Current Report Filing (8-k)

September 26 2017 - 3:18PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Act of 1934

September 19, 2017

(Date of earliest event Reported)

NEXT GROUP HOLDINGS, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Florida

|

|

333-148987

|

|

20-3537265

|

(State or other jurisdiction

of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1111 Brickell Avenue, Suite 2200, Miami,

FL, 33131

(Address of principal executive offices)

Registrant's telephone number, including

area code: (800) 611-3622

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

NOTE ABOUT FORWARD LOOKING STATEMENTS

Most of the matters discussed within this

report include forward-looking statements on our current expectations and projections about future events. In some cases you can

identify forward-looking statements by terminology such as “may,” “should,” “potential,” “continue,”

“expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,”

and similar expressions. These statements are based on our current beliefs, expectations, and assumptions and are subject to a

number of risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual

results to differ materially from those expressed, projected or implied in or by the forward-looking statements. Such risks and

uncertainties include the risks noted under “Item 1A Risk Factors.” We undertake no obligation to update or revise

publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 1.01. Entry into a Definitive Material Agreement.

On September 19, 2017, a STOCKPURCHASE

AGREEMENT (the “Agreement”) was entered into by and among Next Group Acquisition, Inc., a Florida corporation (“NextAcquisition”

or the

“Purchaser”),

Next Group Holdings, Inc., a Florida corporation listed on the OTC:QB exchange with the

symbol “NXGH” (“NXGH” or the “Parent Company”), Heritage Ventures Limited, an Irish private

limited company (“Heritage” or the “Seller”), LimeCom, Inc., a Florida corporation (the “Company”).

LimeCom is engaged in the business of purchase and resale of international long distance VOIP minutes. The Agreement provides for

the sale of all of the issued and outstanding shares of common stock of LimeCom owned by Heritage to NextAcquisition for an aggregate

price of 51,864,809 shares of restricted common stock of NXGH and the sum of $2,000,000 in cash payable within eight (8) months

of the closing date. The Agreement is contingent upon LimeCom providing audited financial statements for its fiscal year ending

December 31, 2015 and December 31, 2016, and updated financial statements in accordance with the Securities and Exchange Commission

S-X accounting rules. Additionally, the Agreement further provides that LimeCom has five (5) days from signing to provide a number

of schedules stated in the Agreement. There are also conditions of closing which require LimeCom to (a) achieve gross recovery

of $125,000,000 and (b) have EBITA of at least $2,500,000. In the event that LimeCom does not reach the financial targets stated

in the Agreement, NextAcquisition has the option of pro rating the $2,000,000 portion of the purchase price. 10,360,809 shares

of the 51,804,809 shares of NXGH stock will be held in escrow against any possible undisclosed liabilities. .

Right of Rescission

There is a mutual right of rescission by

NXGH and Heritage in that in the event there is a material adverse change in LimeCom’s net profit or net asset value before

the rescission date, the parent company may elect to rescind the transaction.

In the event that NXGH does not pay the

sum of $2,000,000 to Heritage in the eight (8) month time period, Heritage can rescind the transaction by returning all of the

shares of stock in NXGH to NXGH, and Heritage will, in turn, return all of the LimeCom stock exchanged for the NXGH stock. In the

event of any losses incurred after the closing until there was a rescission, NXGH would be responsible for the losses. Heritage

has the additional option to be paid the $2,000,000 from LimeCom revenues on a first priority basis if it determines not to exercise

its right of rescission.

Orlando Taddeo, owner of record and beneficially

of 95% of Heritage, on closing will be appointed to the Board of Directors of NXGH and will continue as President of LimeCom, and

will enter into an Employment Agreement with NXGH on the same terms and conditions as that of Arik Maimon, the Chief Executive

Officer and Chairman of NXGH.

Item 9.01 Financial Statements and Exhibits.

The following exhibit is filed with this report:

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Dated: September 26, 2017

|

NEXT GROUP HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Arik Maimon

|

|

|

|

Arik Maimon

Chief Executive Officer

|

3

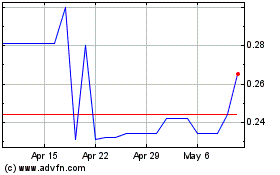

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

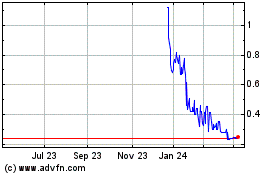

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Apr 2023 to Apr 2024