A.M. Best Affirms Credit Ratings of United Fire Group, Inc. and Its Property/Casualty Subsidiaries

September 29 2017 - 12:59PM

Business Wire

A.M. Best has affirmed the Financial Strength Rating

(FSR) of A (Excellent) and the Long-Term Issuer Credit Ratings

(Long-Term ICR) of “a” of the property/casualty (P/C) subsidiaries

of United Fire Group, Inc. (UFG) [NASDAQ:UFCS] (collectively

known as United Fire & Casualty Group), which operate

under an inter-company pooling agreement led by United Fire

& Casualty Company. Concurrently, A.M. Best has affirmed

the Long-Term ICR of “bbb” of UFG. The outlook of these Credit

Ratings (ratings) remains stable. All companies are headquartered

in Cedar Rapids, IA. (See below for a detailed listing of the

companies and ratings.)

The rating affirmations reflect United Fire & Casualty

Group’s solid risk-adjusted capitalization, diversified commercial

product offerings, historically favorable core reserve levels,

long-standing agency relationships, solid regional franchise and

the financial flexibility afforded by UFG. These positive rating

factors are offset partially by the variability in United Fire

& Casualty Group’s underwriting and operating results in recent

years, driven in part by its exposure to catastrophe and

weather-related losses, and the continued challenging market

conditions in the group’s core markets. The rating affirmations

also are based on A.M. Best’s expectation that catastrophe losses

incurred during the recent hurricanes will be within stated risk

tolerances that the group provided to A.M. Best.

The Long-Term ICR of UFG recognizes the capital strength of its

subsidiaries and the fact that it has no outstanding debt. Positive

rating actions could occur if the group were to achieve consistent

profitable results that outperform its peers over a sustained

period. Negative rating actions could occur if there is a severe

reduction in the profitability of the core operating entities’ core

books of business, material losses in the risk-adjusted

capitalization of the operating units, or acute deterioration of

the group’s reserve strength affecting surplus.

The FSR of A (Excellent) and the Long-Term ICRs of “a” have been

affirmed with stable outlooks for United Fire & Casualty

Company and its following P/C subsidiaries:

- Lafayette Insurance Company

- Addison Insurance Company

- United Fire & Indemnity

Company

- United Fire Lloyds

- Mercer Insurance Company

- Financial Pacific Insurance

Company

- Mercer Insurance Company of New

Jersey, Inc.

- Franklin Insurance Company

- UFG Specialty Insurance

Company

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings. For information on the proper media use of Best’s

Credit Ratings and A.M. Best press releases, please view

Guide for Media - Proper Use of Best’s Credit Ratings and A.M.

Best Rating Action Press Releases.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2017 by A.M. Best Rating

Services, Inc. and/or its subsidiaries. ALL RIGHTS

RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170929005606/en/

A.M. BestRobert Valenta, +1 908 439 2200, ext.

5291Senior Financial

Analystrobert.valenta@ambest.comorRaymond Thomson,

CPCU, ARe, ARM, +1 908 439 2200, ext. 5621Associate

Directorraymond.thomson@ambest.comorChristopher

Sharkey, +1 908 439 2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

+1 908 439 2200, ext. 5644Director, Public

Relationsjames.peavy@ambest.com

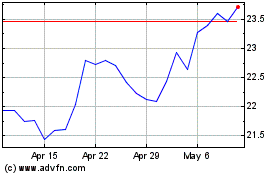

United Fire (NASDAQ:UFCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

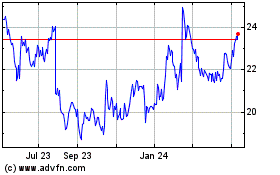

United Fire (NASDAQ:UFCS)

Historical Stock Chart

From Apr 2023 to Apr 2024