UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

¨

|

|

|

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

|

Table Trac, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

TABLE TRAC, INC.

6101 Baker Road, Suite 206

Minnetonka, Minnesota 55345

PROXY STATEMENT

2017 ANNUAL MEETING OF STOCKHOLDERS

to be held on October 12, 2017

This Proxy Statement is furnished in connection

with the solicitation of proxies by the Board of Directors of Table Trac, Inc. (the “Company”) for use at the 2017

Annual Meeting of Stockholders (the “Annual Meeting”) to be held at

the Sheraton Minneapolis West Hotel

at 12201

Ridgedale Drive, Minnetonka, MN, 55305 (next to the Ridgedale Mall off Highway 394)

at 9:00 AM

local time, for the purpose

of considering and taking appropriate action with respect to the following:

|

|

1.

|

To elect directors to the Company’s Board of Directors; and

|

|

|

2.

|

To ratify the appointment of Boulay P.L.L.P. as our independent registered public accounting firm for fiscal year 2017.

|

This Proxy Statement and the enclosed proxy

card are first being mailed or given to stockholders on or about September 8, 2017.

Proxies and Voting Procedures

Only holders of record of our common stock

at the close of business on August 28, 2017 (the “record date”), will be entitled to attend and vote at the Annual

Meeting or any adjournments thereof. There were 4,511,965 shares of our common stock outstanding on the record date. Each share

of common stock entitles the holder thereof to one vote upon each matter submitted to a vote of stockholders at the Annual Meeting.

A quorum, consisting of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, must be present

in person or represented by proxy before legal action may be taken at the Annual Meeting.

Each proxy returned to the Company will

be voted in accordance with the instructions indicated thereon; provided, however, that if no direction is given by a stockholder

who returns a properly executed proxy, then the shares will be voted as recommended by the Company’s Board of Directors.

If a stockholder abstains from voting on any matter, then the abstention will be counted for purposes of determining whether a

quorum is present at the Annual Meeting for the transaction of business as well as shares entitled to vote on that matter. Under

Section 320 of the Nevada General Corporation Law (Chapter 78 of the Nevada Revised Statutes), the affirmative vote of the holders

of a majority of the total votes cast, in person or represented by proxy at the Annual Meeting and entitled to vote, is required

for ratification and approval of each proposal contained in this Proxy Statement, other than the election of directors. For the

election of directors, director-nominees are approved upon their receipt of a plurality of votes cast at the meeting. Accordingly,

an abstention on any matter (other than the election of directors) will have the same effect as a vote against that matter. In

the case of the election of directors (who are elected by a plurality of votes cast), an abstention is the equivalent of simply

not casting a vote.

A “broker non-vote” occurs when

a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee

does not have discretionary voting power and has not received instructions from the beneficial owner. Broker non-votes on a matter

are counted as present for purposes of establishing a quorum for the Annual Meeting, but are not considered “entitled to

vote” on that particular matter. Consequently, broker non-votes generally do not have the same effect as a negative vote

on the matter being voted on.

Each stockholder who signs and returns a

proxy card in the form enclosed with this Proxy Statement may revoke the proxy at any time prior to its use by giving notice of

revocation to our Secretary in writing, in open meeting, or by executing and delivering a new proxy card to our Secretary.

Unless revoked, the shares represented by each proxy card will be voted at the Annual Meeting and at any adjournments thereof.

A stockholder’s mere presence at the Annual Meeting does not revoke any proxy that the stockholder has previously delivered.

Please note that if you are a beneficial

owner of shares registered in the name of your broker, bank, custodian, nominee or other agent (commonly referred to as holding

your shares in “street name”), you will have received a voting instruction form with these proxy materials from that

organization rather than from the Company. In such a case, you should complete and mail the voting instruction form as instructed

by your broker, bank, custodian, nominee or other agent to ensure that your vote is counted. Alternatively, you may vote by telephone

or over the Internet as instructed by your broker, bank, custodian, nominee or other agent. If you hold your shares in street

name and you wish to vote in person at the Annual Meeting, then you must obtain a legal proxy from your broker, bank, custodian,

nominee or other agent. To do so, follow the instructions you received with these proxy materials, or contact your broker, bank,

custodian, nominee or other agent to request a legal proxy form. You may also request a legal proxy at

www.proxyvote.com

.

