time to time, some of which does not apply to this offering. If the description of this

offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement. In addition, the registration statement we filed with the SEC includes exhibits that provide more

detail of the matters discussed in this prospectus supplement. You should read this prospectus supplement, the accompanying prospectus and the related exhibits filed with the SEC, together with additional information described under the heading

“Where You Can Find More Information,” before making your investment decision.

Unless otherwise stated or the context otherwise

requires, the terms “we,” “us,” “our,” “Tejon” and the “Company” refer to Tejon Ranch Co. and its subsidiaries.

You should rely only on the information contained or incorporated by reference in this prospectus supplement. We have not authorized anyone to

provide you with additional or different information. If anyone provides you with additional, different, or inconsistent information, you should not rely on it. We are not making an offer to sell securities in any jurisdiction in which the offer or

sale is not permitted. You should assume that the information in this prospectus supplement is accurate only as of the date on the front cover of this prospectus supplement, and any information we have incorporated by reference is accurate only as

of the date of the document incorporated by reference, in each case, regardless of the time of delivery of this prospectus supplement or any exercise of the rights. Our business, financial condition, results of operations, and prospects may have

changed since that date.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus supplement constitute forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for

forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide our current expectations and forecasts about future events.

These forward-looking statements include, among other things, statements regarding strategic alliances, the almond, pistachio and grape

industries, the future plantings of permanent crops, future yields and prices, water availability for our crops and real estate operations, future prices, production and demand for oil and other minerals, future development of our property, future

revenue and income of our jointly-owned travel plaza and other joint venture operations, potential losses to the Company as a result of pending environmental proceedings, the adequacy of future cash flows to fund our operations, market value risks

associated with investment and risk management activities and with respect to inventory, accounts receivable and our own outstanding indebtedness and other future events and conditions. In some cases these statements are identifiable through the use

of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,”

“will,” “should,” “would,” and similar expressions. We caution you not to place undue reliance on these forward-looking statements. These forward-looking statements are not a guarantee of future performances and are

subject to assumptions and involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of the Company, or industry results, to differ

materially from any future results, performance, or achievement implied by such forward-looking statements. These risks, uncertainties and important factors include, but are not limited to,

weather, market and economic forces, availability of financing for land development activities, competition and success in obtaining various governmental approvals and entitlements for land development activities.

No assurance can be given that the actual future results will not differ materially from the forward-looking statements that we make for a

number of reasons including those described above and in the “Risk Factors” section of this prospectus supplement beginning on page

S-7

and in our Annual Report on Form

10-K

for the year ended December 31, 2016, as well as in any future filings we may make that may be incorporated by reference herein. For information on the documents we are incorporating by reference and

how to obtain a copy, please see the “Where You Can Find More Information” section in this prospectus supplement. Unless required by law, we undertake no obligation to publicly update or revise any forward-looking statements to reflect new

information or future events or otherwise.

You should read this prospectus supplement with the understanding that our actual future

results may be materially different from what we expect.

TABLE OF CONTENTS

Prospectus Supplement

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING

The following are examples of what we anticipate will be common questions about the rights offering. The answers are based on selected

information from this prospectus supplement and the documents incorporated by reference herein. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you

may have about the rights offering. This prospectus supplement and the documents incorporated by reference herein contain more detailed descriptions of the terms and conditions of the rights offering and provide additional information about us and

our business, including potential risks related to the rights offering, our common stock, and our business.

Exercising the rights and

investing in our common stock involves a high degree of risk. We urge you to carefully read the section entitled “Risk Factors” beginning on page

S-7

of this prospectus supplement, the section

entitled “Risk Factors” in our Annual Report on Form

10-K

for the year ended December 31, 2016 and all other information included or incorporated herein by reference in this prospectus

supplement in its entirety before you decide whether to exercise your rights.

What is a rights offering?

A rights offering is a distribution of subscription rights on a

pro rata

basis to all stockholders of a company. We are distributing to

holders of our common stock as of 5:00 p.m., New York time, on October 4, 2017, the “record date,” at no charge, subscription rights to purchase shares of our common stock. You will receive one subscription right for every share of

our common stock you owned as of 5:00 p.m., New York time, on the record date. The subscription rights will be evidenced by rights certificates.

What

is a right?

Each whole right gives our stockholders the opportunity to purchase 0.20 shares of our common stock for $18.00 per share

and carries with it a basic subscription privilege and an over-subscription privilege, as described below. We determined the ratio of rights required to purchase one share by dividing the approximate $75.0 million by the subscription price of

$18.00 to determine the number of shares to be issued in the rights offering and then dividing that number of shares by the number of shares outstanding on the record date.

How many shares may I purchase if I exercise my rights?

Each right entitles you to purchase 0.20 shares of our common stock for $18.00 per share. We will not issue fractional shares of common stock

in the rights offering, and holders will only be entitled to purchase a whole number of shares of common stock, rounded down to the nearest whole number a holder would otherwise be entitled to purchase. For example, if you owned 99 shares of our

common stock on the record date, you would be granted 99 subscription rights and you would have the right to purchase 19 shares of our common stock (19.8 rounded down to the nearest whole number) for $18.00 per share (or a total payment of $342.00).

You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights.

If you hold your

shares in street name through a broker, bank, or other nominee who uses the services of the Depository Trust Company, or DTC, then DTC will issue one subscription right to your nominee for every share of our common stock you own at the record date.

The basic subscription right can then be used to purchase 0.20 shares of common stock for $18.00 per share. As in the example above, if you owned 99 shares of our common stock on the record date, you have the right to purchase 19 shares of common

stock for $18.00 per share. For more information, see “What should I do if I want to participate in the rights offering, but my shares are held in the name of my broker, dealer, custodian bank or other nominees?” in this section.

S-i

Will fractional subscription shares be issued?

No. We will not issue fractional shares of common stock in the rights offering, and holders will only be entitled to purchase a whole number of

shares of common stock, rounded down to the nearest whole number a holder would otherwise be entitled to purchase.

