UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14f-1

INFORMATION STATEMENT

PURSUANT TO SECTION 14(F) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14F-1 THEREUNDER

|

WINCASH APOLO GOLD & ENERGY, INC.

|

|

(Name of Registrant)

|

____________________________________

|

Nevada

|

|

000-27791

|

|

98-0412805

|

|

(State of Incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification Number)

|

20/F, EIB Centre, 40-44 Bonham Strand

Sheung Wan, Hong Kong

(Address of Principal Executive Offices)

(852) 2516 5060

(Registrant’s Telephone Number, Including Area Code)

WINCASH APOLO GOLD & ENERGY, INC.

20/F, EIB Centre, 40-44 Bonham Strand, Sheung Wan, Hong Kong

INFORMATION STATEMENT PURSUANT TO SECTION 14(F) OF THE

SECURITIES EXCHANGE ACT OF 1934 AND

RULE 14f-1 THEREUNDER

Notice of Change in the Majority of the Board of Directors

INTRODUCTION

The information contained in this Information Statement is being furnished to all holders of record of common stock of Wincash Apolo Gold & Energy, Inc. (the “Company” or “APLL”) at the close of business on September 28, 2017 in accordance with the requirements of Section 14(f) of the Securities Exchange Act of 1934 and Rule 14f-1 under that Act in order to effect a change in majority control of the Company’s Board of Directors other than by a meeting of stockholders. This Information Statement is being distributed on or about October 4, 2017.

NO VOTE OR OTHER ACTION BY THE COMPANY’S STOCKHOLDERS IS REQUIRED IN RESPONSE TO THIS INFORMATION STATEMENT. PROXIES ARE NOT BEING SOLICITED AND YOU ARE REQUESTED NOT TO SEND THE COMPANY A PROXY.

On or about September 18, 2017, the shareholders of APLL entered into a Stock Purchase Agreement (“SPA”) with certain purchasers of such shares (“Purchasers”), which was approved by the Board of Directors. Under the terms of the SPA, the purchasers will purchase approximately 3,811,429 shares of the APLL common stock (the “Purchase Transaction”).

In connection with the purchase of the common stock the Purchasers and the Board of Directors has decided to reconstitute the Board of Directors and Executive Officers. This Information Statement contains information about persons who will serve as officers of the Company or as Directors on the Board of Directors.

THE CHANGE IN THE COMPOSITION OF THE BOARD OF DIRECTORS DISCLOSED IN THIS SCHEDULE 14f-1 FILING WILL RESULT IN A CHANGE IN CONTROL OF THE BOARD OF DIRECTORS OF THE COMPANY.

No action is required by the shareholders of the Company in connection with the election or appointment of the new directors. However, Section 14(f) of the Securities Act of 1934, as amended, requires the mailing to the Company’s shareholders of this Information Statement not less than ten days prior to the change in a majority of the Company’s directors if said change occurs without a meeting of the Company’s shareholders.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS THEREOF

As of the date of this Information Statement, the authorized capital stock of the Company consisted of 300,000,000 shares of common stock, par value $.001 per share, of which approximately 26,137,387 shares are issued and outstanding and 25,000,000 shares of preferred stock of $.001 par value, of which none have been issued and are outstanding. Each share of common stock is entitled to one vote with respect to all matters to be acted on by the stockholders

DIRECTORS AND EXECUTIVE OFFICERS

Set forth below are the current officers and directors of the Company.

|

Name and Address

|

|

Age

|

|

Position(s)

|

|

Tommy Tsap

|

|

61

|

|

Director, President, Secretary and Chief Executive Officer

|

|

Edward Low

|

|

46

|

|

Chief Financial Officer

|

|

Chow Wing Fai

|

|

48

|

|

Director

|

Set forth below are the biographies of the Officers and Director of the Company prior to the Purchase Transaction:

