Current Report Filing (8-k)

September 12 2017 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 11, 2017

THE COOPER COMPANIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-8597

|

|

94-2657368

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

6140 Stoneridge Mall Road, Suite 590, Pleasanton, California 94588

(Address of principal executive offices)

(925)

460-3600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c)

|

|

☐

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of

the Securities Exchange Act of 1934

(§240.12b-2

of this chapter). Emerging growth company ☐

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act. ☐

|

Item 1.01. Entry into a Material Definitive Agreement.

Purchase Agreement

On September 11, 2017, The Cooper

Companies, Inc. (the “Company”) announced that CooperSurgical, Inc. (“CooperSurgical), a wholly-owned subsidiary of the Company, entered into an Asset Purchase Agreement (the “Purchase Agreement”) pursuant to which

CooperSurgical will acquire the global rights and business of the Paragard Intrauterine Device (IUD) business of Teva Pharmaceutical Industries Limited (“Teva”), subject to the terms and conditions of the Purchase Agreement (the

“Purchase”).

CooperSurgical will pay $1.1 billion in cash, subject to adjustment in accordance with an inventory adjustment mechanism.

The completion of the Purchase is contingent upon standard closing conditions, including regulatory approval in the United States and no material adverse

change in the business to be acquired. The Company expects that the Purchase will be completed prior to the end of the current calendar year. The foregoing description of the Purchase Agreement is qualified in its entirety by reference to the full

text of the Purchase Agreement which is filed hereto as Exhibit 2.1 and incorporated herein by reference.

In connection with the Purchase, the Company

secured a financing commitment letter as further described in Item 7.01 below. Neither the Company nor any of its subsidiaries or respective affiliates has any material relationship with Teva or any of its affiliates other than in respect of the

Purchase Agreement and the other ancillary agreements entered into in connection with the Purchase.

Item 7.01. Regulation FD Disclosure.

In connection with the Purchase, the Company has arranged a commitment for a bridge loan of $1.1 billion through DNB Capital LLC and DNB Markets, Inc.

(collectively, “DNB”) to support funding of the acquisition. DNB’s obligations under the commitment letter are subject to customary conditions. The Company anticipates using the bridge loan or alternative financing to fund all or a

portion of the Purchase.

On September 11, 2017, the Company issued a press release announcing the signing of the Purchase Agreement and the bridge

loan commitment with DNB. A copy of this release is attached hereto as Exhibit 99.1. The Company has also prepared an investor presentation with respect to the transaction, a copy of which is attached as Exhibit 99.2 hereto and incorporated by

reference.

Internet addresses in the release are for information purposes only and are not intended to be hyperlinks to other The Cooper Companies, Inc.

information.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

2.1*

|

|

Asset Purchase Agreement, dated as of September 11, 2017, by and between CooperSurgical, Inc. and Teva Pharmaceutical Industries Ltd.

|

|

|

|

|

99.1

|

|

Press Release dated September 11, 2017, of The Cooper Companies, Inc.

|

|

|

|

|

99.2

|

|

Investor Presentation of The Cooper Companies, Inc.

|

|

*

|

Pursuant to Item 601(b)(2) of Regulation

S-K,

certain exhibits and schedules to this agreement have been omitted. The Company hereby agrees to furnish supplementally to the

Securities and Exchange Commission, upon its request, any or all of such omitted exhibits or schedules.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

THE COOPER COMPANIES, INC.

|

|

|

|

|

By:

|

|

/s/ Albert G. White, III

|

|

|

|

Albert G. White, III

|

|

|

|

Executive Vice President, Chief Financial Officer and Chief Strategy Officer

|

Dated: September 11, 2017

EXHIBIT INDEX

|

*

|

Pursuant to Item 601(b)(2) of Regulation

S-K

promulgated by the SEC, certain exhibits and schedules to this agreement have been omitted. The Company hereby agrees to furnish

supplementally to the SEC, upon its request, any or all of such omitted exhibits or schedules.

|

Cooper Companies (NYSE:COO)

Historical Stock Chart

From Mar 2024 to Apr 2024

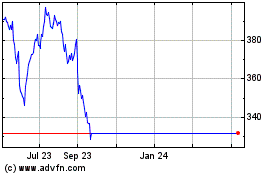

Cooper Companies (NYSE:COO)

Historical Stock Chart

From Apr 2023 to Apr 2024