____________________________________

Net Sales Revenue (NSR) Decreased 0.6%, and

Increased 1.3% in Constant Currency

NSR/HL Decreased 0.2%, and Increased 1.7% in

Constant Currency

Worldwide Brand Volume Increased 2.3% to

26.4 million HL

EPS of $1.49 increased 4.2%, and Underlying

EPS (Non-GAAP) of $1.66 Increased 3.1%

On Track to Deliver Full-Year Business Plans

and Cost Savings

____________________________________

Molson Coors Brewing Company (NYSE: TAP; TSX: TPX) today

reported results for the 2017 second quarter. Molson Coors

president and chief executive officer Mark Hunter said, "In the

second quarter, we continued to drive our First Choice for

Consumers and Customers agenda, with laser focus on strengthening

our core brands, premiumizing our portfolio, accelerating our

international footprint, enhancing our customer partnerships, and

driving the integration of MillerCoors and the Miller brands

globally to unlock synergies and other cost savings. As a sign of

progress against this agenda, our team delivered solid growth in

constant currency net sales, global brand volume, underlying

EBITDA, net income, earnings per share and free cash flow.

Additionally, we exceeded our goals for cash generation and debt

reduction in the first half of this year and have maintained our

investment-grade debt ratings. Our second quarter performance was

in-line with our expectations, and we remain on track to deliver

our 2017 business and financial plans, cost savings targets and

cash flow goals."

Consolidated Performance - Second

Quarter 2017

Three Months Ended ($ in

millions, except per share data) (Unaudited)

June 30, 2017

June 30, 2016

Reported%

Increase(Decrease)

ForeignExchangeImpact($)

ConstantCurrency%

Increase(Decrease)

Actual Pro forma Net Sales $ 3,091.3 $ 3,109.2

(0.6)

%

$ (57.3 ) 1.3 % U.S. GAAP Net income (loss)(1) $ 321.7 $ 309.3 4.0

% Per diluted share $ 1.49 $ 1.43 4.2 % Underlying (Non-GAAP) Net

income (loss)(1) $ 358.9 $ 348.7 2.9 % Per diluted share $ 1.66 $

1.61 3.1 % Underlying EBITDA (Non-GAAP) $ 793.8 $ 761.8 4.2 % $

(11.5 ) 5.7 %

(1) Net income (loss) attributable to MCBC

from continuing operations. See Appendix for definitions and

reconciliations of non-GAAP financial measures.

Quarterly Highlights (versus Second

Quarter 2016 Pro Forma Results, unless otherwise noted)

- Net sales per HL: $109.08,

decreased 0.2 percent, and increased 1.7 percent in constant

currency, driven by higher pricing and sales mix in U.S., Canada

and Europe.

- Volume: Worldwide brand volume

of 26.4 million hectoliters increased 2.3 percent due to strong

growth in Europe and International, partially as a result of adding

the Miller global brands business and also from growth in some of

our core brands. Global priority brand volume increased 4.6

percent. Financial volume of 28.3 million hectoliters decreased 0.4

percent, driven by lower contract brewing volume.

- U.S. GAAP net income from

continuing operations attributable to MCBC increased 4.0 percent,

and underlying net income (non-GAAP) increased 2.9 percent,

both driven by increased brand volume, higher net pricing, positive

sales mix, cost savings and lower marketing spending, partially

offset by a higher effective tax rate.

- The company looks at value creation

from the MillerCoors transaction through the lens of the sum of

three numbers. In the 2nd quarter, these three numbers were:

- Underlying net earnings of

$358.9 million, plus…

- $103 million of transaction-related

cash tax benefits and…

- $11 million of transaction-related

after-tax book amortization.

- To calculate this measure on a

per-share basis, the company had 216.4 million weighted average

diluted shares outstanding in the 2nd quarter.

- Underlying EBITDA: Increased 4.2

percent and on a constant-currency basis increased 5.7 percent,

driven by higher pricing, positive sales mix, cost savings and

lower marketing spending versus a year ago.

- U.S. GAAP cash from operations:

Net cash from operating activities for the first half of 2017 was

$818.5 million, which represents an increase of $536.1 million from

actual prior year results, driven by the addition of the other 58

percent of MillerCoors cash flows, as well as lower cash paid for

taxes, which were partially offset by higher cash paid for

interest.

- Underlying free cash flow:

$586.7 million for the first half of 2017, a 232 percent increase

from actual prior year results of $176.9 million, driven by the

same factors as cash from operations.

- Debt: Total debt at the end of

the second quarter was $11.872 billion, and cash and cash

equivalents totaled $502.9 million, resulting in net debt of

$11.369 billion, which is more than $522 million lower than at the

beginning of the second quarter.

Business Review- Second Quarter

2017

Net

Sales

($ in millions) (Unaudited)

Three Months

Ended June 30, 2017 June 30, 2016

Reported%Increase(Decrease)

ForeignExchangeImpact($)

ConstantCurrency

%Increase(Decrease)

United States (1) $ 2,138.9 $ 2,132.2 0.3 % $ — 0.3 % Canada $

407.6 $ 425.9

(4.3)

%

$ (16.9 )

(0.3)

%

Europe $ 524.7 $ 522.1 0.5 % $ (40.5 ) 8.3 % International $ 65.1 $

39.2 66.1 % $ 0.1 65.8 % Corporate $ 0.3 $ 0.2 50.0 % $ — 50.0 %

Pretax Income

(U.S. GAAP)

($ in millions) (Unaudited)

Three

Months Ended June 30, 2017 June 30, 2016

Reported%Increase(Decrease)

ForeignExchangeImpact($)

ConstantCurrency

%Increase(Decrease)

United States (1) $ 484.7 $ 418.2 15.9 % $ (0.8 ) 16.1 % Canada $

68.7 $ 88.5

(22.4)

%

$ (1.6 )

(20.6)

%

Europe $ 73.3 $ 59.0 24.2 % $ (4.8 ) 32.4 % International $ (7.7 )

$ (33.4 ) 76.9 % $ (0.3 ) 77.8 % Corporate $ (169.2 ) $ (109.1 )

(55.1)

%

$ 1.1

(56.1)

%

Underlying

EBITDA (Non-GAAP)(2)

($ in millions) (Unaudited)

Three

Months Ended June 30, 2017 June 30, 2016

Reported%Increase(Decrease)

ForeignExchangeImpact($)

ConstantCurrency

%Increase(Decrease)

United States (1) $ 619.4 $ 574.0 7.9 % $ (0.8 ) 8.0 % Canada $

100.4 $ 111.2

(9.7)

%

$ (2.8 )

(7.2)

%

Europe $ 118.3 $ 104.0 13.8 % $ (7.9 ) 21.3 % International $ (0.9

) $ (1.7 ) 47.1 % $ (0.3 ) 64.7 % Corporate $ (43.4 ) $ (28.2 )

(53.9)

%

$ 0.3

(55.0)

%

(1) United States second quarter 2016 results

are presented on a pro forma basis. (2) See Appendix for

definitions and reconciliations of non-GAAP financial measures.

United States Business

(MillerCoors) (versus Second Quarter 2016 Pro Forma

Results)

- Volume: U.S. domestic

sales-to-retailers volume (STRs) declined 1.9 percent for the

quarter, driven by lower volume in the Premium Light and Below

Premium segments, partially offset by growth in the Above Premium

segment. Domestic sales-to-wholesalers volume (STWs) decreased 0.4

percent.