ELECTION OF DIRECTORS

(Proposal One)

The Company’s directors are elected

upon a plurality of votes cast. If elected or re-elected, each nominee has consented to serve as a director of the Company, to

hold office until the next annual meeting of stockholders or until his successor is elected and shall have qualified. If any director-nominee

should withdraw or otherwise become unavailable for reasons not presently known, the proxies that would have otherwise been voted

for that director nominee may be voted for a substitute director nominee selected by the Company’s Board of Directors.

Set forth below is information regarding

the individuals nominated for election to the Board of Directors, which includes information furnished by them as to their principal

occupations for the last five years, certain other directorships held by them, and their ages as of the date of this Proxy Statement:

Chad Hoehne (age 55) - Director since 1999

Mr. Hoehne is the President and founder

of the Company. He has a B.S. degree in Business Administration, Finance and computer minor from Minnesota State University. Mr.

Hoehne founded Table Trac, Inc. in 1994 after working nine years for a successful Minneapolis electronics manufacturer and software

company.

Brian Hinchley (age 51) - Director since 2015

Mr. Hinchley is the CEO and CFO of the Company.

He has a B.A. degree in Business Administration/Accounting from the University of St. Thomas in St. Paul, Minnesota. Prior to joining

Table Trac, Mr. Hinchley was the Chief Financial Officer from September 1998 to May 2011 of two privately owned international software

companies, Intercim, LLC and WorkWise, Inc. Mr. Hinchley also served in accounting roles for Griffin Companies, a commercial real

estate company, from May 1992 to August 1998. Mr. Hinchley has been the Company’s CFO since June 2011, and was named the

CEO April 2016.

Steven A. Browne (age 61) - Independent Director since 2010

Mr. Browne has been involved in the gaming

industry since the late 1970s, including companies such as Del Webb’s Sahara Tahoe, the Eldorado, and Club Cal-Neva in northern

Nevada. Mr. Browne has worked in many positions at all levels, primarily in the area of table games management and operations.

In 1988, Mr. Browne and two partners purchased Cactus Jack’s Casino in Carson City, Nevada, and spent the next ten years

as Treasurer and General Manager of that property. During that period, Mr. Browne was instrumental in developing a unique, customer-driven

marketing and service program that took an underperforming casino down the road to seven years of double-digit growth. In 1997,

he stepped down as General Manager and sold his interest in the casino. Since that time, Mr. Browne has developed a successful

consulting practice specializing in the areas of customer service, player development, and casino operations. He works extensively

with casino clients across North America and overseas. Mr. Browne is the author of two books,

Gambling And Service: The Complete

Book On Casinos, Customer Service, And Selling An Entertainment Experience That Enriches People’s Lives

, and

The Math

of Player Development

. He is also the author of several complete Service and Sales Training Programs for gaming employees and

managers. Mr. Browne has been instrumental in leading the charge to developing customer service and customer-focused marketing

as a competitive edge in today’s fiercely competitive gaming markets. Mr. Browne has been a director at Table Trac since

December 2010.

Louis Fornetti (age 67) - Independent Director since 2011

Mr. Fornetti has many years of experience

in finance and corporate governance. Mr. Fornetti has served on the Board of Directors of Saxon Mortgage Corporation (NYSE) (2005-2006),

American Medical Security (NYSE) (2003-2004), Stockwalk Corporation (NASD) (2001), and American Express Financial Advisors (1988-1995).

