Camden Property Trust Announces Closing of Offering of Common Shares

September 14 2017 - 10:15AM

Business Wire

Camden Property Trust (NYSE:CPT) today announced the closing of

a public offering of 4,750,000 common shares. The company received

net proceeds before expenses of approximately $442.6 million from

the offering. Deutsche Bank Securities and J.P. Morgan, the joint

book-running managers for the offering, have been granted a 30-day

option to purchase up to an additional 712,500 common shares. The

underwriters may offer the common shares from time to time for sale

in one or more transactions on the New York Stock Exchange, in the

over-the-counter market, through negotiated transactions or

otherwise at market prices prevailing at the time of sale, at

prices related to prevailing market prices or at negotiated prices.

Camden intends to use the net proceeds for general corporate

purposes, which may include financing for acquisitions and funding

for development activities, reducing borrowings under its $600

million unsecured line of credit, the repayment of other

indebtedness, and the redemption or other repurchase of outstanding

debt or equity securities.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any Camden common shares, nor shall

there be any sale of these securities in any jurisdiction in which

such an offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. The offering may be made only by means of a

prospectus and a related prospectus supplement, copies of which may

be obtained when available from Deutsche Bank Securities Inc.,

Attention: Prospectus Group, 60 Wall Street, New York, NY

10005-2836, by email to prospectus.cpdg@db.com, or by telephone at

(800) 503-4611, or J.P. Morgan Securities LLC, Attention:

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, Telephone: (866) 803-9204.

In addition to historical information, this press release

contains forward-looking statements under the federal securities

law. These statements are based on current expectations, estimates,

and projections about the industry and markets in which Camden

operates, management's beliefs, and assumptions made by management.

Forward-looking statements are not guarantees of future performance

and involve certain risks and uncertainties which are difficult to

predict. Factors which may cause Camden’s actual results or

performance to differ materially from those contemplated by

forward-looking statements are described under the heading “Risk

Factors” in Camden’s Annual Report on Form 10-K and in other

filings with the Securities and Exchange Commission.

Forward-looking statements made in today’s press release represent

management’s current opinions at the time of this publication, and

Camden assumes no obligation to update or supplement these

statements because of subsequent events.

Camden Property Trust, an S&P 400 Company, is a real estate

company engaged in the ownership, management, development,

redevelopment, acquisition, and construction of multifamily

apartment communities. Camden owns interests in and operates 155

properties containing 53,771 apartment homes across the United

States. Upon completion of 6 properties under development, the

Company’s portfolio will increase to 55,644 apartment homes in 161

properties. Camden was recently named by FORTUNE® Magazine for the

tenth consecutive year as one of the “100 Best Companies to Work

For” in America, ranking #22.

For additional information, please contact Camden's Investor

Relations Department at (713) 354-2787.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170914005905/en/

Camden Property TrustKim Callahan, 713-354-2549

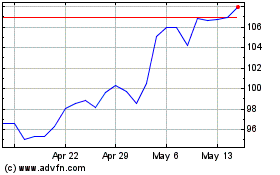

Camden Property (NYSE:CPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

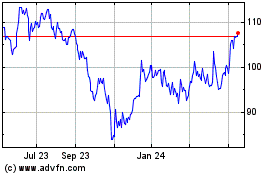

Camden Property (NYSE:CPT)

Historical Stock Chart

From Apr 2023 to Apr 2024