What is the basic subscription

privilege?

The basic subscription privilege of each subscription right entitles you to purchase 0.20 shares of our common stock at the

subscription price of $18.00 per share.

What is the over-subscription privilege?

If you purchase all of the shares of common stock available to you pursuant to your basic subscription privilege, you may also choose to

purchase any portion of our shares of common stock that are not purchased by our other stockholders through the exercise of their respective basic subscription privileges. You should indicate on your rights certificate how many additional shares you

would like to purchase pursuant to your over-subscription privilege.

If sufficient shares of common stock are available, we will seek to

honor your over-subscription request in full. If, however, over-subscription requests exceed the number of shares of common stock available for sale in the rights offering, we will allocate the available shares of common stock pro rata among each

stockholder exercising the over-subscription privilege in proportion to the number of shares of common stock owned by such stockholder on the record date, relative to the number of shares owned on the record date by all stockholders exercising the

over-subscription privilege. If this pro rata allocation results in any stockholder receiving a greater number of shares of common stock than the stockholder subscribed for pursuant to the exercise of the over-subscription privilege, then such

stockholder will be allocated only that number of shares for which the stockholder over-subscribed, and the remaining shares of common stock will be allocated among all other stockholders exercising the over-subscription privilege on the same pro

rata basis described above. The proration process will be repeated until all shares of common stock have been allocated or all over-subscription requests have been satisfied.

If there are not enough unsubscribed shares to honor all requests pursuant to the over-subscription privilege, we may, in our discretion,

issue up to an additional 833,333 shares to honor requests under the over-subscription privilege, subject to the same terms and conditions of the rights offering (such additional shares, the “over-allotment shares”). For more information,

see the section entitled “The Rights Offering—Over-Subscription and Over-Allotment Privilege.”

In order to properly

exercise your over-subscription privilege, you must deliver the subscription payment related to your over-subscription privilege prior to the expiration of the rights offering. Because we will not know the total number of unsubscribed shares prior

to the expiration of the rights offering, if you wish to maximize the number of shares you purchase pursuant to your over-subscription privilege, you will need to deliver payment in an amount equal to the aggregate subscription price for the maximum

number of shares of our common stock that may be available to you (

i.e.

, for the maximum number of shares of our common stock available to you, assuming you exercise all of your basic subscription privilege and are allotted the full amount of

your over-subscription as elected by you). For more information, see the section entitled “The Rights Offering—Over-Subscription and Over-Allotment Privilege.”

Fractional common shares resulting from the exercise of the over-subscription privilege will be eliminated by rounding down to the nearest

whole share, with the total subscription payment being adjusted accordingly.

Am I required to exercise all of the rights I receive in the rights

offering?

No. You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights.

However, if you choose not to exercise your basic subscription privilege in full, the relative

S-ii

percentage of our shares of common stock that you own will decrease, and your voting and other rights will be diluted. In addition, if you do not exercise your basic subscription privilege in

full, you will not be entitled to participate in the over-subscription privilege. For more information, see “How many shares of common stock will be outstanding after the rights offering?” in this section.

Will our officers, directors and significant stockholders be exercising their subscription rights?

Our officers, directors and greater than 5% beneficial stockholders may participate in this offering at the same subscription price per share

as all other purchasers, but none of our officers, directors or greater than 5% beneficial shareholders are obligated to so participate.

Our directors, who as of October 4, 2017, the last practicable date before filing of this prospectus supplement, collectively owned

approximately 28.85% of our outstanding shares, Third Avenue Management LLC, which manages various funds and accounts that own, in the aggregate, as of October 4, 2017, the last practicable date before the filing of this prospectus supplement,

approximately 10.60% of our outstanding shares, and Towerview LLC, which as of October 4, 2017, the last practicable date before filing of this prospectus supplement, owned approximately 13.39% of our outstanding shares, have indicated that

they will participate in the rights offering and may elect to subscribe for additional shares pursuant to the over-subscription privilege. However, there is no guarantee or commitment that these stockholders will ultimately decide to exercise any of

their rights, including their basic or over-subscription rights.

Has our board of directors made a recommendation to our stockholders regarding the

exercise of rights under the rights offering?

No. Our board of directors is making no recommendation regarding your exercise of the

subscription rights. Stockholders who exercise their subscription rights risk investment loss on their investment. We cannot assure you that the market price of our common stock will be above the subscription price or that anyone purchasing shares

at the subscription price will be able to sell those shares in the future at the same price or a higher price. You are urged to make your decision based on your own assessment of our business and the rights offering. Please see the section entitled

“Risk Factors” for a discussion of some of the risks involved in investing in our common stock.

Why are we conducting the rights offering?

We are conducting the rights offering to raise capital for general corporate purposes, including to fund general infrastructure costs

and the development of buildings at Tejon Ranch Commerce Center, or TRCC, to continue forward with entitlement and permitting programs for the Centennial at Tejon Ranch, or Centennial, and Grapevine at Tejon Ranch, or Grapevine, and costs related to

the preparation of the development of Mountain Village at Tejon Ranch, or MV. A rights offering provides the eligible stockholders the opportunity to participate in a capital raise on a pro rata basis and minimizes the dilution of their ownership

interest in our company. Assuming all the shares of common stock offered are sold we expect that the gross proceeds from the rights offering will be approximately $75.0 million. If there are not enough unsubscribed shares to honor all requests

under the over-subscription privilege, and we issue the maximum of 833,333 over-allotment shares to honor requests under the over-subscription privilege, we expect the gross proceeds from the rights offering to be approximately $90.0 million.

How was the subscription price of $18.00 per share determined?

The subscription price was determined by members of the Special Committee of our board of directors who were designated to approve pricing

decisions. The members of the Special Committee are Norman J. Metcalfe, Robert A. Alter, Steven A. Betts, Gregory S. Bielli, Anthony Leggio, Geoffrey L. Stack and Frederick C. Tuomi. The subscription price represents a discount to the market price

of a share of common stock on the date that the

S-iii

subscription price was determined. Factors considered by the Special Committee pursuant to the direction of the board of directors included the strategic alternatives to our company for raising

capital, the market price of the common stock before the announcement of the rights offering, the business prospects of our company and the general condition of the securities market. We cannot assure you that the market price for our common stock

during the rights offering will be equal to or above the subscription price or that a subscribing owner of rights will be able to sell the shares of common stock purchased in the rights offering at a price equal to or greater than the subscription

price.

