3rd Quarter Net Income and Operating Income

up 9% on Net Sales Increase of 10%

HEICO CORPORATION (NYSE: HEI.A) (NYSE: HEI) today reported that

net income increased 9% to a record $45.7 million, or 53 cents

per diluted share, in the third quarter of fiscal 2017, up from

$42.0 million, or 49 cents per diluted share, in the third

quarter of fiscal 2016. In the first nine months of fiscal 2017,

net income increased 18% to a record $132.3 million, or $1.53 per

diluted share, up from $111.9 million, or $1.32 per diluted share,

in the first nine months of fiscal 2016.

All share and per share information has been adjusted

retrospectively to reflect a 5-for-4 stock split distributed by the

Company in April 2017.

Operating income increased 9% to $76.1 million in the third

quarter of fiscal 2017, up from $69.9 million in the third quarter

of fiscal 2016. In the first nine months of fiscal 2017, operating

income increased 15% to a record $217.2 million, up from $189.3

million in the first nine months of fiscal 2016.

The Company's consolidated operating margin was 19.4% and 19.6%

in the third quarter of fiscal 2017 and 2016, respectively. The

Company's consolidated operating margin improved to 19.7% in the

first nine months of fiscal 2017, up from 18.7% in the first nine

months of fiscal 2016.

Net sales increased 10% to a record $391.5 million in the third

quarter of fiscal 2017, up from $356.1 million in the third quarter

of fiscal 2016. Net sales increased 9% to a record $1,103.6 million

in the first nine months of fiscal 2017, up from $1,013.0 million

in the first nine months of fiscal 2016.

Consolidated Results

Laurans A. Mendelson, HEICO’s Chairman and CEO, commented on the

Company's third quarter and year-to-date results stating, "HEICO's

operating segments have continued to execute at a high level of

profitable performance and I am very pleased with the record

financial results. These outstanding results reflect record net

sales and operating income for the first nine months of fiscal 2017

within both the Flight Support Group and Electronic Technologies

Group, achieved through increased demand for the majority of our

products. Additionally, our subsidiaries continue to deliver strong

cash flows in support of our overall corporate strategy of high

cash flow generation.

We recently announced our largest acquisition in history when we

entered into an agreement to acquire AeroAntenna Technology, Inc.,

(“AAT”). Closing, which is subject to governmental approval and

standard closing conditions, is expected to occur during the fourth

quarter of fiscal 2017 and we expect the acquisition to be

accretive to our earnings per share within the first twelve months

following closing. We plan to fund our acquisition of AAT through

our existing credit facility and available cash.

Cash flow provided by operating activities remained robust,

totaling $179.3 million, or 136% of net income, in the first nine

months of fiscal 2017, up from $172.4 million in the first nine

months of fiscal 2016. Cash flow provided by operating activities

increased 17% to $81.6 million in the third quarter of fiscal 2017,

up from $69.7 million in the third quarter of fiscal 2016. For the

full fiscal year 2017, we continue to anticipate cash flow provided

by operating activities to approximate 150% of consolidated net

income.

Our total debt to shareholders' equity ratio was 36.3% as of

July 31, 2017. Our net debt to shareholders’ equity ratio was 32.2%

as of July 31, 2017, with net debt (total debt less cash and cash

equivalents) of $385.3 million principally incurred to fund

acquisitions in fiscal 2017 and 2016. We have no significant debt

maturities until fiscal 2019 and plan to utilize our financial

flexibility to continue to aggressively pursue high quality

acquisition opportunities to accelerate growth and maximize

shareholder returns.

As we look ahead to the remainder of fiscal 2017, we anticipate

net sales growth within the Flight Support Group and Electronic

Technologies Group resulting from increased demand across the

majority of our product lines moderated by short-term lower

defense-related net sales principally due to customer delays in

getting some anticipated new orders under contract. Also, we will

continue our commitments to developing new products and services,

further market penetration, and an aggressive acquisition strategy

while maintaining our financial strength and flexibility.

Based on our current economic visibility, we are increasing our

estimated consolidated fiscal 2017 year-over-year growth in net

sales to 9% - 11% and in net income to 14% - 16%, up from prior

growth estimates in net sales of 8% - 10% and in net income of 12%

- 14%. Additionally, we continue to anticipate our consolidated

operating margin to approximate 20%, depreciation and amortization

expense to approximate $65 million and cash flow from operations to

approximate $270 million. Further, we now anticipate capital

expenditures to approximate $31 million. These estimates include

our pending acquisition of AAT (from estimated closing through

10/31/17), but exclude any other additional acquired businesses, if

any."

