Current Report Filing (8-k)

August 30 2017 - 2:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

and Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 30, 2017

CARDIFF INTERNATIONAL, INC.

(Exact name of Registrant as specified

in its charter)

|

Florida

|

000-49709

|

84-1044583

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No

.)

|

401 E. Las Olas Blvd. Suite 1400

Ft. Lauderdale, FL 33301

(Address of principal executive offices,

including zip code)

(844) 628-2100

(Registrant's telephone number, including

area code)

_________________________________________________________

(Former name or former address, if changed

since last report)

Check the appropriate box below if the 8-K filing is intended to

simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

o

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

¨

In this Current Report on Form 8-K,

“Registrant,” “Company,” “our company,” “us,” and “our” refer to Cardiff

International, Inc., unless the context requires otherwise.

Item 4.02 Non-Reliance on Previously

Issued Financial Statements or a Related Audit Report or Completed Interim Review

On August 23, 2017 the Board of Directors

(the “Board”) of Cardiff International, Inc. (the “Company”) concluded that the unaudited financial statements

for the 2

nd

Quarter 2017 (the “Relevant Period”), as previously filed as part of the Company’s previously

issued unaudited consolidated financial statement as of and for the quarter ended June 30

th

, 2017 should no longer be

relied upon. The Company will restate its unaudited consolidated financial statements for the Restated Period to reflect adjustments

in the fair market value.

The Company has concluded to restate its

financial statements for the Relevant Period to correct the above identified accounting and disclosure errors. The Company and

MaloneBailey LLP, its independent auditors are working expeditiously to complete this review and the Company intends to bring current

its financial reporting obligations as soon as practicable.

Item 1.02 Termination of a Material Definitive Agreement.

As previously disclosed, on March 29, 2017 Cardiff International,

Inc. a company incorporated in the State of Florida ("Cardiff"), entered into an Acquisition Agreement (the “Agreement”)

to purchase American Cycle Finance d/b/a Ride Today Acceptance, Inc. (“ACF”), a company incorporated in the State of

Massachusetts in a Tax-Free Exchange under section 368 (a)(1)(B) of the United States Internal Revenue Code of 1986. Due to the

failure to meet the terms of the agreement it was agreed to rescind the forward acquisition agreement.

The Company placed in reserve 35,000,000 shares of Convertible

Preferred “K” stock of which 9,607,840 shares were to be issued pursuant to the Agreement. The Preferred “K”

shares have a 1 to 1.25 conversion rate (the “Conversion”) governed by a Lock-Up/Leak-Out Agreement in exchange for

100% of shares of ACF represented by all assets valued at $2,401,960.

The Company believes the termination and revocation of this

Acquisition is in the best interest of our Shareholders. The Asset Acquisition Agreement is attached as Exhibit 1A to the Current

Report on Form 8-K filed by Cardiff this 24

th

day of August 2017 and which is incorporated herein by reference.

The decision to rescind this Acquisition

Agreement was approved by the Company’s Board of Directors on August 23

rd

, 2017.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Cardiff International, Inc.

By:

/s/ Daniel Thompson

Daniel Thompson

Title:

Chairman

Dated: August 30, 2017

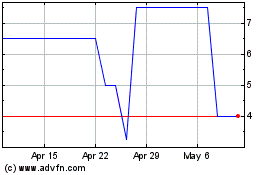

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

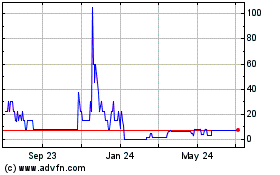

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024