The selling shareholders named in this prospectus supplement are offering 33,333,334 ordinary shares. We will not receive any proceeds from the sale of the

shares being sold by the selling shareholders.

Our ordinary shares are currently traded on the New York Stock Exchange (the “NYSE”) under the

symbol “NOMD”. On September 5, 2017, the closing price of our ordinary shares on the NYSE was $14.92 per ordinary share.

The underwriters have

agreed to purchase the ordinary shares from the selling shareholders at a price of $14.157 per ordinary share, which will result in $471.9 million of proceeds to the selling shareholders before expenses. The Company has agreed to purchase from the

underwriters 7,063,643 of the 33,333,334 ordinary shares in the offering at the same price at which the underwriters have agreed to purchase the shares from the selling shareholders in this offering.

The underwriters expect to deliver the shares on or about September 11, 2017.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the terms of the offering of the ordinary shares and adds to and

supplements information contained in the accompanying prospectus and the documents incorporated by reference therein. The second part is the accompanying prospectus, which we refer to as the “accompanying prospectus.” The accompanying

prospectus describes more general information regarding our securities, some of which may not apply to the ordinary shares offered hereby. The accompanying prospectus also incorporates by reference documents that are described under

“Incorporation by Reference” beginning on page S-32 of this prospectus supplement.

You should rely only on the information contained or

incorporated by reference in this prospectus supplement, in the accompanying prospectus or in any related free writing prospectus filed by us with the Securities and Exchange Commission (the “SEC”). If information in this prospectus

supplement conflicts with or is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. Neither we, the selling shareholders nor the underwriters have authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. You should not assume that the information contained or incorporated by reference in this prospectus supplement and the accompanying

prospectus or in any such free writing prospectus is accurate as of any date other than the respective dates thereof. Our business, financial condition, results of operations and prospects may have changed since those dates.

Neither we, the selling shareholders nor the underwriters are making an offer of any securities other than the registered securities to which this prospectus

supplement and the accompanying prospectus relate, nor are we, any selling shareholders or the underwriters making an offer to sell or soliciting an offer to buy ordinary shares in any jurisdiction where an offer or sale is not permitted.

Unless otherwise indicated or the context otherwise requires, references in this prospectus supplement to “we,” “our,” “us,”

“Nomad,” “the Company” and similar terms refer to Nomad and its subsidiaries. References herein to “Iglo” and “the Iglo Group” refer solely to Iglo and its consolidated subsidiaries which we purchased on

June 1, 2015. References herein to “Findus” and “the Findus Group” refer to Findus Sverige AB and its consolidated subsidiaries which we purchased on November 2, 2015. All references in this prospectus to the

“Predecessor” refer to Iglo for all periods prior to its acquisition by us and all references to the “Successor” refer to the Company for all periods after the Iglo Acquisition.

Presentation of Financial and Other Information

In June

2015, our Board of Directors approved a change in our fiscal year end from March 31 to December 31 in order to align our fiscal year with the Iglo Group’s historical reporting calendar. As a result of this change, the consolidated financial

statements include presentation of the Successor for the year ended March 31, 2015, the year ended December 31, 2016 and the nine month period from April 1, 2015 to December 31, 2015.

Certain numerical figures included or incorporated by reference in this prospectus supplement or prospectus supplement, including financial data presented in

billions, millions or thousands and percentages describing market shares, have been subject to rounding adjustments and, as a result, the totals of the data in this prospectus supplement may vary slightly from the actual arithmetic totals of such

information.

We present certain supplemental financial measures that are not recognized by IFRS in the financial data included or incorporated by

reference in this prospectus supplement. These financial measures are unaudited and have not been prepared in accordance with IFRS, SEC requirements or the accounting standards of any other jurisdiction. The

non-IFRS

financial measures include Adjusted EBITDA and Adjusted EBITDA margin.

Adjusted EBITDA is EBITDA

adjusted to exclude (when they occur) exited markets, trading day impacts, chart of account alignments and exceptional items such as restructuring charges, goodwill and intangible asset

S-ii

impairment charges, the impact of share based payment charges, charges relating to the founders’ preferred shares annual dividends, charges relating to the redemption of warrants and other

unusual or

non-recurring

items. The Company believes Adjusted EBITDA provides important comparability of underlying operating results, allowing investors and management to assess operating performance on a

consistent basis.

Adjusted

non-IFRS

financial measures should be read in conjunction with our historical

financial statements incorporated by reference into this prospectus supplement and the accompanying prospectus.

We believe our

non-IFRS

financial measures provide an important additional measure with which to monitor and evaluate the Company’s ongoing financial results, as well as to reflect its acquisitions. Our calculation of these

financial measures may be different from the calculations used by other companies and comparability may therefore be limited. The non-IFRS financial measures presented herein is based upon certain assumptions that we believe to be reasonable and is

presented for informational purposes only and is not necessarily indicative of any anticipated financial position or future results of operations that the Company will experience. You should not consider the Company’s

non-IFRS

financial measures an alternative or substitute for the Company’s reported results and are cautioned not to place undue reliance on these results and information as they may not be representative of

our actual or future results as a Company.

Please see on pages

S-9-S-10,

the

non-IFRS

reconciliation tables for an explanation and reconciliation of the Adjusted financial information to the most directly comparable IFRS measure.

Market and Industry Data

The data included or

incorporated by reference in this prospectus supplement regarding our business and the market in which we operate and compete, including certain market data and certain economic and industry data and forecasts, were obtained from internal surveys,

market research and governmental and other publicly available information, independent industry publications and reports prepared by industry consultants that we believe to be reliable. Certain market share information and other statements presented

and incorporated by reference herein regarding our position relative to our competitors with respect to the manufacturing or distribution of particular products are based on statistical data or information obtained from independent third parties

that we believe to be reliable, including Euromonitor, Kantar Worldpanel, AC Nielsen and IRI and other sources, as well as on our knowledge of our markets and industry, our own investigation into market conditions and our calculations based on such

information. For internal analyses, we use different data providers for our assessment of market share. We use Euromonitor data because the data it collects covers a wider range of the food market and we believe consequently gives a more consistent

and holistic view of market size and growth data. We have also based our estimates on information obtained from our customers, trade and business organizations and associations and other contacts in our industries. In addition, some of the

information herein has been extrapolated from such market data or reports using our experience and internal estimates. Furthermore, we operate in a number of different markets and it is difficult to obtain precise or current industry and market

information, which makes the available industry and market information incomplete or non-comparable. In those cases where there was no readily available or reliable external information to validate market-related analyses or estimates or the data

conflicted with other data or was non-comparable or internally inconsistent, statements regarding the industries in which we operate and our position in these industries are based solely on our experience, studies and estimates and our own

investigation of market conditions.

