Washington Federal, Inc. (“Washington Federal”) (NASDAQ:

WAFD) and Anchor Bancorp (“Anchor”) (NASDAQ: ANCB) announced

today that they have mutually agreed to amend their merger

agreement that was entered into on April 11, 2017. The amendment

extends from December 31, 2017 to

June 30, 2018, the date after which either party can

elect to terminate the agreement if the transaction contemplated by

the agreement (the “Merger”) has not yet been completed.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170927006307/en/

The need for the amendment was due to the identification of

certain issues with respect to procedures, systems and processes of

Washington Federal’s bank subsidiary, Washington Federal,

National Association, relating to its Bank Secrecy Act (“BSA”)

program. Washington Federal is taking proactive steps to remediate

these issues. Given that these remediation efforts likely would

impact regulatory approvals necessary to consummate the Merger,

Washington Federal has decided to withdraw its regulatory

applications relating to the Merger and resubmit them after the

remediation has progressed. The amendment to the merger agreement

also provides for up to three additional six month extensions

beyond June 30, 2018, and addresses certain Anchor operational

matters in light of the extension. There can be no assurance that

the Merger will be completed by the extended termination date or

any further extended date.

Washington Federal’s President and Chief Executive Officer Brent

Beardall commented, “We are disappointed that we will not be able

to complete the Anchor transaction in the time-frame originally

anticipated; however, we will use this opportunity to improve our

processes and systems. We have been very impressed with both the

clients and employees of Anchor Bank and look forward to bringing

our two banks together.”

Jerry Shaw, President and Chief Executive Officer of Anchor

stated, "We continue to believe that a merger with Washington

Federal is beneficial to our shareholders and the communities we

serve. We could not have asked for a better strategic partner than

Washington Federal as we continue to work together towards a

successful outcome."

About Washington Federal

As of June 30, 2017, Washington Federal reported total assets of

$15.0 billion and net income of $172 million for the four quarters

then ended.

Washington Federal, National Association, is a national bank

with headquarters in Seattle, Washington, and 236 branches in eight

western states. To find out more about Washington Federal, please

visit our website www.washingtonfederal.com. Washington Federal

uses its website to distribute financial and other material

information about Washington Federal.

About Anchor

As of June 30, 2017, Anchor reported total assets of $462.5

million and net income of $2.4 million for the fiscal year then

ended.

Anchor is headquartered in Lacey, Washington and is the parent

company of Anchor Bank, a community-based savings bank

primarily serving Western Washington through its 10 full-service

banking offices (including one Wal-Mart in-store location) within

Grays Harbor, Thurston, Lewis, Pierce and Mason counties, and

one loan production office located in King County, Washington.

Anchor's common stock is traded on the NASDAQ Global Market under

the symbol "ANCB" and is included in the Russell 2000 Index. For

more information, visit the Anchor's web site

www.anchornetbank.com.

Important Cautionary

Statements

This press release contains statements about Washington

Federal’s and Anchor’s future that are not statements of historical

fact. These statements are “forward looking statements” for

purposes of applicable securities laws, and are based on current

information and/or management's good faith belief as to future

events. The words “believe,” “expect,” “anticipate,” “project,”

“should,” and similar expressions signify forward-looking

statements. Forward-looking statements should not be read as a

guarantee of future performance. By their nature, forward-looking

statements involve inherent risk and uncertainties, which change

over time; and actual performance, could differ materially from

those anticipated by any forward-looking statements. Washington

Federal and Anchor undertake no obligation to update or revise any

forward-looking statement. In addition to factors previously

disclosed in Washington Federal’s and Anchor’s SEC reports

(accessible on the SEC’s website at www.sec.gov and on Washington

Federal’s website at www.washingtonfederal.com and Anchor’s website

at www.anchornetbank.com), and elsewhere in this press release, the

following factors, among others, could cause actual results to

differ materially from forward-looking statements or historical

performance, particularly in view of the BSA issues that have

caused the parties to extend the termination date in the merger

agreement: ability to obtain regulatory approvals and meet other

closing conditions to the Merger, including approval by Anchor’s

shareholders, on the expected terms and schedule; the potential

delay in closing the Merger beyond the date after which either

party can terminate the merger agreement; the success, timeliness

and cost of Washington Federal’s remediation efforts; actions of

government authorities; the success timing and ability to pursue

Washington Federal’s growth or other business initiatives; and the

ability to retain customers and personnel.

Additional Information

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote or approval. In connection with the proposed transaction

with Anchor, Washington Federal has filed a registration statement

on Form S-4 with the SEC that contains a proxy statement/prospectus

to be distributed to the shareholders of Anchor in connection with

their vote on the Merger. Each party will also file other documents

regarding the proposed transaction with the SEC. Before making any

voting or investment decision regarding the transaction,

shareholders of Anchor are encouraged to read the registration

statement and any other relevant documents filed with the SEC,

including the proxy statement/prospectus that is part of the

registration statement, as well as any amendments or supplements to

those documents, when they become available, because they will

contain important information about the Merger. The final proxy

statement/prospectus will be mailed to shareholders of Anchor.

Investors and security holders will be able to obtain the documents

free of charge at the SEC’s website, www.sec.gov. In addition,

documents filed with the SEC by Washington Federal will be

available free of charge by accessing Washington Federal’s website

at www.washingtonfederal.com or by writing Washington Federal at

425 Pike Street, Seattle, WA 98101, Attention:

Investor Relations or calling (206) 626-8178, or by writing Anchor

at 601 Woodland Square Loop SE, Lacey, WA 98503,

Attention: Corporate Secretary or calling (360) 537-1388.

Participants in the Transaction

Washington Federal, Anchor, their directors, executive officers

and certain other persons may be deemed to be participants in the

solicitation of proxies from Anchor shareholders in favor of the

approval of the Merger. Information about the directors and

executive officers of Washington Federal and their ownership of

Washington Federal stock is included in the proxy statement for its

2017 annual meeting of shareholders, which was filed with the SEC

on December 9, 2016. Information about the directors and executive

officers of Anchor and their ownership of Anchor stock is set forth

in the proxy statement for its 2016 annual meeting of

shareholders, which was filed with the SEC on September 9, 2016,

and also will be included in the proxy statement/prospectus for the

Merger. Additional information regarding the interests of those

participants and other persons who may be deemed participants in

the transaction may be obtained by reading the registration

statement and the proxy statement/prospectus regarding the proposed

merger when it becomes available. Free copies of this document may

be obtained as described in the preceding paragraph.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170927006307/en/

Washington Federal, Inc.Brad Goode, 206-626-8178orAnchor

BancorpJerald L. Shaw, 360-491-2250

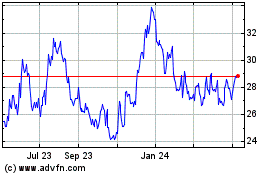

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

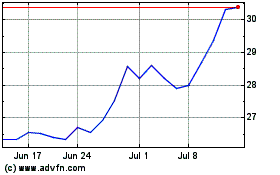

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Apr 2023 to Apr 2024