- Revenue: Domestic net sales per

hectoliter, which excludes contract brewing and

company-owned-distributor sales, grew 1.0 percent as a result of

higher net pricing and positive sales mix, partially offset by

cycling a multi-year adjustment in federal excise tax expense last

year.

- Cost of goods sold (COGS) per

hectoliter increased 0.3 percent, driven by higher input costs,

portfolio premiumization, and volume deleverage, partially offset

by cost savings.

- Marketing, general and

administrative (MG&A) expense decreased 5.7 percent due to

lower marketing and employee-related expenses.

- On a U.S. GAAP basis, United States

income from continuing operations before income taxes increased

15.9 percent to $484.7 million, primarily due to lower special

charges related to the Eden, North Carolina, brewery closure; lower

MG&A expenses; higher net pricing; positive sales mix; and cost

savings.

- United States underlying EBITDA

increased 7.9 percent to $619.4 million, driven by lower MG&A

expenses, higher net pricing, positive sales mix and cost

savings.

Canada Business

- Volume: Canada brand volume

decreased 1.3 percent in the second quarter, as a result of lower

domestic volumes, partially offset by the return of the Miller

brands to our portfolio. Canada financial volume, which includes

contract brewing volume, decreased 2.6 percent primarily due to

lower contract brewing volume.

- Revenue: Net sales per

hectoliter increased 2.3 percent in local currency, primarily due

to positive pricing and brand mix, driven by higher import brand

volume.

- COGS per hectoliter increased

4.6 percent in local currency due to mix shift to higher-cost

import brands, volume deleverage, and input cost inflation

(including unfavorable transactional foreign currency impacts),

partially offset by ongoing cost savings initiatives.

- MG&A expense increased 10.4

percent in local currency, driven primarily by higher brand

amortization expense of approximately $10 million related to

changing the Molson brands to definite-lived intangible assets last

year.

- On a U.S. GAAP basis, Canada

reported a decrease in income from continuing operations before

income taxes of 22.4 percent to $68.7 million, compared to the

prior year, which was primarily driven by lower domestic volume and

higher brand amortization expense.

- Canada underlying EBITDA

decreased 9.7 percent to $100.4 million in the quarter, driven

primarily by the impact of lower domestic volume and unfavorable

COGS rate, partially offset by positive pricing.

Europe Business

- Volume: Europe brand volume

increased 11.5 percent in the second quarter versus a year ago,

primarily driven by the transfer of royalty and export brand volume

across Europe from our International business and the addition of

the Miller brands, along with the later timing of the Easter

holiday this year and strong growth from our core and above-premium

brands. Europe financial volume, which includes contract brewing

and factored brands but excludes royalty volume, increased 4.4

percent.

- Revenue: Europe net sales per

hectoliter increased 3.7 percent in local currency, due to positive

mix and net pricing.

- COGS per hectoliter increased

4.7 percent in local currency, primarily driven by mix shift to

higher-cost brands and geographies, partially offset by higher net

pension benefit this year.

- MG&A expense decreased 3.8

percent in local currency, due to the quarterly timing of marketing

investments.

- On a U.S. GAAP basis, Europe

reported an increase in income from continuing operations before

income taxes of 24.2 percent to $73.3 million compared to the

prior year due to higher volume, positive sales mix, lower brand

investments, increased net pension benefit, and favorable timing of

Easter this year, partially offset by unfavorable foreign

currency.

- Europe underlying EBITDA

increased 13.8 percent to $118.3 million, driven by the same

factors that impacted U.S. GAAP income.

International Business

- Volume: International brand

volume increased by 43.2 percent in the second quarter, driven by

the transfer of the Puerto Rico business from MillerCoors, Coors

Light growth primarily in Latin America, and the addition of the

Miller global brands business. These factors were partially offset

by the transfer of royalty and export brand volume to Europe.

- Revenue: Net sales per

hectoliter decreased 5.5 percent, driven by sales mix changes,

partially offset by positive pricing.

- COGS per hectoliter increased

5.9 percent, due to sales mix changes.

- MG&A expense increased 53.4

percent, driven by increased brand investments, along with higher

organization and integration costs related to the acquisition of

the Miller global brands business.

- On a U.S. GAAP basis, International

segment reported a loss from continuing operations before

income taxes of $7.7 million improved from a loss of $33.4

million a year ago, driven by cycling impairment charges related to

our India business in the second quarter of 2016.

- International underlying EBITDA

was a loss of $0.9 million in the second quarter, versus a loss of

$1.7 million a year ago, driven by higher volume and positive

pricing, partially offset by higher MG&A expense.

Corporate

- On a U.S. GAAP basis, corporate loss

from continuing operations on a reported basis was $169.2

million in the second quarter compared to a loss of $109.1 million

in the prior year, primarily due to increased interest and MG&A

expense, as well as unrealized mark-to-market losses from commodity

hedges this quarter.

- Corporate underlying EBITDA was

a loss of $43.4 million for the second quarter versus a $28.2

million loss in the prior year, driven primarily by higher global

investments in commercial, supply chain and information

technology.

Worldwide Brand and Financial

Volume(1)

(In millions of hectoliters) (Unaudited)

Three Months Ended June 30, 2017

June 30, 2016 % Change June 30,

2016 Actual Pro forma Actual Financial

Volume(1) 28.340 28.455

(0.4)

%

9.377 Contract brewing and wholesaler volume (2.390 ) (2.836 )

(15.7)

%

(0.800 ) Royalty Volume 1.033 0.521 98.3 % 0.521

Sales-To-Wholesaler to Sales-To-Retail adjustment (0.617 ) (0.361 )

70.9 % (0.036 ) Owned Volume 26.366 25.779 2.3 % 9.062

Proportionate share of Equity Investment Worldwide Brand Volume —

— — % 7.021

Total Worldwide Brand

Volume(1) 26.366 25.779 2.3 % 16.083

(1) See Appendix for

definitions and additional discussion regarding Financial and

Worldwide Brand Volume.

Other Results

Effective Income

Tax Rates (versus second quarter 2016 pro forma

results)

Three Months Ended June 30, 2017

June 30, 2016 U.S. GAAP effective tax rate 27.4 %

26.1 % Underlying effective tax rate 28.4 % 27.2 %

- The effective tax rate on a reported

and underlying basis was slightly higher this year due to

geographic mix and lower discrete benefits in 2017.

Special and Other Non-Core

Items

The following special and other non-core items have been

excluded from underlying results. See the Appendix for

reconciliations of non-GAAP financial measures.

- During the second quarter, MCBC

recognized a net special charge of $16.5 million, primarily

driven by charges related to the Eden brewery closure in the U.S.

and the planned closure of our Burton South brewery in Europe and

Vancouver brewery in Canada.

- Additionally during the second quarter,

we recorded other non-core net charges of $42.3 million,

primarily driven by unrealized mark-to-market losses on commodity

hedges and integration costs related to the Acquisition.

2017 Outlook

The following targets for full year 2017 are unchanged from

previous disclosures, unless otherwise indicated:

- Underlying free cash

flow: $1.2 billion, plus or minus 10 percent.