Mr. Fornetti has also served on the Board of Directors of Othnet, Inc., a private software development corporation, and IPool Corporation,

a private consumer advocacy corporation. From 2004 to present, Mr. Fornetti has been a business advisor and consultant. His prior

work experience includes service as the Executive Vice President and Chief Financial Officer of RBC Dain Rauscher (1995-1997),

Senior Vice President and Chief Financial Officer of American Express Financial Advisors (1992-1995), corporate controller of American

Express Financial Advisors (1985-1992), Vice President and Corporate Controller of St. Paul Travelers (f/k/a The St. Paul Companies,

Inc.) (1979-1985), and audit manager at KPMG (Peat Marwick) (1972-1979). Mr. Fornetti received his B.A. from Northern Michigan

and a CPA certificate from the State of Minnesota in 1974. Mr. Fornetti has been a director at Table Trac since June 2011.

Gary Loebig (age 68) - Independent Director since 2011

Gary Loebig has nearly 30 years of experience

in Class II and Class III gaming. Mr. Loebig is the Principal and a Founder of GLL Consulting, a consulting services company specializing

in sales, marketing and product development and regulatory matters for the Class II, Class III, lottery, charitable and commercial

gaming market segments. Mr. Loebig currently is a Managing Director of a firm involved in game development; as well as Chief

Compliance Office for an Internet gaming company. From 1998-2008, Mr. Loebig served in various positions with Multimedia

Games (NASDAQ), including Executive Vice Present-Sales and Interim Chief Executive Officer, on a variety of issues including Class

II business strategies and new business development. Mr. Loebig has also held executive management positions at Stuart Entertainment,

Inc. (NASDAQ), where he served as the corporation’s Senior Vice President-Market and Product Development; and at Directory

Service Company, a private printing, publishing and advertising corporation, where he served as Vice President-Sales and Marketing.

Mr. Loebig has a BBA and MBA degree from the University of Iowa. Mr. Loebig has been a director at Table Trac since June 2011.

The Board of Directors recommends

that stockholders vote FOR each of the above-named director-nominees.

EXECUTIVE COMPENSATION

Summary Compensation Table

The table below summarizes the total compensation

paid or earned during the fiscal years ended December 31, 2015 and 2016.

|

Name, Principal Position

|

|

|

|

Salary

|

|

|

Stock

Awards (1)

|

|

|

Stock Option

Awards

|

|

|

Total

|

|

|

Chad Hoehne,

|

|

2016

|

|

$

|

275,008

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

275,008

|

|

|

President

|

|

2015

|

|

$

|

234,021

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

234,021

|

|

|

Robert Siqveland,

|

|

2016

|

|

|

103,600

|

|

|

|

0

|

|

|

|

0

|

|

|

|

103,600

|

|

|

Secretary

|

|

2015

|

|

|

91,050

|

|

|

|

0

|

|

|

|

0

|

|

|

|

91,050

|

|

|

Brian Hinchley,

|

|

2016

|

|

|

200,000

|

|

|

|

0

|

|

|

|

0

|

|

|

|

200,000

|

|

|

CEO / CFO

|

|

2015

|

|

|

157,664

|

|

|

|

11,974

|

|

|

|

0

|

|

|

|

169,638

|

|

|

|

(1)

|

The amounts in this column represent the aggregate grant date fair value with respect to stock options granted in the years

indicated, including the incremental grant date fair value of stock options repriced during the years indicated, if any. The fair

value was calculated in accordance with stock-based accounting rules (ASC 718).

|

We do not currently have any employment

or change-in-control agreements with any named executives or any other current members of our executive management. As of the date

of this Proxy Statement, we do not offer our executive employees any pension, annuity, profit-sharing or similar benefit plans

other than insurance. Executive compensation is subject to change from time to time concurrent with our requirements and policies

as established by the Board of Directors and its Compensation Committee.

Outstanding Equity Awards at Fiscal Year End

The Company had no outstanding equity awards

as of December 31, 2016 for any named executives.