How soon must I act to exercise my rights?

If you received a rights certificate and elect to exercise any or all of your subscription rights, the subscription agent must receive your

completed and signed rights certificate and payment prior to the expiration of the rights offering, which is October 27, 2017, at 5:00 p.m., New York time, unless extended by us. If you hold your shares in the name of a custodian bank, broker,

dealer or other nominee, your custodian bank, broker, dealer or other nominee may establish a deadline prior to 5:00 p.m. New York time, on October 27, 2017 by which you must provide it with your instructions to exercise your subscription

rights and pay for your shares.

Although we will make reasonable attempts to provide this prospectus supplement to holders of

subscription rights, the rights offering and all subscription rights will expire at 5:00 p.m., New York time on October 27, 2017 (unless extended), whether or not we have been able to locate each person entitled to subscription rights. Although

we have the option of extending the expiration of the rights offering, we currently do not intend to do so.

May I transfer my rights?

Yes. The subscription rights are transferable and have been admitted for trading and currently trade on the New York Stock Exchange under the

symbol “TRC RT.” We currently expect that they will continue to trade until 4:00 p.m., New York time, on October 26, 2017, the last business day prior to the scheduled expiration date of this rights offering (or if the offer is

extended, on the business day immediately prior to the extended expiration date). However, the subscription rights are a new issue of securities with no prior trading market, and we cannot provide you with any assurances as to the liquidity of any

trading market for the subscription rights or the market value of the subscription rights.

If you hold your shares through a broker,

custodian bank or other nominee, you may sell your subscription rights by contacting your broker, custodian bank or other nominee until the close of business on the business day preceding the expiration date of this rights offering. To sell your

subscription rights, in addition to any other procedures your broker, custodian bank or other nominee may require, you should complete and return to your broker, custodian bank or other nominee the form entitled “Beneficial Owner Election

Form” such that it will be received by 4:00 p.m., New York City time, on October 26, 2017, the last business day prior to the expiration date of this rights offering. If you are a record holder of a rights certificate, you may sell your

subscription rights through the subscription agent. To do so, you must deliver your properly executed rights certificate, with appropriate instructions, to the subscription agent. The subscription agent will only facilitate transfers or sales of the

rights until 5:00 p.m., New York City time, on October 20, 2017, five business days prior to the scheduled October 27, 2017 expiration date of this rights offering. Commissions and applicable taxes or broker fees may apply if you sell your

subscription rights. See “The Rights Offering—Transferability of Subscription Rights.”

Are we requiring a minimum subscription to

complete the rights offering?

There is no minimum subscription requirement in the rights offering. However, our board of directors

reserves the right to cancel the rights offering for any reason, including if our board of directors believes that there is insufficient participation by our stockholders.

S-iv

Can the board of directors cancel, terminate, amend, or extend the rights offering?

Yes. We have the option to extend the rights offering and the period for exercising your subscription rights, although we do not presently

intend to do so. Our board of directors may cancel the rights offering at any time for any reason. If the rights offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest or

penalty. Our board of directors reserves the right to amend or modify the terms of the rights offering at any time, for any reason.

When will I

receive my rights certificate?

Promptly after the date of this prospectus supplement, the subscription agent will send a rights

certificate to each registered holder of our common stock as of the close of business on the record date, based on our stockholder registry maintained at the transfer agent for our common stock. If you hold your shares of common stock through a

brokerage account, bank, or other nominee, you will not receive an actual rights certificate. Instead, as described in this prospectus supplement, you must instruct your broker, bank or nominee whether or not to exercise rights on your behalf. If

you wish to obtain a separate rights certificate, you should promptly contact your broker, bank or other nominee and request a separate rights certificate. It is not necessary to have a physical rights certificate, if you hold your shares of common

stock through a brokerage account, bank, or other nominee, to elect to exercise your rights.

What will happen if I choose not to exercise my

subscription rights?

If you do not exercise any subscription rights, the number of our shares of common stock you own will not change.

Due to the fact that shares may be purchased by other stockholders, your percentage ownership of our company will be diluted after the completion of the rights offering, unless you exercise your basic subscription privilege. For more information,

see “How many shares of common stock will be outstanding after the rights offering?” in this section.

How do I exercise my subscription

rights?

If you wish to participate in the rights offering, you must take the following steps:

|

|

•

|

|

deliver payment to the subscription agent; and

|

|

|

•

|

|

deliver your properly completed and signed rights certificate, and any other subscription documents, to the subscription agent.

|

Please follow the payment and delivery instructions accompanying the rights certificate. Do not deliver documents to Tejon. You are solely

responsible for completing delivery to the subscription agent of your subscription documents, rights certificate and payment. We urge you to allow sufficient time for delivery of your subscription materials to the subscription agent so that they are

received by the subscription agent by 5:00 p.m., New York time, on October 27, 2017. We are not responsible for subscription materials sent directly to our offices.

If you cannot deliver your rights certificate to the subscription agent prior to the expiration of the rights offering, you may follow the

guaranteed delivery procedures described under “The Rights Offering—Guaranteed Delivery Procedures.”

If you send a payment

that is insufficient to purchase the number of shares you requested, or if the number of shares you requested is not specified in the forms, the payment received will be applied to exercise your subscription rights to the fullest extent possible

based on the amount of the payment received, subject to the availability of shares under the over-subscription privilege and the elimination of fractional shares. Any excess subscription payments received by the subscription agent will be returned

promptly, without interest or penalty, following the expiration of the rights offering.

S-v

What should I do if I want to participate in the rights offering, but my shares are held in the name of my

broker, dealer, custodian bank or other nominee?