- Cash pension contributions in

the range of $300 to $320 million as a result of an additional,

discretionary contribution to the U.S. pension plan. - Updated

(formerly $100 to $120 million)

- Included in 2017 underlying free cash

flow target.

- Transaction-related cash tax

benefits: approximately $400 million.

- Capital spending: approximately

$750 million, plus or minus 10 percent.

- Cost savings: more than $175

million.

- Cost of goods sold per

hectoliter:

- MillerCoors: low-single-digit

increase.

- Canada: mid-single-digit

increase (local currency).

- Europe: low-single-digit

increase (local currency).

- International business: decrease

at a mid-single-digit rate. - Updated (formerly double-digit

decrease)

- Underlying Corporate MG&A

expense: approximately $170 million, plus or minus 10

percent.

- Underlying depreciation and

amortization: approximately $790 million.

- Pension income: approximately

$24 million.

- Underlying consolidated net interest

expense: approximately $370 million, plus or minus 5

percent.

- Underlying effective tax rate in

the top half of the range of 24 to 28 percent. - Updated

Notes

Unless otherwise indicated in this release, all $ amounts are in

U.S. Dollars, and all quarterly comparative results are for the

Company’s second quarter ended June 30, 2017, compared to the

second quarter ended June 30, 2016. All per-hectoliter calculations

include contract brewing and non-owned factored beverage volume in

the denominator, as well as the financial impact of these sales in

the numerator, unless otherwise indicated. Some numbers may not sum

due to rounding.

As used in this release, the term “Acquisition” refers to the

Company’s acquisition from Anheuser-Busch InBev SA/NV on October

11, 2016, of SABMiller plc’s 58 percent economic interest and 50

percent voting interest in MillerCoors LLC and all trademarks,

contracts and other assets primarily related to the Miller

International business outside of the U.S. and Puerto Rico.

2017 Second Quarter Conference

Call

Molson Coors Brewing Company will conduct an earnings conference

call with financial analysts and investors at 11:00 a.m. Eastern

Time today to discuss the Company’s 2017 second quarter results.

The live webcast will be accessible via the Company’s website,

www.molsoncoors.com. Online replays of the webcast will be

available until 11:59 p.m. Eastern Time on October 31, 2017. The

Company will post this release and related financial statements on

its website today.

The company will not host an Investor Relations Follow-Up

Session call.

Upcoming Investor

Webcast

The company will host an online, real-time webcast at the

Barclays Global Consumer Staples Conference in Boston on Wednesday,

September 6, 2017, at 9:00 a.m. Eastern Time. A live webcast of

this investor event will be accessible via the Molson Coors Brewing

Company website, www.molsoncoors.com, on the Investors page. An

online replay of the presentation webcast will be available on the

website within two hours after the presentation.

Overview of Molson Coors

With a story that starts in 1774, Molson Coors has spent

centuries defining brewing greatness. As one of the largest global

brewers, Molson Coors works to deliver extraordinary brands that

delight the world’s beer drinkers. From Coors Light, Miller Lite,

Carling, Staropramen and Sharp’s Doom Bar to Leinenkugel’s Summer

Shandy, Blue Moon Belgian White and Creemore Springs Premium Lager,

Molson Coors offers a beer for every beer lover.

Molson Coors operates through Molson Coors Canada, MillerCoors,

Molson Coors Europe and Molson Coors International. The company is

not only committed to brewing extraordinary beers, but also running

a business focused on respect for its employees, communities and

drinkers, which means corporate responsibility and accountability

right from the start. It has been listed on the Dow Jones

Sustainability World Index for the past five years. To learn more

about Molson Coors Brewing Company, visit molsoncoors.com,

ourbeerprint.com or on Twitter through @MolsonCoors.

About Molson Coors Canada

Inc.

Molson Coors Canada Inc. (MCCI) is a subsidiary of Molson Coors

Brewing Company. MCCI Class A and Class B exchangeable

shares offer substantially the same economic and voting rights as

the respective classes of common shares of MCBC, as described in

MCBC’s annual proxy statement and Form 10-K filings with the U.S.

Securities and Exchange Commission. The trustee holder of the

special Class A voting stock and the special Class B

voting stock has the right to cast a number of votes equal to the

number of then outstanding Class A exchangeable shares and

Class B exchangeable shares, respectively.

Forward-Looking

Statements

This press release includes “forward-looking statements” within

the meaning of the U.S. federal securities laws. Generally, the

words “believe,” “expect,” “intend,” “anticipate,” “project,”

“will,” and similar expressions identify forward-looking

statements, which generally are not historic in nature. Although

the Company believes that the assumptions upon which its

forward-looking statements are based are reasonable, it can give no

assurance that these assumptions will prove to be correct.

Important factors that could cause actual results to differ

materially from the Company’s historical experience, and present

projections and expectations are disclosed in the Company’s filings

with the Securities and Exchange Commission (“SEC”). These factors

include, among others, our ability to successfully integrate the

acquisition of MillerCoors; our ability to achieve expected tax

benefits, accretion and cost savings and synergies; impact of

increased competition resulting from further consolidation of

brewers, competitive pricing and product pressures; health of the

beer industry and our brands in our markets; economic conditions in

our markets; additional impairment charges; our ability to maintain

manufacturer/distribution agreements; changes in our supply chain

system; availability or increase in the cost of packaging

materials; success of our joint ventures; risks relating to

operations in developing and emerging markets; changes in legal and

regulatory requirements, including the regulation of distribution

systems; fluctuations in foreign currency exchange rates; increase

in the cost of commodities used in the business; the impact of

climate change and the availability and quality of water; loss or

closure of a major brewery or other key facility; our ability to

implement our strategic initiatives, including executing and

realizing cost savings; our ability to successfully integrate newly

acquired businesses; pension plan and other post-retirement benefit

costs; failure to comply with debt covenants or deterioration in

our credit rating; our ability to maintain good labor relations;

our ability to maintain brand image, reputation and product

quality; and other risks discussed in our filings with the SEC,

including our most recent Annual Report on Form 10-K and our

Quarterly Reports on Form 10-Q. All forward-looking statements in

this press release are expressly qualified by such cautionary

statements and by reference to the underlying assumptions. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. We do not undertake

to update forward-looking statements, whether as a result of new

information, future events or otherwise.

APPENDIX

Consolidated Financial

Performance(1)

Molson Coors Brewing

Company Three Months Ended June 30, 2017

% Change

(In millions, except per share

data)(Unaudited)

U.S. GAAP

Non-GAAPAdjustments(2)

Non-GAAPUnderlying(2)

U.S. GAAP

Non-GAAPUnderlying

Net sales $ 3,091.3 $ — $

3,091.3 (0.6 )% (0.6 )% Net

Sales per HL change (0.2 )% (0.2 )%

Cost of goods sold $

(1,756.1 ) $ 28.4 $ (1,727.7 )

1.1 % (1.2

)% Cost of goods sold per HL change 1.6 % (0.8 )%

Gross

profit $ 1,335.2 $ 28.4 $

1,363.6 (2.7 )% 0.3 %

Marketing, general and administrative expenses $

(781.2 ) $ 13.9 $ (767.3

) (0.3 )% (2.1 )% Special items,

net $ (16.5 ) $ 16.5 $ — (77.7 )% N/M

Operating income

(loss) $ 537.5 $ 58.8 $

596.3 4.2 % 3.4 % Interest

income (expense), net $ (89.2 ) $ — $ (89.2 ) (2.7 )% (2.7 )% Other

income (expense), net $ 1.5 $ — $ 1.5 (37.5 )% (37.5 )% Income

(loss) from continuing operations before income taxes $ 449.8 $

58.8 $ 508.6 5.5 % 4.4 % Income tax benefit (expense) $ (123.0 ) $

(21.6 ) $ (144.6 ) 10.7 % 9.0 %

Net income (loss)(3)

