Genco Shipping & Trading Limited (NYSE:GNK) (“Genco” or the

“Company”) today reported its financial results for the three and

six months ended June 30, 2017.

The following financial review discusses the

results for the three and six months ended June 30, 2017 and June

30, 2016.

Second Quarter 2017 and

Year-to-Date Highlights

- Recorded a net loss of $14.5 million for the second quarter of

2017• Basic and diluted loss per share of $0.42• Adjusted

basic and diluted loss of $12.5 million or $0.36 per share,

excluding $1.3 million for gain on sale of vessel and $3.3 million

non-cash impairment charge1

- During the second quarter of 2017 we completed our vessel sale

program• Sold the Genco Prosperity for total net proceeds of $2.9

million

_____________________________________1 We believe the non-GAAP

measure presented provides investors with a means of better

evaluating and understanding the Company’s operating

performance.

Financial Review: 2017 Second

Quarter

The Company recorded a net loss for the second

quarter of 2017 of $14.5 million, or $0.42 basic and diluted net

loss per share. Comparatively, for the three months ended June 30,

2016, the Company recorded a net loss of $110.7 million, or $15.32

basic and diluted net loss per share. Basic and diluted net loss

per share for the three months ended June 30, 2016 has been

adjusted for the one-for-ten reverse stock split of Genco’s common

stock effected on July 7, 2016.

John C. Wobensmith, Chief Executive Officer,

commented, “During the second quarter, we took additional steps to

strengthen our leading and sizeable drybulk platform as the market

continues its recovery. Our ongoing success optimizing the profile

and deployment of Genco’s diversified fleet provides us significant

optionality in a rising market. In addition, our fleet strongly

aligns with global trade dynamics and our increased focus on

providing customers with a full-service logistics solution through

direct liftings of both major and minor bulks contribute to our

strong commercial prospects. We intend to maintain our position as

a leading low cost operator, which should serve us well as supply

and demand fundamentals continue to come into balance. With

significant financial flexibility, we also remain well positioned

to capitalize on compelling opportunities as we seek to further

enhance Genco’s industry leadership.”

The Company’s revenues increased to $45.4

million for the three months ended June 30, 2017, compared to $31.9

million for the three months ended June 30, 2016. The increase was

primarily due to higher spot market rates achieved by the majority

of the vessels in our fleet during the second quarter of 2017

versus the same period last year partially offset by the operation

of fewer vessels during the second quarter of 2017 as compared to

the second quarter of 2016.

The average daily time charter equivalent, or

TCE, rates obtained by the Company’s fleet was $8,439 per day for

the three months ended June 30, 2017 as compared to $4,618 for the

three months ended June 30, 2016. The increase in TCE was primarily

due to higher spot rates achieved by the majority of the vessels in

our fleet during the second quarter of 2017 versus the second

quarter of 2016. The freight market strength that materialized at

the end of Q1 2017 carried into the beginning of the second quarter

as a result of record Chinese steel output which led to heightened

demand for seaborne iron ore and coal cargoes. Additionally, the

South American grain season aided in supporting smaller class

vessels. Towards the end of the quarter, the freight market came

under pressure as the drybulk fleet expanded at a higher pace due

to a significant year-over-year decline in demolition activity.

Total operating expenses were $52.6 million for

the three months ended June 30, 2017 compared to $132.6 million for

the three months ended June 30, 2016. During the three months ended

June 30, 2017, a $3.3 million impairment loss was recorded as of

June 30, 2017, as the Company determined that the sum of the

estimated undiscounted future cash flows for the Genco Surprise, a

1998-built Panamax vessel, would not exceed the carrying value of

the vessel. Additionally, as of June 30, 2017, we recorded a gain

on sale of vessel in the amount of $1.3 million due to the sale of

the Genco Prosperity during Q2 2017. During the three months ended

June 30, 2016, a $67.6 million impairment loss was recorded in

order to adjust the value of nine of our vessels to their estimated

net realizable value as of June 30, 2016, as the Company determined

that the sale or scrapping of these vessels was more likely than

not based on the terms of the commitment letter of the $400 Million

Credit Facility. Vessel operating expenses declined to $23.9

million for the three months ended June 30, 2017 compared to $28.5

million for the three months ended June 30, 2016. This decrease was

primarily due to the operation of fewer vessels during the second

quarter of 2017 as compared to the same period of the prior year.

The decrease was also due to lower expenses related to crewing and

insurance as well as the timing of purchases of stores partially

offset by higher drydocking related expenses. General and

administrative expenses were $5.8 million for the second quarter of

2017 compared to $11.6 million for the second quarter of 2016,

primarily due to a decrease in nonvested stock amortization

expense. Included in general and administrative expenses is

nonvested stock amortization expense of $1.6 million and $5.4

million for the second quarter of 2017 and 2016, respectively.

Depreciation and amortization expenses decreased to $18.2 million

for the three months ended June 30, 2017 from $19.7 million for the

three months ended June 30, 2016, primarily due to the operation of

fewer vessels in the second quarter of 2017 as well as the

revaluation of ten of our vessels to their estimated net realizable

value during the first half of 2016.

Daily vessel operating expenses, or DVOE,

decreased to $4,333 per vessel per day for the second quarter of

2017 compared to $4,511 per vessel per day for the same quarter of

2016, predominantly due to lower expenses related to crewing and

insurance as well as the timing of purchases of stores, partially

offset by higher drydocking related expenses. We believe daily

vessel operating expenses are best measured for comparative

purposes over a 12‑month period in order to take into account all

of the expenses that each vessel in our fleet will incur over a

full year of operation. For the six months ended June 30, 2017 our

DVOE decreased to $4,364 from $4,542 for the same period of 2016.

Based on estimates provided by our technical managers and

management’s views, our DVOE budget for 2017 is $4,440 per vessel

per day on a weighted average basis for the entire year for the

core fleet of 60 vessels.

Apostolos Zafolias, Chief Financial Officer,

commented, “Our year-over-year results improved and reflected

higher spot market rates achieved by the majority of the vessels in

our fleet. This enabled Genco to increase its cash position to $181

million at the end of the second quarter, further enhancing our

financial flexibility. We also continued to focus on cost

management initiatives in the quarter, enabling Genco to maintain

break-even levels among the lowest in the industry.”