Market share data presented is measured by retail sales value. The frozen food market data we refer to includes the

following categories: frozen processed meat, frozen processed seafood, frozen meat substitutes, frozen pizza, frozen ready meals, frozen noodles, frozen soup, frozen baked goods and processed frozen vegetables.

Although we believe that our sources are reliable, and we accept responsibility for having correctly reproduced information obtained from industry

publications or public sources, you should keep in mind that we have not independently verified information we have obtained from industry and other third-party sources and that

S-iii

information from our internal surveys and management estimates has not been verified by any independent sources. In addition, while we are not aware of any misstatements regarding the industry or

similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors. We cannot assure you that any of the assumptions underlying these statements are accurate or correctly reflect our

competitive position or those of the other market participants in the industry. In addition, none of Euromonitor, Kantar Worldpanel, AC Nielsen, IRI or any other sources has assumed responsibility for any of the information included in this

prospectus supplement or accompanying prospectus. As a result, we cannot make any representation or warranty as to the accuracy or completeness of this information.

Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable,

but that the accuracy and completeness of such information is not guaranteed. Where we have found information from different sources to be conflicting, we have used the information that we believe to be the most accurate and prepared on a basis

consistent with the other sources we have used.

As used herein, the term “kilotonne” refers to 1,000,000 kilograms.

Exchange Rate Information

The tables

below set forth, for the periods and dates indicated, the high, low, average and period end Bloomberg Generic Composite Rate, expressed in U.S. dollars per €1.00. The below rates may differ from the actual rates used in the preparation of our

consolidated financial statements and the other financial information appearing in this prospectus supplement and accompanying prospectus. No representation is made that euros could have been, or could be, converted into U.S. dollars at these rates

or at any other rate.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period End

|

|

|

Average

(1)

|

|

|

High

|

|

|

Low

|

|

|

2012

|

|

|

1.3216

|

|

|

|

1.2911

|

|

|

|

1.3487

|

|

|

|

1.2043

|

|

|

2013

|

|

|

1.3743

|

|

|

|

1.3300

|

|

|

|

1.3895

|

|

|

|

1.2745

|

|

|

2014

|

|

|

1.2098

|

|

|

|

1.3207

|

|

|

|

1.3994

|

|

|

|

1.2096

|

|

|

2015

|

|

|

1.0862

|

|

|

|

1.1032

|

|

|

|

1.2109

|

|

|

|

1.0462

|

|

|

2016

|

|

|

1.0517

|

|

|

|

1.1036

|

|

|

|

1.1618

|

|

|

|

1.0352

|

|

|

(1)

|

The average of the exchange rates on the last business day of each month during the relevant period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

Period End

|

|

|

Average

(1)

|

|

|

High

|

|

|

Low

|

|

|

March

|

|

|

1.0652

|

|

|

|

1.0687

|

|

|

|

1.0906

|

|

|

|

1.0495

|

|

|

April

|

|

|

1.0728

|

|

|

|

1.0658

|

|

|

|

1.0778

|

|

|

|

1.0570

|

|

|

May

|

|

|

1.1186

|

|

|

|

1.1048

|

|

|

|

1.1269

|

|

|

|

1.0839

|

|

|

June

|

|

|

1.1440

|

|

|

|

1.1229

|

|

|

|

1.1447

|

|

|

|

1.1119

|

|

|

July

|

|

|

1.1751

|

|

|

|

1.1516

|

|

|

|

1.1778

|

|

|

|

1.1312

|

|

|

August

|

|

|

1.1884

|

|

|

|

1.1814

|

|

|

|

1.2071

|

|

|

|

1.1662

|

|

|

September (through September 4, 2017)

|

|

|

1.1897

|

|

|

|

1.1880

|

|

|

|

1.1980

|

|

|

|

1.1849

|

|

|

(1)

|

The average of the exchange rates on the last business day of each month during the relevant period.

|

S-iv

The Offering

|

Ordinary shares offered by the selling shareholders

|

33,333,334 shares

|

|

Ordinary shares outstanding after this offering

|

165,291,546 ordinary shares will be outstanding after this offering after giving effect to the share repurchase.

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of ordinary shares in this offering.

|

|

Concurrent share repurchase

|

The Company has agreed to purchase from the underwriters 7,063,643 ordinary shares in the offering at a price of $14.157 per ordinary share, which represents the price at which the underwriters have agreed to purchase the shares from the

selling shareholders in this offering.

|

|

Dividend policy

|

We have not declared or paid any dividends on our ordinary shares since our inception on April 1, 2014, and have no current plans to pay dividends on our ordinary shares. The declaration and payment of future dividends to holders of our

ordinary shares will be at the discretion of our board of directors and will depend upon many factors, including our financial condition, earnings, legal requirements, restrictions in our debt agreements and other factors deemed relevant by our

board of directors. In addition, as a holding company, our ability to pay dividends depends on our receipt of cash dividends from our operating subsidiaries, which may further restrict our ability to pay dividends as a result of the laws of their

respective jurisdictions of organization, agreements of our subsidiaries or covenants under future indebtedness that we or they may incur. See “Dividend Policy” in this prospectus supplement and in our Annual Report on Form

20-F

for the fiscal year ended December 31, 2016 incorporated by reference herein.

|

|

Risk factors

|

You should read the “Risk Factors” section of this prospectus supplement, and the “Risk Factors” section of our Annual Report on Form

20-F

for the fiscal year ended December 31,

2016 incorporated by reference herein, for a discussion of factors that you should consider carefully before deciding to invest in our ordinary shares, as such factors may be updated from time to time in the other documents and reports that we file

with the SEC that are incorporated or deemed to be incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

New York Stock Exchange symbol

|

“NOMD”

|

S-6

Unless otherwise indicated, the number of ordinary shares outstanding after this offering assumes the

repurchase of $100 million of our ordinary shares by us and excludes:

|

|

•

|

|

125,000 ordinary shares issuable upon the exercise of options to purchase shares with an exercise price of $11.50 per share;

|

|

|

•

|

|

1,500,000 ordinary shares issuable upon the conversion of our founder preferred shares;

|

|

|

•

|

|

5,212,000 performance stock units; and

|

|

|

•

|

|

an aggregate of approximately 11,954,010 shares reserved for future issuance under our share-based compensation plans.

|

Summary Financial Information

The tables below present

our summary historical consolidated financial information and other data for the periods presented, which should be read in conjunction with our audited consolidated financial statements incorporated by reference herein.

The statement of income data and the statement of cash flow data for the year ended December 31, 2016, the nine months ended December 31, 2015, the

year ended March 31, 2015, the five months ended May 31, 2015 and the year ended December 31, 2014 and the balance sheet data as of December 31, 2016 and 2015 have been derived from our audited consolidated financial statements

incorporated by reference herein.

