GRAVITY REPORTS SECOND QUARTER OF 2017 RESULTS AND BUSINESS

UPDATES

Seoul, South Korea – August 9, 2017 – GRAVITY

Co., Ltd. (NasdaqCM: GRVY) (“Gravity” or “Company”), a developer

and publisher of online and mobile games based in South Korea,

today announced its unaudited financial results for the second

quarter ended June 30, 2017, prepared in accordance with generally

accepted accounting principles in the United States.

SECOND QUARTER 2017 HIGHLIGHTS

- Total revenues were KRW 27,028 million (US$ 23,631 thousand),

representing a 15.7% increase from the first quarter ended March

31, 2017 (“QoQ”) and a 198.4% increase from the second quarter

ended June 30, 2016 (“YoY”).

- Operating income was KRW 4,373 million (US$ 3,823 thousand),

representing a 32.6% increase QoQ and an increase of KRW 5,879

million (US$ 5,140 thousand) from KRW 1,506 million of operating

loss in the same period last year.

- Income before income tax expenses was KRW 4,560 million (US$

3,987 thousand), representing a 34.8% increase QoQ and an increase

of KRW 5,772 million (US$ 5,047 thousand) from KRW 1,212 million of

loss before income tax expenses in the same period last year.

- Net Income attributable to parent company was KRW 3,555 million

(US$ 3,108 thousand), representing a 63.8% increase QoQ and an

increase of KRW 5,160 million (US$ 4,511 thousand) from KRW 1,605

million of net loss attributable to parent company in the same

period last year.

Mr. Hyun Chul Park, CEO of Gravity said, “We

delivered a stronger set of financial results for the second

quarter of 2017, compared to the first quarter of 2017 and the

second quarter of 2016. Gravity is dedicated to continuously

provide better game experiences and innovative content to our

global game users.”

REVIEW OF SECOND QUARTER 2017 FINANCIAL

RESULTS

Revenues

Subscription revenues were KRW 9,786 million

(US$ 8,556 thousand), representing a 0.7% decrease QoQ from KRW

9,855 million and a 321.3% increase YoY from KRW 2,323million.

The decrease QoQ was mainly attributable to

lower revenue from Ragnarok Online in Taiwan, which was partially

offset by higher revenues derived from Ragnarok Online in United

States and Canada and Dragonica Online in Taiwan. The Company

launched Dragonica Online in Taiwan in May 2017. The increase YoY

was largely due to strong revenue growth from Ragnarok Online and

Ragnarok Prequel in Taiwan. The Company began to directly offer

Ragnarok Online in Taiwan since June 2016 and Ragnarok Prequel was

launched in Taiwan in July 2016.

Royalty and license fee revenues were KRW 3,546

million (US$ 3,100 thousand), representing a 20.8% decrease QoQ

from KRW 4,475 million and a 28.3% increase YoY from KRW 2,763

million.

The decrease QoQ was primarily due to lower

revenues from Ragnarok Online in Japan and Thailand. The increase

YoY resulted mainly from revenue growth from Ragnarok Online in

Thailand and Indonesia. Our local licensee, Electronic Extreme

Ltd.(“Extreme”), successfully re-launched Ragnarok Online in

Thailand and Indonesia in July 2016 and February 2017,

respectively.

Mobile game and application revenues were KRW

12,239 million (US$ 10,701 thousand), representing a 51.8% increase

QoQ from KRW 8,063 million and a 290.0% increase YoY from KRW 3,138

million.

The increase QoQ mainly reflected growth in

revenue from launchings of Ragnarok R in Thailand and Korea in

February 2017 and April 2017, respectively. The increase YoY

resulted primarily from increased revenues from Ragnarok R in

Taiwan, Thailand and Korea, which was launched in December 2016,

February 2017 and April 2017, respectively.

Character merchandising and other revenues were

KRW 1,457 million (US$ 1,274 thousand), representing 51.9% increase

QoQ from KRW 959 million and a 74.9 % increase YoY from KRW 833

million.

Cost of Revenue

Cost of revenue was KRW 15,463 million (US$

13,520 thousand), representing a 10.7% increase QoQ from KRW 13,969

million and a 125.9% increase YoY from KRW 6,846 million.

The increase QoQ was mainly due to: i) higher

commission paid to mobile platforms including App Store and Google

Play Store for mobile game distribution service for Ragnarok R in

Korea; and ii) royalty payments related to Ragnarok R in Korea,

which was launched in April 2017. The increase YoY was mostly from

increased royalty payments, game channeling service fees and

outsourcing fees related to Ragnarok R and Ragnarok Prequel. Also,

such increase was also driven by higher commission paid to mobile

platforms for service of Ragnarok R in Korea, Taiwan and

Thailand.

