SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to ss.240.14a-11(c) or ss.240.14a-12

FLEXIBLE SOLUTIONS INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

William T. Hart - Attorney for Registrant

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant

to Exchange Act Rule 0-11:

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

1

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

2

FLEXIBLE SOLUTIONS INTERNATIONAL, INC.

5803 52 Ave.

Taber, AB

Canada T1G 1W9

(250) 477-9969

PROXY STATEMENT

The accompanying proxy is solicited by the Company's directors for voting

at the annual meeting of shareholders to be held on November 2, 2017, at 6:00

p.m. Pacific Time, and at any and all adjournments of such meeting. If the proxy

is executed and returned, it will be voted at the meeting in accordance with any

instructions, and if no specification is made, the proxy will be voted for the

proposals set forth in the accompanying notice of the annual meeting of

shareholders. Shareholders who execute proxies may revoke them at any time

before they are voted, either by writing to the Company at the address shown

above or in person at the time of the meeting. Additionally, any later dated

proxy will revoke a previous proxy from the same shareholder. This proxy

statement was posted on the Company's website on September 21, 2017.

There is one class of capital stock outstanding. Provided a quorum

consisting of one-third of the shares entitled to vote is present at the

meeting, the affirmative vote of a majority of the shares of common stock voting

in person or represented by proxy is required to elect directors and to adopt

the other proposals to come before the meeting. Cumulative voting in the

election of directors is not permitted.

Shares of the Company's common stock represented by properly executed

proxies that reflect abstentions or "broker non-votes" will be counted as

present for purposes of determining the presence of a quorum at the annual

meeting. "Broker non-votes" represent shares held by brokerage firms in

"street-name" with respect to which the broker has not received instructions

from the customer or otherwise does not have discretionary voting authority.

Abstentions and broker non-votes will not be counted as having voted against the

proposals to be considered at the meeting.

PRINCIPAL SHAREHOLDERS

The following table lists, as of September 21, 2017, the shareholdings of

(i) each person owning beneficially 5% or more of the Company's common stock

(ii) each officer of the Company, (iii) each person nominated to be a director,

and (iv) all officers and nominees to the Board of Directors as a group. Unless

otherwise indicated, each owner has sole voting and investment powers over his

shares of common stock.

3

Name and Address Number of Shares (1) Percent of Class

---------------- -------------------- ----------------

Daniel B. O'Brien 4,521,900 39.3%

Unit 15 - 6782 Veyaness Rd.

Saanichton, BC

Canada V8M 2C2

John Bientjes 15,000 0.1%

#1-230 West 13th Street,

North Vancouver, B.C.

Canada V7M 1N7

Robert Helina 15,000 0.1%

Suite 262 505 - 8840 210th St.

Langley, BC

Canada V1M 2Y2

Dr. Thomas Fyles 15,000 0.1%

Box 3065

Victoria, BC

Canada V8W 3V6

Ben Seaman 800 0.0%

Unit 605 55 E. Cordova St.

Vancouver BC

Canada V6A 0A5

David Flynn 0 0.0%

202-2526 Yale Court,

Abbotsford, BC

Canada V2S 8G9

All Officers and Directors 4,566,900 39.7%

as a Group (6 persons)

|

(1) Includes shares which may be acquired on the exercise of the stock options

listed below, all of which were exercisable as of September 21, 2017.

4

Shares Issuable Upon

the Exercise of Exercise

Name Options Price Expiration Date

---- -------------------- -------- ---------------

John Bientjes 5,000 $1.21 December 31, 2017

5,000 $1.00 December 31, 2018

5,000 $1.05 December 31, 2019

Robert Helina 5,000 $1.21 December 31, 2017

5,000 $1.00 December 31, 2018

5,000 $1.05 December 31, 2019

Dr. Thomas Fyles

5,000 $1.21 December 31, 2017

5,000 $1.00 December 31, 2018

5,000 $1.05 December 31, 2019

|

ELECTION OF DIRECTORS

Unless the proxy contains contrary instructions, it is intended that the

proxies will be voted for the election of the persons listed below to serve as

members of the board of directors until the next annual meeting of shareholders

and until their successors shall be elected and shall qualify.

All nominees to the Board of Directors have consented to stand for

re-election. In case any nominee shall be unable or shall fail to act as a

director by virtue of an unexpected occurrence, the proxies may be voted for

such other person or persons as shall be determined by the persons acting under

the proxies in their discretion.

