Initial Statement of Beneficial Ownership (3)

September 07 2017 - 7:03PM

Edgar (US Regulatory)

|

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Ackerman Robert Carl

|

2. Date of Event Requiring Statement (MM/DD/YYYY)

9/5/2017

|

3. Issuer Name

and

Ticker or Trading Symbol

CROWN CASTLE INTERNATIONAL CORP [CCI]

|

|

(Last)

(First)

(Middle)

1220 AUGUSTA DRIVE SUITE 600

|

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director

_____ 10% Owner

___

X

___ Officer (give title below)

_____ Other (specify below)

SVP-COO-Towers and Small Cell /

|

|

(Street)

HOUSTON, TX 77057

(City)

(State)

(Zip)

|

5. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4)

|

2. Amount of Securities Beneficially Owned

(Instr. 4)

|

3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5)

|

4. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Common Stock $0.01 Par Value

|

99

|

D

|

|

|

Common Stock $0.01 Par Value

|

199

(1)

|

I

|

As custodian for child 1 under UTMA

|

|

Common Stock $0.01 Par Value

|

199

(1)

|

I

|

As custodian for child 2 under UTMA

|

|

Common Stock $0.01 Par Value

|

199

(1)

|

I

|

As custodian for child 3 under UTMA

|

|

Common Stock $0.01 Par Value

|

199

(1)

|

I

|

As custodian for child 4 under UTMA

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4)

|

2. Date Exercisable and Expiration Date

(MM/DD/YYYY)

|

3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4)

|

4. Conversion or Exercise Price of Derivative Security

|

5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5)

|

6. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Time RSUs

(2)

|

(3)

|

(3)

|

Common Stock

|

901.0

|

$0.0

|

D

|

|

|

Performance RSUs

(2)

|

(4)

(5)

|

(4)

(5)

|

Common Stock

|

9339.0

|

$0.0

|

D

|

|

|

Time RSUs

(2)

|

(6)

|

(6)

|

Common Stock

|

1890.0

|

$0.0

|

D

|

|

|

Performance RSUs

(2)

|

(7)

(8)

|

(7)

(8)

|

Common Stock

|

9923.0

|

$0.0

|

D

|

|

|

Time RSUs

(2)

|

(9)

|

(9)

|

Common Stock

|

2775.0

|

$0.0

|

D

|

|

|

Performance RSUs

(2)

|

(10)

(11)

|

(10)

(11)

|

Common Stock

|

9851.0

|

$0.0

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

The reporting person disclaims beneficial ownership of these shares, and this report shall not be deemed an admission that the reporting person is the beneficial owner of such securities for purposes of Section 16 or for any other purpose.

|

|

(2)

|

Each Restricted Stock Unit ("RSU") is issued pursuant to the Company's 2013 Long-Term Incentive Plan and represents a contingent right to receive one share of common stock, and vesting (i.e., forfeiture restriction termination) generally is subject to (i) the reporting person remaining an employee or director of the Company or its affiliates and (ii) the other criteria described in the footnotes below.

|

|

(3)

|

100% of these Time RSUs may vest on February 19, 2018.

|

|

(4)

|

0-100% of these Performance RSUs may vest on February 19, 2018 based upon the Company's total stockholder return ("TSR") performance ranking ("TSR Rank") relative to a peer group of companies approved by the Company's board of directors for the three year period ending February 19, 2018 ("Period 2018"). If the TSR Rank is at the 30th percentile or more up to the 55th percentile, then 33.34% to 66.67% of the Performance RSUs vest on a pro rata basis based upon the level of the TSR Rank (i.e., approximately an additional 1.3336% of the units vest for each 1.0 percentile increase in the TSR Rank above the 30th percentile up to the 55th percentile), with 66.67% of the Performance RSUs vesting at the 55th percentile. (Continued in Footnote 5)

|

|

(5)

|

(Continued from Footnote 4) If the TSR Rank is at the 55th percentile or more, then 66.67% to 100% of the Performance RSUs vest on a pro rata basis based upon the level of the TSR Rank (i.e., approximately an additional 0.95229% of the units vest for each 1.0 percentile increase in the TSR Rank above the 55th percentile up to the 90th percentile (or above)), with 100% of the units vesting at or above the 90th percentile. However, if the TSR is negative for the Period 2018 and the TSR Rank is at or above the 30th percentile, the percentage of units which vest shall be 33.34%. If the TSR Rank is below the 30th percentile, 100% of the Performance RSUs will be forfeited.

