CVD Equipment Corporation (NASDAQ: CVV), a leading provider of

chemical vapor deposition systems, today announced its second

quarter 2017 financial results.

Revenue for the second quarter was $10.8 million, an increase of

12.2% over the prior quarter and 189.3% from the same period last

year. During the quarter, the Company received approximately $6.0

million in new orders. Backlog as of June 30, 2017 was $24.8

million.

“Solid execution of our growth strategy led to record revenue

and strong profitability in the quarter,” said Leonard Rosenbaum,

President and Chief Executive Officer. “As we deliver and execute

on our large aviation project and rebuild our core business

pipeline, we are achieving exceptional results. The strong

performance of our systems in the field and our ongoing development

of additional coating products will generate future demand in a

variety of new and adjacent markets.”

Net income for the second quarter was $1.3 million compared to

$1.0 million in the prior quarter and a loss of ($496,000) a year

ago. Net earnings per diluted share increased to $0.20 from $0.16

in the first quarter and a net loss of ($0.08) in the second

quarter of 2016.

The Company will hold a conference call to discuss its results

today at 4:30 p.m. (Eastern Time). To participate in the live

conference call, please dial toll free (877) 407-0784 or

International (201) 689-8560. A telephone replay will be available

for 7 days following the call. To access the replay, dial (844)

512-2921 or (412) 317-6671. The replay passcode is 13667684. A live

and archived webcast of the call is also available on the Company’s

website at

https://www.cvdequipment.com/events/category/investor-meetings/

CVD Equipment Corporation and

Subsidiaries

Condensed Consolidated Statements of

Operations

(In thousands except per share

information)

Three Months Ended June 30 Six months Ended

June 30 2017 2016 2017 2016 Revenue $10,830 3,744

$20,480 8,747 Gross profit 4,410 494 8,582 2,027 Operating expenses

2,580 1,475 5,034

3,540 Operating income/(loss) 1,830 (980) 3,548

(1,513) Net income/(loss)

1,257 (496)

2,281 (833) Diluted earnings per share

$0.20 $(0.08) $0.36 $(0.13)

CVD Equipment Corporation and

Subsidiaries

Condensed Consolidated Balance

Sheets

(In thousands)

June 30,

2017

December 31, 2016

Assets

Current assets: Cash and cash equivalents $21,477 $21,677 Accounts

Receivable, net 1,852 608 Costs and estimated earnings in excess of

billings on contracts in progress 3,027 2,597 Inventories 3,102

3,287 Other current assets

344 235 Total

current assets 29,802 28,404 Property, plant and equipment, net

14,280 14,439 Deferred taxes 1,952 2,440 Other assets 272 68

Intangible assets 240 254

Total assets $46,546

$45,605 Liabilities and stockholders' equity

Current liabilities: Accounts payable $1,173 $743 Accrued expenses

and other current liabilities 2,122 1,943 Current portion of

long-term debt 300 300 Billings in excess of costs and estimated

earnings on contracts in progress 2,985 5,262 Deferred revenue

99 78 Total current liabilities 6,678

8,326 Long-term debt 2,816 2,966

Total liabilities 9,494

11,292

Total stockholders' equity 37,052

34,313 Total liabilities and stockholders'

equity $46,546 $45,605

Earnings release should be read in conjunction

with Company’s Annual Report on Form 10-K for fiscal year ended

December 31, 2016

About CVD Equipment Corporation

CVD Equipment Corporation (NASDAQ: CVV) designs, develops, and

manufactures a broad range of chemical vapor deposition, gas

control, and other state-of-the-art equipment and process solutions

used to develop and manufacture materials and coatings for research

and industrial applications. This equipment is used by our

customers to research, design, and manufacture these materials or

coatings for aerospace engine components, medical implants,

semiconductors, solar cells, smart glass, carbon nanotubes,

nanowires, LEDs, MEMS, and other applications. Through our

application laboratory, we provide process development support and

process startup assistance with the focus on enabling tomorrow’s

technologies™. Its wholly owned subsidiary CVD Materials

Corporation provides advanced metal surface treatments and coatings

serving demanding applications in the biomedical, petroleum,

pharmaceutical, and many other industrial markets.

The Private Securities Litigation Reform Act of 1995 provides a

“safe harbor” for forward-looking statements. Certain information

included in this press release (as well as information included in

oral statements or other written statements made or to be made by

CVD Equipment Corporation) contains statements that are

forward-looking. All statements other than statements of historical

fact are hereby identified as “forward-looking statements, “as such

term is defined in Section 27A of the Securities Exchange Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. Such forward looking information involves a

number of known and unknown risks and uncertainties that could

cause actual results to differ materially from those discussed or

anticipated by management. Potential risks and uncertainties

include, among other factors, conditions, success of CVD Equipment

Corporation’s growth and sales strategies, the possibility of

customer changes in delivery schedules, cancellation of orders,

potential delays in product shipments, delays in obtaining

inventory parts from suppliers and failure to satisfy customer

acceptance requirements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170814005745/en/

CVD Equipment CorporationGina Franco, 631-981-7081Fax:

631-981-7095investorrelations@cvdequipment.com

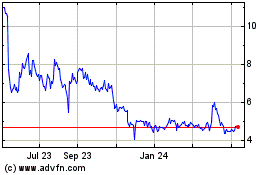

CVD Equipment (NASDAQ:CVV)

Historical Stock Chart

From Mar 2024 to Apr 2024

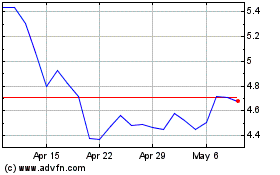

CVD Equipment (NASDAQ:CVV)

Historical Stock Chart

From Apr 2023 to Apr 2024