Financial Review: First Half

2017

The Company recorded a net loss of $30.1 million

or $0.89 basic and diluted net loss per share for the six months

ended June 30, 2017. This compares to a net loss of $165.1 million

or $22.87 basic and diluted net loss per share for the six months

ended June 30, 2016. Basic and diluted net loss per share for the

six months ended June 30, 2016 has been adjusted for the

one-for-ten reverse stock split of Genco’s common stock effected on

July 7, 2016. Net loss for the six months ended June 30, 2017 and

2016, includes non-cash vessel impairment charges of $3.3 million

and $69.3 million, respectively. Net loss for the six months ended

June 30, 2017 also includes the gain on sale of vessels in the

amount of $7.7 million due to the sale of five vessels during the

period. Revenues increased to $83.6 million for the six months

ended June 30, 2017 compared to $52.8 million for the six months

ended June 30, 2016 due to higher spot market rates achieved by the

majority of our vessels partially offset by the operation of fewer

vessels. TCE rates obtained by the Company increased to $7,458 per

day for the six months ended June 30, 2017 from $3,622 per day for

the six months ended June 30, 2016, due to higher rates achieved by

the majority of the vessels in our fleet. Total operating expenses

for the six months ended June 30, 2017 and 2016 were $99.4 million

and $200.5 million, respectively. Total operating expenses,

excluding a non-cash vessel impairment charge of $3.3 million

relating to the revaluation of the Genco Surprise to its fair value

as of June 30, 2017 and the gain on sale of vessels of $7.7

million, were $103.8 million for the six months ended June 30,

2017. This compares to adjusted total operating expenses, which

excludes non-cash vessel impairment charges totaling $69.3 million

relating to the revaluation of ten vessels to their estimated net

realizable value, of $131.3 million for the six months ended June

30, 2016. We believe the presentation of the adjusted amounts above

is useful to investors in understanding our current performance and

financial condition, as it excludes items that may not be

indicative of our core operating results. General and

administrative expenses for the six months ended June 30, 2017

decreased to $10.7 million as compared to $22.2 million for the

same period of 2016, primarily due to a decrease in nonvested stock

amortization expense. Daily vessel operating expenses per vessel

were $4,364 versus $4,542 in the comparative periods predominantly

due to lower expenses related to crewing and insurance, as well as

the timing of purchases of spares and stores partially offset by

higher drydocking related expenses.

After the second quarter of 2017, the Company

decided to dispose of the five 1999-built vessels in its fleet at

times and on terms to be determined in the future. Since the

estimated future undiscounted cash flows for each of these vessels

did not exceed their net book values, we have adjusted their values

to fair market value and will incur an impairment loss of

approximately $19 million in the third quarter of 2017.

Liquidity and Capital

Resources

Cash Flow

Net cash used in operating activities for the

six months ended June 30, 2017 and 2016 was $0.6 million and $41.2

million, respectively. Included in the net loss during the six

months ended June 30, 2017 and 2016 are $3.3 million and $72.0

million of non-cash impairment charges, respectively. Also included

in the net loss during the six months ended June 30, 2017 and 2016

are $2.3 million and $10.9 million, respectively, of non-cash

amortization of nonvested stock compensation related to the

Company’s equity incentive plans. There was also a gain on sale of

vessels in the amount of $7.7 million due to the sale of five

vessels and paid in kind interest of $3.0 million related to the

$400 Million Credit Facility during the six months ended June 30,

2017. Depreciation and amortization expense for the six months

ended June 30, 2017 decreased by $3.7 million primarily due to the

operation of fewer vessels in the second quarter of 2017 as well as

the revaluation of ten of our vessels to their estimated net

realizable value during the first half of 2016. Additionally, the

fluctuation in prepaid expense and other current assets decreased

by $8.8 million due to the timing of prepaid payments made and the

hull and machinery insurance claims for repairs of the Genco Tiger

and Baltic Lion. Lastly, there was a $4.2 million increase in

deferred drydocking costs incurred because there were more vessels

that completed drydocking during the six months ended June 30, 2017

as compared to the same period during 2016. This was offset by

an increase in the fluctuation in accounts payable and accrued

expenses of $2.9 million due to the timing payments.

Net cash provided by investing activities was

$17.0 million during the six months ended June 30, 2017 as compared

to $3.7 million during the six months ended June 30, 2016.

The increase is primarily due to a $13.6 million increase in the

proceeds from the sale of five vessels during the six months ended

June 30, 2017 as compared to the scrapping of one vessel during the

six months ended June 30, 2016. Additionally, there was a $1.8

million decrease in deposits of restricted cash during the six

months ended June 30, 2017 primarily as a result of the release of

restricted cash for required capital expenditures for our

vessels. These increases were partially offset by a decrease

of $2.4 million for the proceeds from the sale of

available-for-sale securities for the six months ended June 30,

2016.

Net cash used in financing activities was $2.7

million and $26.9 million during the six months ended June 30, 2017

and 2016, respectively. Net cash used in financing activities

of $2.7 million for the six months ended June 30, 2017 consisted

primarily of the following: $1.1 million payment of Series A

Preferred Stock issuance costs; $1.4 million repayment of debt

under the 2014 Term Loan Facilities; and $0.2 million repayment of

debt under the $400 Million Credit Facility. Net cash

used in financing activities of $26.9 million for the six months

ended June 30, 2016 consisted primarily of the following: $10.2

million repayment of debt under the $253 Million Term Loan

Facility, $6.0 million repayment of debt under the $148

Million Credit Facility, $3.8 million repayment of debt under the

$100 Million Term Loan Facility, $3.3 million repayment of

debt under the 2015 Revolving Credit Facility, $1.4 million

repayment of debt under $44 Million Term Loan Facility, $1.4

million repayment of debt under the 2014 Term Loan Facilities; and

$0.8 million repayment of debt under the $22 Million Term Loan

Facility. On November 15, 2016, the $400 Million Credit

Facility refinanced the following six credit facilities: the $253

Million Term Loan Facility, the $148 Million Credit Facility,

the $100 Million Term Loan Facility, the 2015 Revolving Credit

Facility, the $44 Million Term Loan Facility and the $22 Million

Term Loan Facility.

Capital Expenditures

We make capital expenditures from time to time

in connection with vessel acquisitions. As of August 7, 2017, our

fleet consists of 13 Capesize, six Panamax, four Ultramax, 21

Supramax, one Handymax and 15 Handysize vessels with an aggregate

capacity of approximately 4,688,000 dwt.

In addition to acquisitions that we may

undertake in future periods, we will incur additional capital

expenditures due to special surveys and drydockings for our fleet.