Daniel O'Brien and John Bientjes have served as directors for a significant

period of time and each of those directors' long-standing experience with the

Company benefits both the Company and its shareholders. Robert Helina is

qualified to act as a director due to his longstanding financial experience. Dr.

Fyles is qualified to act as a director due to his experience in chemistry. Ben

Seaman is familiar with the Company and is qualified to act as a director due to

his experience in marketing and distribution. David Fynn has accounting

experience which benefits both the Company and its shareholders.

Information concerning the nominees to the Company's Board of Directors

follows:

Name Age Position

---- --- --------

Daniel B. O'Brien 61 President, Director

John H. Bientjes 64 Director

Robert Helina 51 Director

Thomas Fyles 65 Director

Ben Seaman 37 Director

David Fynn 59 Director

|

5

Directors are elected annually and hold office until the next annual

meeting of our stockholders and until their successors are elected and

qualified. All executive offices are chosen by the board of directors and serve

at the board's discretion.

Daniel B. O'Brien has served as the Company's President and Chief Executive

Officer, as well as a director of the Company since June 1998. He has been

involved in the swimming pool industry since 1990, when he founded the Company's

subsidiary, Flexible Solutions Ltd. From 1990 to 1998 Mr. O'Brien was also a

teacher at Brentwood College where he was in charge of outdoor education.

John H. Bientjes has been a director of the Company since February 2000.

Since 1984, Mr. Bientjes has served as the manager of the Commercial Aquatic

Supplies Division of D.B. Perks & Associates, Ltd., located in Vancouver,

British Columbia, a company that markets supplies and equipment to commercial

swimming pools which are primarily owned by municipalities. Mr. Bientjes

graduated in 1976 from Simon Fraser University in Vancouver, British Columbia

with a Bachelor of Arts Degree in Economics and Commerce.

Robert T. Helina has been a director since October 2011. Mr. Helina has

been involved in the financial services industry for over 25 years which has

given him extensive knowledge in business, economics and finance. His specially

is in corporate finance and capital markets. Mr. Helina holds a Bachelor of Arts

degree from Trinity Western University.

Thomas M. Fyles has been a director of the Company since August 2012. Since

1979 Dr. Fyles has been a chemistry professor at the University of Victoria

(Assistant Professor 1979-1984/Associate Professor 1984-1992/and Professor with

Tenure since 1992) Dr. Fyles received his Bachelor of Science degree (with

honors) from the University of Victoria in 1974 and his Ph.D. in chemistry from

York University in 1977. Dr. Fyles was a postdoctoral fellow with Prof. J.M.

Lehn, Institut Le Bel, Universite Louis Pasteur, Strasbourg, France, between

September 1977 and July 1979.

Ben Seaman has been a director of the Company since October 2016. Mr.

Seaman has been the CEO of Eartheasy.com Sustainable Living Ltd since 2007,

growing the company from $50K to over $25M in annual revenue. His company has

contributed over $1M towards clean water projects in Kenya since 2013, and has

been recognized internationally by the Stockholm Challenge Award and the Outdoor

Industry Inspiration Award in 2016. Prior to that, he worked in sales and

investor relations at Flexible Solutions. Mr. Seaman graduated from the

University of Victoria with a Bachelor of Science degree in 2004. He has

significant experience in launching new products, marketing, distribution and

e-commerce in both the US and Canada. He's a strong believer in the triple

bottom line approach to business, giving consideration to social and

environmental issues in addition to financial performance.

David Fynn has been a director of the Company since October 2016. Mr. Fynn

is a Canadian Chartered Professional Accountant and services

individuals/companies in many sectors including mining and commodities in his

private practice. David worked as a senior manager with KPMG in Canada and Ernst

& Young in the United Kingdom and Saudi Arabia. Since 1996 he has been the

principal of D.A. Fynn & Associates Inc., an accounting firm.

6

Daniel B. O'Brien devotes substantially all of his time to the Company's

business.

The Company's Board of Directors met twice during the year ended December

31, 2016. All of the Directors, attended this meeting either in person, by

telephone conference call or by email.

The Company's Board of Directors does not have a "leadership structure", as

such, since each director is entitled to introduce resolutions to be considered

by the Board and each director is entitled to one vote on any resolution

considered by the Board. The Company's Chief Executive Officer is not the

Chairman of the Company's Board of Directors.