Operating Expenses

Operating expenses were KRW 7,192 million (US$

6,288 thousand), representing a 18.2% increase QoQ from KRW 6,085

million and a 93.5% increase YoY from KRW 3,717 million.

The increase QoQ was mainly attributable to

higher advertising expenses related to marketing for Ragnarok R,

which was officially launched in Korea in April, 2017. The increase

YoY was mostly resulted from increased advertising expenses related

to Ragnarok R and higher commission paid for payment gateway

fees.

Income before income tax expenses

Income before income tax expenses was KRW 4,560

million (US$ 3,987 thousand) compared with income before income tax

expense of KRW 3,382 million for the first quarter of 2017 and loss

before income tax expenses of KRW 1,212 million for the second

quarter of 2016.

Net Income

As a result of the foregoing factors, Gravity

recorded a net income attributable to parent company of KRW 3,555

million (US$ 3,108 thousand) compared with net income attributable

to parent company of KRW 2,170 million for the first quarter of

2017 and a net loss attributable to parent company of KRW 1,605

million for the second quarter of 2016.

Liquidity

The balance of cash and cash equivalents and

short-term financial instruments was KRW 45,572 million (US$ 39,845

thousand) as of June 30, 2017.

Note: For convenience purposes only, the KRW

amounts have been expressed in U.S. dollars at the exchange rate of

KRW 1,143.75 to US$ 1.00, the noon buying rate in effect on June

30, 2017 as quoted by the Federal Reserve Bank of New York.

GRAVITY BUSINESS UPDATES

- Ragnarok M, an MMORPG mobile game

On August 8, 2017, Gravity, Shanghai the Dream

Network Technology Co., Ltd. and X.D. Network Inc.(“the Partners”)

announced that the Partners entered into an agreement to launch

Ragnarok M in Taiwan, Korea and Thailand. Ragnarok M is scheduled

to be launched in Taiwan during the fourth quarter of 2017 and the

launching schedules for Korea and Thailand are to be announced in

the future.

The Partners co-developed Ragnarok M based on

the content of Ragnarok Online and Ragnarok M has drawn a large

attention among Ragnarok Online users for its recreation of

Ragnarok Online.

- Ragnarok R, a card RPG mobile game

The Company plans to launch Ragnarok R in United

States and Canada during the fourth quarter of 2017. Also,

such game is expected to be launched in more Asian markets in

2018.

Our local licensee, Extreme, re-launched

Ragnarok Online in Philippines on June 20, 2017. Such game was

successfully re-launched in Taiwan, Thailand and Indonesia. Gravity

and Extreme plan to re-launch Ragnarok Online in more Asian

markets.

About GRAVITY Co., Ltd.

---------------------------------------------------

Based in Korea, Gravity is a developer and

publisher of online and mobile games. Gravity's principal product,

Ragnarok Online, is a popular online game in many markets,

including Japan and Taiwan, and is currently commercially offered

in 79 markets and countries. For more information about Gravity,

please visit http://www.gravity.co.kr.

Forward-Looking Statements:

Certain statements in this press release may

include, in addition to historical information, "forward-looking

statements" within the meaning of the "safe-harbor" provisions of

the U.S. Private Securities Litigation Reform Act 1995.

Forward-looking statements can generally be identified by the use

of forward-looking terminology, such as "may," "will," "expect,"

"intend," "estimate," "anticipate," "believe", "project," or

"continue" or the negative thereof or other similar words, although

not all forward-looking statements contain these words. Investors

should consider the information contained in our submissions and

filings with the United States Securities and Exchange Commission

(the "SEC"), including our annual report for the fiscal year ended

December 31, 2016 on Form 20-F, together with such other documents

that we may submit to or file with the SEC from time to time, on

Form 6-K. The forward-looking statements speak only as of this

press release and we assume no duty to update them to reflect new,

changing or unanticipated events or circumstances.

Contact:

Mr. Heung Gon Kim Chief Financial Officer

Gravity Co., Ltd. Email: kheung@gravity.co.kr

Ms. Ji Hee Kim IR Manager Gravity Co., Ltd.