Tsap Wai Ping (Tommy Tsap), President, CEO, Secretary, Director

Tsap Wai Ping (Tommy Tsap): President, Chief Executive Officer, Secretary, Director. Mr. Tsap is a securities and gold trading professional with extensive experience in the industry. He was the marketing director for HT Securities Ltd., a Hong Kong based broker dealer from August 1995 to July 2000. From July 2000 to September 2005 he was a director at Wintech Securities Ltd., a Hong Kong based brokerage firm specializing in Hong Kong listed stocks. From January 2006 until October 2008, he was the chief advisor at Legarleon International Ltd., a Hong Kong based gold trading firm. He was chief advisor from United Simsen Global Markets Ltd., a Hong Kong based brokerage firm from November 2008 until July 2009. He joined South China Bullion Limited, a gold and futures trading firm in July 2009 as Chief advisor and departed on March 2010. He was appointed as a director at Legarleon Precious Metals Limited from April 2010 and resigned on August 27, 2012. Mr. Tsap, is a citizen of Hong Kong and is a licensed broker with a Series 7 Futures license and a Series 3 Securities license (USNFA). He is based in Hong Kong.

Edward Low, Chief Financial Officer

Mr. Low, based in Vancouver, Canada, has provided accounting services to public companies for the past 18 years. Currently, Mr. Low serves as CFO for a number of publicly traded companies listed in Canada and the United States.

Set forth below are the proposed directors and officers to be elected following the closing of the Purchase Transaction:

APPOINTMENTS TO THE BOARD OF DIRECTORS

|

Name and Address

|

|

Age

|

|

Position(s)

|

|

Jeffrey Firestone

|

|

64

|

|

Director, President and Secretary

|

|

Chow Wing Fai

|

|

48

|

|

Director, CEO and CFO

|

BIOGRAPHY

The following sets forth biographical information regarding the Company’s proposed officers and directors following the completion of the Purchase Transaction:

Jeffrey Firestone, President and Secretary

Jeffrey Firestone is a U.S. Attorney licensed in Illinois and working in the U.S., China, Europe, Asia and the former Soviet Union. He graduated from Marshall Law School in 1978. As a multi lingual attorney, Jeffrey has been educated on several continents. He represents a wide range of clients from individuals to large banks and international corporations. He has a practice concentrated in investments, international trade, trademarks, intellectual property, finance, creditors’ rights, litigation, bankruptcy, transactions, and contract law. He was appointed to the U.S. Justice Department panel of bankruptcy trustees while working as an in-house creditors’ rights attorney for Household International. He was further appointed as a Court arbitrator by Cook County to arbitrate lawsuits.

Chow Wing Fai, Director, CEO and CFO

Chow Wing Fai is a businessman and entrepreneur who has been involved with numerous ventures in both China/Hong Kong and the UK over the past 20 years. In 1991, Mr. Chow attained a business administration degree from Coatbridge College in Glasgow, UK. Upon graduation, Mr. Chow was employed from August 1991 to June 2001 at the Catering and Beverage Management Institute of Coatbridge, starting as a management trainee and eventually attaining the position as Senior Purchasing Manager. After leaving his employment at the institute, Mr. Chow moved to Birmingham, UK. From July 2001 to November 2011, Mr. Chow worked as an external consultant on the management team of the Catering & Beverage industry company in Birmingham. In February 2012, he established the Catering & Beverage Management Company Ltd. he currently serves as the company’s Chief Executive Manager and a Director. Mr. Chow travels to China and Hong Kong on a regular basis and has established a management team of Catering & beverage agents throughout China and Hong Kong.

All Directors hold their office until the next annual meeting of shareholders or until their successors are duly elected pursuant to NRS 78.320, and qualified. Any vacancy occurring in the Board of Directors may be filled by the shareholders, or the Board of Directors. A Director elected to fill a vacancy is elected for the unexpired term of his predecessor in office. Any Directorship filled by reason of an increase in the number of Directors shall expire at the next shareholders’ meeting in which Directors are elected, unless the vacancy is filled by the shareholders, in which case the term shall end on the later of (i) the next meeting of the shareholders or (ii) the term designated for the Director at the time of creation of the position being filled.

Committees: Meetings of the Board

The Company does not have a separate Compensation Committee, Audit Committee or Nominating Committee. These functions are done by the Board of Directors meeting as a whole. The Company’s Board of Directors held both in person meetings during the fiscal year ended June 30,2016 and meetings by were conducted by telephone. All corporate actions by the Board of Directors were either consented to in writing by all Directors or were agreed to unanimously at a meeting where proper notice had been given and a quorum was present.

