As filed with the Securities and Exchange Commission on August 23, 2017

Securities Act Registration No. 333-214506

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

|

|

|

☒

Registration Statement under the Securities Act of 1933

|

|

☐

Pre-Effective Amendment No.

|

|

☒

Post-Effective Amendment No. 4

|

GOLDMAN SACHS BDC, INC.

(Exact Name of Registrant as Specified in the Charter)

200 West Street

New York, New York 10282

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (212) 902-0300

Jonathan Lamm

Neena Reddy

Goldman Sachs BDC, Inc.

200 West Street

New York,

New York 10282

(Name and Address of Agent for Service)

Copies of information to:

|

|

|

|

|

|

|

Stuart Gelfond, Esq.

Joshua Wechsler, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza

New York, New

York 10004

Telephone: (212) 859-8000

Facsimile: (212) 859-4000

|

|

Geoffrey R.T. Kenyon, Esq.

Thomas J. Friedmann, Esq.

William J. Tuttle, Esq.

Dechert LLP

One International Place, 40

th

Floor

100 Oliver Street

Boston,

Massachusetts 02110

Telephone: (617) 728-7100

Facsimile: (617) 426-6567

|

|

Margery K. Neale, Esq.

James G. Silk, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New

York, New York 10019

Telephone: (212) 728-8000

Facsimile: (212) 728-9294

|

Approximate date of proposed public offering:

From time to time after the effective date of this Registration Statement

If any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933, other

than securities offered in connection with dividend or interest reinvestment plans, check the following box ☒

It is proposed that this

filing will become effective (check appropriate box):

|

☒

|

when declared effective pursuant to section 8(c)

|

CALCULATION OF REGISTRATION FEE UNDER THE

SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities Being Registered

|

|

Amount Being

Registered

|

|

Proposed

Maximum

Offering

Price per Unit

|

|

Proposed Maximum

Aggregate Offering

Price (1)

|

|

Amount of

Registration Fee (1)

|

|

Common Stock, $0.001 par value per share (2)(3)

|

|

|

|

|

|

|

|

|

|

Preferred Stock, $0.001 par value per share (2)

|

|

|

|

|

|

|

|

|

|

Warrants (4)

|

|

|

|

|

|

|

|

|

|

Debt Securities (5)

|

|

|

|

|

|

|

|

|

|

Subscription Rights (2)

|

|

|

|

|

|

|

|

|

|

Total (6)

|

|

|

|

|

|

$200,000,000(6)

|

|

$23,180(1)

|

|

|

|

|

|

(1)

|

Registration fee previously paid. The proposed maximum offering price per security will be determined, from time to time, by the Registrant in connection with the sale by the Registrant of the securities registered

under this registration statement.

|

|

(2)

|

Subject to Note 6 below, there is being registered hereunder an indeterminate number of shares of common stock or preferred stock, or subscription rights to purchase shares of common stock as may be sold, from time to

time.

|

|

(3)

|

Includes such indeterminate number of shares of common stock as may, from time to time, be issued upon conversion or exchange of other securities registered hereunder, to the extent any such securities are, by their

terms, convertible or exchangeable for common stock.

|

|

(4)

|

Subject to Note 6 below, there is being registered hereunder an indeterminate number of warrants as may be sold, from time to time, representing rights to purchase common stock, preferred stock or debt securities.

|

|

(5)

|

Subject to Note 6 below, there is being registered hereunder an indeterminate principal amount of debt securities as may be sold, from time to time. If any debt securities are issued at an original issue discount, then

the offering price shall be in such greater principal amount as shall result in an aggregate price to investors not to exceed $200,000,000.

|

|

(6)

|

In no event will the aggregate offering price of all securities issued from time to time pursuant to this registration statement exceed $200,000,000.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(c) of the Securities Act of 1933, as amended, or until the Registration Statement shall become

effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(c), may determine.

The information in this prospectus is not complete and may be changed. We may not sell

these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where

the offer and sale is not permitted.

|

|

|

|

|

PRELIMINARY PROSPECTUS

|

|

SUBJECT TO COMPLETION AUGUST 23, 2017

|

$200,000,000

GOLDMAN SACHS BDC, INC.

Common Stock

Preferred

Stock

Warrants

Debt Securities

Subscription Rights

We are an

externally managed specialty finance company that is a non-diversified, closed-end management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended (the

“Investment Company Act”). We are focused on lending to “middle-market companies,” a term we generally use to refer to companies with earnings before interest, taxes, depreciation and amortization (“EBITDA”) of

between $5 million and $75 million annually. Our investment objective is to generate current income and, to a lesser extent, capital appreciation primarily through direct originations of secured debt, including first lien, unitranche, including

last out portions of such loans, and second lien debt, and unsecured debt, including mezzanine debt, as well as through select equity investments.

We are managed by our investment adviser, Goldman Sachs Asset Management, L.P. (“GSAM” or “Investment Adviser”), a

wholly-owned subsidiary of The Goldman Sachs Group, Inc. (“Group Inc.”). Group Inc., together with Goldman Sachs & Co. LLC (including its predecessors, “GS & Co.”), GSAM and its other subsidiaries and

affiliates, is referred to herein as “Goldman Sachs.”

We may offer, from time to time, in one or more offerings, together or

separately, up to $200,000,000 of our common stock, preferred stock, warrants, debt securities or subscription rights representing rights to purchase shares of our common stock, preferred stock or debt securities, which we refer to, collectively, as

the “securities.” The securities may be offered at prices and on terms to be described in one or more supplements to this prospectus.

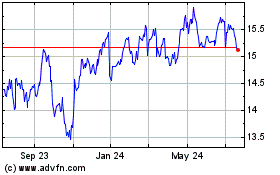

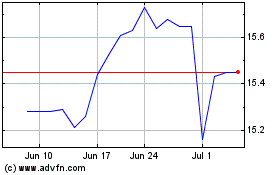

Our common stock is traded on the New York Stock Exchange under the symbol “GSBD”. On August 22, 2017, the last reported

sales price for our common stock on the New York Stock Exchange was $22.22 per share. The net asset value (“NAV”) of our common stock as of June 30, 2017 (the last date prior to the date of this prospectus as of which we determined

NAV) was $18.23.

We are an “emerging growth company” within the meaning of the Jumpstart Our Business Startups Act (the

“JOBS Act”).

This prospectus and the accompanying prospectus supplement contain important information you should know before

investing in our securities. Please read it before you invest and keep it for future reference. We file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission (the

“SEC”). You may obtain this information or make stockholder inquiries by written or oral request and free of charge by contacting us at 200 West Street, New York, NY 10282, on our website at www.goldmansachsbdc.com, or by calling us

collect at (212) 902-0300. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider that information to be a part of this prospectus. The SEC also maintains a website at

http://www.sec.gov that contains this information.

Shares of closed-end investment companies, including business development companies,

that are listed on an exchange frequently trade at a discount to their NAV per share

. If our shares trade at a discount to our NAV, it may increase the risk of loss for purchasers in any offering.