Flight Support Group

Eric A. Mendelson, HEICO's Co-President and President of HEICO's

Flight Support Group, commented on the Flight Support Group's third

quarter results stating, "The Flight Support Group's record net

sales and operating income in the third quarter of fiscal 2017 were

principally attributed to our recent acquisitions and continued

strong organic growth within our aftermarket replacement parts and

repair and overhaul parts and services product lines.

The Flight Support Group's net sales increased 16% to a record

$258.0 million in the third quarter of fiscal 2017, up from $222.6

million in the third quarter of fiscal 2016. The Flight Support

Group's net sales increased 10% to a record $710.7 million in the

first nine months of fiscal 2017, up from $647.4 million in the

first nine months of fiscal 2016. The increase in the third quarter

and first nine months of fiscal 2017 reflects organic growth of 6%

in both periods and the impact of our recent profitable

acquisitions. The organic growth in the third quarter and first

nine months of fiscal 2017 is principally attributed to increased

demand and new product offerings within our aftermarket replacement

parts and repair and overhaul parts and services product lines and

were partially offset by lower demand within our specialty products

product line for certain commercial aerospace and defense products

in the third quarter of fiscal 2017 and for certain industrial and

defense products in the first nine months of fiscal 2017.

The Flight Support Group's operating income increased 11% to a

record $46.7 million in the third quarter of fiscal 2017, up from

$42.0 million in the third quarter of fiscal 2016. The Flight

Support Group's operating income increased 12% to $132.8 million in

the first nine months of fiscal 2017, up from $118.8 million in the

first nine months of fiscal 2016. The increase in the third quarter

and first nine months of fiscal 2017 principally reflects the

previously mentioned net sales growth. Additionally, the first nine

months of fiscal 2017 reflects efficiencies realized from the

benefit of our net sales growth on relatively consistent

period-over-period SG&A expenses.

The Flight Support Group's operating margin was 18.1% and 18.9%

in the third quarter of fiscal 2017 and 2016, respectively. The

Flight Support Group's operating margin increased to 18.7% in the

first nine months of fiscal 2017, up from 18.3% in the first nine

months of fiscal 2016. The decrease in the third quarter of fiscal

2017 principally reflects an increase in intangible asset

amortization and depreciation expense associated with our

profitable fiscal 2017 acquisitions, as well as the impact from

changes in the estimated fair value of accrued contingent

consideration, principally due to foreign currency transaction

adjustments, associated with a prior year acquisition. The increase

in the first nine months of fiscal 2017 is mainly attributed to the

previously mentioned SG&A efficiencies.

With respect to the remainder of fiscal 2017, we now estimate

high-single digit growth in the Flight Support Group's net sales

over fiscal 2016 levels and the full year Flight Support Group

operating margin to approximate 19%. Further, we continue to

estimate that approximately half our fiscal 2017 growth will be

generated organically.”

Electronic Technologies Group

Victor H. Mendelson, HEICO's Co-President and President of

HEICO’s Electronic Technologies Group, commented on the Electronic

Technologies Group's third quarter results stating, "Our strong

quarterly results in net sales were driven principally by increased

customer demand for the majority of our products.

The Electronic Technologies Group's net sales increased 1% to

$137.9 million in the third quarter of fiscal 2017, up from $136.2

million in the third quarter of fiscal 2016. The Electronic

Technologies Group's net sales increased 9% to a record $405.2

million in the first nine months of fiscal 2017, up from $372.9

million in the first nine months of fiscal 2016. The increase in

the third quarter and first nine months of fiscal 2017 reflects

increased demand for our aerospace, space, other electronics and

medical products, partially offset by a decrease in defense-related

net sales principally due to customer delays in getting some

anticipated new orders under contract. Additionally, the increase

in the first nine months of fiscal 2017 reflects organic growth of

4% as well as the contribution from our profitable fiscal 2016

acquisition.

