KRONOS WORLDWIDE ANNOUNCES €400 MILLION PRIVATE OFFERING OF SENIOR SECURED NOTES

September 01 2017 - 9:47AM

DALLAS, TEXAS - September 1, 2017 - Kronos

Worldwide, Inc. (NYSE: KRO) today announced that, subject to

market conditions, it intends to offer €400 million in aggregate

principal amount of senior secured notes due 2025 (the "Notes") for

sale to eligible purchasers in a private offering (the "Notes

Offering"). The Notes would be issued by the Company's

wholly-owned subsidiary Kronos International, Inc., and guaranteed

on a senior secured basis by the Company and its domestic

wholly-owned subsidiaries. The Company intends to use the net

proceeds from the Notes Offering to prepay in full the outstanding

balance of its existing term loan indebtedness ($338.6 million

principal amount outstanding), and repay all indebtedness

outstanding under its North American revolving credit

facility. The balance of the net proceeds from the Notes

Offering would be available for the Company's general corporate

purposes.

The Notes to be offered have not been registered

under the Securities Act of 1933, as amended (the "Securities Act")

or any state securities laws, and unless so registered, the Notes

may not be offered or sold in the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and applicable

state securities laws. The Notes are expected to be eligible for

resale to qualified institutional buyers under Rule 144A and

non-U.S. persons under Regulation S.

This announcement shall not constitute an offer to

sell or a solicitation of an offer to buy any of the Notes, nor

shall there be any sale of the Notes in any state in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state.

The statements in this release

relating to matters that are not historical facts are

forward-looking statements that represent management's beliefs and

assumptions based on currently available information. These

statements may include, but are not limited to, statements

regarding the terms of the Notes, the completion, timing or size of

the proposed private offering, and the anticipated use of proceeds

from the Notes Offering. Although the Company believes that the

expectations reflected in such forward-looking statements are

reasonable, it cannot give any assurances that these expectations

will prove to be correct. Such statements by their nature

involve substantial risks and uncertainties that could

significantly impact expected results, and actual future results

could differ materially from those described in such

forward-looking statements. Should one or more of these risks

materialize (or the consequences of such a development worsen), or

should the underlying assumptions prove incorrect, actual results

could differ materially from those forecasted or expected.

The Company disclaims any intention or obligation to update or

revise any forward-looking statement whether as a result of changes

in information, future events or otherwise.

Kronos Worldwide, Inc. is a major international

producer of titanium dioxide products.

* * * * *

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Kronos Worldwide via Globenewswire

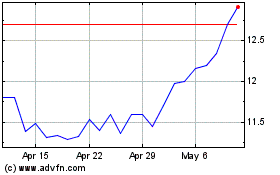

Kronos Worldwide (NYSE:KRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

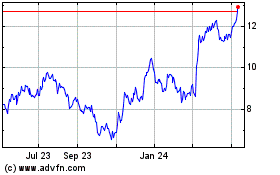

Kronos Worldwide (NYSE:KRO)

Historical Stock Chart

From Apr 2023 to Apr 2024