Four of our vessels completed drydocking during the second quarter

of 2017. We currently expect five of our vessels to be drydocked

during the remainder of 2017 including one Capesize, two Panamax

and two Supramax vessels.

We estimate our capital expenditures related to

drydocking for our fleet through 2017 to be:

| |

|

Q3 2017 |

|

Q4 2017 |

| Estimated Costs

(1) |

|

$3.2

million |

|

$0.9

million |

| Estimated Offhire Days

(2) |

|

80 |

|

20 |

(1) Estimates are based on our budgeted cost of

drydocking our vessels in China. Actual costs will vary based on

various factors, including where the drydockings are actually

performed. We expect to fund these costs with cash from operations.

These costs do not include drydock expense items that are reflected

in vessel operating expenses or potential costs associated with the

installation of ballast water treatment systems.

(2) Actual length will vary based on the

condition of the vessel, yard schedules and other factors.

Four of our vessels completed drydocking during

the second quarter of 2017 while one other vessel began drydocking

during the end of the second quarter. The offhire days recorded for

these vessels during the second quarter of 2017 due to scheduled

drydocking amounted to 100.6 days. Capitalized costs associated

with drydocking incurred during the second quarter of 2017 were

approximately $2.5 million.

Summary Consolidated Financial

and Other Data

The following table summarizes Genco Shipping

& Trading Limited’s selected consolidated financial and other

data for the periods indicated below.

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months EndedJune 30, 2017 |

|

Three Months EndedJune 30, 2016 |

|

Six Months EndedJune 30, 2017 |

|

Six Months EndedJune 30, 2016 |

|

| |

|

|

|

(Dollars in thousands, except share and per share

data) |

|

(Dollars in thousands, except share and per share

data) |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

(unaudited) |

|

(unaudited) |

|

|

INCOME STATEMENT DATA: |

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

| |

Voyage

revenues |

$ |

45,370 |

|

|

$ |

31,460 |

|

|

$ |

83,619 |

|

|

$ |

51,590 |

|

|

| |

Service

revenues |

|

- |

|

|

|

414 |

|

|

|

- |

|

|

|

1,225 |

|

|

| |

|

Total

revenues |

|

45,370 |

|

|

|

31,874 |

|

|

|

83,619 |

|

|

|

52,815 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| |

Voyage

expenses |

|

951 |

|

|

|

3,074 |

|

|

|

4,192 |

|

|

|

6,970 |

|

|

| |

Vessel

operating expenses |

|

23,852 |

|

|

|

28,538 |

|

|

|

48,736 |

|

|

|

57,665 |

|

|

| |

General and administrative expenses (inclusive of

nonvested stock amortization |

|

5,752 |

|

|

|

11,589 |

|

|

|

10,661 |

|

|

|

22,158 |

|

|

| |

expense of $1.6 million, $5.4 million, $2.3 million and

$10.9 million respectively) |

|

|

|

|

|

|

|

|

| |

Technical

management fees |

|

1,871 |

|

|

|

2,264 |

|

|

|

3,852 |

|

|

|

4,550 |

|

|

| |

Depreciation and amortization |

|

18,185 |

|

|

|

19,686 |

|

|

|

36,358 |

|

|

|

40,025 |

|

|

| |

Other

operating income |

|

- |

|

|

|

(182 |

) |

|

|

- |

|

|

|

(182 |

) |

|

| |

Impairment

of vessel assets |

|

3,339 |

|

|

|

67,594 |

|

|

|

3,339 |

|

|

|

69,278 |

|

|

| |

(Gain) loss

on sale of vessels |

|

(1,343 |

) |

|

|

77 |

|

|

|

(7,712 |

) |

|

|

77 |

|

|

| |

|

Total

operating expenses |

|

52,607 |

|

|

|

132,640 |

|

|

|

99,426 |

|

|

|

200,541 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

(7,237 |

) |

|

|

(100,766 |

) |

|

|

(15,807 |

) |

|

|

(147,726 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other

(expense) income: |

|

|

|

|

|

|

|

|

| |

Impairment

of investment |

|

- |

|

|

|

(2,696 |

) |

|

|

- |

|

|

|

(2,696 |

) |

|

| |

Other

expense |

|

(50 |

) |

|

|

(50 |

) |

|

|

(115 |

) |

|

|

(174 |

) |

|

| |

Interest

income |

|

338 |

|

|

|

33 |

|

|

|

512 |

|

|

|

95 |

|

|

| |

Interest

expense |

|

(7,564 |

) |

|

|

(7,013 |

) |

|

|

(14,702 |

) |

|

|

(14,127 |

) |

|

| |

|

Other

expense |

|

(7,276 |

) |

|

|

(9,726 |

) |

|

|

(14,305 |

) |

|

|

(16,902 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss before

reorganization items, net |

|

(14,513 |

) |

|

|

(110,492 |

) |

|

|

(30,112 |

) |

|

|

(164,628 |

) |

|

| |

Reorganization items, net |

|

- |

|

|

|

(65 |

) |

|

|

- |

|

|

|

(160 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss before

income taxes |

|

(14,513 |

) |

|

|

(110,557 |

) |

|

|

(30,112 |

) |

|

|

(164,788 |

) |

|

| |

Income tax

expense |

|

- |

|

|

|

(96 |

) |

|

|

- |

|

|

|

(350 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(14,513 |

) |

|

$ |

(110,653 |

) |

|

$ |

(30,112 |

) |

|

$ |

(165,138 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss

per share - basic |

$ |

(0.42 |

) |

|

$ |

(15.32 |

) |

|

$ |

(0.89 |

) |

|

$ |

(22.87 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss

per share - diluted |

$ |

(0.42 |

) |

|

$ |

(15.32 |

) |

|

$ |

(0.89 |

) |

|

$ |

(22.87 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average common shares outstanding - basic |

|

34,430,766 |

|

|

|

7,221,735 |

|

|

|

33,965,835 |

|

|

|

7,220,265 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average common shares outstanding - diluted |