Investing in our securities

involves a high degree of risk, including credit risk and the risk of the use of leverage, and is highly speculative. Before buying any securities, you should read the discussion of the material risks of investing in our securities in “

Risk

Factors

” beginning on page 13 of this prospectus.

The securities in which we invest are generally not rated by any rating agency, and if they were

rated, they would be below investment grade (rated lower than “Baa3” by Moody’s Investors Service and lower than “BBB-” by Fitch Ratings or Standard & Poor’s Ratings Services (“S&P”)). These

securities, which may be referred to as “junk bonds,” “high yield bonds” or “leveraged loans,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay

principal.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to

consummate sales of securities unless accompanied by a prospectus supplement.

The date of this

prospectus is , 2017

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized any other person

to provide you with different information or to make any representations not contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition,

results of operations, cash flows and prospects may have changed since that date.

TRADEMARKS

This prospectus contains trademarks and service marks owned by Goldman Sachs. This prospectus may also contain trademarks and service marks

owned by third parties.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the SEC using the “shelf” registration process. Under

the shelf registration process, which constitutes a delayed offering in reliance on Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), we may offer, from time to time, up to $200,000,000 of our common stock,

preferred stock, warrants, debt securities or subscription rights representing rights to purchase shares of our common stock, preferred stock or debt securities on the terms to be determined at the time of the offering. The securities may be offered

at prices and on terms described in one or more supplements to this prospectus. We may sell our securities through underwriters or dealers, “at-the-market” to or through a market maker, into an existing trading market or otherwise directly

to one or more purchasers or through agents or through a combination of methods of sale. The identities of such underwriters, dealers, market makers or agents, as the case may be, will be described in one or more supplements to this

prospectus. This prospectus provides you with a general description of the securities that we may offer. Each time we use this prospectus to offer securities, we will provide a prospectus supplement that will contain specific information about

the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. Please carefully read this prospectus and any prospectus supplement together with any exhibits before you make an

investment decision.

ii

PROSPECTUS SUMMARY

This summary highlights some of the information contained elsewhere in this prospectus. This summary may not contain all of the information

that you should consider before investing in the securities offered by this prospectus. You should review the more detailed information contained in this prospectus, especially the information set forth under the heading “Risk Factors”.

Unless indicated otherwise in this prospectus or the context requires otherwise, the terms “Company,” “we,”

“us,” or “our” refer to Goldman Sachs BDC, Inc. and its consolidated subsidiaries, as the context may require, or for periods prior to our conversion from a limited liability company to a corporation (the “Conversion”),

Goldman Sachs Liberty Harbor Capital, LLC.

Goldman Sachs BDC, Inc.

We are a specialty finance company focused on lending to middle-market companies. We are a closed-end management investment company that has

elected to be regulated as a business development company (“BDC”) under the Investment Company Act. In addition, we have elected to be treated as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue

Code of 1986, as amended (the “Code”), commencing with our taxable year ended December 31, 2013. From our formation in 2012 through June 30, 2017 we have originated more than $2.17 billion in aggregate principal amount of debt

and equity investments prior to any subsequent exits and repayments. We seek to generate current income and, to a lesser extent, capital appreciation primarily through direct originations of secured debt, including first lien, unitranche, including

last out portions of such loans, and second lien debt, and unsecured debt, including mezzanine debt, as well as through select equity investments. Unitranche loans are first lien loans that may extend deeper in a company’s capital structure

than traditional first lien debt and may provide for a waterfall of cash flow priority between different lenders in the unitranche loan. In a number of instances, we may find another lender to provide the “first out” portion of such loan

and retain the “last out” portion of such loan, in which case, the “first out” portion of the loan would generally receive priority with respect to payment of principal, interest and any other amounts due thereunder over the

“last out” portion that we would continue to hold. In exchange for the greater risk of loss, the “last out” portion earns a higher interest rate. We use the term “mezzanine” to refer to debt that ranks senior only to a

borrower’s equity securities and ranks junior in right of payment to all of such borrower’s other indebtedness. We may make multiple investments in the same portfolio company.

We invest primarily in U.S. middle-market companies, which we believe are underserved by traditional providers of capital such as banks and

the public debt markets. In describing our business, we generally use the term “middle market companies” to refer to companies with EBITDA of between $5 million and $75 million annually. However, we may from time to time invest in larger

or smaller companies. We generate revenues primarily through receipt of interest income from the investments we hold. In addition, we generate income from various loan origination and other fees, dividends on direct equity investments and capital

gains on the sales of investments. Fees received from portfolio companies (directors’ fees, consulting fees, administrative fees, tax advisory fees and other similar compensation) are paid to us, unless, to the extent required by applicable law

or exemptive relief, if any, therefrom, we only receive our allocable portion of such fees when invested in the same portfolio company as another account managed by Goldman Sachs. The companies in which we invest use our capital for a variety

of purposes, including to support organic growth, fund acquisitions, make capital investments or refinance indebtedness.

Investment Strategy

Our origination strategy focuses on leading the negotiation and structuring of the loans or securities in which we invest and holding the

investments in our portfolio to maturity. In many cases we are the sole investor

1

in the loan or security in our portfolio. Where there are multiple investors, we generally seek to control or obtain significant influence over the rights of investors in the loan or security.

Our investments typically have maturities between three and ten years and generally range in size between $10 million and $75 million, although we may make larger or smaller investments on occasion. In addition, part of our strategy involves an

investment in a joint venture, Senior Credit Fund, LLC (the “Senior Credit Fund”), with the Regents of the University of California (“Cal Regents”). The Senior Credit Fund’s principal purpose is to make investments, either

directly or indirectly through its wholly owned subsidiary, Senior Credit Fund SPV I, LLC (“SPV I”), primarily in senior secured loans to middle-market companies.

Investment Portfolio

As of

June 30, 2017 and December 31, 2016, our portfolio (excluding our investment in a money market fund managed by an affiliate of Group Inc. of $2.12 million and $0.00 million, respectively) consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of

|

|

|

|

|

June 30, 2017

|

|

|

December 31, 2016

|

|

|

Investment Type

|

|

Amortized

Cost

|

|

|

Fair Value

|

|

|

Percentage

of

Total

Portfolio at

Fair Value

|

|

|

Amortized

Cost

|

|

|

Fair Value

|

|

|

Percentage

of Total

Portfolio at

Fair Value

|

|

|

|

|

($ in millions)

|

|

|

|

|

|

($ in millions)