$ 321.7 $ 37.2 $ 358.9

4.0

% 2.9 % Per diluted share 1.49

0.17 1.66 4.2 % 3.1 %

EBITDA(4) $ 793.8 4.2 %

Molson Coors Brewing Company Six Months Ended June

30, 2017 % Change (In millions, except per share

data)(Unaudited)

U.S. GAAP

Non-GAAPAdjustments(2)

Non-GAAPUnderlying(2)

U.S. GAAP

Non-GAAPUnderlying

Net sales $ 5,540.0 $ — $

5,540.0 (0.5 )% (0.5 )% Net

Sales per HL change 0.9 % 0.9 %

Cost of goods sold $

(3,129.0 ) $ (34.0 ) $ (3,163.0 )

(1.8 )% (1.2

)% Cost of goods sold per HL change (0.3 )% (0.3 )%

Gross

profit $ 2,411.0 $ (34.0 )

$ 2,377.0 1.2 % 0.4 %

Marketing, general and administrative expenses $

(1,484.0 ) $ 32.2 $

(1,451.8 ) 2.9 % 0.6 %

Special items, net $ (20.3 ) $ 20.3 $ — 822.7 % N/M

Operating

income (loss) $ 906.7 $ 18.5

$ 925.2 (3.4 )% — %

Interest income (expense), net $ (185.8 ) $ — $ (185.8 ) 1.8 % 1.8

% Other income (expense), net $ 1.9 $ (8.1 ) $ (6.2 ) (73.2 )%

(187.3 )% Income (loss) from continuing operations before income

taxes $ 722.8 $ 10.4 $ 733.2 (5.3 )% (2.2 )% Income tax benefit

(expense) $ (187.6 ) $ (9.5 ) $ (197.1 ) 0.4 % (3.1 )%

Net

income (loss)(3) $ 523.6 $

0.9 $ 524.5

(7.6 )% (2.3 )%

Per diluted share 2.42 — 2.42

(7.6 )% (2.8 )% EBITDA(4)

$ 1,308.7 1.0 %

- Versus comparable 2016 period Pro Forma

Results.

- Refer to the table "Actual and Pro

Forma Condensed Consolidated Statements of Operations" for detailed

descriptions and reconciliation of non-GAAP adjustments and 2016

results.

- Net income (loss) attributable to MCBC

from continuing operations.

- EBITDA is earnings before interest,

taxes, depreciation and amortization, a non-GAAP financial

measure.

Pro Forma Information

We have presented consolidated and U.S. segment pro forma

information in this release to enhance comparability of financial

information between periods. Canada, Europe, International and

Corporate results are not presented on a pro forma basis. The pro

forma financial information is based on the historical consolidated

financial statements of MCBC and MillerCoors, both prepared in

accordance with U.S. GAAP, and gives effect to the acquisition of

the remaining 58 percent interest of MillerCoors and the completed

financing as if they were completed on January 1, 2016. Our U.S.

segment pro forma information has been updated from the version

previously provided on February 14, 2017, to reflect the removal of

the Puerto Rico business effective as of January 1, 2017, from the

results of the MillerCoors business, which were previously reported

as part of the U.S. segment, and are now reported within the

International segment. Pro forma adjustments are based on items

that are factually supportable, are directly attributable to the

acquisition or the related completed financing, and are expected to

have a continuing impact on MCBC's results of operations and/or

financial position. Any nonrecurring items directly attributable to

the acquisition or the related completed financing are excluded in

the pro forma statements of operations. Pro forma information does

not include adjustments for costs related to integration activities

following the completion of the acquisition, synergies or other

cost savings that have been or may be achieved by the combined

businesses. The pro forma information is unaudited, based on

significant estimates and continues to be subject to significant

change throughout the one-year post-acquisition measurement period,

as we have referenced in our previous disclosures. The pro forma

information is presented for illustrative purposes only and does

not necessarily reflect the results of operations of MCBC that

actually would have resulted, had the acquisition and the related

financing occurred at the date indicated, nor does this information

project the results of operations of MCBC for any future dates or

periods.

Actual and Pro Forma Worldwide Brand

and Financial Volumes

As a result of the Acquisition, we aligned our volume reporting

policies resulting in adjustments to our historically reported

volumes. Specifically, financial volume for all consolidated

segments has been recast to include contract brewing and wholesaler

non-owned brand volumes (including factored brands in Europe and

non-owned brands distributed in the U.S.), as the corresponding

sales are reported within our gross sales amounts. Additionally,

financial volumes continue to include our owned brands sold to

unrelated external customers within our geographic markets, net of

returns and allowances.

Worldwide brand volume reflects only owned brands sold to

unrelated external customers within our geographic markets, net of

returns and allowances, royalty volume and our proportionate share

of equity investment worldwide brand volume calculated consistently

with MCBC owned volume. 2017 and pro forma worldwide brand volume

includes 100 percent of MillerCoors brand volume. Contract brewing

and wholesaler volume is included within financial volume as noted

above, but is removed from worldwide brand volume as this is

non-owned volume for which we do not directly control performance.

We also modified our worldwide brand volume definition to include

an adjustment from Sales-to-Wholesaler (STW) volume to

Sales-to-Retailer (STR) volume. We believe the STR metric is

important because, unlike STWs, it provides the closest indication

of the performance of our brands in relation to market and

competitor sales trends. Prior periods presented have been revised

to reflect these changes. We believe this definition of worldwide

brand volume more closely aligns with how we measure the

performance of our owned brands within the markets in which they

are sold. Effective January 1, 2017, European markets, including

Sweden, Spain, Germany, Ukraine and Russia, which were previously

reported under our International segment, are now presented within

our Europe segment. Additionally, effective January 1, 2017, the

results of the MillerCoors Puerto Rico business, which were

previously reported as part of the U.S. segment, are now reported

within the International segment.

Use of Non-GAAP Measures

In addition to financial measures presented on the basis of

accounting principles generally accepted in the U.S.

("U.S. GAAP"), we also present "underlying pretax and net

income," "underlying income per diluted share," "underlying

effective tax rate," and "underlying free cash flow," which are

non-GAAP measures and should be viewed as supplements to (not

substitutes for) our results of operations presented under

U.S. GAAP. We also present underlying earnings before

interest, taxes, depreciation, and amortization ("underlying

EBITDA") as a non-GAAP measure. Our management uses underlying

income, underlying income per diluted share, underlying EBITDA, and

underlying effective tax rate as measures of operating performance,

as well as underlying free cash flow in the measure of cash

generated from core operations, to assist in comparing performance

from period to period on a consistent basis; as a measure for

planning and forecasting overall expectations and for evaluating

actual results against such expectations; in communications with

the board of directors, stockholders, analysts and investors

concerning our financial performance; as useful comparisons to the

performance of our competitors; and as metrics of certain

management incentive compensation calculations. We believe that

underlying income, underlying income per diluted share, underlying

EBITDA, and underlying effective tax rate performance are used by,

and are useful to, investors and other users of our financial

statements in evaluating our operating performance, as well as

underlying free cash flow in evaluating our generation of cash from

core operations, because they provide an additional tool to

evaluate our performance without regard to special and non-core

items, which can vary substantially from company to company

depending upon accounting methods and book value of assets and

capital structure. In addition to the reasons discussed above, we

consider underlying free cash flow an important measure of our

ability to generate cash, grow our business and enhance shareholder

value, driven by core operations and after adjusting for non-core

items. For discussion and analysis of our liquidity, see the

consolidated statements of cash flows and the Liquidity and Capital

Resources section of our Management’s Discussion and Analysis of

Financial Condition and Results of Operations in our latest Form

10-K and 10-Q filings with the SEC.