The statement of income data and the statement of cash flow data for the six months ended June 30, 2017 and

June 30, 2016 and the balance sheet data as of June 30, 2017 have been derived from our unaudited interim financial statements incorporated by reference herein.

In June 2015, the Company’s Board of Directors approved a change in the Company’s fiscal year end from March 31 to December 31 in order to

align the Company’s fiscal year with the Iglo Group’s historical reporting calendar. As a result of this change, the consolidated financial statements include presentation of the Successor for the year ended March 31, 2015, the year

ended December 31, 2016 and the nine month period ended December 31, 2015.

We present certain supplemental financial measures that are not

recognized by IFRS in the financial data included or incorporated by reference in this prospectus supplement. These financial measures are unaudited and have not been prepared in accordance with IFRS, SEC requirements or the accounting standards of

any other jurisdiction. The

non-IFRS

financial measures include Adjusted EBITDA and Adjusted EBITDA margin.

Adjusted EBITDA is EBITDA adjusted to exclude (when they occur) exited markets, trading day impacts, chart of account alignments and exceptional items such as

restructuring charges, goodwill and intangible asset impairment charges, the impact of share based payment charges, charges relating to the Founders Preferred Shares Annual Dividend Amount, charges relating to the redemption of warrants and other

unusual or

non-recurring

items. The Company believes Adjusted EBITDA provides important comparability of underlying operating results, allowing investors and management to assess operating performance on a

consistent basis.

Adjusted

non-IFRS

financial measures should be read in conjunction with our historical

financial statements incorporated by reference into this prospectus supplement and the accompanying prospectus.

We believe our

non-IFRS

financial measures provide an important additional measure with which to monitor and evaluate the Company’s ongoing financial results, as well as to reflect its acquisitions. Our calculation of these

financial measures may be different from the calculations used by other companies and comparability may therefore be limited. The non-IFRS financial measures presented herein is based upon certain assumptions that we believe to be reasonable and is

presented for informational purposes only and is not necessarily indicative of any anticipated financial position or future results of operations that the Company will experience. You should

S-7

not consider the Company’s

non-IFRS

financial measures an alternative or substitute for the Company’s reported results and are cautioned not to

place undue reliance on these results and information as they may not be representative of our actual or future results as a Company.

Please see on pages

S-9-S-10,

the

non-IFRS

reconciliation tables for an explanation and reconciliation of the Adjusted financial information to the

most directly comparable IFRS measure.

Certain numerical figures set out in this prospectus supplement, including financial data presented in billions,

millions or thousands and percentages describing market shares, have been subject to rounding adjustments and, as a result, the totals of the data in this prospectus supplement may vary slightly from the actual arithmetic totals of such information.

In making an investment decision, you must rely upon your own examination of the terms of the offering and the financial information contained in this

prospectus supplement and the accompanying prospectus.

The following tables set forth summary historical consolidated financial and other data for the

Company and the Predecessor for the periods presented. The following tables should also be read in conjunction with the information contained in “Presentation of Financial, Market and Other Information”, “Use of Proceeds,” and

“Capitalization” included elsewhere herein and our, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” from our Annual Report on Form

20-F

for the

year ended December 31, 2016 and our consolidated financial statements and related notes incorporated by referenced herein.

Consolidated

Financial Statements of Profit or Loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Predecessor

|

|

|

Predecessor

|

|

|

Successor

|

|

|

Successor

|

|

|

Successor

|

|

|

Successor

|

|

|

Successor

|

|

|

(€ in millions)

|

|

Year

ended

Dec 31

2014

|

|

|

Five months

ended

May 31

2015

|

|

|

Year

ended

Mar 31

2015

|

|

|

Nine months

ended

Dec 31

2015

|

|

|

Year

ended

Dec 31

2016

|

|

|

Six months

ended

June 30,

2016

|

|

|

Six months

ended

June 30,

2017

|

|

|

Revenue

|

|

|

1,500.9

|

|

|

|

640.3

|

|

|

|

—

|

|

|

|

894.2

|

|

|

|

1,927.7

|

|

|

|

1,003.0

|

|

|

|

989.4

|

|

|

Cost of sales

|

|

|

(970.9

|

)

|

|

|

(417.9

|

)

|

|

|

—

|

|

|

|

(663.0

|

)

|

|

|

(1,356.7

|

)

|

|

|

(695.9

|

)

|

|

|

(689.0

|

)

|

|

Other operating expenses

|

|

|

(254.2

|

)

|

|

|

(109.5

|

)

|

|

|

(0.7

|

)

|

|

|

(138.6

|

)

|

|

|

(298.4

|

)

|

|

|

(154.8

|

)

|

|

|

(156.2

|

)

|

|

Operating profit/(loss)

|

|

|

222.9

|

|

|

|

28.6

|

|

|

|

(167.6

|

)

|

|

|

(314.1

|

)

|

|

|

138.1

|

|

|

|

74.1

|

|

|

|

132.8

|

|

|

Net finance (costs)/income

|

|

|

(290.2

|

)

|

|

|

(115.7

|

)

|

|

|

0.1

|

|

|

|

(35.5

|

)

|

|

|

(62.1

|

)

|

|

|

(23.6

|

)

|

|

|

(48.4

|

)

|

|

(Loss)/profit before tax

|

|

|

(67.3

|

)

|

|

|

(87.1

|

)

|

|

|

(167.5

|

)

|

|

|

(349.6

|

)

|

|

|

76.0

|

|

|

|

50.5

|

|

|

|

84.4

|

|

|

Taxation

|

|

|

(41.8

|

)

|

|

|

(40.9

|

)

|

|

|

—

|

|

|

|

12.3

|

|

|

|

(39.6

|

)

|

|

|

(15.6

|

)

|

|

|

(17.1

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss)/profit for the period attributable to Parent Company

|

|

|

(109.1

|

)

|

|

|

(128.0

|

)

|

|

|

(167.5

|

)

|

|

|

(337.3

|

)

|

|

|

36.4

|

|

|

|

34.9

|

|

|

|

67.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Financial Statements of Financial Position