|

34,430,766 |

|

|

|

7,221,735 |

|

|

|

33,965,835 |

|

|

|

7,220,265 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

June 30, 2017 |

|

December 31, 2016 |

|

|

|

|

BALANCE SHEET DATA: |

|

|

|

(unaudited) |

|

|

|

|

| Cash

(including restricted cash) |

|

|

$ |

180,995 |

|

|

$ |

169,068 |

|

|

|

|

| Current

assets |

|

|

|

184,354 |

|

|

|

172,605 |

|

|

|

|

| Total

assets |

|

|

|

1,541,719 |

|

|

|

1,568,960 |

|

|

|

|

| Current

liabilities (excluding current portion of long-term debt) |

|

|

|

22,003 |

|

|

|

24,373 |

|

|

|

|

| Current

portion of long-term debt |

|

|

|

9,576 |

|

|

|

4,576 |

|

|

|

|

| Long-term

debt (net of $10.2 million and $11.4 million of unamortized debt

issuance |

|

|

|

506,044 |

|

|

|

508,444 |

|

|

|

|

| |

|

costs at

June 30, 2017 and December 31, 2016, respectively) |

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

1,001,868 |

|

|

|

1,029,699 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Six Months EndedJune 30, 2017 |

|

Six Months EndedJune 30, 2016 |

|

|

|

| |

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

| Net cash

used in operating activities |

|

|

$ |

(585 |

) |

|

$ |

(41,230 |

) |

|

|

|

| Net cash

provided by investing activities |

|

|

|

17,022 |

|

|

|

3,697 |

|

|

|

|

| Net cash

used in financing activities |

|

|

|

(2,684 |

) |

|

|

(26,879 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months EndedJune 30, 2017 |

|

Three Months EndedJune 30, 2016 |

|

Six Months EndedJune 30, 2017 |

|

Six Months EndedJune 30, 2016 |

|

| |

|

|

|

(Dollars in thousands) |

|

(Dollars in thousands) |

|

| EBITDA Reconciliation: |

(unaudited) |

|

(unaudited) |

|

| |

Net

loss |

$ |

(14,513 |

) |

|

$ |

(110,653 |

) |

|

$ |

(30,112 |

) |

|

$ |

(165,138 |

) |

|

| |

+ |

Net interest expense |

|

7,226 |

|

|

|

6,980 |

|

|

|

14,190 |

|

|

|

14,032 |

|

|

| |

+ |

Income tax expense |

|

- |

|

|

|

96 |

|

|

|

- |

|

|

|

350 |

|

|

| |

+ |

Depreciation and amortization |

|

18,185 |

|

|

|

19,686 |

|

|

|

36,358 |

|

|

|

40,025 |

|

|

| |

|

EBITDA(1) |

$ |

10,898 |

|

|

$ |

(83,891 |

) |

|

$ |

20,436 |

|

|

$ |

(110,731 |

) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

|

|

June 30, 2017 |

|

June 30, 2016 |

|

June 30, 2017 |

|

June 30, 2016 |

|

|

GENCO CONSOLIDATED FLEET DATA: |

(unaudited) |

|

(unaudited) |

|

| Total

number of vessels at end of period |

|

60 |

|

|

|

69 |

|

|

|

60 |

|

|

|

69 |

|

|

| Average

number of vessels (2) |

|

60.5 |

|

|

|

69.5 |

|

|

|

61.7 |

|

|

|

69.8 |

|

|

| Total

ownership days for fleet (3) |

|

5,505 |

|

|

|

6,326 |

|

|

|

11,167 |

|

|

|

12,696 |

|

|

| Total

available days for fleet (4) |

|

5,264 |

|

|

|

6,146 |

|

|

|

10,650 |

|

|

|

12,321 |

|

|

| Total

operating days for fleet (5) |

|

5,086 |

|

|

|

6,107 |

|

|

|

10,415 |

|

|

|

12,177 |

|

|

| Fleet

utilization (6) |

|

96.6 |

% |

|

|

99.4 |

% |

|

|

97.8 |

% |

|

|

98.8 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE DAILY RESULTS: |

|

|

|

|

|

|

|

|

| Time

charter equivalent (7) |

$ |

8,439 |

|

|

$ |

4,618 |

|

|

$ |

7,458 |

|

|

$ |

3,622 |

|

|

| Daily

vessel operating expenses per vessel (8) |

|

4,333 |

|

|

|

4,511 |

|

|

|

4,364 |

|

|

|

4,542 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

1) EBITDA represents net income (loss) plus net interest

expense, taxes, and depreciation and amortization. EBITDA is

included because it is used by management and certain investors as

a measure of operating performance. EBITDA is used by analysts in

the shipping industry as a common performance measure to compare

results across peers. Our management uses EBITDA as a performance

measure in consolidating internal financial statements and it is

presented for review at our board meetings. For these reasons, we

believe that EBITDA is a useful measure to present to our

investors. EBITDA is not an item recognized by U.S. GAAP (i.e.

non-GAAP measure) and should not be considered as an alternative to

net income, operating income or any other indicator of a company's

operating performance required by U.S. GAAP. EBITDA is not a source

of liquidity or cash flows as shown in our consolidated statement

of cash flows. The definition of EBITDA used here may not be

comparable to that used by other companies.2) Average number of

vessels is the number of vessels that constituted our fleet for the

relevant period, as measured by the sum of the number of days each

vessel was part of our fleet during the period divided by the

number of calendar days in that period.3) We define ownership days

as the aggregate number of days in a period during which each

vessel in our fleet has been owned by us. Ownership days are an

indicator of the size of our fleet over a period and affect both

the amount of revenues and the amount of expenses that we record

during a period.4) We define available days as the number of our

ownership days less the aggregate number of days that our vessels

are off-hire due to scheduled repairs or repairs under guarantee,

vessel upgrades or special surveys and the aggregate amount of time

that we spend positioning our vessels between time charters.

Companies in the shipping industry generally use available days to

measure the number of days in a period during which vessels should

be capable of generating revenues.5) We define operating days as

the number of our available days in a period less the aggregate

number of days that our vessels are off-hire due to unforeseen

circumstances. The shipping industry uses operating days to measure

the aggregate number of days in a period during which vessels

actually generate revenues.6) We calculate fleet utilization by

dividing the number of our operating days during a period by the

number of our available days during the period. The shipping

industry uses fleet utilization to measure a company's efficiency

in finding suitable employment for its vessels and minimizing the

number of days that its vessels are off-hire for reasons other than

scheduled repairs or repairs under guarantee, vessel upgrades,

special surveys or vessel positioning.7) We define TCE rates as our

net voyage revenue (voyage revenues less voyage expenses (including

voyage expenses to Parent)) divided by the number of our available

days during the period, which is consistent with industry

standards. TCE rate is a common shipping industry performance

measure used primarily to compare daily earnings generated by

vessels on time charters with daily earnings generated by vessels

on voyage charters, because charterhire rates for vessels on voyage

charters are generally not expressed in per-day amounts while

charterhire rates for vessels on time charters generally are

expressed in such amounts.8) We define daily vessel operating

expenses to include crew wages and related costs, the cost of

insurance expenses relating to repairs and maintenance (excluding

drydocking), the costs of spares and consumable stores, tonnage

taxes and other miscellaneous expenses. Daily vessel operating

expenses are calculated by dividing vessel operating expenses by

ownership days for the relevant period.