Audit Committee

The board of directors has not established an audit committee. The functions of the audit committee are currently performed by the entire board of directors. The Company is under no legal obligation to establish an audit committee and has elected not to do so at this time so as to avoid the time and expense of identifying independent directors willing to serve on the audit committee. The Company may establish an audit committee in the future if the board determines it to be advisable or we are otherwise required to do so by applicable law, rule or regulation.

As the board of directors does not have an audit committee, it therefore has no “audit committee financial expert” within the meaning of Item 401(e) of Regulation S-B. except its chief financial officer. In general, an “audit committee financial expert” is an individual member of the audit committee who:

|

●

|

understands generally accepted accounting principles and financial statements,

|

|

|

|

|

●

|

is able to assess the general application of such principles in connection with accounting for estimates, accruals and reserves,

|

|

|

|

|

●

|

has experience preparing, auditing, analyzing or evaluating financial statements comparable to the breadth and complexity to our financial statements,

|

|

|

|

|

●

|

understands internal controls over financial reporting, and

|

|

|

|

|

●

|

understands audit committee functions.

|

Board of Directors Independence

One of the Company’s directors is “independent” within the meaning of definitions established by the Securities and Exchange Commission or any self-regulatory organization. This director is Tsap Wai, Ping (Tommy Tsap). The Company is not currently subject to any law, rule or regulation requiring that all or any portion of its board of directors include “independent” directors.

Director Nominees

The Company does not have a nominating committee. The board of directors, sitting as a board, selects those individuals to stand for election as members of our board. Since the board of directors does not include a majority of independent directors, the decision of the board as to director nominees is made by persons who have an interest in the outcome of the determination. The board will consider candidates for directors proposed by security holders, although no formal procedures for submitting candidates have been adopted. Until otherwise determined, not less than 90 days prior to the next annual board of directors’ meeting at which the slate of board nominees is adopted, the board accepts written submissions that include the name, address and telephone number of the proposed nominee, along with a brief statement of the candidate’s qualifications to serve as a director and a statement of why the shareholder submitting the name of the proposed nominee believes that the nomination would be in the best interests of shareholders. If the proposed nominee is not the security holder submitting the name of the candidate, a letter from the candidate agreeing to the submission of his or her name for consideration should be provided at the time of submission. The letter should be accompanied by a resume supporting the nominee’s qualifications to serve on the board of directors, as well as a list of references.

The board identifies director nominees through a combination of referrals, including by management, existing board members and security holders, where warranted. Once a candidate has been identified the board reviews the individual’s experience and background, and may discuss the proposed nominee with the source of the recommendation. If the board believes it to be appropriate, board members may meet with the proposed nominee before making a final determination whether to include the proposed nominee as a member of management’s slate of director nominees submitted for shareholders for election to the board.

Among the factors that the board considers when evaluating proposed nominees are their knowledge of and experience with and knowledge of and experience in business matters, finance, capital markets and mergers and acquisitions. The board may request additional information from the candidate prior to reaching a determination. The board is under no obligation to formally respond to all recommendations, although as a matter of practice, it will endeavor to do so.

Code of Ethics

Under the Sarbanes-Oxley Act of 2002 and the Securities and Exchange Commission’s related rules, the Company is required to disclose whether it has adopted a code of ethics that applies to the Company’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Company has adopted a code of ethics that applies to its chief executive officer, chief financial officer and other officers, legal counsel and to any person performing similar functions. The Company has made the code of ethics available and intends to provide disclosure of any amendments or waivers of the code within five business days after an amendment or waiver on the Company’s website wwww.apologold.com.

RELATED PARTIES

There is no family relationship between any Director, executive or person nominated or chosen by the Company to become a Director or executive officer.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of September 1, 2017, by (i) each person who is known by us to own beneficially more than 5% of our outstanding common stock; (ii) each of our officers and directors; and (iii) all our directors and officers as a group.