Director Compensation

The table below summarizes the total compensation

paid or earned during the fiscal year ended December 31, 2016 by each individual who served, or is currently serving, as a Company

director during the fiscal year ended December 31, 2016.

|

Name

|

|

|

|

Compensation

|

|

|

Stock

Awards (1)

|

|

|

Stock Option

Awards

|

|

|

Total

|

|

|

Chad Hoehne

|

|

2016

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Brian Hinchley

|

|

2016

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Steven A. Browne

|

|

2016

|

|

|

10,500

|

|

|

|

16,500

|

|

|

|

0

|

|

|

|

27,000

|

|

|

Louis Fornetti

|

|

2016

|

|

|

33,300

|

|

|

|

0

|

|

|

|

0

|

|

|

|

33,300

|

|

|

Gary Loebig

|

|

2016

|

|

|

25,800

|

|

|

|

0

|

|

|

|

0

|

|

|

|

25,800

|

|

|

|

(1)

|

The amounts in this column represent the aggregate grant date fair value with respect to stock options granted in the years

indicated, including the incremental grant date fair value of stock options repriced during the years indicated, if any. The fair

value was calculated in accordance with stock-based accounting rules (ASC 718).

|

CORPORATE GOVERNANCE MATTERS

Board of Directors and Independence

The Board of Directors has a standing Compensation

Committee and Audit Committee. The Compensation Committee is composed of Messrs. Browne, Fornetti and Loebig (with Mr.

Loebig serving as chairperson). The Audit Committee is composed of Messrs. Browne, Fornetti and Loebig (with Mr. Fornetti

serving as chairperson). Each of the foregoing committees has a written charter, a copy of each of which is available

at our website at

www.tabletrac.com

. The composition of our Audit Committee and Compensation Committee complies with the

listing requirements of The Nasdaq Marketplace Rules.

The Board of Directors has determined that

Messrs. Browne, Fornetti and Loebig are each “independent,” as such term is defined in Section 5605(a)(2) of the The

Nasdaq Marketplace Rules, and meet the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act

of 1934.

Board Leadership Structure and Risk Oversight

Our Board of Directors is led by a Chairman

of the Board who is an independent director, although all of our directors (including our independent directors) participate in

board leadership. Presently, Mr. Browne serves as our Chairman of the Board. Because a majority of our directors are independent

and all of the members of our board participate in leadership, we believe the leadership structure of our Board of Director allows

it to maintain oversight of our management and to carry out its roles and responsibilities of behalf of the stockholders.

Management and our Board of Directors discuss

risks primarily in our board meetings. These discussions generally identify risks that are prioritized and assigned to the appropriate

board committee or the full Board for oversight. Our entire Board of Directors periodically discusses our management or risks.

Additional review or reporting on Company risks is conducted as needed or as requested by management, the Board of Directors, a

board committee, or any single director.

Board Meetings

The Board of Directors held one formal meeting

during fiscal 2016 and took action by written consent in lieu of a meeting on one occasion. During fiscal 2016, the Audit Committee

held four formal meetings, and the Compensation Committee held two formal meetings. One member of the Board of Directors attended

87.5% of the board meetings and meetings of committees to which they belong, while the other members attended 100% of the board

meetings and meetings of committees to which they belong. Although we have no formal policy regarding directors’ attendance

at our annual stockholder meetings, we encourage our directors to attend those meetings. All of our directors serving on the Board

of Directors at the time of our 2016 annual meeting of stockholders attended that meeting.

Audit Committee Financial Expert and Related Matters

The Board of Directors has determined that

at least one member of the Audit Committee, Mr. Lou Fornetti, is an “audit committee financial expert” as that term

is defined in Regulation S-K promulgated under the Securities Exchange Act of 1934. Mr. Fornetti’s relevant experience

is detailed above. Mr. Fornetti qualifies as an “independent director,” as such term is defined in Section 5605(a)(2)

of the NASDAQ Listing Rules, and meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange

Act of 1934. The Board of Directors has determined each member of the Audit Committee is able to read and understand

fundamental financial statements and that at least one member of the Audit Committee has past experience in finance or accounting

matters.