Genco Shipping & Trading Limited’s

Fleet

Genco Shipping & Trading Limited transports

iron ore, coal, grain, steel products and other drybulk cargoes

along worldwide shipping routes. As of August 7, 2017, Genco

Shipping & Trading Limited’s fleet consists of 13 Capesize, six

Panamax, four Ultramax, 21 Supramax, one Handymax and 15 Handysize

vessels with an aggregate capacity of approximately 4,688,000

dwt.

Our current fleet contains 15 groups of sister

ships, which are vessels of virtually identical sizes and

specifications. We believe that maintaining a fleet that includes

sister ships reduces costs by creating economies of scale in the

maintenance, supply and crewing of our vessels. As of August 7,

2017, the average age of our current fleet was 9.3 years.

The following table reflects the employment of

Genco’s fleet as of August 7, 2017:

|

Vessel |

Year Built |

Charterer |

CharterExpiration(1) |

|

Cash DailyRate(2) |

|

|

|

|

|

|

|

|

Capesize Vessels |

|

|

|

|

|

| Genco

Augustus |

2007 |

Swissmarine Services S.A. |

February 2018 |

|

106% of BCI |

| Genco

Tiberius |

2007 |

Cargill International S.A. |

September 2017 |

|

$10,500 |

| Genco

London |

2007 |

Swissmarine Services S.A. |

May

2018 |

|

98% of BCI(3) |

| Genco

Titus |

2007 |

Louis Dreyfus Company Freight Asia Pte. Ltd. |

September 2017 |

|

$12,000 |

| Genco

Constantine |

2008 |

Cargill Ocean Transportation Pte. Ltd./Oldendorff GMBH &

Co. |

Aug./Sep. 2017 |

|

$8,750/$14,500(4) |

| Genco

Hadrian |

2008 |

Swissmarine Services S.A. |

August

2017 |

|

98.5% of BCI |

| Genco

Commodus |

2009 |

Swissmarine Asia Pte. Ltd. |

January 2018 |

|

88% of BCI(5) |

| Genco

Maximus |

2009 |

Trafigura Maritime Logistics Pte. Ltd. |

August

2017 |

|

$11,000 |

| Genco

Claudius |

2010 |

Louis Dreyfus Company Freight Asia Pte. Ltd. |

September 2017 |

|

$13,000 |

| Genco

Tiger |

2011 |

Uniper Global Commodities SE. |

October 2017 |

|

$10,750 |

| Baltic

Lion |

2012 |

Koch Shipping Pte. Ltd. |

October 2017 |

|

$15,300(6) |

| Baltic

Bear |

2010 |

Classic Maritime Inc./Trafigura Maritime Logistics Pte. Ltd. |

Jul./Oct. 2017 |

|

$10,500/$10,750 (7) |

| Baltic

Wolf |

2010 |

Cargill International S.A. |

February 2018 |

|

$15,350 |

|

|

|

|

|

|

|

|

Panamax Vessels |

|

|

|

|

|

| Genco

Beauty |

1999 |

Intermarine Shipping Co., Ltd. |

June

2017 |

|

$4,600(8) |

| Genco

Knight |

1999 |

Cargill International S.A. |

August

2017 |

|

$9,000(9) |

| Genco

Vigour |

1999 |

Raffles Shipping International Pte. Ltd. |

September 2017 |

|

$10,500(10) |

| Genco

Surprise |

1998 |

Swissmarine Asia Pte., Ltd. |

October 2017 |

|

$8,000(11) |

| Genco

Raptor |

2007 |

Cofco Agri Freight Geneva, S.A./Golden Ocean Trading Ltd.