The Electronic Technologies Group's operating income increased

15% to $38.5 million in the third quarter of fiscal 2017, up from

$33.6 million in the third quarter of fiscal 2016. The increase

principally reflects a favorable gross margin impact from increased

net sales, as well as lower legal expenses and a more favorable

product mix for certain of our space, other electronics, aerospace

and medical products partially offset by a decrease in net sales

and less favorable product mix for certain of our defense

products

The Electronic Technologies Group's operating income increased

19% to a record $106.5 million in the first nine months of fiscal

2017, up from $89.3 million in the first nine months of fiscal

2016. The increase principally reflects the previously mentioned

net sales growth and a decrease in acquisition costs associated

with a prior year acquisition as well as the previously mentioned

decrease in legal expenses. Additionally, the increase reflects the

gross margin impact from higher net sales and a more favorable

product mix for our aerospace, other electronics and medical

products partially offset by a decrease in net sales for certain of

our defense products and a less favorable product mix for certain

of our space products.

The Electronic Technologies Group's operating margin improved to

28.0% in the third quarter of fiscal 2017, up from 24.7% in the

third quarter of fiscal 2016. The Electronic Technologies Group's

operating margin improved to 26.3% in the first nine months of

fiscal 2017, up from 23.9% in the first nine months of fiscal 2016.

The increase in the third quarter and first nine months of fiscal

2017 principally reflects the previously mentioned improved gross

profit margin and impact from a decrease in legal expenses.

Additionally, the first nine months of fiscal 2017 reflects the

previously mentioned decrease in acquisition costs.

With respect to the remainder of fiscal 2017, we now estimate

high-single digit growth in the Electronic Technologies Group's net

sales over fiscal 2016 levels, and anticipate the full year

Electronic Technologies Group's operating margin to approximate

26%. Further, we continue to estimate that approximately half our

fiscal 2017 growth will be generated organically. These estimates

include our pending acquisition of AAT, but exclude any other

additional acquired businesses, if any.”

(NOTE: HEICO has two classes of common stock traded on

the NYSE. Both classes, the Class A Common Stock (HEI.A) and

the Common Stock (HEI), are virtually identical in all economic

respects. The only difference between the share classes is

the voting rights. The Class A Common Stock (HEI.A) has 1/10

vote per share and the Common Stock (HEI) has one vote per

share.)

There are currently approximately 50.7 million shares of HEICO's

Class A Common Stock (HEI.A) outstanding and 33.8 million shares of

HEICO's Common Stock (HEI) outstanding. The stock symbols for

HEICO’s two classes of common stock on most websites are HEI.A and

HEI. However, some websites change HEICO's Class A Common Stock

trading symbol (HEI.A) to HEI/A or HEIa.

As previously announced, HEICO will hold a conference call on

Thursday, August 24, 2017 at 9:00 a.m. Eastern Daylight Time to

discuss its third quarter results. Individuals wishing to

participate in the conference call should dial: U.S. and Canada

(877) 586-4323, International (706) 679-0934, wait for the

conference operator and provide the operator with the Conference ID

65293197. A digital replay will be available two hours after the

completion of the conference for 14 days. To access, dial: (404)

537-3406, and enter the Conference ID 65293197.

HEICO Corporation is engaged primarily in the design,

production, servicing and distribution of products and services to

certain niche segments of the aviation, defense, space, medical,

telecommunications and electronics industries through its

Hollywood, Florida-based Flight Support Group and its Miami,

Florida-based Electronic Technologies Group. HEICO's customers

include a majority of the world's airlines and overhaul shops, as

well as numerous defense and space contractors and military

agencies worldwide, in addition to medical, telecommunications and

electronics equipment manufacturers. For more information about

HEICO, please visit our website at http://www.heico.com.

Certain statements in this press release constitute

forward-looking statements, which are subject to risks,

uncertainties and contingencies. HEICO's actual results may differ

materially from those expressed in or implied by those

forward-looking statements as a result of factors including: lower

demand for commercial air travel or airline fleet changes or

airline purchasing decisions, which could cause lower demand for

our goods and services; product specification costs and

requirements, which could cause an increase to our costs to

complete contracts; governmental and regulatory demands, export

policies and restrictions, reductions in defense, space or homeland

security spending by U.S. and/or foreign customers or competition

from existing and new competitors, which could reduce our sales;

our ability to introduce new products and services at profitable

pricing levels, which could reduce our sales or sales growth;

product development or manufacturing difficulties, which could

increase our product development costs and delay sales; our ability

to make acquisitions and achieve operating synergies from acquired

businesses; customer credit risk; interest, foreign currency

exchange and income tax rates; economic conditions within and

outside of the aviation, defense, space, medical,

telecommunications and electronics industries, which could

negatively impact our costs and revenues; and defense budget cuts,

which could reduce our defense-related revenue. Parties receiving

this material are encouraged to review all of HEICO's filings with

the Securities and Exchange Commission, including, but not limited

to filings on Form 10-K, Form 10-Q and Form 8-K. We undertake no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, except to the extent required by applicable law.

