Radian Group Inc. (NYSE:RDN) (the “Company”) announced today the

early tender results and upsizing of its previously announced cash

tender offers (the “Tender Offers”) for the debt securities in the

table below (collectively, the “Notes”). The Company has amended

the terms of the Tender Offers to increase the Maximum Series

Tender Cap (as defined below) relating to the 7.00% Senior Notes

due 2021 from $125 million to $175 million in aggregate

consideration. All other terms of the Tender Offers remain

unchanged. The “Maximum Series Tender Cap” refers to the aggregate

consideration to be paid by the Company in respect of each series

of Notes, excluding Accrued Interest (as defined below).

The aggregate principal amount of Notes of each series that were

validly tendered and not validly withdrawn as of 5:00 p.m., New

York City time, on September 25, 2017 (the “Early Participation

Time”), as reported by the Depositary (as defined below), and the

aggregate principal amount of each series of Notes that are

expected to be accepted for purchase by the Company on September

26, 2017 (the “Early Settlement Date”), subject to the satisfaction

or waiver of certain conditions to the Tender Offers set forth in

the Offer to Purchase (defined below) are specified in the table

below.

Notes(CUSIP/ISIN)

OutstandingPrincipalAmount

OriginalMaximumSeriesTenderCap

RevisedMaximumSeries

TenderCap

PrincipalAmountTendered

Principal

AmountExpected to beAccepted forPurchase onEarlySettlement

Date

TotalConsideration(rounded) (1)(2)

5.50% SeniorNotes due

2019(750236AR2/US750236AR21)

$300,000,000 $150,000,000 No change $231,835,000 $141,377,000

$149,999,583

5.25% SeniorNotes due 2020

(750236AS0/US750236AS04)

$350,000,000 $125,000,000 No change $277,852,000 $115,874,000

$124,999,078

7.00% SeniorNotes due

2021(750236AT8/US750236AT86)

$350,000,000 $125,000,000 $175,000,000 $322,588,000 $152,339,000

$174,999,426 (1) Excludes Accrued Interest (as

defined below), which will be paid by the Company. (2) Includes the

Early Participation Premium (as defined below) of $30.00 per $1,000

principal amount of Notes.

The terms and conditions of the Tender Offers are set forth in

an Offer to Purchase dated September 12, 2017 (as amended hereby,

the “Offer to Purchase”), which has been sent to holders of the

Notes. Holders of the Notes are urged to read carefully the Offer

to Purchase, as it contains important information regarding the

Tender Offers.

Subject to the terms and conditions of the Tender Offers,

holders who validly tendered their Notes on or prior to the Early

Participation Time and whose Notes are accepted for purchase will

receive the applicable Total Consideration set forth in the table

above for each $1,000 principal amount of Notes purchased pursuant

to the Tender Offers, which includes an early participation premium

of $30.00 per $1,000 principal amount of Notes (the “Early

Participation Premium”), plus accrued and unpaid interest on such

Notes from, and including, the applicable last interest payment

date with respect to those Notes to, but not including, the Early

Settlement Date (“Accrued Interest”). Withdrawal rights for the

Notes expired at 5:00 p.m., New York City time, on September 25,

2017.

As the aggregate consideration to be paid by the Company in

respect of each series of Notes that have been tendered would

exceed the applicable Maximum Series Tender Caps, acceptance for

tenders of each series of Notes has been prorated such that (i) of

the $231,835,000 aggregate principal amount of the 5.50% Senior

Notes due 2019 that were tendered as of the Early Participation

Time, only $141,377,000 aggregate principal amount are expected to

be accepted for purchase on the Early Settlement Date; (ii) of the

$277,852,000 aggregate principal amount of the 5.25% Senior Notes

due 2020 that were tendered as of the Early Participation Time,

only $115,874,000 aggregate principal amount are expected to be

accepted for purchase on the Early Settlement Date; and (iii) of

the $322,588,000 aggregate principal amount of the 7.00% Senior

Notes due 2021 that were tendered as of the Early Participation

Time, only $152,339,000 aggregate principal amount are expected to

be accepted for purchase on the Early Settlement Date.