We have provided reconciliations of all historical non-GAAP

measures to their nearest U.S. GAAP measure and have consistently

applied the adjustments within our reconciliations in arriving at

each non-GAAP measure. These adjustments consist of special items

from our U.S. GAAP financial statements as well as other non-core

items, such as acquisition and integration related costs,

unrealized mark-to-market gains and losses, and gains and losses on

sales of non-operating assets, included in our U.S. GAAP results

that warrant adjustment to arrive at non-GAAP results. We consider

these items to be necessary adjustments for purposes of evaluating

our ongoing business performance and are often considered

non-recurring. Such adjustments are subjective and involve

significant management judgment.

Our guidance for corporate underlying MG&A, underlying

depreciation and amortization, underlying EBITDA margin, underlying

free cash flow, underlying effective tax rate, and underlying

consolidated net interest expense are also non-GAAP financial

measures that exclude or otherwise have been adjusted for special

items from our U.S. GAAP financial statements as well as other

non-core items, such as acquisition and integration related costs,

unrealized mark-to-market gains and losses, and gains and losses on

sales of non-operating assets, included in our U.S. GAAP results

that warrant adjustment to arrive at non-GAAP results. We consider

these items to be necessary adjustments for purposes of evaluating

our ongoing business performance and are often considered

non-recurring. Such adjustments are subjective and involve

significant management judgment. We are unable to reconcile the

above described guidance measures to their nearest U.S. GAAP

measures without unreasonable efforts because we are unable to

predict with a reasonable degree of certainty the actual impact of

the special and other non-core items. By their very nature, special

and other non-core items are difficult to anticipate with precision

because they are generally associated with unexpected and unplanned

events that impact our company and its financial results.

Therefore, we are unable to provide a reconciliation of these

measures.

Reconciliations to Nearest U.S. GAAP

Measures

Underlying Actual

and Pro Forma EBITDA

(In millions) (Unaudited)

Three Months

Ended June 30, 2017 June 30, 2016

% change June 30, 2016 Actual Pro

Forma Actual U.S. GAAP:

Net income (loss)

attributable to MCBC from continuing operations $

321.7 $ 309.3 4.0 %

$ 174.1 Add:

Net income (loss) attributable to noncontrolling interests 5.1

5.9

(13.6)

%

1.6 U.S. GAAP:

Net income (loss) from continuing

operations 326.8 315.2 3.7 % 175.7 Add: Interest expense

(income), net 89.2 91.7

(2.7)

%

40.5 Add: Income tax expense (benefit) 123.0 111.1 10.7 % 21.2 Add:

Depreciation and amortization 198.9 219.2

(9.3)

%

70.2 Adjustments included in underlying income(1) 58.8 60.9

(3.4)

%

86.2 Adjustments to arrive at underlying EBITDA(2) (2.9 ) (36.3 )

(92.0)

%

(16.6 ) Adjustments to arrive at underlying EBITDA related to our

investment in MillerCoors(3) — — — % 51.5

Non-GAAP:

Underlying EBITDA $ 793.8

$ 761.8 4.2 %

$ 428.7

(In millions) (Unaudited)

Six Months Ended

June 30, 2017 June 30, 2016 %

change June 30, 2016 Actual Pro

Forma Actual U.S. GAAP:

Net income (loss)

attributable to MCBC from continuing operations $

523.6 $ 566.7

(7.6)

%

$ 337.3 Add: Net income (loss) attributable to

noncontrolling interests 11.6 9.5 22.1 % 2.4

U.S. GAAP:

Net income (loss) from continuing operations

535.2 576.2

(7.1)

%

339.7 Add: Interest expense (income), net 185.8 182.6 1.8 % 87.8

Add: Income tax expense (benefit) 187.6 186.8 0.4 % 37.9 Add:

Depreciation and amortization 396.0 438.6

(9.7)

%

137.7 Adjustments included in underlying income(1) 10.4 (13.1 )

(179.4)

%

29.0 Adjustments to arrive at underlying EBITDA(2) (6.3 ) (75.2 )

(91.6)

%

(40.0 ) Adjustments to arrive at underlying EBITDA related to our

investment in MillerCoors(3) — — — % 100.0

Non-GAAP:

Underlying EBITDA $ 1,308.7

$ 1,295.9 1.0 %

$ 692.1

(1)

Includes adjustments to non-GAAP underlying income within the table

above related to special and non-core items. (2) Represents

adjustments to remove amounts related to interest, depreciation and

amortization included in the adjustments to non-GAAP underlying

income above, as these items are added back as adjustments to net

income attributable to MCBC from continuing operations. (3)

Adjustments to our equity income from MillerCoors, which include

our proportionate share of MillerCoors' interest, income tax,

depreciation and amortization, special items, and amortization of

the difference between the MCBC contributed cost basis and

proportionate share of the underlying equity in net assets of

MillerCoors.

Underlying Free

Cash Flow

(In millions) (Unaudited)

Actual

Six Months Ended June 30, 2017 June

30, 2016 U.S. GAAP:

Net Cash Provided by (Used In) Operating

Activities $ 818.5 $ 282.4 Less:

Additions to properties(1) (354.0 ) (121.6 ) Less: Investment in

MillerCoors(1) — (810.6 ) Add: Return of capital from

MillerCoors(1) — 731.1 Add: Cash impact of special items(2) 59.0

4.0 Add: Non-core costs related to acquisition of businesses(3)

63.2 90.6 Add: MillerCoors cash impact of special items(4) —

1.0 Non-GAAP:

Underlying Free Cash Flow $

586.7 $ 176.9

(1) Included in net cash used in investing

activities. (2) Included in net cash provided by (used in)

operating activities and primarily reflects costs paid for brewery

closures and restructuring activities. Also, includes additions to

properties within net cash used in investing activities related to

the cash paid to build a new efficient and flexible brewery in

British Columbia, following the sale of our Vancouver brewery in

the first quarter of 2016. The proceeds of $140.8 million received

from the sale of the Vancouver brewery are being used to fund the

construction of the new brewery in British Columbia. (3)

Included in net cash provided by operating activities and reflects

costs paid associated with the Acquisition of 58% of MillerCoors,

LLC, and the Miller global brand portfolio. (4) Amounts

represent our proportionate 42% share of the cash flow impacts for

the pre-Acquisition period January 1, 2016, through June 30, 2016.