The Company's Board of Directors has the ultimate responsibility to

evaluate and respond to risks facing the Company. The Company's Board of

Directors fulfills its obligations in this regard by meeting on a regular basis

and communicating, when necessary, with the Company's officers.

John Bientjes, Dr. Thomas Fyles, Ben Seaman and David Flynn are independent

directors as that term is defined in section 803 of the listing standards of the

NYSE American.

For purposes of electing directors at its annual meeting the Company does

not have a nominating committee or a committee performing similar functions. The

Company's Board of Directors does not believe a nominating committee is

necessary since the Company's Board of Directors is small and the board of

directors as a whole performs this function. The current nominees to the Board

of Directors were selected by a majority vote of the Company's independent

directors.

The Company does not have any policy regarding the consideration of

director candidates recommended by shareholders since a shareholder has never

recommended a nominee to the board of directors. However, the Company's board of

directors will consider candidates recommended by shareholders. To submit a

candidate for the board of directors the shareholder should send the name,

address and telephone number of the candidate, together with any relevant

background or biographical information, to the Company's Chief Executive

Officer, at the address shown on the cover page of this proxy statement. The

board has not established any specific qualifications or skills a nominee must

meet to serve as a director. Although the board does not have any process for

identifying and evaluating director nominees, the board does not believe there

would be any differences in the manner in which the board evaluates nominees

submitted by shareholders as opposed to nominees submitted by any other person.

There have been no material changes to the procedures by which security holders

may recommend nominees to the Company's board of directors during the past three

years.

The Company does not have a policy with regard to board member's attendance

at annual meetings. All board members attended via conference the last annual

shareholder's meeting held on October 24, 2016.

Holders of the Company's common stock can send written communications to

the Company's entire board of directors, or to one or more board members, by

addressing the communication to "the Board of Directors" or to one or more

7

directors, specifying the director or directors by name, and sending the

communication to the Company's offices in Victoria, British Columbia.

Communications addressed to the Board of Directors as whole will be delivered to

each board member. Communications addressed to a specific director (or

directors) will be delivered to the director (or directors) specified.

Security holder communications not sent to the board of directors as a

whole or to specified board members are not relayed to board members.

The Company has adopted a Code of Ethics that applies to the its Principal

Financial and Accounting Officer, as well as the other company employees. The

Code of Ethics is available at the Company's website at

www.flexiblesolutions.com.

If a violation of the code of ethics act is discovered or suspected, an

officer of the Company must (anonymously, if desired) send a detailed note, with

relevant documents, to the Company's Audit Committee, c/o John Bientjes, #1-230

West 13th St., North Vancouver, B.C., Canada V7M 1N7.

Executive Compensation

The following table shows in summary form the compensation earned by (i)

the Company's Principal Executive and Financial Officer and (ii) by each other

executive officer of the Company who earned in excess of $100,000 during the

fiscal years ended December 31, 2016 and 2015:

All

Other

Restric- Annual

ted Stock Options Compen-

Name and Princi- Fiscal Salary Bonus Awards Awards sation

pal Position Year (1) (2) (3) (4) (5) Total

------------------- ------ ------ ------- -------- ------- ------ -----

Daniel B. O'Brien 2016 $ 743,042 -- -- $ -- -- $ 743,042

President, Principal 2015 $ 616,295 -- -- $ 2,870 -- $ 619,165

Executive and

Financial Officer

|

(1) The dollar value of base salary (cash and non-cash) earned.

(2) The dollar value of bonus (cash and non-cash) earned.

(3) During the periods covered by the table the fair value of stock issued for

services computed in accordance with ASC 718 on the date of grant.

(4) During the periods covered by the table the fair value of options granted

computed in accordance with ASC 718 on the date of grant. The options in

the table expired prior to 2017.

(5) All other compensation received that could not properly be reported in any

other column of the table.

8

Non-Qualified Stock Option Plan

In August 2014 we adopted a Non-Qualified Stock Option Plan which

authorizes the issuance of up to 1,500,000 shares of our common stock to persons

that exercise options granted pursuant to the Plan. Our employees, directors and

officers, and consultants or advisors are eligible to be granted options

pursuant to the Non-Qualified Plan.

The Plan is administered by our Compensation Committee. The Committee is

vested with the authority to determine the number of shares issuable upon the

exercise of the options, the exercise price and expiration date of the options,

and when, and upon what conditions options granted under the Plan will vest or

otherwise be subject to forfeiture and cancellation.