The following table set forth the proposed beneficial ownership information before the closing:

Security Ownership of Certain Beneficial Owners and Management

|

Class

|

|

Beneficial Owner

|

|

Position

|

|

Amount and Nature of Beneficial Owner

|

|

|

% of Class

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

|

|

Tommy Tsap

|

|

Director, Chairman, CEO

|

|

|

2,000,000

|

|

|

|

11.95

|

%

|

|

|

|

Edward Low

|

|

CFO

|

|

|

400,000

|

|

|

|

0.01

|

%

|

COMPENSATION OF DIRECTORS AND OFFICERS

The following table shows for the fiscal years ending June 30, 2017, and 2016, the compensation awarded or paid by the Company to its Chief Financial Officer. No executive officers of the Company had total salary and bonus exceeding $100,000 during such year.

Summary Compensation Table

|

|

|

|

|

Annual Compensation

|

|

Long Term Compensation

|

|

|

Name and Principle Position

|

|

Fiscal Year

|

|

Salary ($)

|

|

|

Other Compensation ($)

|

|

Stock Option Awards (#)

|

|

Value of Stock Option Awards ($)

|

|

All Other Compen-sation ($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tommy Tsap Wai Pin, CEO

|

|

2017

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

Nil

|

|

Nil

|

|

|

Edward Low, CFO

|

|

2017

|

|

|

24,000

|

|

|

Nil

|

|

Nil

|

|

Nil

|

|

Nil

|

|

|

Tommy Tsap Wai Pin, CEO

|

|

2016

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

Nil

|

|

Nil

|

|

|

Edward Low, CFO

|

|

2016

|

|

|

17,650

|

|

|

8,000

|

|

Nil

|

|

Nil

|

|

Nil

|

|

Option Grants in Last Fiscal Year ending June 30, 2017 was $Nil

Compensation of Directors

Standard Arrangements: The members of the Company’s Board of Directors are reimbursed for actual expenses incurred in attending Board meetings.

Other Arrangements: There are no other arrangements.

Employment Contracts and Termination of Employment, And Change-in-control Arrangements

The Company’s CEO and CFO do not have employment agreements.

Termination of Employment and Change of Control Arrangement

There is no compensatory plan or arrangement in excess of $100,000 with respect to any individual named above which results or will result from the resignation, retirement or any other termination of employment with the Company, or from a change in the control of the Company.

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis (CD&A) provides information on the compensation programs established for our “Named Executive Officers” during our fiscal year ended June 30, 2016. All information provided herein should be read in conjunction with the tables provided below.

Our Board of Directors is responsible for establishing, implementing and monitoring the policies governing compensation for our executives. Currently our Board does not have a compensation committee. Our officers are members of our Board of Directors and are able to vote on matters of compensation. We are not currently under any legal obligation to establish a compensation committee and have elected not to do so at this time. In the future, we may establish a compensation committee if the Board determines it to be advisable or we are otherwise required to do so by applicable law, rule or regulation. During the year ended June 30, 2016 our Board did not employ any outside consultants to assist in carrying out its responsibilities with respect to executive compensation, although we have access to general executive compensation information regarding both local and national industry compensation practices. In future periods we may participate in regional and national surveys that benchmark executive compensation by peer group factors such as company size, annual revenues, market capitalization and geographical location.

The executive employment market in general is very competitive due to the number of companies with whom we compete to attract and retain executive and other staff with the requisite skills and experience to carry out our strategy and to maintain compliance with multiple Federal and State regulatory agencies. Many of these companies have significantly greater economic resources than our own. Our Board has recognized that our compensation packages must be able to attract and retain highly talented individuals that are committed to our goals and objectives, without at this time paying cash salaries that are competitive with some of our peers with greater economic resources. Our compensation structure is weighted towards equity compensation in the form of options to acquire common stock, which the Board believes motivates and encourages executives to pursue strategic opportunities while managing the risks involved in our current business stage, and aligns compensation incentives with value creation for our shareholders.