Because the Tender Offers have been fully subscribed as of the

Early Participation Time, no Notes tendered after the Early

Participation Time will be accepted for purchase in the Tender

Offers. Any Notes tendered after the Early Participation Time,

together with any Notes tendered at or prior to the Early

Participation Time but not accepted by the Company, including Notes

not accepted because of proration, will be returned to the holders

thereof. The Tender Offers will expire at 11:59 p.m. New York City

time, on October 10, 2017, unless extended or earlier

terminated.

The obligation of the Company to accept any Notes tendered and

to pay the consideration therefor is subject to, and conditioned

upon, the satisfaction or waiver of certain conditions described in

the Offer to Purchase, including the consummation of an offering of

senior debt securities, which the Company commenced concurrently

with the Tender Offers, the net proceeds of which, together with

other available cash, will fund the Tender Offers (the “Debt

Financing”). The Debt Financing is expected to close on September

26, 2017, subject to customary closing conditions.

The dealer manager for the Tender Offers is RBC Capital Markets,

LLC (the “Dealer Manager”). The information agent and the

depositary for the Tender Offers is Global Bondholder Services

Corporation (the “Depositary”). Any questions regarding the terms

of the Tender Offers should be directed to the Dealer Manager at

(toll-free) (877) 381-2099 or (212) 618-7822. Any questions

regarding procedures for tendering Notes should be directed to the

information agent at (toll-free) (866) 873-6300 or (for banks and

brokers) (212) 430-3774) or 65 Broadway, Suite 404, New York, NY

10006.

This news release shall not be construed as an offer to purchase

or sell or a solicitation of an offer to purchase or sell any of

the Notes or any other securities. The Company, subject to

applicable law, may amend, extend or terminate any or all of the

Tender Offers and may postpone the acceptance for purchase of, and

payment for, the Notes so tendered. The Tender Offers are not being

made in any jurisdiction in which the making or acceptance thereof

would not be in compliance with the securities, blue sky or other

laws of such jurisdiction. None of the Company, the Dealer Manager,

the information agent or the Depositary makes any recommendations

as to whether holders of the Notes should tender their Notes

pursuant to the Tender Offers. Nothing contained herein shall

constitute an offer of the debt securities that are the subject of

the Debt Financing.

About Radian

Radian Group Inc. (NYSE:RDN), headquartered in Philadelphia,

provides private mortgage insurance, risk management products and

real estate services to financial institutions. Radian offers

products and services through two business segments:

- Mortgage Insurance, through its

principal mortgage insurance subsidiary Radian Guaranty Inc. This

private mortgage insurance protects lenders from default-related

losses, facilitates the sale of low-downpayment mortgages in the

secondary market and enables homebuyers to purchase homes more

quickly with downpayments less than 20%.

- Mortgage and Real Estate

Services, through its principal services subsidiary Clayton, as

well as Green River Capital, Red Bell Real Estate and ValuAmerica.

These solutions include information and services that financial

institutions, investors and government entities use to evaluate,

acquire, securitize, service and monitor loans and asset-backed

securities.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170926005972/en/

Radian Group Inc.Emily Riley,

215-231-1035emily.riley@radian.biz

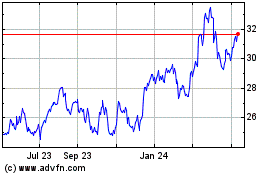

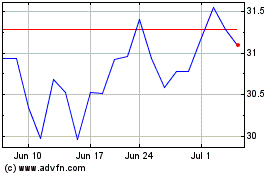

Radian (NYSE:RDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Radian (NYSE:RDN)

Historical Stock Chart

From Apr 2023 to Apr 2024