By Lynn Cook, Bradley Olson and Alison Sider

HOUSTON -- Tropical Storm Harvey, the most powerful storm to hit

Texas in half a century, has shut a significant portion of the

state's shale production, cutting off as much as 15% of U.S. oil

supplies.

Now, in what is the first major storm to test U.S. shale, the

big question is how quickly the sector can make a comeback.

As the storm's widespread devastation has come into focus,

several analysts say that much, if not most, of the 1.4 million

barrels of oil produced daily in the Eagle Ford shale of South

Texas has been cut off and may not return for weeks. The Eagle

Ford, which is on the doorstep of Corpus Christi where the storm

made landfall, is second in output in the state only to the Permian

Basin of West Texas.

Early indications from a handful of companies are that the

severity of the storm was much greater than expected but damage to

fields was moderate, according to Paul Sankey, an equities analyst

with Wolfe Research. Many big shale producers in the Eagle Ford

shut their oil and gas wells before Harvey made landfall as a

hurricane Friday.

While some companies made efforts to restart production Tuesday,

a snarled supply chain is keeping a lot of oil in the ground for

now.

Shale producers rely on a vast, multibillion-dollar network of

energy infrastructure -- from ports to train tracks to pipelines --

that has developed in recent years along the Texas coast. Many

pieces of that network appear to be swamped, and since there hasn't

been a storm of this magnitude since shale drilling took off about

a decade ago, it is harder to predict how long it will take for the

infrastructure to recover.

ConocoPhillips, one of the biggest producers in the area,

normally pumps 130,000 barrels a day in the Eagle Ford; it shut its

wells ahead of the hurricane. As of Tuesday, it had restarted some

fields on a limited basis, but was struggling with the pipelines

and trucks needed to take the crude away.

"The effect to shale could linger given the extent and

catastrophic level of forecasted flooding, which interferes with

shale logistics," said Benny Wong, an analyst with Morgan

Stanley.

In the past, hurricanes have dealt a blow to the Texas energy

industry by knocking out offshore oil platforms in the Gulf of

Mexico; but in many cases, once storms passed, those big

installations could quickly return to pumping crude.

The fracking-induced boom in Texas has heightened the state's

role in the U.S. economy, which means that if the oil fields and

surrounding infrastructure are out of service for long, it could

have outsize economic impacts on the state and shave $20 billion or

more off U.S. gross domestic product, said Joe Brusuelas, chief

economist with RSM US LLP, an accounting and consulting firm.

More than 15% of U.S. refining capacity is closed in the wake of

the storm. That prompted crude prices to drop more than 2.5% since

Friday to $46.44 a barrel, largely because closed plants don't need

to buy any crude.

If they stay shut, or if the ports where they are located

sustained damage that takes weeks to repair, producers won't be

able to turn their spigots back on. Prolonged refinery outages

could lead to fuel shortages in different parts of the country.

Companies were trying Tuesday to assess the damage to their

facilities. But the sprawling nature of the storm -- it was

downgraded from hurricane status on Saturday -- and continued rain

in some areas hampered those efforts.

Wind and water damage and outages from the storm have doused

tens of thousands of square miles with torrential rainfall and

ravaged a wide swath of coastline, halting the flow of up to $800

million a day in energy industry revenue, analysts said.

Corpus Christi and Houston are the two major exit points for

U.S. oil, which is now shipped to the four corners of the

globe.

"The biggest contribution of shale is that it has given the U.S.

a much bigger foothold in the global picture as a supplier of oil,

gas, petrochemicals and refined products all over the world," said

Uday Turaga, chief executive of consultancy ADI Analytics.

As the hurricane's widespread devastation unfurled, some

companies confirmed their operations had come to a near

standstill.

Big producers in the area, including EOG Resources Inc. and

Chesapeake Energy Corp., stopped fracking, curbed production or

suspended operations completely, analysts said.

EOG wouldn't quantify how much of its production is shut down,

but the company said it is working to resume operations "where it

is safe to do so."

Chesapeake said that "while it is premature to speculate on the

ultimate impact to our production, we anticipate volumes will be

restrained until Gulf Coast and Houston refineries are back

online."

Shipping traffic in Houston, Corpus Christi and other ports may

not be fully restored for two weeks. That and other infrastructure

limitations will have a domino effect back to production, said Tony

Sanchez III, chief executive of Eagle Ford operator Sanchez Energy

Corp.

Restarting wells may not guarantee that they resume flowing at

the same rate, he said. On a technical level he fears that shale

wells, once shut off, could lose pressure. Most of his company's

production wasn't shut in as it lies in areas west of the storm's

path.

"It's not just a matter of flipping a switch," he said. "There

is significant risk in those wells not coming back to previous

levels."

The market may be underestimating Harvey's impact because

nothing like this flood has ever happened to the shale industry

before, said Giovanni Staunovo, a commodities analyst at UBS Wealth

Management.

"There is no historical comparison," he said.

Write to Lynn Cook at lynn.cook@wsj.com, Bradley Olson at

Bradley.Olson@wsj.com and Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

August 29, 2017 18:02 ET (22:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

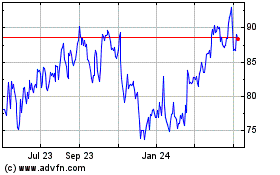

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

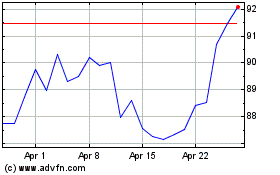

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024