Audit Committee Report

The Audit Committee is responsible primarily

for providing oversight and monitoring the preparation and review of our financial statements, which are provided to stockholders

and the general public in the disclosures we file with the SEC. In addition, the Audit Committee is responsible for appointing,

and reviewing the services of, our independent registered public accounting firm.

The Audit Committee does not prepare our

financial statements, or determine whether our financial statements are complete and accurate. Rather, our management is responsible

for preparing our financial statements. Our independent registered public accountants are responsible for auditing our financial

statements to ensure their completeness and accuracy.

The Audit Committee also oversees our accounting

policies and the internal controls over financial reporting, which our management is responsible for establishing and maintaining

and our independent registered accountants are responsible for reviewing to determine effectiveness.

In fulfilling its oversight over our independent

registered public accounting firm, the Audit Committee carefully reviews the engagement of the independent registered public accounting

firm, which includes, among other things, the scope of the audit; fees; the assigned partner(s) and other personnel and their industry

experience; auditor independence; peer and Public Company Accounting Oversight Board (PCAOB) reviews; significant legal proceedings;

previous experience with the firm’s performance; and any non-audit services performed by our independent registered public

accounting firm.

The Audit Committee reviewed and discussed

the audit and the audited financial statements for the year ended December 31, 2016 with management and Boulay, including a discussion

related to the accounting principles used that are unique to this industry. The Audit Committee also has received and reviewed

the written disclosures and the letter from Boulay required by the PCAOB regarding Boulay’s communications with the Audit

Committee concerning independence, and has discussed with Boulay its independence. The Audit Committee also discussed with Boulay

the matters required to be discussed by Auditing Standard No. 16, “Communications with Audit Committees” issued by

the PCAOB. The Audit Committee meets independently with management, independently with Boulay, and also in executive session with

only the Committee members present.

Based on the reviews and discussions referred

to above, the Audit Committee recommended to the Board that the financial statements referred to above be included in our Annual

Report on Form 10-K for the year ended December 31, 2016.

AUDIT COMMITTEE:

Steven A. Browne

Louis Fornetti (Chair)

Gary Loebig

Compensation Committee

Our Compensation Committee is charged with

oversight responsibility for the adequacy and effectiveness of our executive compensation and benefit plans, and is primarily responsible

for all matters relating to compensation of our executive officers and the directors, the adoption of all employee compensation

and employee benefit plans and the administration of such plans including granting stock incentives or other benefits, and the

review and approval of disclosures regarding executive compensation included in this Proxy Statement. Our Compensation Committee

has the authority to obtain advice and assistance from external legal, accounting or other advisors, and has the authority to retain,

terminate and approve the fees payable to any external compensation consultant to assist in the evaluation of director, and senior

executive compensation. Nevertheless, any services to be rendered by our independence accounting firm must be pre-approved by the

Audit Committee under our policy regarding the pre-approval of such services.

Nomination of Directors

The Company does not have a standing nominating

committee (or other committee performing similar functions). Currently, the full Board of Directors participates in the consideration

of all director-nominees. The full Board of Directors does not employ any charter or other form of official written policy or guidelines

for the purposes of considering director-nominees. Nevertheless, when considering director-nominees, the Board of Directors recruits

and considers candidates without regard to race, color, religion, sex, ancestry, national origin or disability. Generally, the

Board of Directors will consider each candidate’s business and industry experience, his or her ability to act on behalf of

stockholders, overall board diversity, potential concerns regarding independence or conflicts of interest and other factors relevant

in evaluating director-nominees. Typically, the candidate will meet with at least a majority of the directors serving on the Board

of Directors. The Board of Directors will also consider a candidate’s personal attributes, including without limitation personal

integrity, loyalty to the Company and concern for its success and welfare, willingness to apply sound and independent business

judgment, awareness of a director’s vital role in the Company’s good corporate citizenship and image, time available

for meetings and consultation on Company matters, and willingness to assume broad fiduciary responsibility.