Statements of Operations -- Molson

Coors Brewing Company and Subsidiaries

Actual and Pro

Forma Condensed Consolidated Statements of

Operations

($ In millions, except per share data)

(Unaudited)

Three Months Ended June 30, 2017

June 30, 2016 Actual Pro forma

Actual

Financial volume in hectoliters(1)

28.340 28.455 9.377 Sales $ 3,793.1 $ 3,818.5

$ 1,407.0 Excise taxes (701.8 ) (709.3 ) (420.8 ) Net sales 3,091.3

3,109.2 986.2 Cost of goods sold (1,756.1 ) (1,736.3 ) (562.2 )

Gross profit 1,335.2 1,372.9 424.0 Marketing, general and

administrative expenses (781.2 ) (783.4 ) (313.6 ) Special items,

net (16.5 ) (73.9 ) (34.5 ) Equity income in MillerCoors — —

191.9 Operating income (loss) 537.5 515.6 267.8

Interest income (expense), net (89.2 ) (91.7 ) (40.5 ) Other income

(expense), net 1.5 2.4 (30.4 ) Income (loss) from

continuing operations before income taxes 449.8 426.3 196.9 Income

tax benefit (expense) (123.0 ) (111.1 ) (21.2 ) Net income (loss)

from continuing operations 326.8 315.2 175.7 Income (loss) from

discontinued operations, net of tax 1.6 (1.8 ) (1.8 ) Net

income (loss) including noncontrolling interests 328.4 313.4 173.9

Net (income) loss attributable to noncontrolling interests (5.1 )

(5.9 ) (1.6 ) Net income (loss) attributable to MCBC $ 323.3

$ 307.5 $ 172.3 Basic net income (loss)

attributable to MCBC per share: From continuing operations $ 1.49 $

1.44 $ 0.81 From discontinued operations 0.01 — (0.01

) Basic net income (loss) attributable to MCBC per share $ 1.50

$ 1.44 $ 0.80 Diluted net income (loss)

attributable to MCBC per share: From continuing operations $ 1.49 $

1.43 $ 0.81 From discontinued operations — — (0.01 )

Diluted net income (loss) attributable to MCBC per share $ 1.49

$ 1.43 $ 0.80 Weighted average shares -

basic 215.4 214.7 214.7 Weighted average shares - diluted 216.4

216.0 216.0 Dividends per share $ 0.41 $ 0.41

Amounts attributable to MCBC Net income (loss) from

continuing operations $ 321.7 $ 309.3 $ 174.1 Income (loss) from

discontinued operations, net of tax 1.6 (1.8 ) (1.8 ) Net

income (loss) attributable to MCBC $ 323.3 $ 307.5 $

172.3

(1)

Historical financial volumes have been

recast to reflect the impacts of aligning policies on reporting

financial volumes as a result of the Acquisition. See "Actual and

Pro Forma Worldwide Brand Volume" above for further details.

($ In millions, except per share data)

(Unaudited)

Six Months Ended June 30, 2017

June 30, 2016 Actual Pro forma

Actual

Financial volume in hectoliters(1)

50.218 50.971 15.707 Sales $ 6,706.9 $ 6,826.7

$ 2,357.8 Excise taxes (1,166.9 ) (1,256.1 ) (714.4 ) Net sales

5,540.0 5,570.6 1,643.4 Cost of goods sold (3,129.0 ) (3,187.1 )

(976.2 ) Gross profit 2,411.0 2,383.5 667.2 Marketing, general and

administrative expenses (1,484.0 ) (1,442.8 ) (564.5 ) Special

items, net (20.3 ) (2.2 ) 74.1 Equity income in MillerCoors —

— 334.3 Operating income (loss) 906.7 938.5

511.1 Interest income (expense), net (185.8 ) (182.6 ) (87.8 )

Other income (expense), net 1.9 7.1 (45.7 ) Income

(loss) from continuing operations before income taxes 722.8 763.0

377.6 Income tax benefit (expense) (187.6 ) (186.8 ) (37.9 ) Net

income (loss) from continuing operations 535.2 576.2 339.7 Income

(loss) from discontinued operations, net of tax 1.0 (2.3 )

(2.3 ) Net income (loss) including noncontrolling interests 536.2

573.9 337.4 Net (income) loss attributable to noncontrolling

interests (11.6 ) (9.5 ) (2.4 ) Net income (loss) attributable to

MCBC $ 524.6 $ 564.4 $ 335.0 Basic net

income (loss) attributable to MCBC per share: From continuing

operations $ 2.43 $ 2.64 $ 1.61 From discontinued operations 0.01

— (0.01 ) Basic net income (loss) attributable to

MCBC per share $ 2.44 $ 2.64 $ 1.60

Diluted net income (loss) attributable to MCBC per share: From

continuing operations $ 2.42 $ 2.62 $ 1.60 From discontinued

operations — — (0.01 ) Diluted net income (loss)

attributable to MCBC per share $ 2.42 $ 2.62 $ 1.59

Weighted average shares - basic 215.3 214.6 209.2

Weighted average shares - diluted 216.4 215.9 210.5

Dividends per share $ 0.82 $ 0.82 Amounts

attributable to MCBC Net income (loss) from continuing operations $

523.6 $ 566.7 $ 337.3 Income (loss) from discontinued operations,

net of tax 1.0 (2.3 ) (2.3 ) Net income (loss) attributable

to MCBC $ 524.6 $ 564.4 $ 335.0

(1)

Historical financial volumes have been

recast to reflect the impacts of aligning policies on reporting

financial volumes as a result of the Acquisition. See "Actual and

Pro Forma Worldwide Brand Volume" above for further details.

Molson Coors Brewing Company and

SubsidiariesU.S. Actual and Pro Forma

Results of Operations

($ In millions) (Unaudited)

Three

Months Ended June 30, 2017 June 30, 2016

Actual Pro Forma Actual

Financial volume in hectoliters(1)(2)

19.190 19.363 19.363 Sales(2) $ 2,433.0 $

2,420.7 $ 2,426.3 Excise taxes (294.1 ) (288.5 ) (299.6 ) Net

sales(2) 2,138.9 2,132.2 2,126.7 Cost of goods sold(2) (1,182.1 )

(1,188.9 ) (1,174.5 ) Gross profit 956.8 943.3 952.2 Marketing,

general and administrative expenses (458.8 ) (486.3 ) (477.1 )

Special items, net(3) (12.6 ) (39.4 ) (39.4 ) Operating income

485.4 417.6 435.7 Interest income (expense), net — (0.4 ) (0.4 )

Other income (expense), net (0.7 ) 1.0 1.0 Income

(loss) from continuing operations before income taxes $ 484.7 $

418.2 $ 436.3 Add/(less): Special items, net(3) 12.6 39.4 39.4

Acquisition and integration related costs(4) 0.8 — —

Non-GAAP: Underlying pretax income (loss) $ 498.1 $ 457.6 $

475.7 Add: Interest expense (income), net — 0.4 0.4 Add:

Depreciation and amortization 121.3 149.0 116.0 Adjustments to

arrive at underlying EBITDA(5) — (33.0 ) (33.0 ) Non-GAAP:

Underlying EBITDA $ 619.4 $ 574.0 $ 559.1

(1)

Historical financial volumes have been

recast to reflect the impacts of aligning policies on reporting

financial volumes as a result of the Acquisition. See "Actual and

Pro Forma Worldwide Brand Volume" above for further details.