If you hold your shares of common stock in the name of a broker, dealer, custodian

bank or other nominee, then your broker, dealer, custodian bank or other nominee is the record holder of the shares you own. You will not receive a rights certificate. The record holder must exercise the subscription rights on your behalf for the

shares of common stock you wish to purchase.

If you wish to purchase shares of our common stock through the rights offering, please

promptly contact your broker, dealer, custodian bank or other nominee as record holder of your shares. We will ask your record holder to notify you of the rights offering. However, if you are not contacted by your broker, dealer, custodian bank or

other nominee, you should promptly initiate contact with that intermediary. Your broker, dealer, custodian bank or other nominee may establish a deadline prior to the 5:00 p.m. New York time on October 27, 2017, which we established as the

expiration date of the rights offering.

When will I receive my new shares?

If you purchase shares in the rights offering by submitting a rights certificate and payment, we will mail you a share certificate as soon as

practicable after the completion of the rights offering. One share certificate will be generated for each rights certificate processed. Until your share certificate is received, you may not be able to sell the shares of our common stock acquired in

the rights offering. If your shares as of the record date were held by a custodian bank, broker, dealer or other nominee, and you participate in the rights offering, you will not receive share certificates for your new shares. Your custodian bank,

broker, dealer or other nominee will be credited with the shares of common stock you purchase in the rights offering as soon as practicable after the completion of the rights offering.

After I send in my payment and rights certificate, may I change or cancel my exercise of rights?

No. All exercises of subscription rights are irrevocable, even if you later learn information that you consider to be unfavorable to the

exercise of your subscription rights. You should not exercise your subscription rights unless you are certain that you wish to purchase additional shares of our common stock at a subscription price of $18.00 per share.

How many shares of common stock will be outstanding after the rights offering?

As of October 4, 2017, the last practicable date before the filing of this prospectus supplement, 20,873,235 of our shares of common stock

were issued and outstanding. Assuming no other transactions by us involving shares of our common stock, and no options for shares of our common stock are exercised, prior to the expiration of the rights offering, if the rights offering is fully

subscribed through the exercise of the subscription rights, then an additional 4,173,067 of our shares of common stock will be issued and outstanding after the closing of the rights offering, for a total of 25,046,302 shares of common stock

outstanding. If there are not enough unsubscribed shares to honor all requests under the over-subscription privilege, and we issue the maximum additional 833,333 over-allotment shares to honor requests under the over-subscription privilege, we

expect a total of 25,879,635 shares of common stock will be outstanding immediately after completion of the rights offering. As a result of the rights offering, the ownership interests and voting interests of the existing stockholders that do not

fully exercise their basic subscription privileges will be diluted.

Are there risks in exercising my subscription rights?

Yes. The exercise of your subscription rights involves risks. Exercising your subscription rights involves the purchase of additional shares of

common stock and should be considered as carefully as you would consider any other equity investment. Among other things, you should carefully consider the risks described in the section entitled “Risk Factors” in this prospectus

supplement and the documents incorporated by reference in this prospectus supplement.

S-vi

If the rights offering is not completed, will my subscription payment be refunded to me?

Yes. The subscription agent will hold all funds it receives in a segregated bank account until completion of the rights offering. If the rights

offering is not completed, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty. If you own shares in “street name,” it may take longer for you to receive payment because the

subscription agent will return payments through the record holder of your shares.

Will the rights be listed on a stock exchange or national market?

The subscription rights have been admitted for trading and currently trade on the New York Stock Exchange under the symbol “TRC

RT.” We currently expect that they will continue to trade until 4:00 p.m., New York time, on October 26, 2017, the last business day prior to the expiration date of this rights offering (or, if the offer is extended, on the business day

immediately prior to the extended expiration date). As a result, you may transfer or sell your subscription rights if you do not want to purchase any shares of our common stock. However, the subscription rights are a new issue of securities with no

prior trading market, and we cannot provide you with any assurances as to the liquidity of the trading market for the subscription rights or the market value of the rights.

How do I exercise my rights if I live outside the United States?

We will not mail this prospectus supplement or the rights certificates to stockholders whose addresses are outside the United States or who

have an army post office or foreign post office address. The subscription agent will hold rights certificates for their account. To exercise subscription rights, our foreign stockholders must notify the subscription agent and timely follow other

procedures described in the section entitled “The Rights Offering—Foreign Stockholders.”

What fees or charges apply if I purchase the

shares of common stock?

We are not charging any fee or sales commission to issue subscription rights to you or to issue shares to you

if you exercise your subscription rights. If you exercise your subscription rights through your broker, dealer, custodian bank or other nominee, you are responsible for paying any fees your nominee may charge you.

What are the material U.S. federal income tax consequences of exercising my subscription rights?

For U.S. federal income tax purposes, you should not recognize income or loss upon receipt or exercise of subscription rights. You should

consult your tax advisor as to your particular tax consequences resulting from the rights offering. For a more detailed discussion, see the section entitled “Material U.S. Federal Income Tax Consequences.”

To whom should I send my forms and payment?

If your shares are held in the name of a broker, dealer or other nominee, then you should send your subscription documents, rights certificate,

notices of guaranteed delivery and subscription payment to that record holder. If you are the record holder, then you should send your subscription documents, rights certificate, notices of guaranteed delivery and subscription payment by first class

mail or courier service to:

|

|

|

|

|

If Delivering by Mail:

Computershare Trust Company, N.A.

Attn: Corporate Actions Voluntary Offer

P.O. Box 43011

Providence, RI

02940-3011

|

|

If Delivering by Overnight Courier:

Computershare Trust Company, N.A.

Attn: Corporate Actions Voluntary Offer

250 Royall Street

Suite V

Canton, MA 02021

|

S-vii

Your payment of the subscription price must be made in United States dollars for the full number

of shares of our common stock for which you are subscribing by personal check drawn upon a United States bank payable to the subscription agent at the address set forth above.