During the fiscal year ended December 31, 2016 we issued 168,000 options

pursuant to the Non-Qualified Plan.

Stock Option Program

Prior to August 2014 we had a Stock Option Program which involved the

issuance of options, from time to time, to our employees, directors, officers,

consultants and advisors. Options were granted by means of individual option

agreements. Each option agreement specified the shares issuable upon the

exercise of the option, the exercise price, the expiration date and other terms

and conditions of the option.

Options granted had terms of between one and five years after the date of

grant and had exercise prices equal to the fair market value of a share of our

common stock on the date of grant.

As a result of the adoption of our Non-Qualified Stock Option Plan in

August 2014, all options are now granted pursuant to the Non-Qualified Stock

Option Plan.

During the fiscal year ended December 31, 2016, no options were granted and

no options were exercised by our officers or directors.

The following table shows information concerning the options granted to our

officers or directors that expired during the fiscal year ended December 31,

2016:

Options Expired

-----------------------------------------

Remaining

Number Exercise Contractual

Name of Options Price Term (Years)

---- ---------- ------------ ------------

John Bientjes 5,000 $1.50 Nil

Robert Helina 5,000 $2.45 Nil

|

9

The following table shows the weighted average exercise price of the

outstanding options granted pursuant to our Stock Option Program as of December

31, 2016, our most complete fiscal year:

Number of

Securities

Remaining

Available for

Number of Future Issuance

Securities to Weighted- Under Equity

be Issued Avergae Compensation

Upon Exercise Exercise (Excluding Plans

Total Shares of Price of Securities

Reserved Outstanding Outstanding Reflected

Plan Category Under Plans Options Options in Column (a))

------------ ------------- ----------- ----------------

(a) (b) (c)

Non-Qualified Stock Option Plan 1,500,000 450,000 1.09 1,015,000

Stock Option Program N/A 363,000 $1.32 --

--- ------- ----- -----------

Total 813,000 $1.19 1,015,000

======= ===== ===========

|

Our Non-Qualified Stock Option Plan and all grants made pursuant to our

Stock Option Program have been approved by our shareholders.

As of September 21, 2017 options to purchase 671,000 shares of the

Company's common stock were outstanding under the Non-Qualified Stock Option

Plan and the Stock Option Program. The exercise price of these options varies

between $0.75 and $2.00 per share. The options expire at various dates between

December 31, 2017 and December 31, 2021.

Director Compensation

The Company reimburses directors for any expenses incurred in attending

board meetings. Prior to 2016, and except for Daniel B. O'Brien, the Company

compensated directors $2,500 annually and granted directors, other than Mr.

O'Brien, options to purchase shares of common stock each year that they serve.

For 2016 and 2017, the Company compensated the directors with an annual payment

of $5,000 and no stock options.

The Company's directors received the following compensation during the year

ended December 31, 2016:

Name Paid in Cash Stock Awards (1) Option Awards (2)

---- ------------ ---------------- -----------------

John H. Bientjes $5,000 -- --

Robert Helina $5,000 -- --

Dr. Thomas Fyles $5,000 -- --

Ben Seaman $5,000 -- --

David Fynn $5,000 -- --

|

10

(1) The fair value of stock issued for services computed on the date of grant.

(2) The fair value of options granted computed in accordance with on the date

of grant.

The terms of outstanding options held by the following persons as of

September 21, 2017 are shown below.

Name Option Price No. of Options Expiration Date

---- ----------- -------------- ---------------

John H. Bientjes $1.21 5,000 December 31, 2017

John H. Bientjes $1.00 5,000 December 31, 2018

John H. Beintjes $1.05 5,000 December 31, 2019

Robert Helina $1.21 5,000 December 31, 2017

Robert Helina $1.00 5,000 December 31, 2018

Robert Helina $1.05 5,000 December 31, 2019

Dr. Thomas Fyles $1.21 5,000 December 31, 2017

Dr. Thomas Fyles $1.00 5,000 December 31, 2018

Dr. Thomas Fyles $1.05 5,000 December 31, 2019

|

Compensation Committee

The Company's Compensation Committee consists of John Bientjes, Ben Seaman

and David Fynn, all of whom are independent as that term is defined in Section

803 of the listing standards of the NYSE American.

The Compensation Committee is empowered to review and approve the annual

compensation and compensation procedures for the Company's officers and

determines the total compensation level for the Company's Chief Executive

Officer. The total proposed compensation of the Company's Chief Executive

Officer is formulated and evaluated by its Chief Executive Officer and submitted

to the Company's Compensation Committee for consideration.