Email: ircommunication@gravity.co.kr Telephone: +82-2-2132-7800

#

# #

GRAVITY Co.,

Ltd.Consolidated Balance Sheet

(In millions of KRW and thousands of US$)

|

|

|

|

As of |

|

|

|

|

31-Dec-16 |

|

30-June-17 |

|

|

|

|

KRW |

|

US$ |

|

KRW |

|

US$ |

| Assets |

(audited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

16,720 |

|

|

14,619 |

|

|

17,070 |

|

|

14,925 |

|

|

|

Short-term financial instruments |

22,000 |

|

|

19,235 |

|

|

28,502 |

|

|

24,920 |

|

|

|

Accounts receivable, net |

11,819 |

|

|

10,334 |

|

|

22,689 |

|

|

19,837 |

|

|

|

Other current assets |

2,852 |

|

|

2,493 |

|

|

3,111 |

|

|

2,720 |

|

|

|

|

Total

current assets |

53,391 |

|

|

46,681 |

|

|

71,372 |

|

|

62,402 |

|

|

|

|

|

|

|

|

|

|

|

|

| Property and equipment, net |

593 |

|

|

518 |

|

|

870 |

|

|

760 |

|

| Leasehold and other deposits |

962 |

|

|

841 |

|

|

972 |

|

|

850 |

|

| Intangible assets |

91 |

|

|

80 |

|

|

85 |

|

|

75 |

|

| Other non-current assets |

153 |

|

|

134 |

|

|

98 |

|

|

85 |

|

|

|

|

Total

assets |

55,190 |

|

|

48,254 |

|

|

73,397 |

|

|

64,172 |

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

10,033 |

|

|

8,772 |

|

|

15,709 |

|

|

13,735 |

|

|

|

Deferred revenue |

9,689 |

|

|

8,471 |

|

|

11,871 |

|

|

10,379 |

|

|

|

Other current liabilities |

964 |

|

|

843 |

|

|

2,161 |

|

|

1,889 |

|

|

|

|

Total

current liabilities |

20,686 |

|

|

18,086 |

|

|

29,741 |

|

|

26,003 |

|

| Long-term deferred revenue |

4,096 |

|

|

3,581 |

|

|

7,083 |

|

|

6,193 |

|

| Accrued severance benefits |

104 |

|

|

91 |

|

|

148 |

|

|

130 |

|

| Other non-current liabilities |

210 |

|

|

184 |

|

|

339 |

|

|

296 |

|

|

|

|

Total

liabilities |

25,096 |

|

|

21,942 |

|

|

37,311 |

|

|

32,622 |

|

| Common shares |

3,474 |

|

|

3,037 |

|

|

3,474 |

|

|

3,037 |

|

| Additional paid-in capital |

75,076 |

|

|

65,640 |

|

|

75,076 |

|

|

65,640 |

|

| Accumulated deficit |

(48,511 |

) |

|

(42,414 |

) |

|

(42,786 |

) |

|

(37,409 |

) |

| Accumulated other comprehensive income |

617 |

|

|

540 |

|

|

912 |

|

|

798 |

|

|

|

|

Total

parent company shareholders' equity |

30,656 |

|

|

26,803 |

|

|

36,676 |

|

|

32,066 |

|

| Non-controlling interest |

(562 |

) |

|

(491 |

) |

|

(590 |

) |

|

(516 |

) |

|

|

|

Total

equity |

30,094 |

|

|

26,312 |

|

|

36,086 |

|

|

31,550 |

|

|

|

|

Total

liabilities and equity |

55,190 |

|

|

48,254 |

|

|

73,397 |

|

|

64,172 |

|

* For convenience purposes only, the KRW amounts

are expressed in U.S. dollars at the rate of KRW 1,143.75 to US$

1.00, the noon buying rate in effect on June 30, 2017 as quoted by

the Federal Reserve Bank of New York.

GRAVITY CO.,

LTD.Consolidated Statements of

Operations

(In millions of KRW and in thousands of US$,

except for shares and ADS data)

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

31-Mar-17 |

|

30-Jun-16 |

|

30-Jun-17 |

|

30-Jun-16 |

|

30-Jun-17 |

|

|

|

|

(KRW) |

|

(KRW) |

|

(KRW) |

|

(US$) |

|

(KRW) |

|

(KRW) |

|

(US$) |

|

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Online games-subscription revenue |

