Global Medical REIT Inc. Announces Closing of Series A Preferred Stock Offering and Over-Allotment Option

September 18 2017 - 8:30AM

Business Wire

Global Medical REIT Inc. (NYSE:GMRE) (the “Company”),

today announced that on September 15, 2017 it closed on the

issuance of 3,105,000 shares of its Series A Cumulative Redeemable

Preferred Stock, $0.001 par value per share (“Series A Preferred

Stock”), inclusive of 405,000 shares of Series A Preferred Stock

issued in connection with the underwriters’ exercise of their

over-allotment option, raising aggregate net proceeds of

approximately $75 million, after deducting underwriting discounts

and commissions and estimated offering expenses paid or payable by

the Company. The Series A Preferred Stock has an initial

liquidation preference of $25 per share. The Company expects

trading of the Series A Preferred Stock on the New York Stock

Exchange to commence on October 16, 2017 under the symbol “GMRE

PrA.”

The Company intends to use the net proceeds from this offering

for general corporate purposes, which may include funding new

acquisitions, and repaying indebtedness.

FBR Capital Markets & Co., a B. Riley Financial Company, and

Janney Montgomery Scott served as the book-running managers for the

offering. BB&T Capital Markets, Compass Point and D.A. Davidson

& Co. served as co-managers.

The offering was made pursuant to the Company’s shelf

registration statement, which was declared effective by the U.S.

Securities and Exchange Commission (“SEC”) on June 19, 2017. Copies

of the final prospectus supplement and accompanying prospectus may

be obtained from the SEC’s website at www.sec.gov or by contacting: FBR Capital Markets

& Co., 1300 North 17th Street, Suite 1400, Arlington, Virginia

22209 or by email at prospectuses@fbr.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any sale of

these shares or any other securities in any state in which such

offer, solicitation or sale would be unlawful, prior to

registration or qualification under the securities laws of any

state.

About Global Medical REIT Inc.

Global Medical REIT Inc. is a Maryland corporation engaged

primarily in the acquisition of licensed, state-of-the-art,

purpose-built healthcare facilities and the leasing of these

facilities to strong clinical operators with leading market share.

The Company intends to produce increasing, reliable rental revenue

by expanding its portfolio, and leasing each of its healthcare

facilities to market-leading operators under a long-term triple-net

lease. The Company’s management team has significant healthcare,

real estate and public real estate investment trust, or REIT,

experience and has long-established relationships with a wide range

of healthcare providers. The Company intends to elect to be taxed

as a REIT for U.S. federal income tax purposes, commencing with its

taxable year ended December 31, 2016.

Forward-Looking Statements

This press release contains statements that are “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”,

and “project” and other similar expressions that predict or

indicate future events or trends or that are not statements of

historical matters. Forward-looking statements should not be read

as a guarantee of future performance or results, and will not

necessarily be accurate indications of the times at, or by, which

such performance or results will be achieved. Forward-looking

statements are based on information available at the time those

statements are made and/or management’s good faith belief as of

that time with respect to future events. These forward-looking

statements are subject to various risks and uncertainties, not all

of which are known to the Company and many of which are beyond the

Company’s control, which could cause actual performance or results

to differ materially from those expressed in or suggested by the

forward-looking statements. These risks and uncertainties are

described in greater detail in the Company’s filings with the SEC,

including, without limitation, the Company’s annual and periodic

reports and other documents filed with the SEC. Unless legally

required, the Company disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise. The Company undertakes no obligation to

update these statements after the date of this release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170918005399/en/

Investor Relations CounselThe Equity Group Inc.Jeremy Hellman,

212-836-9626Senior Associatejhellman@equityny.comorAdam Prior,

212-836-9606Senior Vice Presidentaprior@equityny.com

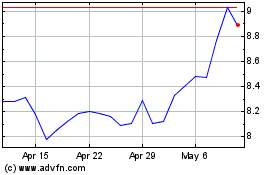

Global Med REIT (NYSE:GMRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

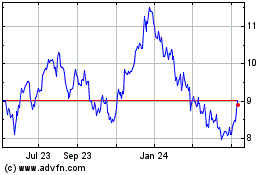

Global Med REIT (NYSE:GMRE)

Historical Stock Chart

From Apr 2023 to Apr 2024