Report of Foreign Issuer (6-k)

September 07 2017 - 9:38AM

Edgar (US Regulatory)

FORM

6 - K

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report

of Foreign Private Issuer

Pursuant

to Rule 13a - 16 or 15d - 16 of

the Securities

Exchange Act of 1934

As of

9/7/2017

Ternium

S.A.

(Translation

of Registrant’s name into English)

Ternium

S.A.

29 Avenue de la Porte-Neuve – 3rd floor

L-2227 Luxembourg

(352) 2668-3152

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F ☑

Form 40-F ☐

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☑

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not

applicable

The attached material is being furnished

to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s press release announcing

Ternium completed the acquisition of CSA Siderúrgica do Atlântico.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

Name: Pablo Brizzio

Title: Chief Financial Officer

Dated: September 7, 2017

Sebastián Martí

Ternium - Investor Relations

+1 (866) 890 0443

+54 (11) 4018 8389

www.ternium.com

Ternium completes acquisition of CSA Siderúrgica

do Atlântico

Luxembourg, September 7, 2017 – Ternium

S.A. (NYSE: TX) announced today that it has completed its previously announced acquisition of a 100% ownership interest in thyssenkrupp

Slab International B.V. (“tkSI”) and its wholly-owned subsidiary CSA Siderúrgica do Atlântico Ltda. (“CSA”)

from thyssenkrupp AG (“tkAG”). In addition, tkAG assigned to Ternium a 2.0 million tons per year agreement to supply

slabs from CSA’s facility in Brazil to thyssenkrupp’s former Calvert re-rolling facility in Alabama, United States.

“This acquisition brings another

state-of-the-art facility into Ternium’s industrial system, along with CSA’s highly-skilled personnel and know-how,

thereby enhancing our differentiation and value-added capabilities in the steel production supply chain,” said Daniel Novegil,

CEO of Ternium. “Upon integration, Ternium customers will not only benefit from our expanded high-end steel slabs capacity,

but also see the results of an enhanced product development and supply chain management effort that will increase our high-end

steel specialization in Mexico and Argentina. We move forward as a strengthened organization across our strategic industrial sectors

in Latin America.”

Ternium disbursed EUR1.4 billion, on a

cash-free, debt-free basis, for the acquisition of both the tkSI shares and the slab supply agreement. Prior to the closing of

the transaction, and following certain cash contributions by tkAG through tkSI, CSA repaid in full its EUR0.3 billion financial

debt with BNDES. To finance its acquisition, Ternium entered into a five-year syndicated term loan facility in a principal amount

of USD1.5 billion.

Ternium will integrate CSA into its industrial

and supply-chain systems. As part of this process, CSA has changed its corporate name to Ternium Brasil Ltda. (“Ternium Brasil”),

and Marcelo Chara, formerly Industrial Director of Ternium’s operations in Argentina, has been named Chief Executive Officer

(

Diretor-Presidente

) of Ternium Brasil. In addition, tkSI has changed its corporate name to Ternium Staal B.V. Ternium will

consolidate Ternium Staal B.V.’s balance sheet and results of operations in its consolidated financial statements beginning

in September 2017.

Forward Looking Statements

Some of the statements contained in

this press release are “forward-looking statements”. Forward-looking statements are based on management’s current

views and assumptions and involve known and unknown risks that could cause actual results, performance or events to differ materially

from those expressed or implied by those statements. These risks include but are not limited to risks arising from uncertainties

as to gross domestic product, related market demand, global production capacity, tariffs, cyclicality in the industries that purchase

steel products and other factors beyond Ternium’s control.

About Ternium

Ternium is Latin America’s leading

flat steel producer, with operating facilities in Mexico, Brazil, Argentina, Colombia, the southern United States and Central America.

The company offers a broad range of high value-added steel products for customers active in the automotive, home appliances, construction,

capital goods, container, food and energy industries through its manufacturing and service center network, and advanced customer

integration systems. More information about Ternium is available at www.ternium.com.

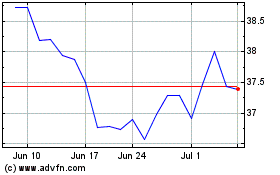

Ternium (NYSE:TX)

Historical Stock Chart

From Mar 2024 to Apr 2024

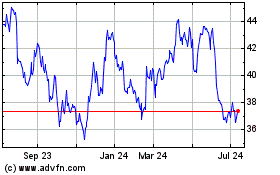

Ternium (NYSE:TX)

Historical Stock Chart

From Apr 2023 to Apr 2024