Teva Pharmaceutical to Sell Paragard Rights to Medical-Device Firm Cooper For $1.1 Billion

September 11 2017 - 5:33PM

Dow Jones News

By Maria Armental

Teva Pharmaceutical Industries Ltd. (TEVA) is selling the rights

to intrauterine contraceptive Paragard to the Cooper Cos. (COO) in

a roughly $1.1 billion cash deal.

The generic-drug giant, which Monday appointed pharmaceutical

industry veteran Kare Schultz as its new chief executive after a

months-long search, said it still expects to make at least $2

billion by year's end from the sale of its global women's health

business and oncology and pain business in Europe. Teva intends to

use the money to pay down some $35 billion in debt.

The Paragard deal, which is subject to antitrust clearance,

includes Teva's facility in Buffalo, N.Y., where Paragard is

produced.

Paragard, currently sold only in the U.S., accounted for about

$168 million in sales for the 12 months through June 30, the

companies said Monday.

Cooper, a Pleasanton, Calif., medical-device company, said the

purchase is expected to add between 70 cents and 75 cents to

earnings per share in its first year.

Shares in Cooper, which are up 45% so far this year, rose 0.1%

to $253.65 in after-hours trading.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

September 11, 2017 17:18 ET (21:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

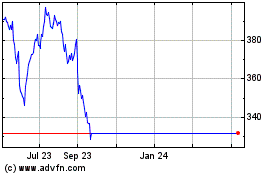

Cooper Companies (NYSE:COO)

Historical Stock Chart

From Mar 2024 to Apr 2024

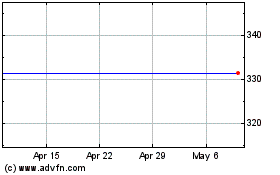

Cooper Companies (NYSE:COO)

Historical Stock Chart

From Apr 2023 to Apr 2024