Our stockholders may recommend to the Board

of Directors candidates to be considered for election at the Company’s annual stockholders meeting. In order to make such

a recommendation, a stockholder generally must submit the recommendation in writing to the Board of Directors, in care of the Company’s

Secretary, at the Company’s headquarters address at least 120 days prior to the mailing date of the previous year’s

annual meeting proxy statement.

Code of Ethics

The Company has adopted a Code of Ethics

that governs the conduct of our officers, directors and employees in order to promote honesty, integrity, loyalty and the accuracy

of our financial statements.

Related-Party Transaction Policy

In all cases, the Company abides by applicable

state corporate law when approving all transactions, including transactions involving officers, directors or affiliates. More particularly,

the Company’s policy is to have any related-party transactions (i.e., transactions involving a director, an officer or an

affiliate of the Company) be approved solely by a majority of the disinterested and independent directors serving on the Board

of Directors.

Stockholder Communications with Directors

Our Board of Directors has established a

means for stockholders and others to communicate with the Board of Directors. If a stockholder has a concern regarding our financial

statements, accounting practices or internal controls, governance practices, business ethics or corporate conduct, the concern

should be submitted in writing to Mr. Brian Hinchley, CEO, in care of our Secretary at the address listed above. If a stockholder

is unsure as to which category the concern relates, the stockholder may communicate it to any independent director in care of our

Secretary at the address listed above. All such stockholder communications will be forwarded to the applicable director(s).

Security

Ownership of

Certain Beneficial Owners and Management

The following table sets forth certain information

regarding beneficial ownership of our common stock as of August 28, 2017, by (i) each person known by the Company to be the beneficial

owner of more than five percent of our outstanding common stock, (ii) each current director, (iii) each executive officer of the

Company and other persons identified as a named executive in the Summary Compensation Table, and (iv) all current executive

officers and directors as a group.

Unless otherwise indicated, each person

or entity named in the table has sole voting power and investment power with respect to the shares set forth opposite his, her

or its name. Unless otherwise indicated, the address of each of the following persons is 6101 Baker Road, Suite 206, Minnetonka,

Minnesota 55345.

|

Name and Address

|

|

Common Shares

Beneficially

Owned

(1)

|

|

|

Percentage of

Common

Shares

(1)

|

|

|

Chad Hoehne

(2)

|

|

|

1,306,100

|

|

|

|

28.95

|

%

|

|

Robert Siqveland

(3)

|

|

|

206,500

|

|

|

|

4.58

|

%

|

|

Brian Hinchley

(4)

|

|

|

35,000

|

|

|

|

*

|

|

|

Steve A. Browne

(5)

|

|

|

84,000

|

|

|

|

1.86

|

%

|

|

Louis Fornetti

(6)

|

|

|

21,500

|

|

|

|

*

|

|

|

Gary Loebig

(7)

|

|

|

15,150

|

|

|

|

*

|

|

|

All directors and officers as a group

(8)

|

|

|

1,668,250

|

|

|

|

36.97

|

%

|

|

Zeff Capital, LP

(9)

1601 Broadway, 12th floor

New York, NY 10019

|

|

|

365,376

|

|

|

|

8.10

|

%

|

* denotes less than one percent.

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules of the SEC, and includes general voting power and/or investment

power with respect to securities. Under the applicable SEC rules, each person’s beneficial ownership is calculated by dividing

the total number of shares with respect to which they possess beneficial ownership by the total number of outstanding shares of

the Company. In any case where an individual has beneficial ownership over securities that are not outstanding, but that are issuable

upon the exercise of options or warrants or similar rights within the next 60 days, that same number of shares is added to the

denominator in the calculation described above. Because the calculation of each person’s beneficial ownership set forth in

the “Percentage of Common Shares” column of the table may include shares that are not presently outstanding, the sum

total of the percentages set forth in such column may exceed 100%.

|

|

|

(2)

|

Mr. Hoehne is the President and a director of the Company.

|

|

|

(3)

|

Mr. Siqveland is the Company’s secretary.

