Buffett Bets on Credit-Card Firm -- WSJ

August 16 2017 - 3:03AM

Dow Jones News

Buying 17.5 million shares of Synchrony represents a wager on

industry growth

By AnnaMaria Andriotis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 16, 2017).

Warren Buffett's Berkshire Hathaway Inc. is increasingly betting

on the growing credit-card industry.

On Monday, Berkshire Hathaway disclosed it bought nearly 17.5

million shares of Synchrony Financial in the second quarter

totaling nearly $521 million. That is a vote of confidence for the

largest U.S. store credit-card issuer, whose shares rose more than

4% on Tuesday.

Berkshire Hathaway already owns $12.8 billion in American

Express Co.'s shares and smaller stakes in Visa Inc. and Mastercard

Inc. While Synchrony's cards are mostly geared at the mass market

with its cardholders comprising shoppers at stores ranging from

Wal-Mart Stores Inc. to Dick's Sporting Goods Inc., American

Express is more geared at affluent consumers. Coupled together, the

holdings increase Berkshire Hathaway's exposure to credit cards, an

industry where overall outstanding balances in June were up about

6% from a year ago, according to the latest data from the Federal

Reserve.

Bill Smead, chief executive of asset management firm Smead

Capital Management Inc., said that Synchrony's relatively cheap

stock price likely played a role in the purchase. Synchrony's

shares fell in late April after the company increased its outlook

for full year 2017 charge-offs. Since the beginning of the year,

Synchrony shares are down 14.8% compared with a 10% increase in the

S&P 500.

Most of Synchrony's loan volume is tied to store credit cards

that it issues. Those include a mix of cards that can be used only

in the store that they are issued for and co-branded cards that can

be used anywhere. Synchrony's net charge-off rate, which reflects

the dollar amount of balances it wrote off as a loss compared with

its total average loan balances, increased by more than 0.90

percentage point from a year prior to 5.42% in the second quarter.

The company also continues to set aside more money to cover future

losses, with provisions rising 30% in the second quarter from a

year prior.

Synchrony's high interest rates, which run up to the high

20%-range for many Synchrony cards, can offset some concern.

Berkshire "must like the way their spread is set up despite the

fact that there are defaults," said Mr. Smead, whose firm is a

Berkshire shareholder.

A representative for Berkshire Hathaway didn't have an immediate

comment. A spokesman for Synchrony declined to comment.

The purchase of Synchrony was further notable in that it came at

the same time that Berkshire sold its holdings of General Electric

Co., unloading nearly 10.6 million shares. Synchrony Financial spun

out of General Electric in 2015.

Paul Lountzis, president of Lountzis Asset Management LLC, a

Berkshire Hathaway shareholder, said Synchrony is well capitalized.

Its board recently approved a share repurchase program of $1.64

billion for the four quarters through June 2018, above the

consensus estimates that averaged around $1.4 billion.

The store credit-card market is less competitive than the rest

of the credit- card industry, with less than a handful of very

large players. Synchrony accounts for about 38% of outstanding

store-card balances, according to trade publication the Nilson

Report. Its longstanding relationships with many merchants increase

the chances that Synchrony will remain a dominant player in a

market where retailers want to see that lenders have delivered on

driving more store sales and loyalty.

"It's always better to be an incumbent and have all those long

standing relationships going back many years," said Mr. Lountzis.

The firm "appeals to a different audience" than American

Express.

By comparison, American Express mostly lends to affluent

cardholders and its losses are among the lowest in the industry.

Its Chief Executive Kenneth Chenault at a conference in June said

that he had no desire to enter the store credit-card market,

referring to it as a "very cyclical, volatile business. When you

have good days, they can be really good, but those bad days are

really, really bad."

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

August 16, 2017 02:48 ET (06:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

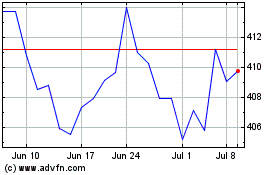

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

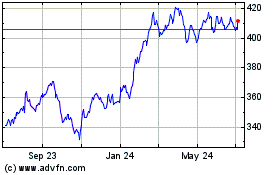

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024