You are solely responsible for completing delivery to the subscription agent of your subscription materials. The subscription materials are to

be received by the subscription agent on or prior to 5:00 p.m., New York time, on October 27, 2017. We urge you to allow sufficient time for delivery of your subscription materials to the subscription agent.

Whom should I contact if I have other questions?

If you have any questions about the rights offering or wish to request another copy of a document, please contact Georgeson LLC, the

information agent for the rights offering, at

1-888-565-5190

(toll free).

For a more complete description of the rights offering, see “The Rights Offering” beginning on page

S-21.

S-viii

SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement or incorporated by reference therein. This summary is

not complete and may not contain all of the information that you should consider before deciding whether or not you should exercise your rights. You should read the entire prospectus supplement carefully and accompanying prospectus, including the

section entitled “Risk Factors” beginning on page S-7 of this prospectus supplement and the section entitled “Risk Factors” in our Annual Report on

Form 10-K

for the year ended

December 31, 2016, and all other information included or incorporated herein by reference in this prospectus supplement in its entirety before you decide whether to exercise your rights.

Tejon Ranch Co.

We are a diversified

real estate development and agribusiness company committed to responsibly using our land and resources to meet the housing, employment, and lifestyle needs of Californians and we are committed to creating value for our shareholders. Current

operations consist of land planning and entitlement, land development, commercial sales and leasing, leasing of land for mineral royalties, water asset management and sales, grazing leases, income portfolio management, farming, and ranch operations.

Our prime asset is approximately 270,000 acres of contiguous, largely undeveloped land that, at its most southerly border, is 60 miles north of Los Angeles and, at its most northerly border, is 15 miles east of Bakersfield. We create value by

securing entitlements for our land, facilitating infrastructure development, strategic land planning, monetization of land through development, and conservation, in order to maximize the highest and best use for our land.

We are involved in several joint ventures, which facilitate the development of portions of our land.

We are incorporated under the laws of the State of Delaware. Our principal executive offices are located at P.O. Box 1000, Lebec, California

93243, and our telephone number is (661)

248-3000.

Our website is www.tejonranch.com. Except for the documents incorporated by reference in this prospectus supplement as described under the heading

“Incorporation by Reference,” the information and other content contained on our website are not incorporated by reference and do not constitute part of this prospectus supplement and should not be relied upon in connection with making any

investment in our securities.

S-1

Summary Financial Information

(In thousands of dollars, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30

|

|

|

Years Ended December 31

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(unaudited)

|

|

|

audited

|

|

|

Total revenues from operations, including interest and other income

|

|

$

|

12,296

|

|

|

$

|

20,128

|

|

|

$

|

47,236

|

|

|

$

|

52,056

|

|

|

$

|

52,291

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations before equity in earnings of unconsolidated joint ventures

|

|

$

|

(5,306

|

)

|

|

$

|

(2,598

|

)

|

|

$

|

(6,247

|

)

|

|

$

|

(2,287

|

)

|

|

$

|

3,165

|

|

|

Equity in earnings of unconsolidated joint ventures

|

|

|

1,788

|

|

|

|

3,297

|

|

|

|

7,098

|

|

|

|

6,324

|

|

|

|

5,294

|

|

|

Net (loss) income

|

|

|

(1,914

|

)

|

|

|

467

|

|

|

|

515

|

|

|

|

2,912

|

|

|

|

5,762

|

|

|

Noncontrolling interest

|

|

|

(38

|

)

|

|

|

(54

|

)

|

|

|

(43

|

)

|

|

|

(38

|

)

|

|

|

107

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to common stockholders

|

|

$

|

(1,876

|

)

|

|

$

|

521

|

|

|

$

|

558

|

|

|

$

|

2,950

|

|

|

$

|

5,655

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

449,978

|

|

|

$

|

445,998

|

|

|

$

|

439,701

|

|

|

$

|

431,919

|

|

|

$

|

431,923

|

|

|

Long-term debt, less current portion

|

|

$

|

67,849

|

|

|

$

|

71,417

|

|

|

$

|

69,853

|

|

|

$

|

73,223

|

|

|

$

|

74,023

|

|

|

Total stockholders’ equity

|

|

$

|

335,014

|

|

|

$

|

331,738

|

|

|

$

|

334,467

|

|

|

$

|

331,308

|

|

|

$

|

324,333

|

|

|

Net income (loss) per share, diluted

|

|

$

|

(0.09

|

)

|

|

$

|

0.03

|

|

|

$

|

0.03

|

|

|

$

|

0.14

|

|

|

$

|

0.27

|

|

S-2

The Rights Offering

The following summary describes the principal terms of the rights offering, but is not intended to be complete. See the information in the

section entitled “The Rights Offering” in this prospectus supplement for a more detailed description of the terms and conditions of the rights offering.

|

Total number of shares of common stock available for primary subscription

|

4,173,067

|

|

Total number of shares of common stock available for over-allotment

|

833,333

|

|

Shares outstanding before the rights offering

|

20,873,235 shares as of October 4, 2017.

|

|

Shares outstanding after completion of

the rights offering

|

Assuming no outstanding options for our common shares are exercised prior to the expiration of the rights offering and the full approximate $75.0 million is subscribed for, we expect 25,046,302 shares of common stock will be outstanding

immediately after completion of the rights offering.

|

|

|

If the maximum 833,333 over-allotment shares are issued, we expect 25,879,635 shares of common stock will be outstanding immediately after completion of the rights offering.

|

|

Securities offered

|

We are distributing to you, at no charge, one transferable subscription right for every share of our common stock that you own as of 5:00 p.m., New York time, on the record date, either as a holder of record or, in the case of shares held of

record by brokers, dealers, custodian banks or other nominees on your behalf, as a beneficial owner of such shares.

|

|

Basic subscription privilege

|

The basic subscription privilege of each subscription right will entitle you to purchase 0.20 shares of our common stock at a subscription price of $18.00 per share. We will not issue fractional shares of common stock in the rights offering, and

holders will only be entitled to purchase a whole number of shares of common stock, rounded down to the nearest whole number a holder would otherwise be entitled to purchase.