Bermuda |

Jul./Oct. 2017 |

|

$8,500/$9,650(12) |

| Genco

Thunder |

2007 |

Swissmarine Services S.A. |

August

2017 |

|

100% of BPI |

|

|

|

|

|

|

|

|

Ultramax Vessels |

|

|

|

|

|

| Baltic

Hornet |

2014 |

Swissmarine Asia Pte. Ltd. |

June

2018 |

|

113.5% of BSI |

| Baltic

Wasp |

2015 |

Pioneer Navigation Ltd. |

July

2018 |

|

$11,000 |

| Baltic

Scorpion |

2015 |

SK

Shipping Co., Ltd. |

September 2017 |

|

$2,700(13) |

| Baltic

Mantis |

2015 |

Pioneer Navigation Ltd. |

August

2017 |

|

115% of BSI |

|

|

|

|

|

|

|

|

Supramax Vessels |

|

|

|

|

|

| Genco

Predator |

2005 |

Western Bulk Carriers A/S/Cargill International S.A. |

Aug./Sep. 2017 |

|

$14,250/$13,000(14) |

| Genco

Warrior |

2005 |

Centurion Bulk Pte. Ltd., Singapore/Western Bulk Carriers A/S |

Aug./Sep. 2017 |

|

98.5% of BSI/ $8,250(15) |

| Genco

Hunter |

2007 |

Pioneer Navigation Ltd. |

August

2017 |

|

104% of BSI |

| Genco

Cavalier |

2007 |

Bulkhandling Handymax A/S |

November 2017 |

|

Spot Pool(16) |

| Genco

Lorraine |

2009 |

Bulkhandling Handymax A/S |

November 2017 |

|

Spot Pool(16) |

| Genco

Loire |

2009 |

Bulkhandling Handymax A/S |

November 2017 |

|

Spot Pool(16) |

| Genco

Aquitaine |

2009 |

Gearbulk Pool Ltd., Norway |

August

2017 |

|

$16,000 (17) |

| Genco

Ardennes |

2009 |

Norvic Shipping International Ltd./ED&F Man Shipping Ltd. |

Aug./Sep. 2017 |

|

Backhaul/$9,000 (18) |

| Genco

Auvergne |

2009 |

Western Bulk Pte. Ltd., Singapore |

August

2017 |

|

$9,350(19) |

| Genco

Bourgogne |

2010 |

Clipper Sapphire Pool |

August

2017 |

|

Spot Pool |

| Genco

Brittany |

2010 |

Clipper Bulk Shipping NV |

August

2017 |

|

$3,500(20) |

| Genco

Languedoc |

2010 |

Oldendorff Carriers GMBH & Co. |

September 2017 |

|

$7,900(21) |

| Genco

Normandy |

2007 |

Bulkhandling Handymax A/S |

November 2017 |

|

Spot Pool(16) |

| Genco

Picardy |

2005 |

Centurion Bulk Pte. Ltd., Singapore |

October 2017 |

|

$9,000(22) |

| Genco

Provence |

2004 |

Eastern Bulk A/S/Cam Negoce Paris |

Jul./Oct. 2017 |

|

$11,600/Voyage (23) |

| Genco

Pyrenees |

2010 |

Clipper Sapphire Pool/Ultrabulk A/S |

Aug./Sep. 2017 |

|

Spot Pool/$6,000 (24) |

| Genco

Rhone |

2011 |

Sims Group Global Trade Corp./ Marubeni Grain and Oilseeds Trading

Asia Pte. Ltd. |

Jul./Aug. 2017 |

|

Voyage(25) |

| Baltic

Leopard |

2009 |

Bulkhandling Handymax A/S |

November 2017 |

|

Spot Pool(16) |

| Baltic

Panther |

2009 |

Bulkhandling Handymax A/S |

November 2017 |

|

Spot Pool(16) |

| Baltic

Jaguar |

2009 |

Oldendorff GMBH & Co./Cargill Americas Inc. |

Aug./Sep. 2017 |

|

$3,350/Voyage (26) |

| Baltic

Cougar |

2009 |

Bulkhandling Handymax A/S |

November 2017 |

|

Spot Pool(16) |

|

|

|

|

|

|

|

|

Handymax Vessels |

|

|

|

|

|

| Genco

Muse |

2001 |

Centurion Bulk Pte. Ltd. Singapore |

Jul./Sep. 2017 |

|

$10,250/ $8,500(27) |

|

|

|

|

|

|

|

|

Handysize Vessels |

|

|

|

|

|

| Genco

Progress |

1999 |

Clipper Logger Pool |

August

2017 |

|

Spot Pool |

| Genco

Explorer |

1999 |

Clipper Logger Pool/Xianglong Shipping Co., Ltd. |

Jul./Aug. 2017 |

|

Spot Pool/ $8,000(28) |

| Baltic

Hare |

2009 |

Clipper Logger Pool |

August

2017 |

|

Spot Pool |

| Baltic

Fox |

2010 |

Clipper Logger Pool |

November 2017 |

|

Spot Pool |

| Genco

Charger |

2005 |

Clipper Logger Pool |

August

2017 |

|

Spot Pool |

| Genco

Challenger |

2003 |

Clipper Logger Pool/Clipper Bulk Shipping Pte. Ltd./Sun United

Maritime Ltd. |

Jul./Aug./Oct. 2017 |

|

Spot Pool/$5,000/ $6,000(29) |

| Genco

Champion |

2006 |

Clipper Logger Pool |

November 2017 |

|

Spot Pool |

| Baltic

Wind |

2009 |

Ultrabulk A/S |

September 2017 |

|

$9,000(30) |

| Baltic

Cove |

2010 |

Clipper Bulk Shipping Ltd. |

September 2017 |

|

$5,750 |

| Baltic

Breeze |

2010 |

Clipper Bulk Shipping |

August

2017 |

|

$8,000(31) |

| Genco

Ocean |

2010 |

Thorco Bulk A/S |

August

2017 |

|

$13,500(32) |

| Genco

Bay |

2010 |

Clipper Bulk Shipping |

September 2017 |

|

$8,000(33) |

| Genco

Avra |

2011 |

Ultrabulk S.A. |

August

2017 |

|

104% of BHSI |

| Genco

Mare |

2011 |

Pioneer Navigation Ltd. |

September 2017 |

|

103.5% of BHSI |

| Genco

Spirit |

2011 |

Ultrabulk S.A. |

September 2017 |

|

$8,500(34) |

(1) The charter expiration dates presented represent the

earliest dates that our charters may be terminated in the ordinary

course. Under the terms of certain contracts, the charterer is

entitled to extend the time charter from two to four months in

order to complete the vessel's final voyage plus any time the

vessel has been off-hire.(2) Time charter rates presented are the

gross daily charterhire rates before third-party brokerage

commission generally ranging from 1.25% to 6.25%. In a time

charter, the charterer is responsible for voyage expenses such as

bunkers, port expenses, agents’ fees and canal dues.(3) We have

reached an agreement with Swissmarine Services S.A. on a time

charter for 11 to 14.5 months at a rate based on 98% of the Baltic

Capesize Index 5TC (BCI), as published by the Baltic Exchange,

reflected in daily reports. Hire is paid every 15 days in arrears

less a 5.00% third-party brokerage commission. The vessel delivered

to charterers on June 19, 2017 after completion of drydocking for

scheduled repairs.(4) We have reached an agreement with Oldendorff

GMBH & Co. on a time charter for approximately 45 days at a

rate of $14,500 per day. Hire is paid every 15 days in advance less

a 5.00% third-party brokerage commission. The vessel is expected to

deliver to charterers on or about August 11, 2017.(5) We have

agreed to an extension with Swissmarine Asia Pte. Ltd. on a time

charter for 6.5 to 9.5 months at a rate on 88% of the BCI, as

published in daily reports. Hire is paid every 15 days in arrears

less a 5.00% third-party brokerage commission. The extension began

on June 26, 2017.(6) We have reached an agreement with Koch

Shipping Pte. Ltd. on a time charter for 5 to 8.5 months at a rate

of $15,300 per day except for the first 50 days in which the hire

rate is $10,000 per day. Hire is paid every 15 days in advance less

a 5.00% third-party brokerage commission. The vessel delivered to

charterers on May 18, 2017.(7) We have reached an agreement with

Trafigura Maritime Logistics Pte. Ltd. on a time charter for 3.5 to

7.5 months at a rate of $10,750 per day. Hire is paid every 15 days

in advance less a 5.00% third-party brokerage commission. The

vessel delivered to charterers on July 12, 2017.(8) The vessel

redelivered to Genco on June 29, 2017 and is currently in

drydocking for scheduled maintenance.(9) We have reached an

agreement with Cargill International S.A. on a time charter trip at

a rate of $9,000 per day. Hire is paid every 15 days in advance

less a 5.00% third-party brokerage commission. The vessel delivered

to charterers on July 2, 2017 after repositioning. A ballast bonus

was awarded after the repositioning period. The vessel redelivered

