First Trust/Aberdeen Global Opportunity Income Fund Declares its Monthly Common Share Distribution of $0.075 Per Share for Oc...

September 20 2017 - 4:52PM

Business Wire

First Trust/Aberdeen Global Opportunity Income Fund (the "Fund")

(NYSE: FAM) has declared the Fund’s regularly scheduled monthly

common share distribution in the amount of $0.075 per share payable

on October 16, 2017, to shareholders of record as of October 3,

2017. The ex-dividend date is expected to be October 2, 2017. The

monthly distribution information for the Fund appears below.

First Trust/Aberdeen

Global Opportunity Income Fund (FAM):

Distribution per share: $0.075 Distribution Rate

based on the September 19, 2017 NAV of $13.17: 6.83% Distribution

Rate based on the September 19, 2017 closing market price of

$11.85: 7.59%

This distribution will consist of net investment income earned

by the Fund and may also consist of return of capital and/or

realized capital gains. The final determination of the source and

tax status of all distributions paid in 2017 will be made after the

end of 2017 and will be provided on Form 1099-DIV.

The Fund is a diversified, closed-end management investment

company that seeks to provide a high level of current income. As a

secondary objective, the Fund seeks capital appreciation. The Fund

pursues these investment objectives by investing in the world bond

markets through a diversified portfolio of investment grade and

below-investment grade government and corporate debt

securities.

First Trust Advisors L.P., the Fund's investment advisor, along

with its affiliate, First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $109

billion as of August 31, 2017 through unit investment trusts,

exchange-traded funds, closed-end funds, mutual funds and separate

managed accounts.

Aberdeen Asset Management Inc. serves as the Fund's investment

sub-advisor (the "Sub-Advisor"). The Sub-Advisor is a wholly owned

subsidiary of Aberdeen Asset Management PLC ("Aberdeen PLC"). The

merger of Standard Life plc and Aberdeen PLC, announced on March 6,

2017 ("Merger"), closed on August 14, 2017. Aberdeen PLC became a

direct subsidiary of Standard Life plc as a result of the Merger

and the combined company changed its name to Standard Life Aberdeen

plc. Shareholders of the Fund are not required to take any action

as a result of the Merger. Following the Merger, the Sub-Advisor is

an indirect subsidiary of Standard Life Aberdeen plc, but otherwise

did not change. The investment sub-advisory agreement for the Fund,

the services provided under the agreement, and the fees charged for

services did not change as a result of the Merger. The portfolio

management team of the Sub-Advisor for the Fund did not change as a

result of the Merger.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost.

Principal Risk Factors: The Fund invests in securities of

non-U.S. issuers which are subject to higher volatility than

securities of U.S. issuers. Risks may be heightened for securities

of companies located in, or with significant operations in,

emerging market countries. Because the Fund invests in non-U.S.

securities, you may lose money if the local currency of a non-U.S.

market depreciates against the U.S. dollar.

The Fund invests in non-investment grade debt instruments,

commonly referred to as "high-yield securities". High yield

securities are subject to greater market fluctuations and risk of

loss than securities with higher ratings. Lower-quality debt tends

to be less liquid than higher-quality debt.

The debt securities in which the Fund invests are subject to

certain risks, including issuer risk, reinvestment risk, prepayment

risk, credit risk, and interest rate risk. Issuer risk is the risk

that the value of fixed-income securities may decline for a number

of reasons which directly relate to the issuer. Reinvestment risk

is the risk that income from the Fund's portfolio will decline if

the Fund invests the proceeds from matured, traded or called bonds

at market interest rates that are below the Fund portfolio's

current earnings rate. Prepayment risk is the risk that, upon a

prepayment, the actual outstanding debt on which the Fund derives

interest income will be reduced. Credit risk is the risk that an

issuer of a security will be unable or unwilling to make dividend,

interest and/or principal payments when due and that the value of a

security may decline as a result. Interest rate risk is the risk

that fixed-income securities will decline in value because of

changes in market interest rates.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the Fund are spelled out in the

shareholder reports and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA

and the Internal Revenue Code. First Trust has no knowledge of and

has not been provided any information regarding any investor.

Financial advisors must determine whether particular investments

are appropriate for their clients. First Trust believes the

financial advisor is a fiduciary, is capable of evaluating

investment risks independently and is responsible for exercising

independent judgment with respect to its retirement plan

clients.

The Fund’s daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170920006334/en/

First Trust/Aberdeen Global Opportunity Income FundPress

Inquiries: Jane Doyle, 630-765-8775Analyst Inquiries: Jeff

Margolin, 630-915-6784Broker Inquiries: Jeff Margolin,

630-915-6784

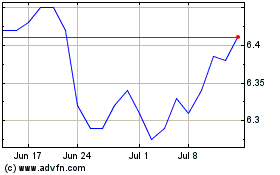

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

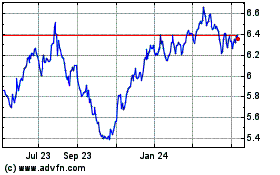

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

From Apr 2023 to Apr 2024