During the year ended December 31, 2016 the Compensation Committee met

once. All members of the Compensation Committee attended this meeting.

During the year ended December 31, 2016, Daniel B. O'Brien, the Company's

only executive officer, did not participate in deliberations of the Company's

Compensation Committee concerning executive officer compensation.

During the year ended December 31, 2016, no director of the Company was

also an executive officer of another entity, which had an executive officer of

the Company serving as a director of such entity or as a member of the

Compensation Committee of such entity.

The following is the report of the Compensation Committee:

The key components of the Company's executive compensation program include

annual base salaries and long-term incentive compensation consisting of stock

options. It is the Company's policy to target compensation (i.e., base salary,

11

stock option grants and other benefits) at approximately the median of

comparable companies in the industries in which the Company competes.

Accordingly, data on compensation practices followed by other companies in the

industries in which the Company competes is considered.

The Company's long-term incentive program consists exclusively of periodic

grants of stock options with an exercise price equal to the fair market value of

the Company's common stock on the date of grant. To encourage retention, the

ability to exercise options granted under the program may be subject to vesting

restrictions. Decisions made regarding the timing and size of option grants take

into account the performance of both the Company and the employee, "competitive

market" practices, and the size of the option grants made in prior years. The

weighting of these factors varies and is subjective. Current option holdings are

not considered when granting options.

Audit Committee

The Company's Audit Committee presently consists of John Bientjes, Ben

Seaman and David Fynn all of whom are independent directors and have strong

financial backgrounds. The purpose of the Audit Committee is to review and

approve the selection of the Company's auditors and review the Company's

financial statements with the Company's independent registered public accounting

firm. The Audit Committee also serves as an independent and objective party to

monitor the Company's financial reporting process and internal control systems.

The Audit Committee meets periodically with management and the Company's

independent auditors.

During the fiscal year ended December 31, 2016, the Audit Committee met

four times. All members of the Audit Committee attended these meetings.

The following is the report of the Audit Committee:

(1) The Audit Committee reviewed and discussed the Company's audited

financial statements for the year ended December 31, 2016 with the

Company's management.

(2) The Audit Committee discussed with the Company's independent

registered public accounting firm the matters required to be discussed

by Statement on Accounting Standards (SAS) No. 61 "Communications with

Audit Committee" as amended by SASs 89 and 90.

(3) The Audit Committee has received the written disclosures and the

letter from the Company's independent registered public accounting

firm required by PCAOB (Public Company Accounting Oversight Board)

standards, and had discussed with the Company's independent registered

public accounting firm the independent registered public accounting

firm's independence.

(4) Based on the review and discussions referred to above, the Audit

Committee recommended to the Board of Directors that the audited

financial statements be included in the Company's Annual Report on

Form 10-K for the year ended December 31, 2016 for filing with the

Securities and Exchange Commission.

12

(5) During the year ended December 31, 2016 the Company paid Meyers Norris

Penny LLP, the Company's independent registered public accounting

firm, audit and audit related fees of $64,553 for professional

services rendered for the audit of the Company's annual financial

statements and the reviews of the financial statements included in the

Company's 10-Q reports for the fiscal year and all regulatory filings.

(6) The Audit Committee is of the opinion that these fees are consistent

with maintaining its independence from the Company.

The foregoing report has been approved by the members of the Audit

Committee:

John Bientjes

Ben Seaman

David Fynn

The Company's Board of Directors has adopted a written charter for the

Audit Committee, a copy of which is available on the Company's website:

www.flexiblesolutions.com.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or

the Dodd-Frank Act, enables the Company's shareholders to vote to approve, on a

nonbinding advisory basis, the compensation of the Company's executive officers.

Accordingly, the Company will ask shareholders to vote for the following

resolution at the annual meeting:

"RESOLVED, that the Company's shareholders approve, on a nonbinding

advisory basis, the compensation of the Company's executive officers,

as disclosed in the Company's Proxy Statement for the Annual Meeting

of Shareholders to be held November 2, 2017 pursuant to the

compensation disclosure rules of the Securities and Exchange

Commission, including the Summary Compensation Table and the other

related tables and narrative disclosure in the Company's proxy

statement."

To the extent there is any significant vote against the named executive

officer compensation as disclosed in this proxy statement, the Company's Board

of Directors and its Compensation Committee will consider shareholders' concerns

and the Compensation Committee will evaluate whether any actions are necessary

to address those concerns.