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Successor

|

|

|

Successor

|

|

|

(€ in millions)

|

|

Dec 31, 2015

|

|

|

Dec 31, 2016

|

|

|

June 30, 2017

|

|

|

Non-current

assets

|

|

|

3,785.2

|

|

|

|

3,835.7

|

|

|

|

3,843.9

|

|

|

Cash and cash equivalents

|

|

|

618.7

|

|

|

|

329.5

|

|

|

|

300.5

|

|

|

Other current assets

|

|

|

525.8

|

|

|

|

544.3

|

|

|

|

514.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

4,929.7

|

|

|

|

4,709.5

|

|

|

|

4,658.4

|

|

|

Current liabilities

|

|

|

1,040.7

|

|

|

|

753.1

|

|

|

|

744.3

|

|

|

Non-current

liabilities

|

|

|

2,000.9

|

|

|

|

2,053.9

|

|

|

|

2,045.7

|

|

|

Total liabilities

|

|

|

3,041.6

|

|

|

|

2,807.0

|

|

|

|

2,790.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

1,888.1

|

|

|

|

1,902.5

|

|

|

|

1,868.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-8

Consolidated Cash Flow Statement

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Predecessor

|

|

|

Predecessor

|

|

|

Successor

|

|

|

Successor

|

|

|

Successor

|

|

|

Successor

|

|

|

(€ in millions)

|

|

Year

ended

Dec 31

2014

|

|

|

Five months

ended

May 31

2015

|

|

|

Year

ended

Mar 31

2015

|

|

|

Nine months

ended

Dec 31

2015

|

|

|

Year

ended

Dec 31

2016

|

|

|

Six Months

ended

June 30,

2017

|

|

|

Net cash from/(used in) operating activities

|

|

|

267.4

|

|

|

|

78.7

|

|

|

|

(0.5

|

)

|

|

|

48.0

|

|

|

|

282.1

|

|

|

|

138.3

|

|

|

Net cash (used in)/generated from investing activities

|

|

|

(26.3

|

)

|

|

|

(6.3

|

)

|

|

|

295.6

|

|

|

|

(959.8

|

)

|

|

|

(50.4

|

)

|

|

|

(19.3

|

)

|

|

Net cash (used in)/generated by financing activities

|

|

|

(344.2

|

)

|

|

|

(29.4

|

)

|

|

|

353.5

|

|

|

|

952.5

|

|

|

|

(67.7

|

)

|

|

|

(132.9

|

)

|

|

Net (decrease)/increase in cash and cash equivalents

|

|

|

(103.1

|

)

|

|

|

43.0

|

|

|

|

57.4

|

|

|

|

40.7

|

|

|

|

164.0

|

|

|

|

(13.9

|

)

|

|

Cash and cash equivalents at end of period

|

|

|

219.2

|

|

|

|

268.4

|

|

|

|

126.8

|

|

|

|

186.1

|

|

|

|

329.5

|

|

|

|

300.5

|

|

Non-IFRS

Financial Information

Adjusted EBITDA/Margin—Twelve months ended December 31, 2016

Please find below a reconciliation from profit before taxes for the twelve months ended December 31, 2016 to Adjusted EBITDA for the same period and the

related Adjusted EBITDA margin.

|

|

|

|

|

|

|

€ in millions

|

|

As reported for the

year ended December 31,

2016

|

|

|

Profit for the period

|

|

|

36.4

|

|

|

Taxation

|

|

|

39.6

|

|

|

Net financing costs

|

|

|

62.1

|

|

|

Depreciation

|

|

|

43.3

|

|

|

Amortization

|

|

|

7.8

|

|

|

|

|

|

|

|

|

EBITDA

|

|

|

189.2

|

|

|

Exceptional items:

|

|

|

|

|

|

Costs related to transactions

|

|

|

4.8

|

(a)

|

|

Costs related to management incentive plans

|

|

|

1.9

|

(b)

|

|

Investigation of strategic opportunities and other items

|

|

|

8.8

|

(c)

|

|

Cisterna fire net income

|

|

|

(4.3

|

)

(d)

|

|

Supply chain reconfiguration

|

|

|

84.3

|

(e)

|

|

Other restructuring costs

|

|

|

(1.0

|

)

(f)

|

|

Integration costs

|

|

|

29.6

|

(g)

|

|

Remeasurement of indemnification assets

|

|

|

10.4

|

(h)

|

|

Other Adjustments:

|

|

|

|

|

|

Share based payment charge

|

|

|

1.2

|

(i)

|

|

|

|

|

|

|

|

Adjusted EBITDA

(j)

|

|

|

324.9

|

|

|

|

|

|

|

|

|

(a)

|

Elimination of costs incurred in relation to completed and potential acquisitions and

one-off

compliance costs incurred as a result of listing on the New York Stock Exchange.

|

|

(b)

|

Adjustment to eliminate long term management incentive scheme costs from prior ownership.

|

|

(c)

|

Elimination of costs incurred in relation to investigation of strategic opportunities for the combined group following acquisition by the Company and other items considered

non-recurring.

|

S-9

|

(d)

|

Elimination of net insurance income offset by incremental operational costs incurred as a result of a fire in August 2014 in the Iglo Group’s Italian production facility which produces Findus branded stock for sale

in Italy.

|

|

(e)

|

Elimination of supply chain reconfiguration costs, namely the closure of the Bjuv factory.

|

|

(f)

|

Elimination of a credit on release of provisions for restructuring activities associated with operating locations.

|

|

(g)

|

Elimination of costs recognized by Nomad relating to the integration of the Findus Group.

|

|

(h)

|

Adjustment to reflect the remeasurement of the indemnification assets recognized on the acquisition of the Findus Group, which is capped at the value of shares held in escrow at the share price as at December 31,

2016.

|

|

(i)

|

Elimination of share payment charge relating to the Nomad 2015 long term incentive plan and annual

non-executive

directors restricted stock awards.

|

|

(j)

|

Adjusted EBITDA margin of 16.9% for the twelve months ended December 31, 2016 is calculated by dividing Adjusted EBITDA by revenue of €1,927.7 million.

|

Adjusted EBITDA/Margin—Six months ended June 30, 2017

Please find below a reconciliation from profit before taxes for the six months ended June 30, 2017 to Adjusted EBITDA for the same period and the related

Adjusted EBITDA margin.

|

|

|

|

|

|

|

€ in millions

|

|

As reported for the

six months ended

June 30, 2017

|

|

|

Profit for the period

|

|

|

67.3

|

|

|

Taxation

|

|

|

17.1

|

|

|

Net financing costs

|

|

|

48.4

|

|

|

Depreciation

|

|

|

18.0

|

|

|

Amortization

|

|

|

3.8

|

|

|

|

|

|

|

|

|

EBITDA

|

|

|

154.6

|

|

|

Exceptional items:

|

|

|

|

|

|

Costs related to transactions

|

|

|

2.5

|

(a)

|

|

Investigation and implementation of strategic opportunities and other items

|

|

|

11.5

|

(b)

|

|

Findus Group integration costs

|

|

|

5.7

|

(c)

|

|

Remeasurement of indemnification assets

|

|

|

(8.3

|

)

(d)

|

|

Other Adjustments:

|

|

|

|

|

|

Share based payment charge

|

|

|

2.1

|

(e)

|

|

|

|

|

|

|

|

Adjusted EBITDA

(f)

|

|

|

168.1

|

|

|

|

|

|

|

|

|

(a)

|

Elimination of costs incurred in relation to completed and potential acquisitions and

one-off

compliance costs incurred as a result of listing on the New York Stock Exchange.