|

|

|

|

|

|

First Lien/Senior Secured Debt

|

|

$

|

369.90

|

|

|

$

|

363.76

|

|

|

|

32.7

|

%

|

|

$

|

436.90

|

|

|

$

|

421.03

|

|

|

|

36.1

|

%

|

|

First Lien/Last-Out Unitranche

|

|

|

334.93

|

|

|

|

306.48

|

|

|

|

27.6

|

|

|

|

329.45

|

|

|

|

310.25

|

|

|

|

26.6

|

|

|

Second Lien/Senior Secured Debt

|

|

|

316.64

|

|

|

|

317.25

|

|

|

|

28.5

|

|

|

|

352.70

|

|

|

|

336.18

|

|

|

|

28.8

|

|

|

Unsecured Debt

|

|

|

3.30

|

|

|

|

3.30

|

|

|

|

0.3

|

|

|

|

3.12

|

|

|

|

3.12

|

|

|

|

0.3

|

|

|

Preferred Stock

|

|

|

11.15

|

|

|

|

11.24

|

|

|

|

1.0

|

|

|

|

11.12

|

|

|

|

11.83

|

|

|

|

1.0

|

|

|

Common Stock

|

|

|

21.43

|

|

|

|

15.00

|

|

|

|

1.4

|

|

|

|

11.63

|

|

|

|

6.49

|

|

|

|

0.5

|

|

|

Investment Funds & Vehicles

|

|

|

94.34

|

|

|

|

94.82

|

|

|

|

8.5

|

|

|

|

77.59

|

|

|

|

78.39

|

|

|

|

6.7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments

|

|

$

|

1,151.69

|

|

|

$

|

1,111.85

|

|

|

|

100.0

|

%

|

|

$

|

1,222.51

|

|

|

$

|

1,167.29

|

|

|

|

100.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2017, our portfolio consisted of 65 investments in 45 portfolio companies across

27 different industries. The largest industries in our portfolio, based on fair value as of June 30, 2017, were Software, Diversified Telecommunication Services, Investment Funds & Vehicles and Air Freight & Logistics,

which represented 9.9%, 8.6%, 8.5% and 6.2%, respectively, of our portfolio at fair value.

As of June 30, 2017, on a fair value

basis, approximately 4.1% of our performing debt investments bore interest at a fixed rate (including income producing preferred stock investments), and approximately 95.9% of our performing debt investments bore interest at a floating rate, which

was primarily London Interbank Offered Rate (“LIBOR”) plus a spread.

The geographic composition of our portfolio at fair value

at June 30, 2017 was United States 98.8%, Germany 1.1% and Canada 0.1%.

As of June 30, 2017, the weighted average yield of our

total portfolio (excluding our investment in a money market fund managed by an affiliate of Group Inc.) at amortized cost and fair value (both of which include interest income and amortization of fees and discounts) was 10.8% and 12.5%,

respectively. The weighted average yield of our portfolio investments does not represent the total return to the Company’s stockholders because it does not reflect our expenses and the sales load, if any, paid by investors. As of June 30,

2017, the weighted average net debt to EBITDA and the weighted average interest coverage ratio of our portfolio companies was 5.0 times and 2.6 times, respectively. The weighted average net debt to EBITDA represents the

2

weighted average ratio of our portfolio companies’ debt (net of cash), including all of our investment and the amount of debt senior to us, to our portfolio companies’ EBITDA. The

weighted average interest coverage ratio (EBITDA to total interest expense) of our portfolio companies reflects our portfolio companies’ EBITDA as a multiple of their interest expense. Portfolio company statistics have been calculated as a

percentage of debt investments and income producing preferred investments, including the underlying debt investments in the Senior Credit Fund and excluding collateral loans where net debt to EBITDA may not be the appropriate measure of credit risk.

Portfolio company statistics are derived from the most recently available financial statements of each portfolio company as of the reported year ended date.

As of June 30, 2017, we and Cal Regents had subscribed to fund and contributed the following in the Senior Credit Fund:

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2017

|

|

|

|

|

Subscribed to

fund

|

|

|

Contributed

|

|

|

|

|

($ in millions)

|

|

|

Company

|

|

$

|

100.00

|

|

|

$

|

94.34

|

|

|

Cal Regents

|

|

|

100.00

|

|

|

|

94.34

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

200.00

|

|

|

$

|

188.68

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2017, the Senior Credit Fund had total investments in senior secured debt at fair value of

$502.43 million. As of June 30, 2017, the Senior Credit Fund had no investments on non-accrual status. In addition, as of June 30, 2017, the Senior Credit Fund had an investment in a money market fund managed by an affiliate of Group Inc.

with a total fair value of $17.43 million. Additionally, as of June 30, 2017, the Senior Credit Fund had six unfunded commitments totaling $12.55 million.

Below is a summary of the Senior Credit Fund’s portfolio (excluding an investment in a money market fund managed by an affiliate of Group

Inc.) as of June 30, 2017:

|

|

|

|

|

|

|

|

|

June 30, 2017

|

|

|

Number of portfolio companies

|

|

|

35

|

|

|

Total senior secured debt

(1)

|

|

$

|

520.80 million

|

|

|

Largest loan to a single borrower

(1)

|

|

$

|

24.95 million

|

|

|

Weighted average current interest rate on senior secured debt

(2)

|

|

|

7.0

|

%

|

|

Percentage of performing debt bearing a floating rate

(3)

|

|

|

100.0

|

%

|

|

Percentage of performing debt bearing a fixed rate

(3)

|

|

|

—

|

%

|

|

Weighted average leverage (net debt/EBITDA)

(4)

|

|

|

4.1x

|

|

|

Weighted average interest coverage

(4)

|

|

|

3.1x

|

|

|

Median EBITDA

(4)

|

|

$

|

43.96 million

|

|

|

(2)

|

Computed as the (a) annual stated interest rate on accruing senior secured debt divided by (b) total senior secured debt at par amount.

|

|

(3)

|

Measured on a fair value basis.

|

|

(4)

|

For a particular portfolio company of the Senior Credit Fund, EBITDA typically represents net income before net

interest expense, income tax expense, depreciation and amortization. The net debt to EBITDA represents the ratio of a portfolio company’s total debt (net of cash) and excluding debt subordinated to the Senior Credit Fund’s investment in a

portfolio company, to a portfolio company’s EBITDA. The interest coverage ratio represents the ratio of a portfolio company’s EBITDA as a multiple of interest expense. Weighted average net debt to EBITDA is weighted based on the fair value

of the Senior Credit Fund’s debt

|

3

|

|

investments. Weighted average interest coverage is weighted based on the fair value of the Senior Credit Fund’s performing debt investments. Median EBITDA is based on the Senior Credit

Fund’s debt investments. Portfolio company statistics are derived from the most recently available financial statements of each portfolio company of the Senior Credit Fund as of the respective reported end date. Statistics of the Senior Credit

Fund’s portfolio companies have not been independently verified by us and may reflect a normalized or adjusted amount.

|

As of June 30, 2017, the Senior Credit Fund was invested across 20 different industries. The largest industries in the Senior Credit

Fund’s portfolio, based on fair value as of June 30, 2017, were IT Services, Software, Internet Software & Services and Capital Markets, which represented 10.4%, 8.4%, 7.2% and 7.0%, respectively, of the Senior Credit Fund’s

portfolio at fair value.

