InnSuites Hospitality Trust (IHT) Revenues, Net Income, Cash and Net Income per Share Grow

September 14 2017 - 10:38PM

Marketwired

InnSuites Hospitality Trust (IHT) Revenues, Net Income, Cash and

Net Income per Share Grow

PHOENIX, AZ-(Marketwired - Sep 14, 2017) - InnSuites Hospitality

Trust (NYSE American: IHT) (NYSE MKT: IHT)

InnSuites Hospitality Trust ("IHT") reported revenues of

approximately $5.46 million for the six months ended July 31, 2017

compared to revenues of approximately $4.70 million for the six

months ended July 31, 2016, an improvement of approximately

$760,000 or 16%. Consolidated Net Income was approximately $9.56

million for the six months ended July 31, 2017 compared with a

small net loss for the six months ended July 31, 2016, an

improvement in reported earnings of approximately $9.81

million.

Included in consolidated net income was non-cash depreciation

expense of approximately $604,000 for the six months ended July 31,

2017 compared to $161,000 for the six months ended July 31, 2016.

Reported net income per share was $0.97 for the six months ended

July 31, 2017 compared with a net loss per share of ($0.03) for the

six months ended July 31, 2016. As of September 14, 2017, IHT's

closing stock price was $1.58. The first fiscal six months improved

results were due in part to the sale of one of the Trusts' hotel

asses which was carried on the accounting books significantly below

the sales/market price. Management believes that its other hotels

assets as well as its IBC Hotels technology division are also

carried at a book value significantly below the market value.

As of July 31, 2017, cash on hand was $7.5 million as compared

to $478,000 as of January 31, 2017.

As of September, 1, 2017, InnSuites corporate office moved into

a new more spacious building located at 1730 E Northern Avenue,

Suite 122 Phoenix, Arizona 85020. The additional space and capacity

is for our fast-growing technology division, IBC Hotels.

For more information, visit www.innsuitestrust.com. With the

exception of historical information, the matters discussed in this

news release may include "forward-looking statements" within the

meaning of the federal securities laws. Forward-looking statements

are not guarantees of future performance due to numerous risks and

uncertainties such as local, national or international economic and

business conditions, including, without limitation, conditions that

may, or may continue to, affect public securities markets

generally, the hospitality industry or the markets in which we

operate or will operate; fluctuations in hotel occupancy rates;

changes in room rental rates that may be charged by InnSuites

Hotels in response to market rental rate changes or otherwise;

seasonality of our business; our ability to sell any of our Hotels

at market value, listed sale price or at all; interest rate

fluctuations; changes in, or reinterpretations of governmental

regulations; competition; availability of credit or other

financing; our ability to meet, refinance or extend present and

future debt service obligations; insufficient resources to pursue

our current strategy; concentration of our investments in the

InnSuites Hotels® brand; loss of membership contracts; the

financial condition of franchises, brand membership companies and

travel related companies; our ability to develop and maintain

positive relations with "Best Western Plus" or "Best Western" and

potential future franchises or brands; our ability to carry out our

strategy, including our strategy regarding IBC Hotels; the Trust's

ability to remain listed on the NYSE MKT; effectiveness of the

Trust's software program; the need to periodically repair and

renovate our Hotels at a cost at or in excess of our standard 4%

reserve; our ability to cost effectively integrate any acquisitions

with the Trust in a timely manner; increases in the cost of labor,

energy, healthcare, insurance and other operating expenses as a

result of changed or increased regulation or otherwise; terrorist

attacks or other acts of war; outbreaks of communicable diseases

attributed to our hotels or impacting the hotel industry in

general; natural disasters, including adverse climate changes in

the areas where we have or serve hotels; airline strikes;

transportation and fuel price increases; adequacy of insurance

coverage; data breaches or cybersecurity attacks; and other

factors. Such uncertainties are described in greater detail in our

filings with the Securities and Exchange Commission. Although we

believe our current expectations to be based upon reasonable

assumptions, we can give no assurance that our expectations will be

attained.

FOR FURTHER INFORMATION: Marc Berg Executive Vice President

602-944-1500 email: mberg@innsuites.com

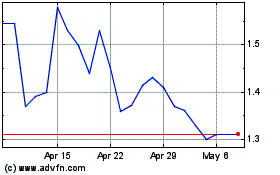

Innsuites Hospitality (AMEX:IHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Innsuites Hospitality (AMEX:IHT)

Historical Stock Chart

From Apr 2023 to Apr 2024