Third Bidder Emerges for Energy Future's Oncor -- Update

August 18 2017 - 3:27PM

Dow Jones News

By David Benoit and Dana Mattioli

A new bidder has emerged with a $9.3 billion offer for

power-transmission company Oncor that could wrest it from a deal

with Warren Buffett's Berkshire Hathaway Inc., according to people

familiar with the matter.

The bidder's existence emerged in a late-scheduled court hearing

on Friday, but the identity wasn't revealed, the people said. It

was referred to as a large strategic company, the people said. The

information came out as hedge fund Elliott Management Corp. was

attempting to learn more about the bid in its efforts to block the

Berkshire deal, the people said.

A new offer would be the latest twist in the long-running saga

of the fate of Energy Future Holdings Corp., the former TXU, which

owns Oncor and has been in bankruptcy. Elliott is its largest

creditor and was trying to organize its own restructuring.

Elliott is seeking to depose executives of Energy Future over

the new bid, raising concerns the company could block a higher

offer to push through Berkshire's deal, the people said.

Mr. Buffett's Berkshire had struck a deal to buy Oncor in a $9

billion deal last month. Elliott had sought to challenge

Berkshire's deal by cobbling together one of its own, although the

details of where that bid stands are unclear.

After months of amassing debt of Energy Future Holdings Corp.,

Elliott bought a strategic slice of notes that would ensure its

ability to block the deal, people familiar with the matter

said.

Berkshire has said it would walk away if its buyout offer wasn't

approved next week. Paul Singer's Elliott says if Berkshire walks,

Elliott will have an easier time raising money for a better deal

for Oncor.

The fight for Oncor was set to come to a head Monday, a judge is

scheduled to decide whether to greenlight Berkshire's $9 billion

takeover offer. Before the emergence of a third bidder, the choice

was between Berkshire, which has financing in place and the favor

of regulators, and Elliott, which has been working to put together

a rival deal that it says is worth hundreds of millions of dollars

more for creditors.

Berkshire says Elliott hasn't shown it can line up the money to

buy Oncor, and the hedge fund likely can't get approval from the

Public Utility Commission of Texas, even if it does get the

financing.

Energy Future has been stuck in bankruptcy since April 2014, and

two earlier attempts to sell Oncor -- to Hunt Consolidated Inc. of

Texas and Florida's NextEra Energy Inc. -- foundered due to action

by Texas energy regulators. With money running short, Energy Future

can't afford another failed deal for the business, its crown

jewel.

Write to David Benoit at david.benoit@wsj.com and Dana Mattioli

at dana.mattioli@wsj.com

(END) Dow Jones Newswires

August 18, 2017 15:12 ET (19:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

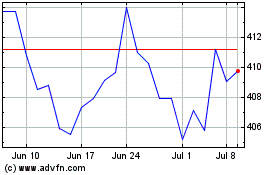

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

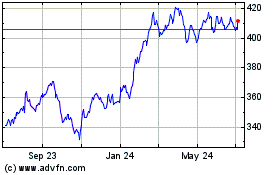

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024