|

|

Subscription price

|

$18.00 per share. To be effective, any payment related to the exercise of a subscription right must clear prior to the expiration of the rights offering.

|

|

Over-subscription privilege

|

If you purchase all of the shares of common stock available to you pursuant to your basic subscription privilege, you may also choose to subscribe for shares of our common stock that are not purchased by our stockholders through the exercise of

their basic subscription privileges. You may subscribe for shares of our common stock pursuant to your over-subscription privilege, subject to proration of available shares.

|

S-3

|

|

If there are not enough unsubscribed shares to honor all requests under the over-subscription privilege, we may, in our discretion, issue up to an additional 833,333 over-allotment shares to honor requests under the

over-subscription privilege, subject to the same terms and conditions of the rights offering.

|

|

Record date

|

5:00 p.m., New York time, on October 4, 2017.

|

|

Expiration date

|

5:00 p.m., New York time, on October 27, 2017, unless we extend the rights offering period.

|

|

Use of proceeds

|

Although the actual amount will depend on participation in the rights offer, if the rights offering is fully subscribed for we expect the gross proceeds from the rights offering to be approximately $75.0 million. If the rights offering is

over-subscribed, and we elect in our sole discretion to issue the over-allotment shares and the maximum of 833,333 over-allotment shares are issued, we expect the gross proceeds from the rights offering to be approximately $90.0 million.

|

|

|

We intend to use the proceeds of the rights offering to provide additional working capital for general corporate purposes, including to fund general infrastructure costs and the development of buildings at TRCC, to

continue forward with entitlement and permitting programs for the Centennial and Grapevine and costs related to the preparation of the development of MV.

|

|

Transferability of rights

|

You may sell your subscription rights by contacting your broker or the institution through which you hold your securities until the close of business on the business day preceding the expiration date of this rights offering. In addition, you may

transfer your subscription rights through the subscription agent as described in this prospectus supplement. See “The Rights Offering—Transferability of Subscription Rights.”

|

|

|

The subscription rights have been admitted for trading and currently trade on the New York Stock Exchange under the symbol “TRC RT.” We currently expect that they will continue to trade until 4:00 p.m., New

York City time, on October 26, 2017, the last business day prior to October 27, 2017, the expiration date of this rights offering (or if the offer is extended, on the business day immediately prior to the extended expiration date).

However, the subscription rights are a new issue of securities with no prior trading market, and we cannot provide you with any assurances as to the liquidity of any trading market for the subscription rights or the market value of the subscription

rights.

|

|

No Board Recommendation

|

Our board of directors makes no recommendation to you about whether you should exercise any rights. You are urged to make an independent investment

decision about whether to exercise your rights based on your own assessment of our business and the rights offering. Please see the section of this prospectus supplement entitled

|

S-4

|

|

“Risk Factors” for a discussion of some of the risks involved in investing in our common stock.

|

|

No revocation

|

Any exercise of subscription rights is irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your rights. You should not exercise your subscription rights unless you are certain that you wish to

purchase additional shares of common stock at a subscription price of $18.00 per share.

|

|

Material U.S. federal income tax considerations

|

For U.S. federal income tax purposes, you should not recognize income or loss upon receipt or exercise of subscription rights. You should consult your own tax advisor as to your particular tax consequences resulting from the rights offering. For

a detailed discussion, see “Material U.S. Federal Income Tax Considerations.”

|

|

Extension, cancellation, and amendment

|

We have the option to extend the rights offering and the period for exercising your subscription rights, although we do not presently intend to do so. Our board of directors may cancel the rights offering at any time for any reason. In the event

that the rights offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty. We also reserve the right to amend or modify the terms of the rights offering.

|

|

Procedure for exercising rights

|

To exercise your subscription rights, you must take the following steps:

|

|

|

•

|

|

If you are a registered holder of our shares of common stock, you may deliver payment and a properly completed rights certificate to the subscription agent before 5:00 p.m., New York time, on October 27, 2017. You

may deliver the documents and payments by mail or commercial carrier. If regular mail is used for this purpose, we recommend using registered mail, properly insured, with return receipt requested.

|

|

|

•

|

|

If you are a beneficial owner of shares that are registered in the name of a broker, dealer, custodian bank or other nominee, or if you would rather an institution conduct the transaction on your behalf, you should

instruct your broker, dealer, custodian bank or other nominee or to exercise your subscription rights on your behalf and deliver all documents and payments before 5:00 p.m., New York time, on October 27, 2017.

|

|

|

•

|

|

If you cannot deliver your rights certificate to the subscription agent prior to the expiration of the rights offering, you may follow the guaranteed delivery procedures described under “The Rights

Offering—Guaranteed Delivery Procedures.”

|

|

Subscription agent

|

Computershare.

|

|

Information agent

|

Georgeson LLC.

|

S-5

|

Questions

|

Questions regarding the rights offering should be directed to Georgeson LLC, at

1-888-565-5190

(toll free).

|

|

Risk factors

|

Stockholders considering exercising their subscription rights should carefully consider the risk factors described in the section of this prospectus supplement entitled “Risk Factors,” beginning on

page S-7.

|

|

Fees and expenses

|

We will pay the fees and expenses relating to the rights offering.

|

|

New York Stock Exchange trading symbol

|

Shares of our common stock are, and we expect that the shares of common stock to be issued in the rights offering will be, traded on the New York Stock Exchange under the symbol “TRC.” The last reported sales price of our common stock

on the New York Stock Exchange on October 4, 2017 was $20.53.

|

S-6

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the specific risks described below, the risks

described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and any risks described in our other filings with the SEC, pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, before making an investment

decision. See the section of this prospectus supplement entitled “Where You Can Find More Information.” Any of the risks we describe below or in the information incorporated herein by reference could cause our business, financial

condition, results of operations or future prospects to be materially adversely affected. Our strategy, focused on more aggressive development of our land, involves significant risk and could result in operating losses. The market price of our

common stock could decline if one or more of these risks and uncertainties develop into actual events and you could lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently deem to be

immaterial also may materially adversely affect our business, financial condition, results of operations or future prospects. Some of the statements in this section of the prospectus supplement are forward-looking statements. For more information

about forward-looking statements, please see the section of this prospectus supplement entitled “Forward-Looking Statements.”