Corporate Structure

We were formed as a private fund in September 2012 and commenced operations in November 2012, using seed capital contributions we received

from Group Inc. In March 2013, we elected to be treated as a BDC. We have elected to be treated, and expect to qualify annually, as a RIC under Subchapter M of the Code, commencing with our taxable year ended December 31, 2013. On

March 18, 2015, our common stock began trading on the New York Stock Exchange (“NYSE”) under the symbol “GSBD”. On March 23, 2015, we closed our initial public offering (“IPO”), issuing 6,000,000 shares of

common stock at a public offering price of $20.00 per share. Net of offering and underwriting costs, we received cash proceeds of $114.57 million. On April 21, 2015, we issued an additional 900,000 shares of our common stock pursuant to the

exercise of the underwriters’ over-allotment option in connection with the IPO. Net of underwriting costs, we received additional cash proceeds of $17.27 million. On May 24, 2017, we sold 3,250,000 shares of our common stock at a public

offering price of $22.50 per share. Net of underwriting costs and offering expenses, we received cash proceeds of $70.9 million. On May 26, 2017, we issued an additional 487,500 shares of our common stock pursuant to the underwriters’

exercise of the option to purchase additional shares that we granted in connection with the May 24, 2017 sale of our common stock. Net of underwriting costs, we received additional cash proceeds of $10.6 million. As a result of the Conversion,

subsequent share repurchases, the IPO and the follow-on equity offering completed in May 2017, as of June 30, 2017, Group Inc. owned approximately 16.17% of our common stock. See “Business—Corporate Structure.”

Our Investment Adviser

GSAM serves as

our investment adviser and has been registered as an investment adviser with the SEC since 1990. Subject to the supervision of our Board of Directors (the “Board of Directors”), a majority of which is made up of independent directors

(including an independent Chairman), GSAM manages our day-to-day operations and provides us with investment advisory and management services and certain administrative services. GSAM is a subsidiary of Group Inc., a public company that is a bank

holding company, financial holding company and a world-wide, full-service financial services organization. Group Inc. is the general partner and owner of GSAM. GSAM has been providing financial solutions for investors since 1988 and had over

$1.21 trillion of assets under supervision as of June 30, 2017.

The Private Credit Group of GSAM (the “GSAM Private Credit

Group”) is responsible for identifying investment opportunities, conducting research and due diligence on prospective investments, negotiating and structuring our investments and monitoring and servicing our investments. The GSAM Private Credit

Group was comprised of 21 investment professionals, as of June 30, 2017, all of whom are dedicated to the Company’s investment strategy and other funds that share a similar investment strategy with the Company. These professionals are

supported by an additional 13 investment professionals, as of June 30, 2017, who are primarily focused on investment strategies in syndicated, liquid credit (together with the GSAM Private Credit Group,

4

“GSAM Credit Alternatives”). These individuals may have additional responsibilities other than those relating to us, but generally allocate a portion of their time in support of our

business and our investment objective as a whole. In addition, GSAM has risk management, legal, accounting, tax, information technology and compliance personnel, among others, who provide services to us. We benefit from the expertise provided by

these personnel in our operations.

The GSAM Private Credit Group is dedicated primarily to private corporate credit investment

opportunities in North America, and utilizes a bottom-up, fundamental research approach to lending. The senior members of the GSAM Private Credit Group have been working together since 2006 and have an average of over 17 years of experience in

leveraged finance and private transactions.

All investment decisions are made by the Investment Committee of GSAM’s Private Credit

Group (the “Investment Committee”), which currently consists of five voting members: Brendan McGovern, Salvatore Lentini, Jon Yoder, David Yu and Scott Turco, as well as three non-voting members with operational and/or legal expertise. For

biographical information about the voting members of the Investment Committee, see “Management—Biographical Information.” The Investment Committee is responsible for approving all of our investments. The Investment Committee also

monitors investments in our portfolio and approves all asset dispositions. We expect to benefit from the extensive and varied relevant experience of the investment professionals serving on the Investment Committee, which includes expertise in

privately originated and publicly traded leveraged credit, stressed and distressed debt, bankruptcy, mergers and acquisitions and private equity. The voting members of the Investment Committee collectively have over 50 years of experience in

middle-market investment and activities related to middle-market investing. The membership of the Investment Committee may change from time to time.

Allocation of Opportunities

Our

investment objectives and investment strategies are similar to those of other client accounts managed by our Investment Adviser (including Goldman Sachs Private Middle Market Credit LLC (“GS PMMC”), a privately offered BDC, and Goldman

Sachs Middle Market Lending Corp. (“GS MMLC”), a privately offered BDC, collectively with other such client accounts managed by our Investment Adviser, the “Accounts”), and an investment appropriate for us may also be

appropriate for those Accounts. This creates potential conflicts in allocating investment opportunities among us and such other Accounts, particularly in circumstances where the availability of such investment opportunities is limited, where the

liquidity of such investment opportunities is limited or where co-investments by us and other Accounts are not permitted under applicable law. For a further explanation of the allocation of opportunities and other conflicts and the risks related

thereto, please see “Business—Allocation of Opportunities” and “Potential Conflicts of Interest.”

Market Opportunity

According to the National Center for the Middle Market and the CIA World Fact Book, the U.S. middle market is comprised of approximately

200,000 companies that represent approximately 33% of the private sector gross domestic product, or approximately $5.9 trillion.

1

This makes the U.S. middle market equivalent to the world’s

third largest global economy on a stand-alone basis. Collectively, the U.S. middle market generates more than $6 trillion in annual revenue. The GSAM Private Credit Group believes that existing market conditions and regulatory changes have combined

to create an attractive investment environment for non-bank lenders such as us to provide loans to U.S. middle market companies. For a further discussion of the market opportunities associated with the Company’s focus on middle market

companies, see “Business—Market Opportunities.”

|

1

|

Estimate by the National Center for the Middle Market, which defined middle market as companies with annual

revenue of $10 million - $1 billion. See http://www.middlemarketcenter.org (relying on data from the 2015 CIA World Factbook, available at https://www.cia.gov/library/publications/the-world-factbook/).

|

5

Competitive Advantages

The Goldman Sachs Platform

: Goldman Sachs is a leading global financial institution that provides a wide range of financial services to

a substantial and diversified client base, including companies and high net worth individuals, among others. The firm is headquartered in New York and maintains offices across the United States and in all major financial centers around the world.

Group Inc.’s asset management subsidiary, GSAM, is one of the world’s leading investment managers with over 650 investment professionals and over $1.21 trillion of assets under supervision, in each case as of June 30, 2017.

GSAM’s investment teams, including the GSAM Private Credit Group, capitalize on the relationships, market insights, risk management expertise, technology and infrastructure of Goldman Sachs. We believe the Goldman Sachs platform delivers a

meaningful competitive advantage to us. For a detailed discussion of the Company’s competitive advantages, see “Business—Competitive Advantages.”

