Omni-Lite Industries Reports Strong Six Month Financial Results and Significant New Orders

September 06 2017 - 9:01AM

For the six months ended June 30, 2017, Omni-Lite Industries Canada

Inc. (the “Company” or "Omni-Lite") (TSXV:OML) (OTCQX:OLNCF) is

pleased to report revenue of $3,479,191 US. In the first six months

of this fiscal year, cash flow from operations(1) was $1,053,995

US, an increase of 11% over the same period in 2016. EBITDA was

$1,015,060 US, an increase of 18% over the prior period. Net income

was $690,001 US, an increase of 19% over the first six months of

2016. Earnings per share were up significantly, 28% above the

results in the first half of the prior year. This was in part

due to the Company’s active and ongoing normal course issuer bid.

“The appointment of Joseph Hachadoorian as VP of

Business Development and Sales has added significant depth to the

Company's customer outreach program. This is evident in that

Omni-Lite has recently been approached to take on several new

projects in the aerospace industry,” stated David Grant, CEO.

"The addition of the hot heading test center has also added a new

dimension to the Company’s technical and product offerings, which

now exceed the in-house capabilities of some of our largest

customers. The Company has been successful in producing components

on the hot heading test center and is optimistic that this will

result in additional production orders in the near future.”

“Of particular importance, the Company has

successfully delivered, for first article approval, two additional

new components for one of our largest aerospace customers and is in

active discussion with the customer on the production requirements

for the two products originally approved last month,” stated Vern

Brown, Manufacturing Manager. “These products are part of a large

family of aerospace components that could include up to twenty

different variants. The Company continues to focus on this program

due to its potential size and contribution to future revenues.”

The Company is making a continuous effort to

focus growth in the higher margin Aerospace and Military areas.

This steady change is represented by the fact that 61% of sales in

the first half of 2017 are in the Aerospace and Military arenas

versus 56% in the first half of 2016. This shift has raised the

gross margin approximately 180 basis points over the first half of

2016.

Omni-Lite is also pleased to note that it has

received new contracts worth $1,066,000 US. Of these orders,

43% are in the Aerospace Division, 35% are in the Sports and

Recreational Division and 22% are in the Specialty Automotive

Division, "This brings the total value of the new orders announced

since the start of the year to approximately $4,800,454 US," stated

Allen W. Maxin, President. "At today's exchange rate this would be

approximately $5,938,162 CDN.”

Omni-Lite has been active in its use of the

normal course issuer bid to increase shareholder returns. The

Company believes that the repurchase of it’s common shares is in

the best interests of it’s shareholders. “Omni-Lite

repurchased a total of 1,145,200 shares for cancellation in fiscal

year 2016 and year to date through September 5, 2017 a further

207,700 shares. Despite the active normal course issuer bid, the

Company continues to possess a very strong balance sheet,” remarked

David Grant. “We are also impressed with the recent progress

made by our affiliate, California Nanotechnologies Corp.

(TSX-V:CNO), wherein they have purchased and are currently

installing, a $650,000 US Fuji Mark V SPS system for production

activities. Since the beginning of 2017, Omni-Lite has purchased an

aggregate of 365,000 shares of CNO, bringing Omni-Lite’s current

ownership position to approximately 19.1% of CNO’s common

shares.”

| SUMMARY OF SIX MONTH FINANCIAL

HIGHLIGHTS |

| All figures in US dollars |

|

|

For the sixmonths

ended June 30, 2017 |

For the sixmonths

ended June 30, 2016 |

%Increase(Decrease) |

|

Revenue |

$ |

3,479,191 |

$ |

3,595,132 |

(3 |

)% |

|

Cash flow from operations(1) |

|

1,053,995 |

|

946,407 |

11 |

% |

|

EBITDA(1) |

|

1,015,060 |

|

859,102 |

18 |

% |

|

Net income |

|

690,001 |

|

581,166 |

19 |

% |

|

EPS |

|

0.07 |

|

0.05 |

28 |

% |

| SUMMARY OF THREE MONTH FINANCIAL

HIGHLIGHTS |

| All figures in US dollars |

|

|

For the threemonths

ended June 30, 2017 |

For the threemonths

ended June 30, 2016 |

%Increase(Decrease) |

|

Revenue |

$ |

1,754,952 |

$ |

2,110,643 |

(17 |

)% |

|

Cash flow from operations(1) |

|

524,731 |

|

604,607 |

(13 |

)% |

|

EBITDA(1) |

|

503,645 |

|

558,745 |

(10 |

)% |

|

Net income |

|

321,806 |

|

410,946 |

(22 |

)% |

|

EPS |

|

0.03 |

|

0.04 |

(16 |

)% |

(1) Cash flow from operations

is a non-IFRS term requested by the oil and gas investment

community that represents net earnings adjusted for non-cash items

including depreciation, depletion and amortization, future income

taxes, asset write-downs and gains (losses) on sale of assets, if

any. EBITDA is a non-IFRS financial measure defined as

earnings before interest, taxes, depreciation and amortization.

These are non-IFRS financial measures, as defined herein, and

should be read in conjunction with IFRS financial measures.

These non-IFRS financial measures are not presented as an

alternative to IFRS cash flows from operations or as a measure of

our liquidity or as an alternative to reported net income as an

indicator of our operating performance. The non-IFRS financial

measures as used herein may not be comparable to similarly titled

measures reported by other companies. We believe the use of

EBITDA and non-IFRS cash flow from operations along with IFRS

financial measures enhances the understanding of our operating

results and may be useful to investors in comparing our operating

performance with that of other companies and estimating our

enterprise value. EBITDA is also a useful tool in evaluating

the operating results of the Company given the significant

variation that can result from, for example, the timing of capital

expenditures and the amount of working capital in support of our

customer programs and contracts. We also use EBITDA internally to

evaluate the operating performance of the Company, to allocate

resources and capital, and to evaluate future growth

opportunities.

For complete results, please visit www.sedar.com or request

a copy from the Company.

Omni-Lite Industries Canada Inc. is a rapidly

growing high technology company that develops and manufactures

mission critical, precision components utilized by Fortune 500

companies including Boeing, Airbus, Bombardier, Embraer, Alcoa,

Ford, Borg Warner, Chrysler, the U.S. Military and Nike.

Except for historical information contained

herein this document contains forward-looking statements. These

statements contain known and unknown risks and uncertainties that

may cause the Company’s actual results or outcomes to be materially

different from those anticipated and discussed herein.

For further information, please contact:

Mr. David GrantFounder, Chairman, and CEOTel. No. (562)

404-8510 or (800) 577-6664 Fax. No. (562) 926-6913, email:

d.grant@omni-lite.com

Website:

www.omni-lite.com

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

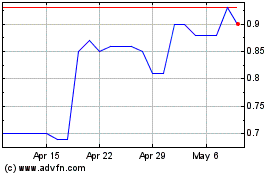

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Apr 2023 to Apr 2024