(2) On a reported basis, includes gross inter-segment sales

and volumes that are eliminated in the consolidated totals.

(3) See Part I—Item 1. Financial Statements, Note 6, "Special

Items" of the Form 10-Q for detailed discussion of special items,

on an actual basis. Results include net special charges primarily

related to the closure of the Eden, North Carolina, brewery, which

for the three months ended June 30, 2016, includes $33.0 million of

accelerated depreciation in excess of normal depreciation

associated with the brewery and $6.4 million of other charges.

These accelerated depreciation charges are included in our

adjustments to arrive at underlying EBITDA. (4) For the

three months ended June 30, 2017, $0.7 million of integration costs

were incurred in cost of goods sold and $0.1 million of integration

costs were incurred in marketing, general & administrative

expenses. (5) Represents adjustments to remove amounts

related to interest, depreciation and amortization included in the

adjustments to non-GAAP underlying income above, as these items are

added back as adjustments to net income attributable to MCBC from

continuing operations. ($ In millions)

(Unaudited)

Six Months Ended June 30, 2017

June 30, 2016 Actual Pro Forma

Actual

Financial volume in hectoliters(1)(2)

34.962 35.751 35.751 Sales(2) $ 4,424.4 $

4,484.1 $ 4,495.6 Excise taxes (535.6 ) (541.7 ) (552.8 ) Net

sales(2) 3,888.8 3,942.4 3,942.8 Cost of goods sold(2) (2,209.0 )

(2,237.6 ) (2,207.5 ) Gross profit 1,679.8 1,704.8 1,735.3

Marketing, general and administrative expenses (863.7 ) (906.7 )

(886.8 ) Special items, net(3) (15.1 ) (76.3 ) (76.3 ) Operating

income 801.0 721.8 772.2 Interest income (expense), net — (0.9 )

(0.9 ) Other income (expense), net (0.7 ) 2.6 2.6

Income (loss) from continuing operations before income taxes $

800.3 $ 723.5 $ 773.9 Add/(less): Special items, net(3) 15.1 76.3

76.3 Acquisition and integration related costs(4) 5.3 —

— Non-GAAP: Underlying pretax income (loss) $ 820.7 $

799.8 $ 850.2 Add: Interest expense (income), net — 0.9 0.9 Add:

Depreciation and amortization 240.6 300.9 233.1 Adjustments to

arrive at underlying EBITDA(5) — (68.9 ) (68.9 ) Non-GAAP:

Underlying EBITDA $ 1,061.3 $ 1,032.7 $ 1,015.3

(1)

Historical financial volumes have been

recast to reflect the impacts of aligning policies on reporting

financial volumes as a result of the Acquisition. See "Actual and

Pro Forma Worldwide Brand Volume" above for further details.

(2) On a reported basis, includes gross inter-segment sales

and volumes that are eliminated in the consolidated totals.

(3) See Part I—Item 1. Financial Statements, Note 6, "Special

Items" of the Form 10-Q for detailed discussion of special items,

on an actual basis. Results include net special charges primarily

related to the closure of the Eden, North Carolina, brewery, which

for the six months ended June 30, 2016, includes $68.9 million of

accelerated depreciation in excess of normal depreciation

associated with the brewery and $7.4 million of other charges.

These accelerated depreciation charges are included in our

adjustments to arrive at underlying EBITDA. (4) For the six

months ended June 30, 2017, $1.2 million of integration costs were

incurred in cost of goods sold and $4.1 million of integration

costs were incurred in marketing, general & administrative

expenses. (5) Represents adjustments to remove amounts

related to interest, depreciation and amortization included in the

adjustments to non-GAAP underlying income above, as these items are

added back as adjustments to net income attributable to MCBC from

continuing operations.

Molson Coors Brewing Company and

SubsidiariesUnderlying Equity Income

in MillerCoors

($ In millions)

(Unaudited)

Three Months Ended Six Months Ended

June 30, 2016 June 30, 2016 Income (loss) from

continuing operations before income taxes $ 436.3 $ 773.9 Income

tax expense (2.5 ) (2.0 ) Net (income) loss attributable to

noncontrolling interest (4.3 ) (7.1 ) Net income attributable to

MillerCoors $ 429.5 $ 764.8 MCBC economic interest 42 % 42 % MCBC

proportionate share of MillerCoors net income 180.4 321.2

Amortization of the difference between

MCBC contributed cost basis andproportionate share of the

underlying equity in net assets of MillerCoors

1.1 2.2 Share-based compensation adjustment(1) (0.7 ) (0.2 ) U.S.

import tax benefit(2) 11.1 11.1 Equity income in

MillerCoors $ 191.9 $ 334.3 Add/(less): MCBC proportionate share of

MillerCoors special items, net of tax(3) 16.5 32.0

Non-GAAP Equity Income in MillerCoors $ 208.4 $ 366.3

(1) The net adjustment is to eliminate all

share-based compensation impacts related to pre-existing SABMiller

equity awards held by former Miller Brewing Company employees

employed by MillerCoors, as well as to add back all share-based

compensation impacts related to pre-existing MCBC equity awards

held by former MCBC employees who transferred to MillerCoors.

(2) Represents a benefit associated with an anticipated

refund to Coors Brewing Company ("CBC"), a wholly-owned subsidiary

of MCBC, of U.S. federal excise tax paid on products imported by

CBC based on qualifying volumes exported by CBC from the U.S.

(3) Results include net special charges of $39.4 million and

$76.3 million for the three and six months ended June 30, 2016,

respectively, primarily related to the closure of the Eden, North

Carolina, brewery for which we recorded our proportionate 42%

share.

Molson Coors Brewing Company and

SubsidiariesCanada Results of

Operations

($ In millions) (Unaudited)

Three Months Ended Six Months Ended

June 30, 2017 June 30, 2016 June 30,

2017 June 30, 2016

Financial volume in hectoliters(1)(2)

2.530 2.597 4.323 4.371 Sales(2) $

527.6 $ 560.0 $ 905.0 $ 913.8 Excise taxes (120.0 ) (134.1 ) (206.3

) (219.9 ) Net sales(2) 407.6 425.9 698.7 693.9 Cost of goods

sold(2) (234.1 ) (239.2 ) (416.0 ) (396.4 ) Gross profit 173.5

186.7 282.7 297.5 Marketing, general and administrative expenses

(105.0 ) (99.3 ) (201.0 ) (176.0 ) Special items, net(3) (1.0 )

(1.4 ) 0.7 107.9 Operating income (loss) 67.5 86.0

82.4 229.4 Other income (expense), net 1.2 2.5 9.4

5.7 Income (loss) from continuing operations before

income taxes $ 68.7 $ 88.5 $ 91.8 $ 235.1 Add/(less): Special

items, net(3) 1.0 1.4 (0.7 ) (107.9 ) Acquisition and integration

related costs(4) 2.8 — 2.8 — Other non-core items(5) — —

(8.1 ) — Non-GAAP: Underlying pretax

income (loss) $ 72.5 $ 89.9 $ 85.8 $ 127.2 Add: Depreciation and

amortization 29.0 22.6 59.8 43.6 Adjustments to arrive at

underlying EBITDA(5) (1.1 ) (1.3 ) (2.3 ) (2.4 ) Non-GAAP:

Underlying EBITDA $ 100.4 $ 111.2 $ 143.3 $

168.4

(1)

Historical financial volumes have been

recast to reflect the impacts of aligning policies on reporting

financial volumes as a result of the Acquisition. See "Actual and

Pro Forma Worldwide Brand Volume" above for further details.