Operating and Regulatory Structure

We

have elected to be treated as a BDC under the Investment Company Act. As a BDC, we are generally prohibited from acquiring assets other than qualifying assets unless, after giving effect to any acquisition, at least 70% of our total assets are

qualifying assets. Qualifying assets generally include securities of eligible portfolio companies, cash, cash equivalents, U.S. government securities and high-quality debt instruments maturing in one year or less from the time of investment. Under

the rules of the Investment Company Act, “eligible portfolio companies” include (i) private U.S. operating companies, (ii) public U.S. operating companies whose securities are not listed on a national securities exchange (e.g.,

the NYSE) or registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and (iii) public U.S. operating companies having a market capitalization of less than $250 million. Public U.S. operating companies

whose securities are quoted on the over-the-counter bulletin board and through OTC Markets Group Inc. are not listed on a national securities exchange and therefore are eligible portfolio companies. In addition, we currently are an “emerging

growth company,” as defined in the JOBS Act. See “Regulation.”

We have elected to be treated, and expect to qualify

annually, as a RIC under Subchapter M of the Code, commencing with our taxable year ended December 31, 2013. As a RIC, we generally will not be required to pay corporate-level U.S. federal income taxes on any net ordinary income or capital

gains that we timely distribute to our stockholders as dividends if we meet certain source of income, distribution and asset diversification requirements. We intend to timely distribute to our stockholders substantially all of our annual taxable

income for each year, except that we may retain certain net capital gains for reinvestment and, depending upon the level of taxable income earned in a year, we may choose to carry forward taxable income for distribution in the following year and pay

any applicable U.S. federal excise tax. In addition, the distributions we pay to our stockholders in a year may exceed our net ordinary income and capital gains for that year and, accordingly, a portion of such distributions may constitute a return

of capital for U.S. federal income tax purposes. See “Price Range of Common Stock and Distributions.”

Use of Leverage

Our senior secured revolving credit agreement (as amended, the “Revolving Credit Facility”) with SunTrust Bank, as administrative

agent, and Bank of America, N.A., as syndication agent, allows us to borrow money and lever our investment portfolio, subject to the limitations of the Investment Company Act, with the objective of increasing our yield. This is known as

“leverage” and could increase or decrease returns to our stockholders. The use of leverage involves significant risks. As a BDC, with certain limited exceptions, we are only permitted to borrow amounts such that our asset coverage ratio,

as defined in the Investment Company Act, equals at least 2 to 1 after such borrowing. Certain trading practices and investments, such as reverse repurchase agreements, may be considered borrowings or involve leverage and thus may be subject to

Investment Company

6

Act restrictions. In accordance with applicable SEC staff guidance and interpretations, when we engage in such transactions, instead of maintaining an asset coverage ratio of at least 2 to 1, we

will segregate or earmark liquid assets, or enter into an offsetting position, in an amount at least equal to our exposure, on a mark-to-market basis, to such transactions (as calculated pursuant to requirements of the SEC). Short-term credits

necessary for the settlement of securities transactions and arrangements with respect to securities lending will not be considered borrowings for these purposes. Practices and investments that may involve leverage but are not considered borrowings

are not subject to the Investment Company Act’s asset coverage requirement and we will not otherwise segregate or earmark liquid assets or enter into offsetting positions for such transactions. The amount of leverage that we employ will depend

on our Investment Adviser’s and our Board of Directors’ assessment of market conditions and other factors at the time of any proposed borrowing.

Recent Developments

As of June 30,

2017, we held two tranches of loans to Kawa Solar Holdings Limited (“Kawa”) comprised of $6.84 million par value of revolving first lien debt and $10.54 million of a first lien guarantee facility that was collateralized by cash. In July

2017, Kawa completed a capital restructuring whereby $4.70 million of the first lien revolver debt was exchanged into common equity of Conergy Asia Holdings Limited, a UK limited company that was formed to purchase and own the shares of Conergy

Asia & ME Pte. Ltd., a subsidiary of Kawa. The remaining revolver was exchanged into a non-interest bearing first lien loan and we funded our pro rata share of $0.40 million of new first lien revolver. As a result of the exchange of the

first lien revolver into non-interest bearing debt and non-income producing equity in connection with this restructuring, the investment was taken off of non-accrual status. The $10.54 million of first lien guarantee facility debt in Kawa was

amended to convert the coupon to PIK.

On July 31, 2017, we and Cal Regents, as members of the Senior Credit Fund, entered into an

amendment to the amended and restated limited liability company agreement of the Senior Credit Fund to extend the investment period for the Senior Credit Fund from August 1, 2017 to November 1, 2017.

On August 1, 2017, our Board of Directors declared a quarterly distribution of $0.45 per share payable on October 16, 2017 to

holders of record as of September 29, 2017.

Summary Risk Factors

Investing in us involves a high degree of risk and you could lose all or part of your investment. We refer to certain of these risks below:

|

|

•

|

|

The capital markets may experience periods of disruption and instability. Such market conditions may materially and adversely affect debt and equity capital markets in the United States, which may have a negative impact

on our business and operations.

|

|

|

•

|

|

Our operation as a BDC imposes numerous constraints on us and significantly reduces our operating flexibility. In addition, if we fail to maintain our status as a BDC, we might be regulated as a closed-end investment

company, which would subject us to additional regulatory restrictions.

|

|

|

•

|

|

We will be subject to corporate-level U.S. federal income tax on all of our income if we are unable to maintain our status as a RIC under Subchapter M of the Code, which would have a material adverse effect on our

financial performance.

|

7

|

|

•

|

|

We are dependent upon management personnel of our Investment Adviser for our future success.

|

|

|

•

|

|

Our ability to grow depends on our ability to raise additional capital.

|

|

|

•

|

|

We borrow money, which may magnify the potential for gain or loss and may increase the risk of investing in us.

|

|

|

•

|

|

We operate in a highly competitive market for investment opportunities.

|

|

|

•

|

|

Potential conflicts of interest with other businesses of Goldman Sachs could impact our investment returns.

|

|

|

•

|

|

Goldman Sachs has influence, and may continue to exert influence, over our management and affairs and over most votes requiring stockholder approval.

|

|

|

•

|

|

Our Board of Directors may change our investment objective, operating policies and strategies without prior notice or stockholder approval.

|

|

|

•

|

|

Our Investment Adviser can resign on 60 days’ notice. We may not be able to find a suitable replacement within that time, resulting in a disruption in our operations that could adversely affect our financial

condition, business and results of operations.

|

|

|

•

|

|

Our ability to enter into transactions with our affiliates is restricted.

|

|

|

•

|

|

We are exposed to risks associated with changes in interest rates.

|

|

|

•

|

|

Our activities may be limited as a result of potentially being deemed to be controlled by a bank holding company.

|

|

|

•

|

|

Our investments are very risky and highly speculative.

|

|

|

•

|

|

The lack of liquidity in our investments may adversely affect our business.

|

|

|

•

|

|

Declines in market prices and liquidity in the corporate debt markets can result in significant net unrealized depreciation of our portfolio, which in turn would reduce our NAV.

|

|

|

•

|

|

Investing in our common stock involves an above average degree of risk.

|

Corporate Information

Our principal executive offices are located at 200 West Street, New York, New York 10282 and our telephone number is (212) 902-0300. We

maintain a website located at www.goldmansachsbdc.com. Information on our website is not incorporated into or a part of this prospectus.