Risks Related to the Rights Offering

When the rights offering is completed, your ownership interest will be diluted if you do not exercise your subscription rights.

To the extent that you do not exercise your rights and shares are purchased by other stockholders in the rights offering, your proportionate

voting interest will be reduced, and the percentage that your original shares represent of our aggregate outstanding common stock after the rights offering will be diluted.

No prior market exists for the subscription rights.

We expect that the subscription rights will trade on the New York Stock Exchange, but the subscription rights are a new issue of securities

with no prior trading market, and we cannot provide you with any assurances as to the liquidity of the trading market for the subscription rights or the market value of the subscription rights. Subject to certain earlier deadlines described in the

section entitled “The Rights Offering—Transferability of Subscription Rights,” the subscription rights are transferable until 4:00 p.m., New York time, on October 26, 2017, the last business day prior to the expiration date of

this rights offering (or, if the offer is extended, on the business day immediately prior to the extended expiration date), at which time they will be no longer transferable. The subscription agent will only facilitate sales or transfers of the

physical rights certificates until 5:00 p.m., New York time, on October 20, 2017, five business days prior to the scheduled expiration date. If you wish to sell your subscription rights or the subscription agent tries to sell subscription

rights on your behalf in accordance with the procedures discussed in this prospectus supplement but such subscription rights cannot be sold, or if you provide the subscription agent with instructions to exercise the subscription rights and your

instructions are not timely received by the subscription agent or if you do not provide any instructions to exercise your subscription rights, then the subscription rights will expire and will be void and no longer exercisable.

The subscription price determined for the rights offering is not necessarily an indication of the fair value of our common stock.

The subscription price is $18.00 per share. The subscription price was determined by members of the Special Committee of our board of

directors. The members of the Special Committee are Norman J. Metcalfe, Robert A. Alter, Steven A. Betts, Gregory S. Bielli, Anthony Leggio, Geoffrey L. Stack and Frederick C. Tuomi. The subscription price represents a discount to the market price

of a share of common stock on the date that the subscription price was determined. Factors considered by the Special Committee pursuant to the direction of the board of directors included the strategic alternatives to our company for raising

capital, the market price of the

S-7

common stock before the announcement of the rights offering, the business prospects of our company and the general condition of the securities market. We cannot assure you that the market price

for our common stock during the rights offering will be equal to or above the subscription price or that a subscribing owner of rights will be able to sell the shares of common stock purchased in the rights offering at a price equal to or greater

than the subscription price.

You may not revoke your subscription exercise and you could be committed to buying shares above the prevailing market

price.

Once you exercise your subscription rights, you may not revoke the exercise of such rights. The public trading market price

of our common stock may decline before the subscription rights expire. If you exercise your subscription rights and, afterwards, the public trading market price of our common stock decreases below the subscription price, you will have committed to

buying shares of our common stock at a price above the prevailing market price, in which case you will have an immediate, unrealized loss. We cannot assure that, following the exercise of your rights, you will be able to sell your shares of common

stock at a price equal to or greater than the subscription price, and you may lose all or part of your investment in our common stock. Until the shares are delivered to you, you will not be able to sell the shares of our common stock that you

purchase in the rights offering. Certificates representing shares of our common stock purchased pursuant to the basic subscription privilege will be delivered promptly after expiration of the rights offering; certificates representing shares of our

common stock purchased pursuant to the over-subscription privilege will be delivered promptly after expiration of the rights offering and after all pro rata allocations and adjustments have been completed. We will not pay you interest on funds

delivered to the subscription agent pursuant to the exercise of rights.

Our common stock is traded on the New York Stock Exchange under

the symbol “TRC,” and the last reported sales price of our common stock on the New York Stock Exchange on October 4, 2017 was $20.53 per share. Moreover, you may be unable to sell your shares of common stock at a price equal to or

greater than the subscription price you paid for such shares.

If you do not act promptly and follow the subscription instructions, your exercise of

subscription rights may be rejected.

Stockholders who desire to purchase shares in the rights offering must act promptly to ensure

that all required forms and payments are actually received by the subscription agent before 5:00 p.m., New York time, on October 27, 2017, the expiration date of the rights offering, unless extended. If you are a beneficial owner of shares, but

not a record holder, you must act promptly to ensure that your broker, bank, or other nominee acts for you and that all required forms and payments are actually received by the subscription agent before the expiration date of the rights offering. We

will not be responsible if your broker, custodian, or nominee fails to ensure that all required forms and payments are actually received by the subscription agent before the expiration date of the rights offering. If you fail to complete and sign

the required subscription forms, send an incorrect payment amount or otherwise fail to follow the subscription procedures that apply to your exercise in the rights offering, the subscription agent may, depending on the circumstances, reject your

subscription or accept it only to the extent of the payment received. Neither we nor our subscription agent undertakes to contact you concerning an incomplete or incorrect subscription form or payment, nor are we under any obligation to correct such

forms or payment. We have the sole discretion to determine whether a subscription exercise properly follows the subscription procedures.

Significant sales of subscription rights and our common stock, or the perception that significant sales may occur in the future, could adversely affect

the market price for the subscription rights and our common stock.

The sale of substantial amounts of the subscription rights and

our common stock could adversely affect the price of these securities. Sales of substantial amounts of our subscription rights and our common stock in the public market, and the availability of shares for future sale, including up to 4,173,067

shares of our common

S-8

stock to be issued in the rights offering, could adversely affect the prevailing market price of our common stock and the subscription rights and could cause the market price of our common stock

to remain low for a substantial amount of time. We may in the future grant stock options and other equity-linked securities under the Company’s incentive plans. We cannot foresee the impact of such potential sales on the market, but it is

possible that if a significant percentage of such available shares and subscription rights were attempted to be sold within a short period of time, the market for our shares and the subscription rights would be adversely affected. It is also unclear

whether or not the market for our common stock (and any market that develops for our subscription rights) could absorb a large number of attempted sales in a short period of time, regardless of the price at which they might be offered. Even if a

substantial number of sales do not occur within a short period of time, the mere existence of this “market overhang” could have a negative impact on the market for our common stock and the subscription rights and our ability to raise

additional capital.