|

|

(6)

|

50% of these Time RSUs may vest on February 19 of each 2018 and 2019.

|

|

(7)

|

0-100% of these Performance RSUs may vest on February 19, 2019 based upon the Company's TSR Rank relative to a peer group of companies approved by the Company's board of directors for the three year period ending February 19, 2019 ("Period 2019"). If the TSR Rank is at the 30th percentile or more up to the 55th percentile, then 33.34% to 66.67% of the Performance RSUs vest on a pro rata basis based upon the level of the TSR Rank (i.e., approximately an additional 1.3336% of the units vest for each 1.0 percentile increase in the TSR Rank above the 30th percentile up to the 55th percentile), with 66.67% of the Performance RSUs vesting at the 55th percentile. (Continued in Footnote 8)

|

|

(8)

|

(Continued from Footnote 8) If the TSR Rank is at the 55th percentile or more, then 66.67% to 100% of the Performance RSUs vest on a pro rata basis based upon the level of the TSR Rank (i.e., approximately an additional 0.95229% of the units vest for each 1.0 percentile increase in the TSR Rank above the 55th percentile up to the 90th percentile (or above)), with 100% of the units vesting at or above the 90th percentile. However, if the TSR is negative for the Period 2019 and the TSR Rank is at or above the 30th percentile, the percentage of units which vest shall be 33.34%. If the TSR Rank is below the 30th percentile, 100% of the Performance RSUs will be forfeited.

|

|

(9)

|

33 1/3% of the Time RSUs vest on February 19 of each of 2018, 2019 and 2020.

|

|

(10)

|

0-100% of these Performance RSUs may vest on February 19, 2020 based upon the Company's TSR Rank relative to a peer group of companies approved by the Company's board of directors for the three year period ending February 19, 2020 ("Period 2020"). If the TSR Rank is at the 30th percentile or more up to the 55th percentile, then 33.34% to 66.67% of the Performance RSUs vest on a pro rata basis based upon the level of the TSR Rank (i.e., approximately an additional 1.3336% of the units vest for each 1.0 percentile increase in the TSR Rank above the 30th percentile up to the 55th percentile), with 66.67% of the Performance RSUs vesting at the 55th percentile. (Continued in Footnote 11)

|

|

(11)

|

(Continued from Footnote 10) If the TSR Rank is at the 55th percentile or more, then 66.67% to 100% of the Performance RSUs vest on a pro rata basis based upon the level of the TSR Rank (i.e., approximately an additional 0.95229% of the units vest for each 1.0 percentile increase in the TSR Rank above the 55th percentile up to the 90th percentile (or above)), with 100% of the units vesting at or above the 90th percentile. However, if the TSR is negative for the Period 2020 and the TSR Rank is at or above the 30th percentile, the percentage of units which vest shall be 33.34%. If the TSR Rank is below the 30th percentile, 100% of the Performance RSUs will be forfeited.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Ackerman Robert Carl

1220 AUGUSTA DRIVE SUITE 600

HOUSTON, TX 77057

|

|

|

SVP-COO-Towers and Small Cell

|

|

Signatures

|

|

/s/ Robert Carl Ackerman

|

|

9/7/2017

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 5(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

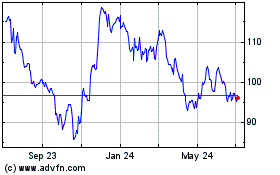

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

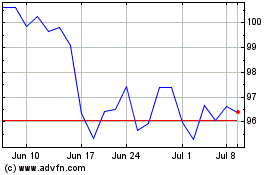

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024