8

FEES AND EXPENSES

The following table is intended to assist you in understanding the fees and expenses that an investor in our common stock will bear, directly

or indirectly, based on the assumptions set forth below. We caution you that some of the percentages indicated in the table below are estimates and may vary. The expenses shown in the table under “annual expenses” are based on estimated

amounts for our current fiscal year. The following table should not be considered a representation of our future expenses. Actual expenses may be greater or less than shown. Except where the context suggests otherwise, whenever this prospectus

contains a reference to fees or expenses paid by “us” or that “we” will pay fees or expenses, the holders of our common stock will indirectly bear such fees or expenses.

|

|

|

|

|

|

|

Stockholder transaction expenses (as a percentage of offering price):

|

|

|

|

|

|

Sales load

|

|

|

—

|

(1)

|

|

Offering expenses

|

|

|

—

|

(2)

|

|

Dividend reinvestment plan expenses

|

|

|

None

|

(3)

|

|

|

|

|

|

|

|

Total stockholder transaction expenses

|

|

|

—

|

|

|

|

|

|

|

|

|

Annual expenses (as a percentage of net assets attributable to common stock):

|

|

|

|

|

|

Base management fee

|

|

|

2.62

|

%

(4)

|

|

Incentive fees payable under the Investment Management Agreement (20% of investment income and

capital gains)

|

|

|

1.48

|

%

(5)

|

|

Interest payments on borrowed funds

|

|

|

2.33

|

%

(6)

|

|

Other expenses

|

|

|

1.31

|

%

(7)

|

|

Acquired fund fees and expenses

|

|

|

1.33

|

%

(8)

|

|

|

|

|

|

|

|

Total annual expenses

|

|

|

9.07

|

%

|

|

|

|

|

|

|

|

(1)

|

In the event that the securities to which this prospectus relates are sold to or through underwriters or agents, a corresponding prospectus supplement will disclose the applicable sales load (underwriting discount or

commission).

|

|

(2)

|

The related prospectus supplement will disclose the estimated amount of offering expenses, the offering price and the offering expenses borne by us as a percentage of the offering price.

|

|

(3)

|

The expenses associated with the dividend reinvestment plan are included in “Other expenses” in the table above. For additional information, see “Dividend Reinvestment Plan.”

|

|

(4)

|

Our management fee (the “Management Fee”) is calculated at an annual rate of 1.50% (0.375% per quarter) of the average value of our gross assets (excluding cash or cash equivalents (such as investments in

money market funds), but including assets purchased with borrowed amounts) at the end of each of the two most recently completed calendar quarters). See “Management—Investment Management Agreement.” The Management Fee

referenced in the table above is based on actual amounts incurred during the six months ended June 30, 2017, annualized for a full year.

|

|

(5)

|

The incentive fee (the “Incentive Fee”) payable to our Investment Adviser is based on our performance and is not paid unless we achieve certain goals. It consists of two components, one based on income and the

other based on capital gains, that are determined independent of each other, with the result that one component may be payable even if the other is not. The Incentive Fee referenced in the table above is based on actual amounts incurred during the

six months ended June 30, 2017, annualized for a full year.

|

The Incentive Fee based on income is determined and paid

quarterly in arrears at the end of each calendar quarter by reference to our aggregate net investment income, as adjusted as described below, from the calendar quarter then ending and the eleven preceding calendar quarters (or if shorter, the number

of quarters that have occurred since January 1, 2015) (in either case, the “Trailing Twelve Quarters”). The hurdle amount for the Incentive Fee based on income is determined on a quarterly basis, and is equal to 1.75% multiplied by

our NAV at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters. The hurdle amount is calculated after making appropriate adjustments for

9

subscriptions (which includes all issuances by us of shares of our common stock, including issuances pursuant to our dividend reinvestment plan) and distributions that occurred during the

relevant Trailing Twelve Quarters.

For the portion of the Incentive Fee based on income, we pay our Investment Adviser a quarterly

Incentive Fee based on the amount by which (A) aggregate net investment income (“Ordinary Income”) in respect of the relevant Trailing Twelve Quarters exceeds (B) the hurdle amount for such Trailing Twelve Quarters. The amount of

the excess of (A) over (B) described in this paragraph for such Trailing Twelve Quarters is referred to as the “Excess Income Amount.” For the avoidance of doubt, Ordinary Income is net of all fees and expenses, including the

Management Fee but excluding any Incentive Fee.

The Incentive Fee based on income for each quarter is determined as follows:

|

|

•

|

|

No Incentive Fee based on income is payable to our Investment Adviser for any calendar quarter for which there is no Excess Income Amount.

|

|

|

•

|

|

100% of the Ordinary Income, if any, that exceeds the hurdle amount, but is less than or equal to an amount, which we refer to as the “Catch-up Amount,” determined as the sum of 2.1875% multiplied by our NAV

at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters is included in the calculation of the Incentive Fee based on income; and

|

|

|

•

|

|

20% of the Ordinary Income that exceeds the Catch-up Amount is included in the calculation of the Incentive Fee based on income.

|

The amount of the Incentive Fee based on income that will be paid to our Investment Adviser for a particular quarter will equal the excess of

the Incentive Fee so calculated minus the aggregate Incentive Fees based on income that were paid in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters but not in excess of the

Incentive Fee Cap (as described below).

The Incentive Fee based on income that is paid to our Investment Adviser for a particular quarter

is subject to a cap (the “Incentive Fee Cap”). The Incentive Fee Cap for any quarter is an amount equal to (a) 20% of the Cumulative Net Return (as defined below) during the relevant Trailing Twelve Quarters minus (b) the

aggregate Incentive Fees based on income that were paid in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters.

“Cumulative Net Return” means (x) the Ordinary Income in respect of the relevant Trailing Twelve Quarters minus (y) any

Net Capital Loss, as defined below, if any, in respect of the relevant Trailing Twelve Quarters. If, in any quarter, the Incentive Fee Cap is zero or a negative value, we will pay no Incentive Fee based on income to our Investment Adviser for such

quarter. If, in any quarter, the Incentive Fee Cap for such quarter is a positive value but is less than the Incentive Fee based on income that is payable to our Investment Adviser for such quarter (before giving effect to the Incentive Fee Cap)

calculated as described above, we will pay an Incentive Fee based on income to our Investment Adviser equal to the Incentive Fee Cap for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is equal to or greater than the

Incentive Fee based on income that is payable to our Investment Adviser for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, we will pay an Incentive Fee based on income to our Investment Adviser equal to

the Incentive Fee calculated as described above for such quarter without regard to the Incentive Fee Cap.

“Net Capital Loss” in

respect of a particular period means the difference, if positive, between (i) aggregate capital losses, whether realized or unrealized, in such period and (ii) aggregate capital gains, whether realized or unrealized, in such period.