|

|

(b)

|

Elimination of costs incurred in relation to investigation and implementation of strategic opportunities and other items considered

non-recurring

for the combined group following

acquisitions by the Company. These costs include commercial reorganization of the combined businesses and settlements of

pre-existing

tax audits.

|

|

(c)

|

Elimination of

non-recurring

costs related to the integration of the Findus Group, primarily relating to the rollout of the Nomad ERP system.

|

|

(d)

|

Adjustment to reflect the remeasurement of the indemnification assets recognized on the acquisition of the Findus

Group, which is capped at the value of shares held in escrow at the share price as at June 30, 2017. Offsetting are the release of indemnification assets associated with final settlement of indemnity claims

|

S-10

|

|

against an affiliate of Permira Advisors LLP, which are legacy tax matters that predate the Company’s acquisition of Iglo Group in 2015.

|

|

(e)

|

Elimination of share based payment charge.

|

|

(f)

|

Adjusted EBITDA margin 17.0% for the six months ended June 30, 2017 is calculated by dividing Adjusted EBITDA by revenue of €989.4 million.

|

S-11

RISK FACTORS

An investment in our ordinary shares involves a high degree of risk. Before investing in our ordinary shares you should carefully consider the other

information included in this prospectus supplement and accompanying prospectus and the risk factors and other information incorporated herein by reference to our Annual Report on Form 20-F for the fiscal year ended December 31, 2016, or any updates

in our reports on Form 6-K, including the “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections, as applicable, and our financial

statements and related notes contained therein. Any of the risks incorporated by reference could materially and adversely affect our business, financial condition or results of operations. In such a case, the trading price of the ordinary shares

could decline and you may lose all or part of your investment.

USE OF PROCEEDS

We will not receive any proceeds from the sale of our ordinary shares in this offering. All of the ordinary shares offered by the selling shareholders

pursuant to this prospectus supplement will be sold by the selling shareholders for their own account. Pursuant to the Registration Rights Agreement (as defined herein), we will pay certain registration expenses of the selling shareholders.

S-12

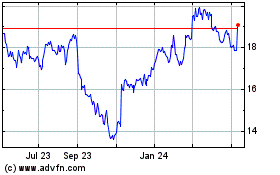

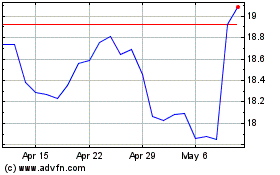

MARKET PRICE OF OUR ORDINARY SHARES

Our ordinary shares are currently listed for trading on the NYSE under the symbol “NOMD.” Our ordinary shares began trading on the London Stock

Exchange (the “LSE”) on April 15, 2014 and were traded on the LSE until April 20, 2015 when trading was halted through June 22, 2015 due to the announcement of the then-pending Iglo Acquisition. On January 12, 2016, the

Company transferred its listing from the LSE to the NYSE. The following table sets forth the high and low reported sale prices of our ordinary shares as reported on the LSE and NYSSE for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

Annual

|

|

|

|

|

|

|

|

|

|

2016 (January 5, 2016 – December 31, 2016)

|

|

$

|

13.40

|

|

|

$

|

6.40

|

|

|

2015 (April 1, 2015 – December 31, 2015)

(2)

|

|

$

|

23.11

|

|

|

$

|

10.28

|

|

|

2014 (April 15, 2014 – March 31, 2015)

|

|

$

|

11.75

|

|

|

$

|

9.75

|

|

|

|

|

|

|

Quarterly

|

|

|

|

|

|

|

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

Fourth Quarter (October 1, 2016 – December 31, 2016)

|

|

$

|

12.97

|

|

|

$

|

9.00

|

|

|

Third Quarter (July 1, 2016 – September 30, 2016)

|

|

$

|

12.39

|

|

|

$

|

7.95

|

|

|

Second Quarter (April 1, 2016 – June 30, 2016)

|

|

$

|

10.43

|

|

|

$

|

7.85

|

|

|

First Quarter (January 5, 2016 – March 31, 2016)

(1)

|

|

$

|

13.40

|

|

|

$

|

6.40

|

|

|

|

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

Third Quarter (October 1, 2015 – December 31, 2015)

|

|

$

|

17.40

|

|

|

$

|

11.00

|

|

|

Second Quarter (July 1, 2015 – September 30, 2015)

|

|

$

|

23.11

|

|

|

$

|

15.50

|

|

|

First Quarter (April 1, 2015 – June 30, 2015)

(2)

|

|

$

|

22.10

|

|

|

$

|

10.28

|

|

|

|

|

|

|

Most Recent Six Months

|

|

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

September (through September 4, 2017)

|

|

$

|

15.28

|

|

|

$

|

14.84

|

|

|

August

|

|

$

|

15.37

|

|

|

$

|

13.73

|

|

|

July

|

|

$

|

14.72

|

|

|

$

|

13.54

|

|

|

June

|

|

$

|

14.72

|

|

|

$

|

13.62

|

|

|

May

|

|

$

|

14.40

|

|

|

$

|

11.33

|

|

|

April

|

|

$

|

11.80

|

|

|

$

|

10.77

|

|

|

March

|

|

$

|

12.00

|

|

|

$

|

10.40

|

|

|

(1)

|

Issued trading on our ordinary shares began on the NYSE on January 5, 2016.

|

|

(2)

|

Trading in our ordinary shares was suspended on the LSE from April 20, 2015 through June 22, 2015 due to the announcement of the then-pending Iglo Acquisition.

|

On September 5, 2017, the closing price of our ordinary shares on the NYSE was $14.92. Computershare Trust Company, N.A. is the transfer agent and

registrar for our ordinary shares. As of May 5, 2017, approximately 137,457,662 ordinary shares, representing approximately 74.87% of our outstanding ordinary shares, were held by approximately 3,990 United States record holders.

S-13

DIVIDEND POLICY

We have not declared or paid any dividends on our ordinary shares since our inception on April 1, 2014, and have no current plans to pay dividends on our

ordinary shares. The declaration and payment of future dividends to holders of our ordinary shares will be at the discretion of our board of directors and will depend upon many factors, including our financial condition, earnings, legal

requirements, restrictions in our debt agreements and other factors deemed relevant by our board of directors. In addition, as a holding company, our ability to pay dividends depends on our receipt of cash dividends from our operating subsidiaries,

which may further restrict our ability to pay dividends as a result of the laws of their respective jurisdictions of organization, agreements of our subsidiaries or covenants under future indebtedness that we or they may incur. See “Item 3D:

Key Information – Risk Factors – Risks Related to our ordinary shares – Dividend payments on our ordinary shares are not expected,” and for a discussion of taxation of any dividends, see

“Certain Tax Considerations” in this prospectus supplement and “Item 10E: Additional Information – Taxation” in our Annual Report on Form

20-F

for the fiscal year ended

December 31, 2016 incorporated by reference herein.