HEICO CORPORATION

Condensed Consolidated Statements of

Operations (Unaudited)

(in thousands, except per share data)

Three Months Ended July

31, 2017 2016 Net sales

$391,500 $356,084 Cost of sales 242,603 222,501 Selling, general

and administrative expenses 72,775 63,729 Operating

income 76,122 69,854 Interest expense (2,447 ) (2,294 ) Other

income 200 16 Income before income taxes and

noncontrolling interests 73,875 67,576 Income tax expense 22,400

20,600 Net income from consolidated operations 51,475

46,976 Less: Net income attributable to noncontrolling interests

5,777 4,974 Net income attributable to HEICO $45,698

$42,002 Net income per share attributable to

HEICO shareholders: (a) Basic $.54 $.50 Diluted $.53 $.49

Weighted average number of common shares outstanding: (a) Basic

84,343 83,908 Diluted 86,893 85,348

Three Months Ended

July 31, 2017 2016 Operating segment information:

Net sales: Flight Support Group $257,966 $222,553 Electronic

Technologies Group 137,860 136,215 Intersegment sales (4,326 )

(2,684 ) $391,500 $356,084 Operating income:

Flight Support Group $46,664 $41,969 Electronic Technologies Group

38,543 33,609 Other, primarily corporate (9,085 ) (5,724 ) $76,122

$69,854

HEICO CORPORATION

Condensed Consolidated Statements of

Operations (Unaudited)

(in thousands, except per share data)

Nine Months Ended July

31, 2017 2016 Net sales $1,103,589

$1,012,959 Cost of sales 688,893 633,151 Selling, general and

administrative expenses 197,482 190,539 Operating

income 217,214 189,269

(c)

Interest expense (6,376 ) (6,194 ) Other income 835 154

Income before income taxes and noncontrolling interests

211,673 183,229 Income tax expense 63,100

(b)

56,600

(d)

Net income from consolidated operations 148,573 126,629 Less: Net

income attributable to noncontrolling interests 16,262

14,699 Net income attributable to HEICO $132,311

(b)

$111,930

(c)(d)

Net income per share attributable to HEICO shareholders: (a)

Basic $1.57

(b)

$1.34

(c)(d)

Diluted $1.53

(b)

$1.32

(c)(d)

Weighted average number of common shares outstanding: (a)

Basic 84,235 83,718 Diluted 86,645 85,102

Nine Months

Ended July 31, 2017 2016 Operating segment

information: Net sales: Flight Support Group $710,676 $647,419

Electronic Technologies Group 405,194 372,933 Intersegment sales

(12,281 ) (7,393 ) $1,103,589 $1,012,959

Operating income: Flight Support Group $132,771 $118,757 Electronic

Technologies Group 106,453 89,280 Other, primarily corporate

(22,010 ) (18,768 ) $217,214 $189,269

HEICO CORPORATION

Footnotes to Condensed Consolidated Statements of

Operations (Unaudited)

(a) All share and per share information has been adjusted

retrospectively to reflect a 5-for-4 stock split effected in April

2017.

(b) During the first quarter of fiscal 2017, the Company adopted

Accounting Standards Update ("ASU") 2016-09, "Improvements to

Employee Share-Based Payment Accounting," resulting in the

recognition of a $3.1 million discrete income tax benefit, which,

net of noncontrolling interests, increased net income attributable

to HEICO by $2.6 million. Additionally, the adoption of ASU 2016-09

resulted in a 745,000 increase in the Company's weighted average

number of diluted common shares outstanding and an increase in net

income per share attributable to HEICO shareholders of $.03 per

basic and $.02 per diluted share in the first nine months of fiscal

2017.

(c) During the first quarter of fiscal 2016, the Company

incurred $3.1 million of acquisition costs in connection with a

fiscal 2016 acquisition. These are one-time nonrecurring costs.