10

The portion of the Incentive Fee based on capital gains is calculated on an annual basis. For

each period beginning on January 1 of each calendar year and ending on December 31 of the calendar year or, in the case of our first and last year, the appropriate portion thereof (each, an “Annual Period”), we pay our Investment

Adviser an Incentive Fee equal to (A) 20% of the difference, if positive, of the sum of our aggregate realized capital gains, if any, computed net of our aggregate realized capital losses, if any, and our aggregate unrealized capital

depreciation, if any, in each case from April 1, 2013 until the end of such Annual Period minus (B) the cumulative amount of Incentive Fees based on capital gains previously paid to our Investment Adviser from April 1, 2013. For the

avoidance of doubt, unrealized capital gains are excluded from the calculation in clause (A), above.

We accrue, but not pay, a portion of

the Incentive Fee based on capital gains with respect to net unrealized appreciation. For more detailed information about the Incentive Fee, see “Management—Investment Management Agreement.”

|

(6)

|

Interest payments on borrowed funds represents an estimate of our annualized interest expense based on borrowings under the Revolving Credit Facility as of June 30, 2017 and the $115 million of Convertible Notes

issued in October 2016. As of June 30, 2017, the weighted average interest rate on our total debt outstanding was 3.33%. For the six months ended June 30, 2017, the Revolving Credit Facility bore a weighted average interest rate of 2.95%,

and the $115 million of Convertible Notes bore interest at an annual rate of 4.50%. We may borrow additional funds from time to time to make investments to the extent we determine that the economic situation is conducive to doing so. We may also

issue additional debt securities or preferred stock, subject to our compliance with applicable requirements under the Investment Company Act. We do not currently anticipate issuing additional debt securities or preferred stock in the next 12 months.

|

|

(7)

|

“Other Expenses” includes overhead expenses, including payments under the administration agreement with our administrator (the “Administration Agreement”), and is estimated for the current fiscal

year. See “Management—Administration Agreement.”

|

|

(8)

|

Our stockholders indirectly bear the expenses of underlying funds or other investment vehicles in which we invest that (1) are investment companies or (2) would be investment companies under section 3(a) of

the Investment Company Act but for the exceptions to that definition provided for in sections 3(c)(1) and 3(c)(7) of the Investment Company Act (“Acquired Funds”). This amount includes the estimated annual fees and expenses of the Senior

Credit Fund and a money market fund managed by an affiliate of Group Inc., which are our only Acquired Funds as of June 30, 2017.

|

Although not reflected above, the Investment Adviser expects to continue to waive a portion of its management fee payable by the Company in an

amount equal to any management fees it earns as an investment adviser for any affiliated money market funds in which the Company invests.

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various

periods with respect to a hypothetical investment in our common stock. In calculating the following expense amounts, we have assumed that our annual operating expenses remain at the

11

levels set forth in the table above, except for the Incentive Fee based on income. Transaction expenses are not included in the following example.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 year

|

|

|

3 years

|

|

|

5 years

|

|

|

10 years

|

|

|

You would pay the following expenses on a $1,000 common stock investment, assuming a 5% annual

return (none of which is subject to the Incentive Fee based on capital gains)

(1)

|

|

$

|

75

|

|

|

$

|

219

|

|

|

$

|

356

|

|

|

$

|

668

|

|

|

You would pay the following expenses on a $1,000 common stock investment, assuming a 5% annual

return resulting entirely from net realized capital gains (all of which is subject to the Incentive Fee based on capital gains)

(2)

|

|

$

|

85

|

|

|

$

|

248

|

|

|

$

|

402

|

|

|

$

|

753

|

|

|

(1)

|

Assumes that we will not realize any capital gains computed net of all realized capital losses and unrealized capital depreciation.

|

|

(2)

|

Assumes no unrealized capital depreciation and a 5% annual return resulting entirely from net realized capital gains and not otherwise deferrable under the terms of the Investment Management Agreement and therefore

subject to the Incentive Fee based on capital gains. Because our investment strategy involves investments that generate primarily current income, we believe that a 5% annual return resulting entirely from net realized capital gains is unlikely.

|

The foregoing table is to assist you in understanding the various costs and expenses that an investor in our common stock

will bear directly or indirectly. While the example assumes, as required by the SEC, a 5% annual return, our performance will vary and may result in a return greater or less than 5%. The Incentive Fee under our Investment Management Agreement,

which, assuming a 5% annual return, would either not be payable or would have an insignificant impact on the expense amounts shown above, is not included in the example. The example assumes reinvestment of all distributions at NAV. In addition,

while the example assumes reinvestment of all dividends and distributions at NAV, under certain circumstances, reinvestment of dividends and other distributions under our dividend reinvestment plan may occur at a price per share that differs from

NAV. See “Dividend Reinvestment Plan” for additional information regarding our dividend reinvestment plan.

This example and

the expenses in the table above should not be considered a representation of our future expenses, and actual expenses (including the cost of debt, if any, and other expenses) may be greater or less than those shown.

12

RISK FACTORS

Investing in our securities involves certain risks relating to our structure and investment objective. You should carefully consider these

risk factors, together with all of the other information included in this prospectus, before you decide whether to make an investment in our securities. The risks set forth below are not the only risks we face, and we may face other risks that we

have not yet identified, which we do not currently deem material or which are not yet predictable. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case,

our NAV and the trading price of our securities could decline, and you may lose all or part of your investment.

Risks Relating to Our Business and

Structure

The capital markets may experience periods of disruption and instability. Such market conditions may materially and adversely affect

debt and equity capital markets in the United States, which may have a negative impact on our business and operations.

From time

to time, capital markets may experience periods of disruption and instability. For example, from 2008 to 2009, the global capital markets were unstable as evidenced by the lack of liquidity in the debt capital markets, significant write-offs in the

financial services sector, the re-pricing of credit risk in the broadly syndicated credit market and the failure of major financial institutions. Despite actions of the U.S. federal government and various foreign governments, these events

contributed to worsening general economic conditions that materially and adversely impacted the broader financial and credit markets and reduced the availability of debt and equity capital for the market as a whole and financial services firms in

particular. While market conditions have improved from the beginning of the disruption, there have been recent periods of volatility and there can be no assurance that adverse market conditions will not repeat themselves in the future. If similar

adverse and volatile market conditions repeat in the future, we and other companies in the financial services sector may have to access, if available, alternative markets for debt and equity capital in order to grow. Equity capital may be

particularly difficult to raise during periods of adverse or volatile market conditions because, subject to some limited exceptions, as a BDC, we are generally not able to issue additional shares of our common stock at a price less than NAV per

share without first obtaining approval for such issuance from our stockholders and our Independent Directors. Volatile economic conditions may lead to strategic initiatives such as the recent increase in merger activity in the BDC space.

