Healthcare Realty Trust Provides Update on Atlanta Portfolio Acquisition

September 27 2017 - 4:36PM

Healthcare Realty Trust Incorporated (NYSE:HR) has entered

into an amended and restated agreement with Meadows & Ohly, LLC

to acquire eight medical office buildings totaling 496,000 square

feet in the Atlanta, Georgia market (the “Portfolio”) for an

aggregate purchase price of $193.8 million, which represents a 2018

cash yield of 5.2%. The Company had previously agreed to

purchase these eight properties for $204.5 million at a 2018 cash

yield of 4.9%.

The eight properties in the Portfolio include seven on-campus

medical office buildings located on three WellStar Health System

(“A” rated) campuses and one off-campus medical office building

fully leased by Piedmont Healthcare (“AA-” rated) with 13 years of

remaining lease term. The seven on-campus properties are 58.3%

occupied by WellStar and 95.5% occupied overall. WellStar

operates 11 hospitals, generated $2.2 billion of revenue in 2016,

and has a 21.0% market share, making it the leading health system

in the Atlanta MSA.

The transaction is expected to be funded with net proceeds from

the Company’s August equity offering and $33.9 million of assumed

debt bearing an average interest rate of 3.8%. The Company expects

the closings of the eight properties to occur throughout the fourth

quarter of 2017, subject to timing of loan assumptions.

The original agreements provided for the acquisition of 15

properties comprising 1.3 million square feet at an aggregate

purchase price of $612.5 million. Fourteen of the properties were

subject to purchase rights held by the three associated health

systems. The health systems exercised rights to purchase seven

properties valued at $408.0 million. The Company had the right to

terminate the transaction if more than $300 million in properties

were removed through the exercise of health system purchase rights.

The Company has elected to purchase the remaining eight properties,

originally valued at $204.5 million, at a reduced price of $193.8

million. The Company’s acquisition of the eight remaining

properties is not subject to any outstanding purchase rights.

Healthcare Realty Trust is a real estate investment trust that

integrates owning, managing, financing and developing

income-producing real estate properties associated primarily with

the delivery of outpatient healthcare services throughout the

United States. As of June 30, 2017, the Company had gross

investments of approximately $3.6 billion in 197 real estate

properties in 26 states totaling approximately 14.5 million square

feet. The Company provided leasing and property management services

to approximately 10.9 million square feet nationwide.

Additional information regarding the Company can be found at

www.healthcarerealty.com. Please contact the Company at

615.269.8175 to request a printed copy of this information.

In addition to the historical information contained within, the

matters discussed in this press release contain forward-looking

statements that involve risks and uncertainties. These risks

include, without limitation, the Company’s ability to complete the

acquisition on the anticipated timeline or at currently anticipated

costs, targeted capitalization rates, or targeted stabilized

yields, or at all, and other risks as more fully described in

filings with the Securities and Exchange Commission by Healthcare

Realty Trust, including its Annual Report on Form 10-K for the year

ended December 31, 2016 under the heading “Risk Factors,” and as

updated in its Quarterly Reports on Form 10-Q filed thereafter.

Forward-looking statements represent the Company’s judgment as

of the date of this release. The Company disclaims any obligation

to update forward-looking statements.

Carla BacaDirector of Corporate CommunicationsP:

615.269.8175

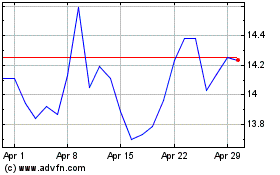

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Mar 2024 to Apr 2024

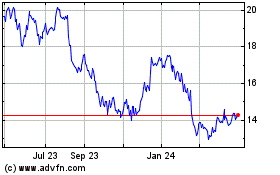

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Apr 2023 to Apr 2024