to Genco on April 17, 2017 and then completed drydocking for

scheduled maintenance.(10) We have reached an agreement with

Raffles Shipping International Pte. Ltd. on a time charter for

approximately 55 days at a rate of $10,500 per day. Hire is paid

every 15 days in advance less a 5.00% third-party brokerage

commission. The vessel delivered to charterers on July 10, 2017

after repositioning. A ballast bonus was awarded after the

repositioning period. The vessel redelivered to Genco on May 26,

2017.(11) We have reached an agreement with Swissmarine Asia Pte.,

Ltd. on a time charter for 3.5 to 8.5 months at a rate of $8,000

per day. Hire is paid every 15 days in advance less a 5.00%

third-party brokerage commission. The vessel delivered to

charterers on June 18, 2017.(12) We have reached an agreement with

Golden Ocean Trading Ltd. Bermuda on a time charter for

approximately 60 days at a rate of $9,650 per day. Hire is paid

every 15 days in advance less a 5.00% third-party brokerage

commission. The vessel delivered to charterers on August 4, 2017

after repositioning. The vessel had redelivered to Genco on July

29, 2017.(13) We have reached an agreement with SK Shipping Co.,

Ltd. on a time charter for approximately 75 days at a rate of

$2,700 per day. If the time charter exceeds 66 days then the hire

rate will be $8,500 per day. Hire is paid every 15 days in advance

less a 6.25% third-party brokerage commission. The vessel delivered

to charterers on June 23, 2017.(14) We have reached an agreement

with Cargill International S.A. on a time charter for approximately

40 days at a rate of $13,000 per day. Hire is paid every 15 days in

advance less a 5.00% third-party brokerage commission. The vessel

is expected to deliver to charterers on or about August 14, 2017

after repositioning. The vessel redelivered to Genco on August 1,

2017.(15) We have reached an agreement with Western Bulk Carriers

A/S on a time charter for approximately 35 days at a rate of $8,250

per day. Hire is paid every 15 days in advance less a 5.00%

third-party brokerage commission. The vessel delivered to

charterers on August 1, 2017.(16) We have reached an agreement to

enter these vessels into the Bulkhandling Handymax A/S Pool, a

vessel pool trading in the spot market of which Torvald Klaveness

acts as the pool manager. Genco can withdraw a vessel with three

months’ notice.(17) We have reached an agreement with Gearbulk Pool

Ltd., Norway on a time charter for approximately 40 days at a rate

of $16,000 per day. Hire is paid every 15 days in advance less a

5.00% third-party brokerage commission. The vessel delivered to

charterers on April 29, 2017 after repositioning. The vessel had

redelivered to Genco on April 10, 2017.(18) We have reached an

agreement with ED&F Man Shipping Ltd. on a time charter for

approximately 25 days at a rate of $9,000 per day. Hire is paid

every 15 days in advance less a 5.00% third-party brokerage

commission. The vessel is expected to deliver to charterers on or

about August 8, 2017.(19) We have reached an agreement with Western

Bulk Pte. Ltd., Singapore on a time charter for 3 to 5.5 months at

a rate of $9,350 per day. Hire is paid every 15 days in advance

less a 5.00% third-party brokerage commission. The vessel delivered

to charterers on March 19, 2017 after repositioning. The vessel had

redelivered to Genco on March 16, 2017.(20) We have reached an

agreement with Clipper Bulk Shipping NV on a time charter for

approximately 50 days at a rate of $3,500. If the time charter

exceeds 50 days then the hire rate will be $7,000 per day. Hire is

paid every 15 days in advance less a 3.75% third-party broker

commission. The vessel delivered to charterers on June 19,

2017.(21) We have reached an agreement with Oldendorff Carriers

GMBH & Co. on a time charter for 3 to 5.5 months at a rate of

$7,900 per day. Hire is paid every 15 days in advance less a 5.00%

third-party brokerage commission. The vessel delivered to

charterers on June 21, 2017.(22) We have agreed to an extension

with Centurion Bulk Pte. Ltd., Singapore on a time charter at a

rate of $9,000 per day. The minimum and maximum expiration dates of

the time charter are October 1, 2017 and December 1, 2017,

respectively. Hire is paid every 15 days in advance less a 5.00%

third-party broker age commission.(23) We have reached an agreement

with Cam Negoce Paris for one voyage for approximately 61 days.(24)

We have reached an agreement with Ultrabulk A/S on a time charter

for approximately 25 days at a rate of $6,000 per day. Hire is paid

every 15 days in advance less a 5.00% third-party brokerage

commission. The vessel is expected to deliver to charterers on or

about August 9, 2017.(25) We have reached an agreement with

Marubeni Grain and Oilseeds Trading Asia Pte. Ltd. for one voyage

for approximately 35 days.(26) We have reached an agreement with

Cargill Americas Inc. for one voyage for approximately 30 days.(27)

We have agreed to an extension with Centurion Bulk Pte. Ltd.

Singapore on a time charter for 2.5 to 5.5 months at a rate of

$8,500 per day. Hire is paid every 15 days in advance less a 5.00%

third-party brokerage commission. The extension began on July 4,

2017.(28) We have reached an agreement with Xianglong Shipping Co.,

Ltd. on a time charter for approximately 20 days at a rate of

$8,000 per day. Hire is paid every 15 days in advance less a 5.00%

third-party brokerage commission. The vessel delivered to

charterers on July 21, 2017.(29) We have reached an agreement with

Sun United Maritime Ltd. on a time charter for approximately 65

days at a rate of $6,000 per day. If the time charter extends

beyond 65 days, the hire rate will be $7,500 per day. Hire is paid

every 15 days in advance less a 5.00% third-party brokerage

commission. The vessel is expected to deliver to charterers on or

about August 17, 2017.(30) We have reached an agreement with

Ultrabulk A/S on a time charter for 2.5 to 5.5 months at a rate of

$9,000 per day. Hire is paid every 15 days in advance less a 5.00%

third-party brokerage commission. The vessel delivered to

charterers on April 23, 2017.(31) We have reached an agreement with

Clipper Bulk Shipping on a time charter for 3 to 5.5 months at a

rate of $8,000 per day. Hire is paid every 15 days in advance less

a 5.00% third-party brokerage commission. The vessel delivered to

charterers on March 15, 2017 after repositioning. The vessel had

redelivered to Genco on February 21, 2017.(32) We have reached an

agreement with Thorco Bulk A/S on a time charter for approximately

30 days at a rate of $13,500 per day. Hire is paid every 15 days in

advance less a 5.00% third-party brokerage commission. The vessel

delivered to charterers on July 2, 2017 after repositioning. The

vessel had redelivered to Genco on June 19, 2017.(33) We have

reached an agreement with Clipper Bulk Shipping on a time charter

for 3 to 5.5 months at a rate of $8,000 per day. Hire is paid every

15 days in advance less a 5.00% third-party brokerage commission.