S-14

CAPITALIZATION

The following table sets forth the consolidated cash and cash equivalents and capitalization of the Company as of June 30, 2017.

|

|

|

|

|

|

|

(€ in millions)

|

|

As of

June 30, 2017

|

|

|

Cash and Cash Equivalents

(1)

|

|

|

300.5

|

|

|

|

|

|

Debt

|

|

|

|

|

|

Senior debt and other loans

(2)

|

|

|

1,035.0

|

|

|

Senior notes

|

|

|

400.0

|

|

|

Total debt

|

|

|

1,435.0

|

|

|

|

|

|

|

|

|

Equity:

|

|

|

|

|

|

Capital reserve

|

|

|

1,707.4

|

|

|

Founder Preferred Shares Dividend reserve

|

|

|

493.4

|

|

|

Other reserves

(3)

|

|

|

82.8

|

|

|

Accumulated deficit

|

|

|

(415.2

|

)

|

|

Total equity

|

|

|

1,868.4

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

|

3,303.4

|

|

|

|

|

|

|

|

|

(1)

|

Cash and cash equivalents includes restricted cash of €0.5 million.

|

|

(2)

|

Senior debt and other loans are shown excluding capitalized deferred borrowing costs of €9.4 million.

|

|

(3)

|

Other reserves are made up of a translation reserve of €81.5 million, a cash flow reserve of €(1.1) million and share based compensation reserve of €2.4 million.

|

S-15

SELLING SHAREHOLDERS

The following table sets forth, the name, the number of ordinary shares beneficially owned as of September 5, 2017, the number of ordinary shares being

offered pursuant to this prospectus supplement and the number of ordinary shares that will be beneficially owned immediately after completion of the offering contemplated by this prospectus supplement and the concurrent share repurchase by each of

the shareholders selling ordinary shares in this offering.

The amounts and percentages of shares beneficially owned are reported on the basis of SEC

regulations governing the determination of beneficial ownership of securities. Under SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares voting power or investment power, which includes the

power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired

are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed to be a beneficial owner of

the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares

Beneficially Owned Prior to

this Offering and

Concurrent Share Repurchase

|

|

|

Ordinary

Shares

Offered

|

|

|

Ordinary Shares

Beneficially Owned After

this Offering

and

Concurrent Share Repurchase

|

|

|

Name of Selling shareholders

|

|

Number

|

|

|

%

(1)

|

|

|

|

Number

|

|

|

%

(1)

|

|

|

Pershing Square Funds

(2)

|

|

|

33,333,334

|

|

|

|

19.4

|

%

|

|

|

33,333,334

|

|

|

|

—

|

|

|

|

—

|

|

|

(1)

|

As of August 8, 2017, we had 172,355,189 ordinary shares outstanding.

|

|

(2)

|

Pershing Square Capital Management, L.P., a Delaware limited partnership (“Pershing Square”), as the investment adviser to Pershing Square, L.P., a Delaware limited partnership (“PSLP”), Pershing

Square II, L.P., a Delaware limited partnership (“PSII”), Pershing Square International, Ltd., a Cayman Islands exempted company (“PSINTL”), and Pershing Square Holdings, Ltd., a limited liability company incorporated in Guernsey

(“PSH” and together with PSLP, PSII and PSINTL, the “Pershing Square Funds”), may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares held by

the Pershing Square Funds. As the general partner of Pershing Square, PS Management GP, LLC, a Delaware limited liability company (“PS Management”), may be deemed to have the shared power to vote or direct the vote of (and the shared power

to dispose or direct the disposition of) the shares held by the Pershing Square Funds. By virtue of William A. Ackman’s position as the Chief Executive Officer of Pershing Square and managing member of PS Management, William A. Ackman may be

deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares held by the Pershing Square Funds. The address of the Pershing Square Funds is c/o Pershing Square Capital

Management, L.P., 888 Seventh Avenue, New York, NY 10019.

|

S-16

SHARES ELIGIBLE FOR FUTURE SALE

We cannot predict what effect, if any, market sales of our ordinary shares or the availability of our ordinary shares for sale will have on the market price

of our ordinary shares prevailing from time to time. Nevertheless, sales of substantial amounts of ordinary shares, including shares issued upon the exercise of outstanding options or restricted stock units, in the public market, or the perception

that such sales could occur, could materially and adversely affect the market price of our ordinary shares and could impair our future ability to raise capital through the sale of our equity or equity-related securities at a time and price that we

deem appropriate.

As of August 8, 2017, we had outstanding an aggregate of approximately 172,355,189 ordinary shares. Of the outstanding shares, the

shares sold in this offering will be freely tradable without restriction or further registration under the Securities Act, except that any shares held by our “affiliates”, as that term is defined under Rule 144, may be sold only in

compliance with the limitations described below. Restricted securities may be sold in the public market only if they are registered or if they qualify for an exemption from registration, including the exemptions under Rule 144, which we

summarize below.

In addition, as of August 8, 2017, there were 125,000 ordinary shares issuable upon the exercise of options to purchase shares with

an exercise price of $11.50 per share; 1,500,000 ordinary shares issuable upon the conversion of our founder preferred shares; 5,212,000 performance stock units; and an aggregate of approximately 11,954,010 shares reserved for future issuance under

our share-based compensation plans.

Rule 144

In

general, under Rule 144, as currently in effect, a person (or persons whose shares are aggregated) who is not deemed to be or have been one of our affiliates for purposes of the Securities Act at any time during 90 days preceding a sale and who has

beneficially owned the shares proposed to be sold for at least six months, including the holding period of any prior owner other than an affiliate, is entitled to sell such shares without registration, subject to compliance with the public

information requirements of Rule 144. If such a person has beneficially owned the shares proposed to be sold for at least one year, including the holding period of a prior owner other than an affiliate, then such person is entitled to sell such

shares without complying with any of the requirements of Rule 144.

In general, under Rule 144, as currently in effect, our affiliates or persons selling

shares on behalf of our affiliates, who have met the six month holding period for beneficial ownership of “restricted shares” of our ordinary shares, are entitled to sell within any three-month period, a number of shares that does not

exceed the greater of:

|

•

|

|

1% of the number of our ordinary shares then outstanding, which equals approximately 1,723,551 shares as of August 8, 2017; or

|

|

•

|

|

the average reported weekly trading volume of our ordinary shares on the NYSE during the four calendar weeks preceding the filing of a notice on Form 144 with respect to such sale.

|

Sales under Rule 144 by our affiliates or persons selling shares on behalf of our affiliates are also subject to certain manner of sale provisions and notice

requirements and to the availability of current public information about us. The sale of these shares, or the perception that sales will be made, could adversely affect the price of our ordinary shares after this offering because a great supply of

shares would be, or would be perceived to be, available for sale in the public market.