|

|

|

(4)

|

Mr. Hinchley is an officer and a director of the Company.

|

|

|

(5)

|

Mr. Browne is a director of the Company.

|

|

|

(6)

|

Mr. Fornetti is a director of the Company.

|

|

|

(7)

|

Mr. Loebig is a director of the Company.

|

|

|

(8)

|

Consists of six persons: Messrs. Hoehne, Siqveland, Hinchley, Browne, Fornetti and Loebig.

|

|

|

(9)

|

Share figures reflected in the table are based on

a January 13, 2017 Schedule 13-G filing with the SEC made by Zeff Capital, LP (and Zeff Holding Company, LLC, and Daniel Zeff),

which is the Company’s most recent and best available information relating to Zeff Capital’s ownership of Company

common stock. Based on the referenced filing, voting and dispositive power with respect to these shares is exercised by Zeff Capital,

LP.

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING

COMPLIANCE

Section 16(a) of the Securities Exchange

Act of 1934 requires the Company’s officers, directors and persons considered to be beneficial owners of more than ten percent

of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the Securities

and Exchange Commission and NASDAQ. Officers, directors and greater-than-ten-percent shareholders are required by SEC

regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of

such forms furnished to the Company by its officers and directors, or the Company’s actual knowledge of transactions involving

such officers and directors, the Company believes that all such filings were filed on a timely basis for fiscal year 2016, other

than two late Form 4 filings made by Steven A. Browne on June 20, 2016 and October 24, 2016, a late Form 3 and Form 4 filing made

by Louis Fornetti on November 21, 2016, and a late Form 4 filing made by Gary Loebig on November 30, 2016.

RATIFICATION OF THE APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

(Proposal Two)

Our Board of Directors is committed to the

quality, integrity and transparency of the Company’s financial reports. Independent auditors play an important part in our

system of financial control. Our Board of Directors and its Audit Committee has appointed Boulay P.L.L.P. (“Boulay”)

as our independent registered public accounting firm for the fiscal year ending December 31, 2017. A representative of Boulay is

expected to attend the Annual Meeting and will be available to make statements and respond to questions from stockholders.

If the stockholders do not ratify the appointment

of Boulay, the Board of Directors and Audit Committee may reconsider its selection, but is not required to do so. Notwithstanding

the proposed ratification of the appointment of Boulay by the stockholders, the Board of Directors and Audit Committee may, in

their discretion, direct the appointment of a new independent registered public accounting firm at any time during the year without

notice to, or the consent of, the stockholders, if the Board of Directors or Audit Committee determines that such a change would

be in the best interests of the Company.

Fees Billed to Company by Independent Registered Public Accounting

Firm

The following table details the fees billed

to the Company by Boulay in 2016 and 2015.

|

|

|

2016

|

|

|

2015

|

|

|

Audit Fees

(1)

|

|

$

|

44,790

|

|

|

$

|

41,500

|

|

|

Tax Fees

(2)

|

|

|

6,200

|

|

|

|

6,000

|

|

|

Audit-Related Fees

(3)

|

|

|

27,270

|

|

|

|

8,560

|

|

|

|

|

$

|

78,260

|

|

|

$

|

56,060

|

|

|

|

(1)

|

Audit Fees consist of fees for professional services rendered for the audit of our consolidated annual financial statements

included in our annual report, and review of the interim consolidated financial statements included in quarterly reports, and services

that are normally provided in connection with statutory and regulatory filings or engagements.

|

|

|

(2)

|

Tax Fees consist of fees for professional services rendered for tax compliance, tax advice and tax planning.

|

|

|

(3)

|

Audit-Related Fees consist of fees for professional services rendered that reasonably related to the performance of the audit

or review of our consolidated financial statements but not reported under the “Audit Fees” category. This category

may include fees related to the performance of audits and attestation services not required by statute or regulations, and accounting

consultations about the application of generally accepted accounting principles to proposed transactions.

|

The Board of Directors has reviewed the

services provided by Boulay during the fiscal year ended December 31, 2016, and the amounts billed for such services. After consideration,

the Board of Directors has determined that the receipt of these fees by Boulay is compatible with the provision of independent

audit services. The Audit Committee has discussed these services and fees with Boulay management to determine that they are appropriate

under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002,

as well as under guidelines of the American Institute of Certified Public Accountants.