The vessel delivered to charterers on March 28, 2017.(34) We have

reached an agreement with Ultrabulk S.A. on a time charter for 2.5

to 5.5 months at a rate of $8,500 per day. Hire is paid every 15

days in advance less a 5.00% third-party brokerage commission. The

vessel delivered to charterers on May 24, 2017.

About Genco Shipping & Trading

Limited

Genco Shipping & Trading Limited transports

iron ore, coal, grain, steel products and other drybulk cargoes

along worldwide shipping routes. As of August 7, 2017, Genco

Shipping & Trading Limited’s fleet consists of 13 Capesize, six

Panamax, four Ultramax, 21 Supramax, one Handymax and 15 Handysize

vessels with an aggregate capacity of approximately 4,688,000

dwt.

Conference Call Announcement

Genco Shipping & Trading Limited will hold a

conference call on Tuesday, August 8, 2017 at 10:00 a.m. Eastern

Time to discuss its 2017 second quarter financial results. The

conference call and a presentation will be simultaneously webcast

and will be available on the Company’s website,

www.GencoShipping.com. To access the conference call, dial (323)

794-2130 or (866) 564-2842 and enter passcode 2914626. A replay of

the conference call can also be accessed for two weeks by dialing

(888) 203-1112 or (719) 457-0820 and entering the passcode 2914626.

The Company intends to place additional materials related to the

earnings announcement, including a slide presentation, on its

website prior to the conference call.

Website Information

We intend to use our website,

www.GencoShipping.com, as a means of disclosing material non-public

information and for complying with our disclosure obligations under

Regulation FD. Such disclosures will be included in our website’s

Investor Relations section. Accordingly, investors should monitor

the Investor Relations portion of our website, in addition to

following our press releases, SEC filings, public conference calls,

and webcasts. To subscribe to our e-mail alert service, please

click the “Receive E-mail Alerts” link in the Investor Relations

section of our website and submit your email address. The

information contained in, or that may be accessed through, our

website is not incorporated by reference into or a part of this

document or any other report or document we file with or furnish to

the SEC, and any references to our website are intended to be

inactive textual references only.

"Safe Harbor" Statement Under the Private

Securities Litigation Reform Act of 1995

This press release contains forward-looking

statements made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements use words such as “anticipate,”

“budget,” “estimate,” “expect,” “project,” “intend,” “plan,”

“believe,” and other words and terms of similar meaning in

connection with a discussion of potential future events,

circumstances or future operating or financial performance.

These forward looking statements are based on management’s current

expectations and observations. Included among the factors that, in

our view, could cause actual results to differ materially from the

forward looking statements contained in this report are the

following: (i) further declines or sustained weakness in demand in

the drybulk shipping industry; (ii) continuation of weakness or

further declines in drybulk shipping rates; (iii) changes in the

supply of or demand for drybulk products, generally or in

particular regions; (iv) changes in the supply of drybulk carriers

including newbuilding of vessels or lower than anticipated

scrapping of older vessels; (v) changes in rules and regulations

applicable to the cargo industry, including, without limitation,

legislation adopted by international organizations or by individual

countries and actions taken by regulatory authorities; (vi)

increases in costs and expenses including but not limited to: crew

wages, insurance, provisions, lube, oil, bunkers, repairs,

maintenance and general, administrative, and management fee

expenses; (vii) whether our insurance arrangements are adequate;

(viii) changes in general domestic and international political

conditions; (ix) acts of war, terrorism, or piracy; (x) changes in

the condition of the Company’s vessels or applicable maintenance or

regulatory standards (which may affect, among other things, our

anticipated drydocking or maintenance and repair costs) and

unanticipated drydock expenditures; (xi) the Company’s acquisition

or disposition of vessels; (xii) the amount of offhire time needed

to complete repairs on vessels and the timing and amount of any

reimbursement by our insurance carriers for insurance claims,

including offhire days; (xiii) the completion of definitive

documentation with respect to charters; (xiv) charterers’

compliance with the terms of their charters in the current market

environment; (xv) the extent to which our operating results

continue to be affected by weakness in market conditions and

charter rates; (xvi) our ability to maintain contracts that are

critical to our operation, to obtain and maintain acceptable terms

with our vendors, customers and service providers and to retain key

executives, managers and employees; and other factors listed from

time to time in our public filings with the Securities and Exchange

Commission including, without limitation, the Company’s Annual

Report on Form 10-K for the year ended December 31, 2016 and its

subsequent reports on Form 10-Q and Form 8-K. Our ability to pay

dividends in any period will depend upon various factors, including

the limitations under any credit agreements to which we may be a

party, applicable provisions of Marshall Islands law and the final

determination by the Board of Directors each quarter after its

review of our financial performance. The timing and amount of

dividends, if any, could also be affected by factors affecting cash

flows, results of operations, required capital expenditures, or

reserves. As a result, the amount of dividends actually paid

may vary. We do not undertake any obligation to update or

revise any forward‑looking statements, whether as a result of new

information, future events or otherwise.

CONTACT:

John C. Wobensmith

Chief Executive Officer

Genco Shipping & Trading Limited

(646) 443-8555

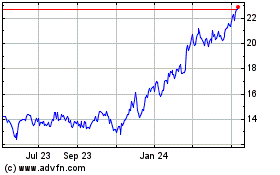

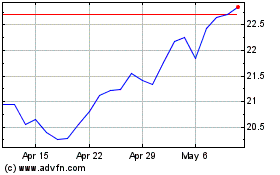

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Apr 2023 to Apr 2024