If the rights offering is not fully subscribed, Third Avenue Management LLC and Towerview LLC may increase their ownership

percentages.

On October 4, 2017, the last practicable date before the filing of this prospectus supplement, Third Avenue

Management LLC beneficially owned 10.60% of our outstanding shares, and Towerview LLC beneficially owned approximately 13.39% of our outstanding shares. As stockholders as of the last practicable date before the filing of this prospectus supplement,

Third Avenue Management LLC and Towerview LLC will have the right to subscribe for and purchase shares of our common stock under both the basic subscription privilege and the over-subscription privilege of the rights offering. They have indicated to

us that they may elect to participate in the rights offering and may elect to subscribe for additional shares pursuant to the over-subscription privilege. However, there is no guarantee or commitment that these stockholders will ultimately decide to

exercise any of their rights, including their basic or over-subscription rights. If they are the only stockholders who exercise their rights in the rights offering, the respective ownership percentages of Third Avenue Management LLC and Towerview

LLC would increase and they would be able to exercise substantial control over matters requiring stockholder approval. Your interests as a holder of common stock may differ from the interests of these stockholders.

We may use the proceeds of this rights offering in ways with which you may disagree.

We intend to use the net proceeds of this offering to raise capital for general corporate purposes, including to fund general infrastructure

costs and the development of buildings at TRCC, to continue forward with entitlement and permitting programs for the Centennial and Grapevine and costs related to the preparation of the development of MV. Accordingly, we will have significant

discretion in the use of the net proceeds of this offering, and it is possible that we may allocate the proceeds differently than investors in this offering desire, or that we will fail to maximize our return on these proceeds. You will be relying

on the judgment of our management with regard to the use of the proceeds from the rights offer, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. For more

information, see the section entitled “Use of Proceeds.”

We may cancel the rights offering at any time, and neither we nor the

subscription agent will have any obligation to you except to return your exercise payments.

We may, in our sole discretion, decide

not to continue with the rights offering or cancel the rights offering. If the rights offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty.

The rights offering does not have a minimum amount of proceeds, which means that if you exercise your rights, you may acquire additional shares of our

common stock when we require additional capital.

There is no minimum amount of proceeds required to complete the rights offering.

In addition, an exercise of your subscription rights is irrevocable. Therefore, if you exercise the basic subscription privilege or the over-

S-9

subscription privilege, but we do not raise the desired amount of capital in this rights offering and the rights offering is not fully subscribed, you may be investing in a company that continues

to require additional capital.

Risks Relating to the Ownership of Our Common Stock

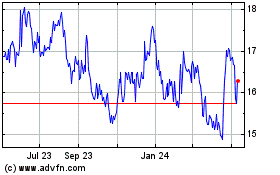

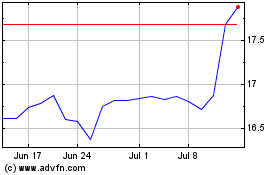

The price of our common stock is volatile and may decline before or after the subscription rights expire.

The market price of our common stock is subject to fluctuations in response to numerous factors, including factors that have little or nothing

to do with us or our performance, and these fluctuations could materially reduce our stock price. These factors include, among other things:

|

•

|

|

actual or anticipated variations in our operating results and cash flow;

|

|

•

|

|

the nature and content of our earnings releases, and our competitors’ and customers’ earnings releases;

|

|

•

|

|

announcements of challenges to land entitlements;

|

|

•

|

|

changes in financial estimates by securities analysts;

|

|

•

|

|

business conditions in our markets and the general state of the securities markets and the market for similar stocks;

|

|

•

|

|

the number of shares of our common stock outstanding;

|

|

•

|

|

changes in capital markets that affect the perceived availability of capital to companies in our industries;

|

|

•

|

|

governmental legislation or regulation;

|

|

•

|

|

currency and exchange rate fluctuations; and

|

|

•

|

|

general economic and market conditions, such as recessions.

|

In addition, the stock market

historically has experienced significant price and volume fluctuations. These fluctuations are often unrelated to the operating performance of particular companies. These broad market fluctuations may cause declines in the market price of our common

stock.

Only a limited market exists for our Common Stock which could lead to price volatility.

The limited trading market for our common stock may cause fluctuations in the market value of our common stock to be exaggerated, leading to

price volatility in excess of that which would occur in a more active trading market of our common stock.

Concentrated ownership of our Common

Stock creates a risk of sudden change in our share price.

Investors who purchase our common stock may be subject to certain risks

due to the concentrated ownership of our common stock. The sale by any of our large shareholders of a significant portion of that shareholder’s holdings could have a material adverse effect on the market price of our common stock. As of

October 4, 2017, the last practicable date before the filing of this prospectus supplement, Towerview LLC owned approximately 13.40% of our outstanding shares, and Third Avenue Management, LLC owned approximately 10.60% of our outstanding

shares.

In addition, the registration of any significant amount of additional shares of our common stock will have the immediate effect

of increasing the public float of our common stock and any such increase may cause the market price of our common stock to decline or fluctuate significantly.

Our executive officers, directors and their affiliates maintain the ability to substantially influence all matters submitted to stockholders for

approval.

As of October 4, 2017, the last practicable date before the filing of this prospectus supplement, directors and

members of our executive management team beneficially owned or controlled approximately 29.30% of our

S-10

common stock. Accordingly, our current executive officers, directors, and their affiliates have substantial influence over the outcome of corporate actions requiring stockholder approval,

including the election of directors, any merger, consolidation or sale of all or substantially all of our assets or any other significant corporate transactions, as well as the management and affairs of the Company. This concentration of ownership