These expenses, net of tax, decreased net income attributable to

HEICO by $2.0 million, or $.02 per basic and diluted share.

(d) During the first quarter of fiscal 2016, the Company

recognized additional income tax credits for qualified R&D

activities related to the last ten months of fiscal 2015 upon the

retroactive and permanent extension of the U.S. federal R&D tax

credit in December 2015. The tax credits, net of expenses,

increased net income attributable to HEICO by $1.7 million, or $.02

per basic and diluted share.

HEICO CORPORATION

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands)

July 31, 2017 October 31, 2016 Cash and cash

equivalents $49,489 $42,955 Accounts receivable, net 206,405

202,227 Inventories, net 340,471 286,302 Prepaid expenses and other

current assets 59,564 52,737 Total current assets 655,929

584,221 Property, plant and equipment, net 129,905 121,611 Goodwill

921,978 865,717 Intangible assets, net 390,926 366,863 Other assets

124,985 101,063 Total assets $2,223,723 $2,039,475

Current maturities of long-term debt $450 $411 Other current

liabilities 226,652 214,010 Total current liabilities

227,102 214,421 Long-term debt, net of current maturities 434,312

457,814 Deferred income taxes 106,866 105,962 Other long-term

liabilities 131,893 114,061 Total liabilities 900,173

892,258 Redeemable noncontrolling interests 126,881 99,512

Shareholders’ equity 1,196,669 1,047,705 Total liabilities

and equity $2,223,723 $2,039,475

HEICO

CORPORATION

Condensed Consolidated Statements of

Cash Flows (Unaudited)

(in thousands)

Nine Months Ended July 31, 2017

2016 Operating Activities: Net income from consolidated

operations $148,573 $126,629 Depreciation and amortization 46,912

44,603 Employer contributions to HEICO Savings and Investment Plan

5,732 5,219 Share-based compensation expense 5,207 4,905 Increase

in accrued contingent consideration 1,227 2,635 Foreign currency

transaction adjustments, net 3,316 876 Deferred income tax benefit

(6,998 ) (6,053 ) Tax benefit from stock option exercises — 867

Excess tax benefit from stock option exercises — (880 ) Decrease

(increase) in accounts receivable 13,343 (2,974 ) Increase in

inventories (22,415 ) (13,914 ) (Decrease) increase in current

liabilities (10,460 ) 14,776 Other (5,134 ) (4,273 ) Net cash

provided by operating activities 179,303 172,416

Investing Activities: Acquisitions, net of cash acquired

(95,759 ) (263,811 ) Capital expenditures (20,445 ) (23,113 ) Other

(685 ) (3,005 ) Net cash used in investing activities (116,889 )

(289,929 ) Financing Activities: (Payments) borrowings on

revolving credit facility, net (26,000 ) 142,000 Distributions to

noncontrolling interests (12,924 ) (16,156 ) Cash dividends paid

(12,807 ) (10,724 ) Payment of contingent consideration (7,039 )

(6,960 ) Acquisitions of noncontrolling interests (3,848 ) (3,599 )

Proceeds from stock option exercises 4,171 4,831 Excess tax benefit

from stock option exercises — 880 Revolving credit facility

issuance costs (270 ) — Other (241 ) (272 ) Net cash (used in)

provided by financing activities (58,958 ) 110,000

Effect of exchange rate changes on cash 3,078 1,101

Net increase (decrease) increase in cash and cash

equivalents 6,534 (6,412 ) Cash and cash equivalents at beginning

of year 42,955 33,603 Cash and cash equivalents at

end of period $49,489 $27,191

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170823006069/en/

HEICO CorporationVictor H. Mendelson, 305-374-1745 ext.

7590orCarlos L. Macau, Jr., 954-987-4000 ext. 7570

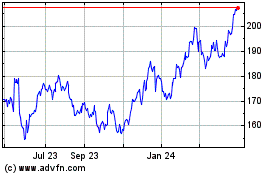

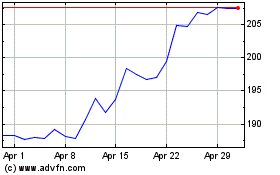

HEICO (NYSE:HEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

HEICO (NYSE:HEI)

Historical Stock Chart

From Apr 2023 to Apr 2024