Registration Rights

On June 1, 2015, we entered into a registration rights agreement with Birds Eye Iglo Limited Partnership Inc., Mariposa Acquisition II, LLC, TOMS Acquisition I

LLC, TOMS Capital Investments LLC and with funds

S-17

managed by Pershing Square, pursuant to which we agreed to file a resale registration statement providing for the resale from time to time by the holders of ordinary shares held by them, use our

commercially reasonable efforts to cause the SEC to declare such registration statement effective as soon as practicable after the filing thereof and use our commercially reasonable efforts to cause such registration statement to remain continuously

effective. Subject to certain conditions, we may suspend sales of shares under an effective registration statement for a limited period of time. Our obligations with respect to a particular holder shall terminate at the earlier of (a) such time as

all of the holders’ ordinary shares have been sold, (b) such time as all of the holder’s ordinary shares have been sold, transferred or otherwise disposed of pursuant to Rule 144 without any volume or manner of sale restrictions and (c)

such time as such Holder is not an affiliate of ours and holds ordinary shares which constitute 2% or less of the outstanding ordinary shares. We have agreed to bear most of the costs associated with fulfillment of our obligations under

the registration rights agreement and to provide a general indemnity (subject to certain limited exceptions) against the liability of any holder that may arise from sales made pursuant to the terms of the registration rights

agreement.

S-18

CERTAIN TAX CONSIDERATIONS

U.S. Federal Income Taxation

General

The following discussion is a summary of certain U.S. federal income tax issues relevant to the acquisition, holding and disposition of the ordinary shares.

Additional tax issues may exist that are not addressed in this discussion and that could affect the U.S. federal income tax treatment of the acquisition, holding and disposition of the ordinary shares.

This discussion does not address U.S. state, local or

non-U.S.

income tax consequences and does not address any

non-income

tax consequences such as estate or gift taxes. The discussion applies, unless indicated otherwise, only to holders of ordinary shares who acquire the ordinary shares as capital assets. It does not address

special classes of holders that may be subject to different treatment under the Internal Revenue Code of 1986, as amended (the “Code”), such as:

|

|

•

|

|

certain financial institutions;

|

|

|

•

|

|

dealers and traders in securities;

|

|

|

•

|

|

persons holding ordinary shares as part of a hedge, straddle, conversion or other integrated transaction;

|

|

|

•

|

|

partnerships or other entities classified as partnerships for U.S. federal income tax purposes;

|

|

|

•

|

|

persons liable for the alternative minimum tax;

|

|

|

•

|

|

tax-exempt

organizations;

|

|

|

•

|

|

certain U.S. expatriates;

|

|

|

•

|

|

persons holding ordinary shares that own or are deemed to own 10 percent or more (by vote or value) of the Company’s voting stock; or

|

|

|

•

|

|

non-U.S.

Holders that do not use the U.S. Dollar as their functional currency.

|

This section is based on the Code, its legislative history, existing and proposed regulations, published rulings by the Internal Revenue Service

(“IRS”) and court decisions, all as currently in effect. These laws are subject to change, possibly on a retroactive basis. Holders of ordinary shares should consult their own tax advisers concerning the U.S. federal, state, local and

non-U.S.

tax consequences of acquiring, holding and disposing of ordinary shares in their particular circumstances.

As

used herein, a “U.S. Holder” is a beneficial owner of ordinary shares that is, for U.S. federal income tax purposes: (i) an individual who is a citizen or resident of the United States; (ii) a corporation or other entity taxable

as a corporation, created or organized in or under the laws of the United States or any political subdivision thereof; (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (iv) a trust

if (1) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more “United States persons” (within the meaning of the Code) have the authority to control all

substantial decisions of the trust, or (2) it has a valid election in effect under applicable Treasury regulations to be treated as a “United States person”.

This discussion is based upon certain understandings and assumptions with respect to the business, assets and shareholders, including that the Company is not,

does not expect to become, nor at any time has been, a controlled foreign corporation as defined in Section 957 of the Code (a “CFC”). The Company believes that it is not and has never been a CFC, and does not expect to become a CFC.

In the event that one or more of such understandings and assumptions proves to be inaccurate, the following discussion may not apply and material adverse U.S. federal income tax consequences may result to U.S. Holders.

S-19

Passive Foreign Investment Company (“PFIC”) Considerations

The U.S. federal income tax treatment of U.S. Holders will differ depending on whether or not the Company is considered a passive foreign investment company

(“PFIC”) for U.S. federal income tax purposes.

In general, the Company will be considered a PFIC for any taxable year in which: (i)

75 percent or more of its gross income consists of passive income; or (ii) 50 percent or more of the average quarterly market value of its assets in that year are assets (including cash) that produce, or are held for the production of,

passive income. For purposes of the above calculations, if the Company, directly or indirectly, owns at least 25 percent by value of the stock of another corporation, then the Company generally would be treated as if it held its proportionate

share of the assets of such other corporation and received directly its proportionate share of the income of such other corporation. Passive income generally includes, among other things, dividends, interest, rents, royalties, certain gains from the

sale of stock and securities, and certain other investment income.

Based on the anticipated market price of shares in the offering and the current and

anticipated composition of the income, assets and operations of the Company and its subsidiaries, the Company believes that it is not a PFIC in the current year and is not likely to be a PFIC in future years. This is a factual determination,

however, that depends on, among other things, the composition of the income and assets, and the market value of the shares and assets, of the Company and its subsidiaries from time to time, and thus there is no assurance that the Company will not be

a PFIC in the current year or in future years. If the Company is a PFIC for any taxable year during which a U.S. Holder holds (or, in the case of a lower-tier PFIC, is deemed to hold) its ordinary shares, such U.S. Holder will be subject to

significant adverse U.S. federal income tax rules. U.S. Holders should consult their tax advisors on the federal income tax consequences of the Company being treated as a PFIC.

Tax Consequences for U.S. Holders if the Company is not a PFIC

Dividends

In general, subject to the PFIC rules discussed

above, a distribution on an ordinary share will constitute a dividend for U.S. federal income tax purposes to the extent that it is made from the Company’s current or accumulated earnings and profits as determined under U.S. federal income tax

principles. If a distribution exceeds the Company’s current and accumulated earnings and profits, it will be treated as a

non-taxable

reduction of basis to the extent of the U.S. Holder’s tax basis

in the ordinary share on which it is paid, and to the extent it exceeds that basis it will be treated as capital gain. Because the Company does not maintain calculations of its earnings and profits under U.S. federal income tax principles, a U.S.

Holder should expect all cash distributions to be reported as dividends for U.S. federal income tax purposes. For purposes of this discussion, the term “dividend” means a distribution that constitutes a dividend for U.S. federal income tax

purposes.