The Board of Directors recommends that the shareholders approve on a

nonbinding advisory basis the resolution approving the compensation of the

Company's executive officers set forth in this proxy statement.

13

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has selected Meyers, Norris, Penny, LLP, an

independent registered public accounting firm, to audit the books and records of

the Company for the fiscal year ending December 31, 2017. Meyers, Norris, Penny

served as the Company's independent registered public accounting firm for the

fiscal years ended December 31, 2016 and 2015. A representative of Meyers,

Norris, Penny, is expected to be present at the shareholders' meeting.

The following table shows the aggregate fees billed to the Company during

the years ended December 31, 2016 and 2015 by Meyers Norris Penny LLP:

Year Ended December 31,

2016 2015

---- ----

Audit Fees $64,553 $58,970

Audit-Related Fees -- --

Tax Fees -- --

All Other Fees -- --

|

Audit fees represent amounts billed for professional services rendered for

the audit of the Company's annual financial statements and the reviews of the

financial statements included in the Company's 10-Q reports for the fiscal year

and all regulatory filings. Audit-related fees represent amounts billed for

reviewing amendments to the Company's 10-K and 10-Q reports. Before Meyers

Norris Penny was engaged by the Company to render audit or non-audit services,

the engagement was approved by the Company's audit committee. The Company's

Board of Directors is of the opinion that the audit fees charged by Meyers

Norris Penny are consistent with that firm maintaining its independence from the

Company.

AVAILABILITY OF ANNUAL REPORT ON FORM 10-K

The Company's Annual Report on Form 10-K for the year ending December 31,

2016 will be sent to any shareholder of the Company upon request. Requests for a

copy of this report should be addressed to the Company's Secretary at the

address provided on the first page of this proxy statement.

SHAREHOLDER PROPOSALS

Any shareholder proposal which may properly be included in the proxy

solicitation material for the annual meeting of shareholders following the

Company's year ending December 31, 2017 must be received by the Company's

Secretary no later than March 31, 2018.

GENERAL

The cost of preparing, printing and mailing the enclosed proxy,

accompanying notice and proxy statement, and all other costs in connection with

solicitation of proxies will be paid by the Company including any additional

solicitation made by letter, telephone or email. Failure of a quorum to be

14

present at the meeting will necessitate adjournment and will subject the Company

to additional expense. The Company's annual report, including financial

statements for the 2016 fiscal year, is available at the Company's website:

www.flexiblesolutions.com.

The Company's Board of Directors does not intend to present and does not

have reason to believe that others will present any other items of business at

the annual meeting. However, if other matters are properly presented to the

meeting for a vote, the proxies will be voted upon such matters in accordance

with the judgment of the persons acting under the proxies.

Please complete, sign and return the attached proxy promptly.

15

PROXY CARD

FLEXIBLE SOLUTIONS INTERNATIONAL, INC.

This Proxy is solicited by the Company's Board of Directors

The undersigned stockholder of Flexible Solutions International, Inc.

acknowledges receipt of the Notice of the Annual Meeting of Stockholders to be

held November 2, 2017, at 6:00 p.m. local time, at the Company's offices located

at Unit 15 - 6782 Veyaness Rd., Saanichton, BC Canada V8M 2C2 and hereby

appoints Daniel O'Brien with the power of substitution, as Attorney and Proxy to

vote all the shares of the undersigned at said annual meeting of stockholders

and at all adjournments thereof, hereby ratifying and confirming all that said

Attorney and Proxy may do or cause to be done by virtue hereof. The above named

Attorney and Proxy is instructed to vote all of the undersigned's shares as

follows:

(1) To elect the persons who shall constitute the Company's Board of

Directors for the ensuing year.

[ ] FOR all nominees listed below (except as marked to the contrary below)

[ ] WITHHOLD AUTHORITY to vote for all nominees listed below

(INSTRUCTION: TO WITHHOLD AUTHORITY TO VOTE FOR ANY INDIVIDUAL NOMINEE, STRIKE A

LINE THROUGH THE NOMINEE'S NAME IN THE LIST BELOW)

Nominees: Daniel B. O'Brien John H. Bientjes Robert Helina

Thomas Fyles Ben Seaman David Fynn

(2) To approve on an advisory basis, the compensation of the Company's

executive officers.