Pre-Approval Policy

The Audit Committee is responsible for appointing,

setting compensation for and overseeing the work of our independent registered public accounting firm. The Audit Committee has

established a policy for pre-approving the services provided by our independent registered public accounting firm in accordance

with the auditor-independence rules of the SEC. This policy requires the review and pre-approval by the Audit Committee (or the

full Board of Directors) of all audit and permissible non-audit services provided by our independent registered public accounting

firm and an annual review of the financial plan for audit fees. During fiscal 2016, 100% of the audit-related and tax services

provided by our independent registered public accounting firm were pre-approved by our Audit Committee in conformity with its pre-approval

policy.

To ensure that auditor independence is maintained,

the Audit Committee annually pre-approves the audit services to be provided by our independent registered public accounting firm

and the related estimated fees for such services, as well as the nature and extent of specific types of audit related, tax and

other non-audit services to be provided by our independent registered public accounting firm.

The Board of Directors recommends

a vote FOR the ratification of the Company’s independent registered public accounting firm.

STOCKHOLDER PROPOSALS AND

DISCRETIONARY PROXY VOTING AUTHORITY

Any stockholder desiring to submit a proposal

for action by the stockholders at the next annual stockholders’ meeting, which will be the 2018 annual meeting, must submit

that proposal in writing to the Secretary of the Company at the Company’s corporate headquarters no later than May 11, 2018

to have the proposal included in the Company’s proxy statement for that meeting (unless the date of the Company’s 2018

annual meeting of stockholders varies more than 30 days from October 12, 2018, in which case a stockholder proposal is due a reasonable

amount of time prior to when the Company begins to print and mail its proxy statement for that meeting). Due to the complexity

of the respective rights of the stockholders and the Company in this area, any stockholder desiring to propose such an action is

advised to consult with his or her legal counsel with respect to such rights. The Company suggests that any such proposal be submitted

by certified mail, return-receipt requested.

Rule 14a-4 promulgated under the Securities

Exchange Act of 1934 governs the Company’s use of its discretionary proxy voting authority with respect to a stockholder

proposal that the stockholder has not sought to include in the Company’s proxy statement. Rule 14a-4 provides that if a proponent

of a proposal fails to notify the Company at least 45 days prior to the month and day of mailing of the prior year’s proxy

statement, then management proxies will be allowed to use their discretionary voting authority when the proposal is raised at the

meeting, without any discussion of the matter.

SOLICITATION

The Company will bear the cost of preparing,

assembling and mailing the proxy, Proxy Statement, Annual Report and other material that may be sent to the stockholders in connection

with this solicitation. Brokerage houses and other custodians, nominees and fiduciaries may be requested to forward soliciting

material to the beneficial owners of stock, in which case they may be reimbursed by the Company for their expenses in doing so.

Proxies are being solicited primarily by mail. Nevertheless, officers and employees of the Company may solicit proxies personally,

by telephone, by special letter, or via the Internet.

The Board of Directors does not intend to

present to the meeting any other matter not referred to above and does not presently know of any matters that may be presented

to the meeting by others. If, however, other matters come before the meeting, it is the intent of the persons named in the enclosed

proxy to vote the proxy in accordance with their best judgment.

By Order of the Board of Directors:

Robert

R. Siqveland

Secretary

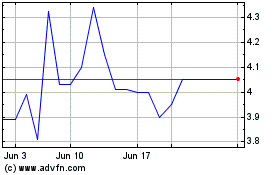

Table Trac (QX) (USOTC:TBTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Table Trac (QX) (USOTC:TBTC)

Historical Stock Chart

From Apr 2023 to Apr 2024