Components of Our Executive Compensation Program

Our executive compensation program incorporates components we believe are necessary in order for the Company to provide a competitive compensation package relative to our peers and to provide an appropriate mix between short-term and long-term cash and non-cash compensation. Elements of our executive compensation are listed below:

|

|

●

|

Base Salary

|

|

|

|

|

|

|

●

|

Stock Awards

|

|

|

|

|

|

|

●

|

Other benefits available to all employees

|

|

|

|

|

|

|

●

|

Items specific to our President and Chief Executive Officer per an employment agreement

|

Base Salary: At present we do not have a salary structure for employees and executive compensation is based on skill set, knowledge and responsibilities. Base salaries may be established as necessary. During the year ended June 30, 2016 none of our Named Executive Officers received a salary increase.

Stock Awards: A portion of compensation paid to our executives is equity based. We believe equity compensation helps align the interests of our executives with the interests of our shareholders. In that regard, our executives’ compensation is subject to downside risk in the event that our common stock price decreases. In addition, we believe stock awards provide incentives to aid in the retention of key executives.

COMMITTEES OF THE COMPANY’S BOARD OF DIRECTORS

We do not have a standing nominating, compensation or audit committee. Rather, our full board of directors performs the functions of these committees. Also, we do not have a financial expert on our board of directors as that term is defined by Item 401(e)(2) of Regulation S-B. We do not believe it is necessary for our board of directors to appoint such committees, because the volume of matters that come before our board of directors for consideration permits the directors to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees. Because our directors are also officers and shareholders of the Company, they are not independent.

Board Leadership Structure and Role in Risk Oversight

We have not adopted a formal policy on whether the Chairman and Chief Executive Officer positions should be separate or combined, however, we have traditionally determined that, due to the small size of the Company and the nature of its operations, it is in the best interests of the Company and its shareholders to combine these roles.

Our Board of Directors is primarily responsible for overseeing our risk management processes. The Board of Directors receives and reviews periodic reports from management, auditors, legal counsel, and others, as considered appropriate regarding our Company’s assessment of risks. The Board of Directors focuses on the most significant risks facing our Company and our Company’s general risk management strategy, and also ensures that risks undertaken by our Company are consistent with the Board’s tolerance for risk. While the Board oversees our Company, our Company’s management is responsible for day-to-day risk management processes. We believe this structure is the most effective approach for addressing the risks facing our Company and that our Board leadership structure supports this approach.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Except for the ownership of the Company’s securities and the proposed acquisition transaction, none of the directors, executive officers, proposed directors, holders of more than five percent of the Company’s outstanding Common Shares, or any member of the immediate family of such person, have, to the knowledge of the Company, had a material interest, direct or indirect, during the Company’s current fiscal year in any transaction or proposed transaction which may materially affect the Company.

No executive officer, present director, proposed director or any member of these individuals’ immediate families, any corporation or organization with whom any of these individuals is an affiliate or any trust or estate in which any of these individuals serve as a trustee or in a similar capacity or has a substantial beneficial interest in is or has been indebted to the Company at any time since the beginning of the Company’s fiscal year.

LEGAL PROCEEDINGS

The Company is not aware of any legal proceedings in which any director, nominee, officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, nominee, officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

NO DISSENTERS RIGHTS

Under the Nevada Revised Statutes shareholders are not entitled to dissenter rights with respect to the transactions described in this information statement.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

The Company is subject to the information and reporting requirements of the Securities Exchange Act of 1934 and, in accordance with that act, files periodic reports, documents and other information with the SEC relating to its business, financial statements and other matters. These reports and other information may be inspected and are available for copying at the offices of the SEC, 100 F Street, N.E., Washington, D.C. 20549 and are available on the SEC’s website at www.sec.gov.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Information Statement to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

WINCASH APOLO GOLD & ENERGY, INC.

|

|

|

|

|

|

|

|

Date: October 4, 2017

|

By:

|

/s/ Chow Wing Fai

|

|

|

|

|

Chow Wing Fai, Chief Executive Officer

|

|

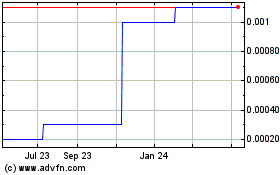

Banny Cosmic (CE) (USOTC:CMHZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banny Cosmic (CE) (USOTC:CMHZ)

Historical Stock Chart

From Apr 2023 to Apr 2024