Current Report Filing (8-k)

September 07 2017 - 4:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 7, 2017

OCEANEERING INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction

of incorporation)

|

1-10945

(Commission

File Number)

|

95-2628227

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

11911 FM 529

Houston, TX

(Address of principal executive offices)

|

77041

(Zip Code)

|

Registrant's telephone number, including area code: (713) 329-4500

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2):

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 7.01 Regulation FD Disclosure.

A slide presentation that will be used with the investors will be available for interested parties to view and download on

September 7, 2017

,

after the close of the market

, at the Investor Relations link at Oceaneering's website, www.oceaneering.com.

The definitions and rationale for the use of the non-GAAP terms EBITDA and Free Cash Flow in the Supplemental Financial Information section of the handout and the reconciliations to their most directly comparable GAAP financial measures can be found where the terms first appear.

The information furnished pursuant to this Item 7.01 shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Please note that certain statements in the meetings and accompanying handout are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 and are subject to the "Safe Harbor" provisions of those statutes. Forward-looking statements are generally accompanied by words such as "estimate," "project," "predict," "believe," "expect," "anticipate," "plan," "guidance," "forecast," "budget," "goal," "should," "would" or other words that convey the uncertainty of future events or outcomes. Among other items, the forward-looking statements in the meetings and handout include statements regarding:

|

|

|

|

•

|

our belief we have strong market positions;

|

|

|

|

|

•

|

our belief we have a solid balance sheet and cash flow;

|

|

|

|

|

•

|

our focus on return of capital to our shareholders;

|

|

|

|

|

•

|

our belief that, longer term, deepwater is still critical to reserve replenishment;

|

|

|

|

|

•

|

our belief that we will provide 10 ROVs and subsea tooling aboard Heerema's deepwater construction vessels and semi-submersible crane vessels on a global basis through 2020;

|

|

|

|

|

•

|

our belief that we will provide eight ROVs, survey and associated services, including subsea tooling, engineering, communication and data solutions, to support Mærsk's global operations;

|

|

|

|

|

•

|

our estimate that our newbuild Jones-Act compliant multi-service support vessel, the

Ocean Evolution

, will be available at the end of December 2017 and placed into service in early first quarter 2018;

|

|

|

|

|

•

|

our belief that our liquidity and cash flow position us well to manage our business and provide optionality through the continuing industry downturn;

|

|

|

|

|

•

|

our organic Capex estimate range for this year of

$90 million

to

$120 million

;

|

|

|

|

|

•

|

our intent to continue to consider investments that augment our service or product offerings, with more focus on our customers operating expenses;

|

|

|

|

|

•

|

our expectation to pay quarterly dividends of $0.15 per share on a sustainable basis;

|

|

|

|

|

•

|

our intent to consider share repurchases;

|

|

|

|

|

•

|

our belief that we are leveraged to deepwater, and deepwater traits include:

|

|

|

|

|

◦

|

projects that take years to develop;

|

|

|

|

|

◦

|

has largely oil reservoirs with high production flow rates;

|

|

|

|

|

◦

|

has a well-capitalized customer base; and

|

|

|

|

|

◦

|

investment is based on long-term commodity price expectations;

|

|

|

|

|

•

|

our belief that, in the long-term, deepwater is still expected to play an essential role in global oil supply growth required to replace depletion and meet projected demand;

|

|

|

|

|

•

|

our 2017 full year and second half outlook, including:

|

|

|

|

|

◦

|

challenging market conditions;

|

|

|

|

|

◦

|

alignment of our operations with anticipate level of activity;

|

|

|

|

|

◦

|

projection of being marginally profitable at the operating income line for the full year 2017;

|

|

|

|

|

◦

|

our forecast of higher second half operating income on relatively flat revenue compared to the first half;

|

|

|

|

|

▪

|

improved Subsea Products and Advanced Technologies;

|

|

|

|

|

▪

|

relatively flat ROV and Asset Integrity; and

|

|

|

|

|

▪

|

considerably lower Subsea Projects;

|

|

|

|

|

•

|

our belief that we can defend, or grow our market share;

|

|

|

|

|

•

|

our belief that we can control costs and maintain an organization commensurate with existing business levels;

|

|

|

|

|

•

|

our belief that we will drive efficiencies throughout the organization;

|

|

|

|

|

•

|

our belief that we will engage directly with customers to develop value added solutions; and

|

|

|

|

|

•

|

our belief that we will look for opportunities to grow the company.

|

These forward-looking statements are based on our current information and expectations that involve a number of risks, uncertainties, and assumptions. Among the factors that could cause the actual results to differ materially from those indicated in the forward-looking statements are:

|

|

|

|

•

|

worldwide demand for oil and gas;

|

|

|

|

|

•

|

general economic and business conditions and industry trends;

|

|

|

|

|

•

|

delays in deliveries of deepwater drilling rigs;

|

|

|

|

|

•

|

delays in or cancellations of deepwater development activities;

|

|

|

|

|

•

|

the ability of the Organization of Petroleum Exporting Countries, or OPEC, to set and maintain production levels;

|

|

|

|

|

•

|

the level of production by non-OPEC countries;

|

|

|

|

|

•

|

the ability of oil and gas companies to generate funds for capital expenditures;

|

|

|

|

|

•

|

contract modifications or cancellations;

|

|

|

|

|

•

|

domestic and foreign tax policy;

|

|

|

|

|

•

|

laws and governmental regulations that restrict exploration and development of oil and gas in various offshore jurisdictions;

|

|

|

|

|

•

|

the political environment of oil-producing regions;

|

|

|

|

|

•

|

the price and availability of alternative fuels; and

|

|

|

|

|

•

|

overall economic conditions.

|

Should one or more of these risks or uncertainties materialize, or should the assumptions underlying the forward-looking statements prove incorrect, actual outcomes could vary materially from those indicated. For additional information regarding these and other factors that could cause our actual results to differ materially from those expressed in our forward-looking statements, see our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2016 and our Quarterly Reports on Form 10-Q.

Except as required by applicable law, we do not undertake any obligation to update or revise any of our forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

OCEANEERING INTERNATIONAL, INC.

|

|

|

|

|

|

|

Date:

|

September 7, 2017

|

By:

|

/S/ W. Cardon Gerner

|

|

|

|

|

W. Cardon Gerner

|

|

|

|

|

Senior Vice President and Chief Accounting Officer

|

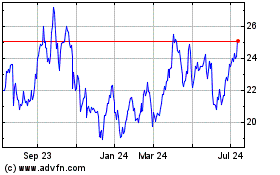

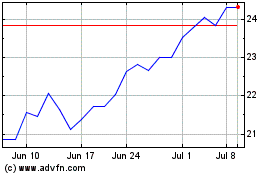

Oceaneering (NYSE:OII)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oceaneering (NYSE:OII)

Historical Stock Chart

From Apr 2023 to Apr 2024