Moreover, the re-appearance of market conditions similar to those experienced from 2008 through 2009 for any substantial length of time could

make it difficult for us to borrow money or to extend the maturity of or refinance any indebtedness we may have under similar terms and any failure to do so could have a material adverse effect on our business. The debt capital that will be

available to us in the future, if any, may be at a higher cost and on less favorable terms and conditions than what we currently experience. If we are unable to raise or refinance debt, then investors in our common stock may not benefit from the

potential for increased returns on equity resulting from leverage and we may be limited in our ability to make new commitments or to fund existing commitments to our portfolio companies.

Given the periods of extreme volatility and dislocation in the capital markets from time to time, many BDCs have faced, and may in the future

face, a challenging environment in which to raise or access capital. In addition, significant changes in the capital markets, including the extreme volatility and disruption over the past several years, has had, and may in the future have, a

negative effect on the valuations of our investments and on the potential for liquidity events involving these investments. While most of our investments are not publicly traded, applicable accounting standards require us to assume as part of our

valuation process that our investments are sold in a principal market to market participants (even if we plan on holding an investment through its maturity). As a result, volatility in the capital markets can adversely affect our investment

valuations. Further, the illiquidity of our investments may make it difficult for us to sell such investments to access capital if required. As a result, we could realize significantly less than the value at which we have recorded our investments if

we were

13

required to sell them for liquidity purposes. In addition, a prolonged period of market illiquidity may cause us to reduce the volume of loans and debt securities we originate and/or fund and

adversely affect the value of our portfolio investments, which could have a material and adverse effect on our business, financial condition, results of operations and cash flows. An inability to raise or access capital could have a material adverse

impact on our business, financial condition or results of operations.

Our operation as a BDC imposes numerous constraints on us and significantly

reduces our operating flexibility. In addition, if we fail to maintain our status as a BDC, we might be regulated as a closed-end investment company, which would subject us to additional regulatory restrictions.

The Investment Company Act imposes numerous constraints on the operations of BDCs. For example, BDCs generally are required to invest at least

70% of their total assets primarily in securities of qualifying U.S. private companies or thinly traded public companies, cash, cash equivalents, U.S. government securities and other high-quality debt investments that mature in one year or less from

the time of investment. These constraints may hinder our Investment Adviser’s ability to take advantage of attractive investment opportunities and to achieve our investment objective. Furthermore, any failure to comply with the requirements

imposed on BDCs by the Investment Company Act could cause the SEC to bring an enforcement action against us and/or expose us to claims of private litigants.

We may be precluded from investing in what GSAM believes are attractive investments if such investments are not qualifying assets for purposes

of the Investment Company Act. If we do not invest a sufficient portion of our assets in qualifying assets, we will be prohibited from making any additional investment that is not a qualifying asset and could be forced to forgo attractive investment

opportunities. Similarly, these rules could prevent us from making follow-on investments in existing portfolio companies (which could result in the dilution of our position).

If we fail to maintain our status as a BDC, we might be regulated as a closed-end investment company that is required to register under the

Investment Company Act, which would subject us to additional regulatory restrictions and significantly decrease our operating flexibility. In addition, any such failure could cause an event of default under any outstanding indebtedness we might

have, which could have a material adverse effect on our business, financial condition or results of operations.

We will be subject to

corporate-level U.S. federal income tax on all of our income if we are unable to maintain our status as a RIC under Subchapter M of the Code, which would have a material adverse effect on our financial performance.

Although we have elected to be treated, and expect to qualify annually, as a RIC under Subchapter M of the Code, we cannot assure you that we

will be able to maintain RIC status. To maintain RIC status and be relieved of U.S. federal income taxes on income and gains distributed to our stockholders, we must meet the annual distribution, source-of-income and asset diversification

requirements described below.

|

|

•

|

|

The annual distribution requirement for a RIC will be satisfied if we distribute to our stockholders on an annual basis at least 90% of our investment company taxable income (generally, our net ordinary income plus the

excess of our realized net short-term capital gains over realized net long-term capital losses, determined without regard to the dividends paid deduction) for each taxable year. Because we expect to use debt financing, we expect to be subject to an

asset coverage ratio requirement under the Investment Company Act, and we expect to be subject to certain covenants contained in our credit agreements and other debt financing agreements. This asset coverage ratio requirement and these covenants

could, under certain circumstances, restrict us from making distributions to our stockholders that are necessary for us to satisfy the distribution requirement. If we are unable to obtain cash from other sources, and thus are unable to make

sufficient distributions to our stockholders, we could fail to maintain our RIC status and thus become subject to corporate-level U.S. federal income tax (and any applicable U.S. state and local taxes).

|

14

|

|

•

|

|

The source-of-income requirement will be satisfied if at least 90% of our gross income for each year is derived from dividends, interest, gains from the sale of stock or securities or similar sources, or net income

derived from an interest in a “qualified publicly traded partnership.”

|

|

|

•

|

|

The asset diversification requirement will be satisfied if, at the end of each quarter of our taxable year, at least 50% of the value of our assets consists of cash, cash equivalents, U.S. government securities,

securities of other RICs and other acceptable securities, and no more than 25% of the value of our assets is invested in the securities (other than U.S. government securities or securities of other RICs) of one issuer, of two or more issuers that

are controlled, as determined under applicable Code rules, by us and that are engaged in the same or similar or related trades or businesses or of certain “qualified publicly traded partnerships.” Failure to meet these requirements may

result in our having to dispose of certain investments quickly in order to prevent the loss of our RIC status. Because most of our investments will be in private companies, and therefore will be relatively illiquid, any such dispositions could be

made at disadvantageous prices and could result in substantial losses.

|

If we fail to maintain our RIC status for any

reason, and we do not qualify for certain relief provisions under the Code, we would be subject to corporate-level U.S. federal income tax (and any applicable U.S. state and local taxes). In this event, the resulting taxes and any resulting

penalties could substantially reduce our net assets, the amount of our income available for distribution and the amount of our distributions to our stockholders, which would have a material adverse effect on our financial performance. For additional

discussion regarding the tax implications of a RIC, see “Certain U.S. Federal Income Tax Considerations.”

We are dependent upon

management personnel of our Investment Adviser for our future success.

We do not have any employees. We depend on the experience,

diligence, skill and network of business contacts of the GSAM Credit Alternatives investment team. The GSAM Credit Alternatives investment team, together with other investment professionals that our Investment Adviser currently retains or may

subsequently retain, identifies, evaluates, negotiates, structures, closes, monitors and manages our investments. Our future success will depend to a significant extent on the continued service and coordination of our Investment Adviser’s

senior investment professionals. The departure of any of our Investment Adviser’s key personnel, including members of the GSAM Private Credit Group Investment Committee, or of a significant number of the investment professionals of our

Investment Adviser, could have a material adverse effect on our business, financial condition or results of operations. In addition, we cannot assure you that our Investment Adviser will remain our investment adviser or that we will continue to have

access to our Investment Adviser or its investment professionals. See “—Our Investment Adviser can resign on 60 days’ notice. We may not be able to find a suitable replacement within that time, resulting in a disruption in our

operations that could adversely affect our financial condition, business and results of operations.”

Our Investment Adviser, its principals,