The gross amount of any dividend on an ordinary share (which will include the amount of any foreign taxes withheld) generally will be subject

to U.S. federal income tax as foreign source dividend income, and will not be eligible for the corporate dividends received deduction.

Subject to certain

exceptions for short-term and hedged positions, a dividend that a

non-corporate

holder receives on an ordinary share will be subject to a maximum federal income tax rate of 20 percent if the dividend is a

“qualified dividend” not including the Net Investment Income Tax, described below. A dividend on an ordinary share will be a qualified dividend if (i) either (a) the ordinary shares are readily tradable on an established market in the

United States or (b) the Company is eligible for the benefits of a comprehensive income tax treaty with the United States that the Secretary of the Treasury determines is satisfactory for purposes of these rules and that includes an exchange of

information program, and (ii) the Company was not, in the year prior to the year the dividend was paid, and is not, in the year the dividend is paid, a PFIC. Since the ordinary shares are listed on the New York Stock Exchange, the ordinary

shares should be treated as readily tradable on an established securities market in the United States. Even if dividends on the ordinary shares would otherwise be eligible for qualified dividend treatment, in order to qualify for the reduced

qualified dividend tax rates, a

non-corporate

holder must

S-20

hold the ordinary share on which a dividend is paid for more than 60 days during the

120-day

period beginning 60 days before the

ex-dividend

date, disregarding for this purpose any period during which the

non-corporate

holder has an option to sell, is under a contractual obligation to sell or has made

(and not closed) a short sale of substantially identical stock or securities, is the grantor of an option to buy substantially identical stock or securities or, pursuant to Treasury regulations, has diminished its risk of loss by holding one or more

other positions with respect to substantially similar or related property. In addition, to qualify for the reduced qualified dividend tax rates, the

non-corporate

holder must not be obligated to make related

payments with respect to positions in substantially similar or related property. Payments in lieu of dividends from short sales or other similar transactions will not qualify for the reduced qualified dividend tax rates.

A

non-corporate

holder that receives an extraordinary dividend eligible for the reduced qualified dividend rates must

treat any loss on the sale of the stock as a long-term capital loss to the extent of the dividend. For purposes of determining the amount of a

non-corporate

holder’s deductible investment interest

expense, a dividend is treated as investment income only if the

non-corporate

holder elects to treat the dividend as not eligible for the reduced qualified dividend tax rates. Special limitations on foreign

tax credits with respect to dividends subject to the reduced qualified dividend tax rates apply to reflect the reduced rates of tax.

Non-corporate

holders of ordinary shares are urged to consult their own tax advisers regarding the availability of the reduced qualified dividend tax rates with respect to dividends received on the ordinary shares

in light of their own particular circumstances.

Capital Gains

Subject to the PFIC rules discussed above, on a sale or other taxable disposition of an ordinary share, a U.S. Holder will recognize capital gain or loss in an

amount equal to the difference between the U.S. Holder’s adjusted basis in the ordinary share and the amount realized on the sale or other disposition, each determined in U.S. Dollars. Such capital gain or loss will be long-term capital gain or

loss if at the time of the sale or other taxable disposition the ordinary share has been held for more than one year. In general, any adjusted net long-term capital gain of an individual is subject to a maximum federal income tax rate of

20 percent, plus the Medicare Contribution Tax of 3.8%, discussed below. Capital gains recognized by corporate U.S. holders generally are subject to U.S. federal income tax at the same rate as ordinary income. The deductibility of capital

losses is subject to limitations.

Any gain a U.S. Holder recognizes generally will be U.S. source income for U.S. foreign tax credit purposes, and,

subject to certain exceptions, any loss will generally be a U.S. source loss. If a

non-U.S.

income tax is paid on a sale or other disposition of an ordinary share, the amount realized will include the gross

amount of the proceeds of that sale or disposition before deduction of the

non-U.S.

tax. The generally applicable limitations under U.S. federal income tax law on crediting foreign income taxes may preclude a

U.S. Holder from obtaining a foreign tax credit for any

non-U.S.

tax paid on a sale or other disposition of an ordinary share. The rules relating to the determination of the foreign tax credit are complex, and

U.S. holders are urged to consult with their own tax advisers regarding the application of such rules. Alternatively, any

non-U.S.

income tax paid on the sale or other disposition of an ordinary share may be

taken as a deduction against taxable income to the extent such tax is not refundable, provided the U.S. Holder takes a deduction and not a credit for all foreign income taxes paid or accrued in the same taxable year.

Medicare Contribution Tax

Dividends received and capital

gains from the sale or other taxable disposition of the ordinary shares recognized by certain

non-corporate

U.S. Holders with respect to ordinary shares will be includable in computing net investment income of

such U.S. Holder for purposes of the 3.8 percent Medicare Contribution Tax.

S-21

Tax Consequences for

Non-U.S.

Holders of Ordinary Shares

Dividends

A

non-U.S.

Holder generally will not be subject to U.S. federal income tax or withholding on dividends received from the Company with respect to ordinary shares, other than in certain specific circumstances

where such income is deemed effectively connected with the conduct by the

non-U.S.

Holder of a trade or business in the United States. If a

non-U.S.

Holder is entitled

to the benefits of a U.S. income tax treaty with respect to those dividends, that income is generally subject to U.S. federal income tax only if it is attributable to a permanent establishment maintained by the

non-U.S.

Holder in the United States. A

non-U.S.

Holder that is subject to U.S. federal income tax on dividend income under the foregoing exception generally will be

taxed with respect to such dividend income on a net basis in the same manner as a U.S. Holder unless otherwise provided in an applicable income tax treaty; a

non-U.S.

Holder that is a corporation for U.S.

federal income tax purposes may also be subject to a branch profits tax with respect to such item at a rate of 30 percent (or at a reduced rate under an applicable income tax treaty).

Sale, Exchange or Other Taxable Disposition of Ordinary Shares

A

non-U.S.

Holder generally will not be subject to U.S. federal income tax or withholding with respect to any gain

recognized on a sale, exchange or other taxable disposition of ordinary shares unless:

|

|

•

|

|

Certain circumstances exist under which the gain is treated as effectively connected with the conduct by the

non-U.S.

Holder of a trade or business in the United States, and, if

certain tax treaties apply, is attributable to a permanent establishment maintained by the

non-U.S.

Holder in the United States; or

|

|

|

•

|

|

the

non-U.S.

Holder is an individual and is present in the United States for 183 or more days in the taxable year of the sale, exchange or other taxable disposition, and meets

certain other requirements.

|

If the first exception applies, the

non-U.S.

Holder generally will be

subject to U.S. federal income tax with respect to such item on a net basis in the same manner as a U.S. Holder unless otherwise provided in an applicable income tax treaty; a

non-U.S.

Holder that is a