9,855 |

|

|

2,323 |

|

|

9,786 |

|

|

8,556 |

|

|

4,460 |

|

|

19,641 |

|

|

17,172 |

|

|

|

Online games-royalties and license fees |

4,475 |

|

|

2,763 |

|

|

3,546 |

|

|

3,100 |

|

|

6,131 |

|

|

8,021 |

|

|

7,013 |

|

|

|

Mobile games and applications |

8,063 |

|

|

3,138 |

|

|

12,239 |

|

|

10,701 |

|

|

5,968 |

|

|

20,302 |

|

|

17,750 |

|

|

|

Character merchandising and other revenue |

959 |

|

|

833 |

|

|

1,457 |

|

|

1,274 |

|

|

1,592 |

|

|

2,416 |

|

|

2,112 |

|

|

|

|

Total

net revenue |

23,352 |

|

|

9,057 |

|

|

27,028 |

|

|

23,631 |

|

|

18,151 |

|

|

50,380 |

|

|

44,047 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

13,969 |

|

|

6,846 |

|

|

15,463 |

|

|

13,520 |

|

|

13,465 |

|

|

29,432 |

|

|

25,733 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

9,383 |

|

|

2,211 |

|

|

11,565 |

|

|

10,111 |

|

|

4,686 |

|

|

20,948 |

|

|

18,314 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

5,516 |

|

|

3,205 |

|

|

6,498 |

|

|

5,681 |

|

|

5,893 |

|

|

12,014 |

|

|

10,504 |

|

|

|

Research and development |

569 |

|

|

512 |

|

|

694 |

|

|

607 |

|

|

855 |

|

|

1,263 |

|

|

1,104 |

|

|

|

Impairment losses on intangible assets |

ㅡ |

|

ㅡ |

|

ㅡ |

|

ㅡ |

|

5 |

|

|

ㅡ |

|

ㅡ |

|

|

|

Total

operating expenses |

6,085 |

|

|

3,717 |

|

|

7,192 |

|

|

6,288 |

|

|

6,753 |

|

|

13,277 |

|

|

11,608 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income(loss) |

3,298 |

|

|

(1,506 |

) |

|

4,373 |

|

|

3,823 |

|

|

(2,067 |

) |

|

7,671 |

|

|

6,706 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

133 |

|

|

131 |

|

|

139 |

|

|

122 |

|

|

263 |

|

|

272 |

|

|

238 |

|

|

|

Interest expense |

(3 |

) |

|

ㅡ |

|

(3 |

) |

|

(3 |

) |

|

ㅡ |

|

(6 |

) |

|

(5 |

) |

|

|

Foreign currency income (loss), net |

(46 |

) |

|

163 |

|

|

51 |

|

|

45 |

|

|

(695 |

) |

|

5 |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income(loss) before income tax expenses |

3,382 |

|

|

(1,212 |

) |

|

4,560 |

|

|

3,987 |

|

|

(2,499 |

) |

|

7,942 |

|

|

6,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expenses |

1,228 |

|

|

410 |

|

|

1,017 |

|

|

889 |

|

|

843 |

|

|

2,245 |

|

|

1,963 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

income(loss) |

2,154 |

|

|

(1,622 |

) |

|

3,543 |

|

|

3,098 |

|

|

(3,342 |

) |

|

5,697 |

|

|

4,980 |

|

| Net income (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

(16 |

) |

|

(17 |

) |

|

(12 |

) |

|

(10 |

) |

|

(36 |

) |

|

(28 |

) |

|

(25 |

) |

|

|

Parent company |

2,170 |

|

|

(1,605 |

) |

|

3,555 |

|

|

3,108 |

|

|

(3,306 |

) |

|

5,725 |

|

|

5,005 |

|

| Earning(loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

Basic and diluted |

312 |

|

|

(231 |

) |

|

512 |

|

|

0.45 |

|

|

(476 |

) |

|

824 |

|

|

0.72 |

|

| Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

Basic and diluted |

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

| Earning(loss) per ADS(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

Basic and diluted |

624 |

|

|

(462 |

) |

|

1,024 |

|

|

0.90 |

|

(952 |

) |

|

1,648 |

|

|

1.44 |

|

* For convenience, the KRW amounts are expressed

in U.S. dollars at the rate of KRW 1,143.75 to US$1.00, the noon

buying rate in effect on June 30, 2017 as quoted by the Federal

Reserve Bank of New York.

(1) Each ADS represents two common shares.

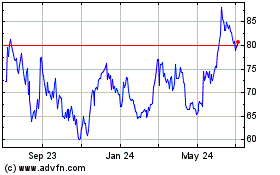

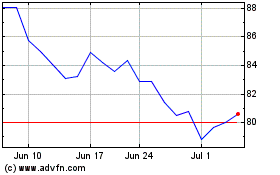

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Apr 2023 to Apr 2024