The 2017 RiskTech Quadrants® measure market

potential and completeness of offering in trader surveillance,

enterprise fraud, anti-money laundering and KYC

NICE Actimize, a NICE (Nasdaq:NICE) business, and the

industry's largest and broadest provider of a single financial

crime, risk and compliance software platform for the financial

services industry, announced today that Chartis Research has

recognized NICE Actimize as a category leader across four major

RiskTech Quadrants® in its 2017 Financial Crime Risk Management

Systems report. NICE Actimize was placed as category leader, a

ranking that measures vendors’ completeness of offering and market

potential, in four core RiskTech Quadrants® including Enterprise

Fraud technology solutions, Anti-Money Laundering (AML) solutions,

Know-Your Customer (KYC) systems, and Trader Surveillance

systems.

Chartis Research provides research and analysis on the global

market for risk management technology. Its RiskTech Quadrant®

category leaders are defined as risk technology vendors with the

necessary depth and breadth of functionality, technology and

content, combined with the organizational characteristics, to

capture significant market share by volume and value. Category

leaders will typically demonstrate a clear strategy for

sustainable, profitable growth, matched with best-in-class

solutions, and will possess the range and diversity of offerings,

sector coverage and financial strength to be able to absorb demand

volatility in specific industry sectors or geographic regions.

"Financial services organizations are exposed to an

ever-increasing range of risks and operational challenges. NICE

Actimize continues to invest in our platform, including entity

resolution and other core components, while implementing artificial

intelligence, advanced analytics, machine learning and robotic

process automation across our solutions portfolio,” said Joe

Friscia, President of NICE Actimize. “Once again, Chartis

recognizes NICE Actimize's ongoing commitment to innovation and

supporting financial services organizations as they manage

financial crime risk management in their operations.”

According to the Chartis Research report, several trends are

increasingly shaping financial institutions’ (FIs’) Financial Crime

Risk Management (FCRM) requirements against a background of rising

financial crime and shifting regulatory pressures. These trends

include: greater numbers of regulatory reports, more complex

relationships involving correspondent banking, and Open Application

Programming Interface (API) banking.

“Tackling these issues effectively will take the considered use

of technology, people and process – all as budgets continue to

tighten and financial crime gets more sophisticated,” said Sid

Dash, Research Director, Chartis Research. “Several technologies

are proving useful, but three in particular – platforms/databases,

AI and entity resolution – are emerging as key elements in the

development of effective new FCRM systems. To make best use of

them, FIs must match them to appropriate use cases, and employ

suitability analysis, backtesting and explicable

methodologies.”

Chartis Research notes that its category leaders also tend to

benefit from strong brand awareness, a global reach, and strong

alliance strategies with leading consulting firms and systems

integrators. Category leaders can also typically demonstrate an

appetite for ongoing investment in innovation, often matched by

deep pockets and a strong financial performance. Ultimately,

category leaders combine deep domain knowledge in various risk

topics with deep technology assets and capabilities

For more information on NICE Actimize’s proven Financial Crime

Enterprise Solutions, please visit our web site, by clicking

here.

About Chartis ResearchChartis Research is the leading

provider of research and analysis on the global market for risk

technology. It is part of Infopro Digital, which owns

market-leading brands such as Risk and Waters Technology. Chartis'

goal is to support enterprises as they drive business performance

through better risk management, corporate governance and

compliance, and to help clients make informed technology and

business decisions by providing in-depth analysis and actionable

advice on virtually all aspects of risk technology. RiskTech

Quadrant® and RiskTech100® are registered trademarks of Chartis

Research (http://www.chartis-research.com).

About NICE ActimizeNICE Actimize is the largest and

broadest provider of financial crime, risk and compliance solutions

for regional and global financial institutions, as well as

government regulators. Consistently ranked as number one in the

space, NICE Actimize experts apply innovative technology to protect

institutions and safeguard consumers and investors assets by

identifying financial crime, preventing fraud and providing

regulatory compliance. The company provides real-time,

cross-channel fraud prevention, anti-money laundering detection,

and trading surveillance solutions that address such concerns as

payment fraud, cybercrime, sanctions monitoring, market abuse,

customer due diligence and insider trading. Find us at

www.niceactimize.com, @NICE_Actimize or Nasdaq:NICE.

About NICENICE (Nasdaq:NICE) is the worldwide leading

provider of both cloud and on-premises enterprise software

solutions that empower organizations to make smarter decisions

based on advanced analytics of structured and unstructured data.

NICE helps organizations of all sizes deliver better customer

service, ensure compliance, combat fraud and safeguard citizens.

Over 25,000 organizations in more than 150 countries, including

over 85 of the Fortune 100 companies, are using NICE solutions.

www.nice.com.

Trademark Note: NICE and the NICE logo are trademarks or

registered trademarks of NICE Ltd. All other marks are trademarks

of their respective owners. For a full list of NICE’s marks, please

see: www.nice.com/nice-trademarks.

Forward-Looking StatementsThis press release contains

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements, including the statements by Mr. Friscia and Mr. Dash,

are based on the current beliefs, expectations and assumptions of

the management of NICE Ltd. (the Company). In some cases, such

forward-looking statements can be identified by terms such as

believe, expect, may, will, intend, project, plan, estimate or

similar words. Forward-looking statements are subject to a number

of risks and uncertainties that could cause the actual results or

performance of the Company to differ materially from those

described herein, including but not limited to the impact of the

global economic environment on the Company’s customer base

(particularly financial services firms) potentially impacting our

business and financial condition; competition; changes in

technology and market requirements; decline in demand for the

Company's products; inability to timely develop and introduce new

technologies, products and applications; difficulties or delays in

absorbing and integrating acquired operations, products,

technologies and personnel; loss of market share; an inability to

maintain certain marketing and distribution arrangements; and the

effect of newly enacted or modified laws, regulation or standards

on the Company and our products. For a more detailed description of

the risk factors and uncertainties affecting the company, refer to

the Company's reports filed from time to time with the Securities

and Exchange Commission, including the Company’s Annual Report on

Form 20-F. The forward-looking statements contained in this press

release are made as of the date of this press release, and the

Company undertakes no obligation to update or revise them, except

as required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170825005010/en/

NICE ActimizeCorporate MediaCindy Morgan-Olson, +1

551-256-5202cindy.morgan-olson@niceactimize.com,

ETorInvestorsMarty Cohen, +1 551-256-5354ir@nice.com,

ETorYisca Erez +972 9 775 3798ir@nice.com, CET

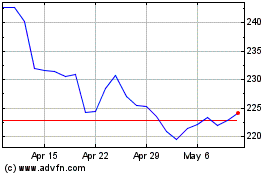

NICE (NASDAQ:NICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

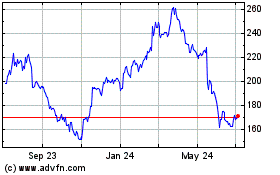

NICE (NASDAQ:NICE)

Historical Stock Chart

From Apr 2023 to Apr 2024