[ ] FOR [ ] AGAINST [ ] ABSTAIN

(3) To ratify the appointment of Meyers, Norris, Penny, LLP as the

Company's independent registered public accounting firm for the fiscal year

ending December 31, 2017.

[ ] FOR [ ] AGAINST [ ] ABSTAIN

To transact such other business as may properly come before the meeting.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED HEREIN BY THE

UNDERSIGNED STOCKHOLDER. IF NO DISCRETION IS INDICATED, THIS PROXY WILL BE VOTED

IN FAVOR OF ALL DIRECTORS AND ITEMS 2 AND 3.

Dated this day of 2017.

----- ------------

---------------------------------------------

(Signature)

|

(Signature)

Please sign your name exactly as it appears on your stock certificate. If

shares are held jointly, each holder should sign. Executors, trustees, and

other fiduciaries should so indicate when signing.

Please Sign, Date and Return this Proxy so that your shares may be voted at

the meeting.

Send the proxy statement by regular mail, email, or fax to:

Flexible Solutions International, Inc.

Attn: Daniel B. O'Brien

5803 52 Ave.

Taber, AB

Canada T1G 1W9

Phone: 403 223 2995

Fax: 403 223 2905

Email: damera@flexiblesolutions.com

FLEXIBLE SOLUTIONS INTERNATIONAL, INC.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Be Held on November 2, 2017.

1. This notice is not a form for voting.

2. This communication presents only an overview of the more complete

proxy materials that are available to you on the Internet. We

encourage you to access and review all of the important information

contained in the proxy materials before voting.

3. The Proxy Statement, Information Statement, Annual Report to

Shareholders is available at

http://flexiblesolutions.com/investor/AGM_2017.shtml

4. If you want to receive a paper or email copy of these documents, you

must request one. There is no charge to you for requesting a copy.

Please make your request for a copy as instructed below on or before

October 6, 2017 to facilitate timely delivery.

The 2017 annual meeting of the Company's shareholders will be held at the

Company's offices located at Unit 15 - 6782 Veyaness Rd., Saanichton, BC Canada

V8M 2C2 on November 2, 2017, at 6:00 p.m. Pacific Time, for the following

purposes:

(1) to elect the directors who shall constitute the Company's Board of

Directors for the ensuing year;

(2) to approve on an advisory basis, the compensation of the Company's

executive officers;

(3) to ratify the appointment of Meyers, Norris, Penny, LLP as the

Company's independent registered public accounting firm for the fiscal

year ending December 31, 2017; and

to transact such other business as may properly come before the meeting.

The Board of Directors recommends that shareholders vote FOR all directors

and proposals 2 and 3.

September 21, 2017 is the record date for the determination of shareholders

entitled to notice of and to vote at such meeting. Shareholders may cast one

vote for each share held.

Shareholders may access the following documents at or

http://flexiblesolutions.com/ investor/ AGM_2017.shtml:

o Notice of the 2017 Annual Meeting of Shareholders

o Company's 2017 Proxy Statement;

o Company's Annual Report on form 10-K for the year ended December 31,

2016

o Proxy Card

Shareholders may request a paper copy of the Proxy Materials and Proxy

Card by calling 1-800-661-3560, by emailing the Company at

http://flexiblesolutions.com/investor/ AGM_2017.shtml, or by visiting

http://flexiblesolutions.com/investor/AGM_2017.shtml and indicating if you want

a paper copy of the proxy materials and proxy card:

o for this meeting only, or

o for this meeting and all other meetings.

If you have a stock certificate registered in your name, or if you have a

proxy from a shareholder of record on September 21, 2017, you can, if desired,

attend the Annual Meeting and vote in person. Shareholders can obtain directions

to the 2017 annual shareholders' meeting at

http://flexiblesolutions.com/investor/AGM_2017.shtml.

Please visit www.flexiblesolutions.com to print and fill out the Proxy

Card. Complete and sign the proxy card and mail the Proxy Card to:

Flexible Solutions International, Inc.

5803 52 Ave.,

Taber, AB

Canada T1G 1W9

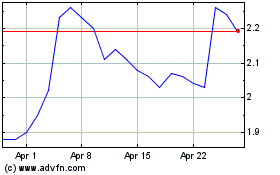

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

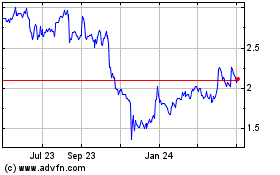

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Apr 2023 to Apr 2024