(2) Reflects gross inter-segment sales, purchases and

volumes that are eliminated in the consolidated totals. (3)

See Part I—Item 1. Financial Statements, Note 6, "Special Items" of

the Form 10-Q for detailed discussion of special items. Special

items for the three months ended June 30, 2017, and June 30, 2016,

includes accelerated depreciation expense of $1.1 million and $1.3

million, respectively, related to the planned closure of the

Vancouver brewery. Special items for the six months ended June 30,

2017, and June 30, 2016, includes accelerated depreciation expense

of $2.3 million and $2.4 million, respectively, related to the

planned closure of the Vancouver brewery. These accelerated

depreciation charges are included in our adjustments to arrive at

underlying EBITDA. (4) For the three and six months ended

June 30, 2017, $2.8 million of acquisition and integration related

costs were incurred in cost of goods sold. (5) For the six

months ended June 30, 2017, a gain of $8.1 million was recorded in

other income (expense), net resulting from a purchase price

adjustment related to the historical sale of Molson Inc.’s

ownership interest in the Montreal Canadiens. (6) Represents

adjustments to remove amounts related to interest, depreciation and

amortization included in the adjustments to non-GAAP underlying

income above, as these items are added back as adjustments to net

income attributable to MCBC from continuing operations.

Molson Coors Brewing Company and

SubsidiariesEurope Results of

Operations

($ In millions) (Unaudited)

Three Months Ended Six Months Ended

June 30, 2017 June 30, 2016 June 30,

2017 June 30, 2016

Financial volume in hectoliters(1)(2)

6.715 6.430 11.074 10.691 Sales(2) $

796.2 $ 800.5 $ 1,310.6 $ 1,361.4 Excise taxes (271.5 ) (278.4 )

(404.3 ) (480.6 ) Net sales(2) 524.7 522.1 906.3 880.8 Cost of

goods sold (313.9 ) (310.9 ) (538.0 ) (550.8 ) Gross profit 210.8

211.2 368.3 330.0 Marketing, general and administrative expenses

(136.5 ) (151.1 ) (261.7 ) (270.4 ) Special items, net(3) (2.6 )

(2.3 ) (5.2 ) (3.0 ) Operating income (loss) 71.7 57.8 101.4 56.6

Interest income, net 1.0 0.9 2.0 1.7 Other income (expense), net

0.6 0.3 0.5 (0.5 ) Income (loss) from

continuing operations before income taxes $ 73.3 $ 59.0 $ 103.9 $

57.8 Add/(less): Special items, net(3) 2.6 2.3 5.2 3.0 Acquisition

and integration related costs(4) 0.1 — 0.3 —

Non-GAAP: Underlying pretax income (loss) $ 76.0 $ 61.3 $

109.4 $ 60.8 Add: Interest expense (income), net (1.0 ) (0.9 ) (2.0

) (1.7 ) Add: Depreciation and amortization 45.1 45.6 88.9 90.2

Adjustments to arrive at underlying EBITDA(5) (1.8 ) (2.0 ) (4.0 )

(3.9 ) Non-GAAP: Underlying EBITDA $ 118.3 $ 104.0 $

192.3 $ 145.4

(1)

Historical financial volumes have been

recast to reflect the impacts of aligning policies on reporting

financial volumes as a result of the Acquisition. See "Actual and

Pro Forma Worldwide Brand Volume" above for further details.

(2) Reflects gross inter-segment sales that are eliminated

in the consolidated totals. Excludes royalty volume of 0.479

million hectoliters and 0.804 million hectoliters for the three and

six months ended June 30, 2017, and excludes royalty volume of

0.051 million hectoliters and 0.087 million hectoliters for the

three and six months ended June 30, 2016, respectively. (3)

See Part I—Item 1. Financial Statements, Note 6, "Special Items" of

the Form 10-Q for detailed discussion of special items. Special

items for the three and six months ended June 30, 2017, includes

accelerated depreciation expense of $1.8 million and $4.0 million,

respectively, related to the planned closure of our Burton South

brewery in the U.K. Special items for the three and six months

ended June 30, 2016, includes accelerated depreciation expense of

$2.0 million and $3.9 million, respectively, associated with this

planned closure. These accelerated depreciation charges are

included in our adjustments to arrive at underlying EBITDA.

(4) For the three and six months ended June 30, 2017, $0.1 million

and $0.3 million, respectively, of acquisition and integration

related costs were incurred in cost of goods sold. (5)

Represents adjustments to remove amounts related to interest,

depreciation and amortization included in the adjustments to

non-GAAP underlying income above, as these items are added back as

adjustments to net income attributable to MCBC from continuing

operations.

Molson Coors Brewing Company and

SubsidiariesInternational Results of

Operations

($ In millions) (Unaudited)

Three Months Ended Six Months Ended

June 30, 2017 June 30, 2016 June 30,

2017 June 30, 2016

Financial volume in hectoliters(1)(2)

0.643 0.366 1.171 0.671 Sales $ 81.3 $

47.5 $ 147.6 $ 84.1 Excise taxes (16.2 ) (8.3 ) (20.7 ) (13.9 ) Net

sales 65.1 39.2 126.9 70.2 Cost of goods sold(3) (47.8 ) (25.7 )

(86.8 ) (46.3 ) Gross profit 17.3 13.5 40.1 23.9 Marketing, general

and administrative expenses (24.7 ) (16.1 ) (45.7 ) (28.8 ) Special

items, net(4) (0.3 ) (30.8 ) (0.6 ) (30.8 ) Operating income (loss)

(7.7 ) (33.4 ) (6.2 ) (35.7 ) Other income (expense), net —

— — — Income (loss) from continuing operations

before income taxes $ (7.7 ) $ (33.4 ) $ (6.2 ) $ (35.7 )

Add/(less): Special items, net(4) 0.3 30.8 0.6 30.8 Acquisition and

integration related costs(5) 4.0 — 4.9 —

Non-GAAP: Underlying pretax income (loss) $ (3.4 ) $ (2.6 )

$ (0.7 ) $ (4.9 ) Add: Depreciation and amortization 2.5 0.9 4.8

1.8 Adjustments to arrive at underlying EBITDA — — —

— Non-GAAP: Underlying EBITDA $ (0.9 ) $ (1.7 ) $ 4.1

$ (3.1 )

(1)

Historical financial volumes have been

recast to reflect the impacts of aligning policies on reporting

financial volumes as a result of the Acquisition. See "Actual and

Pro Forma Worldwide Brand Volume" above for further details.

(2)

Excludes royalty volume of 0.554 million

hectoliters and 1.027 million hectoliters for the three and six

months ended June 30, 2017, respectively, and excludes royalty

volume of 0.470 million and 0.771 million hectoliters for the three

and six months ended June 30, 2016, respectively.

(3) Reflects gross inter-segment purchases that are

eliminated in the consolidated totals. (4) See Part I—Item

1. Financial Statements, Note 6, "Special Items" of the Form 10-Q

for detailed discussion of special items. (5) For the three

and six months ended June 30, 2017, $1.4 million of integration

costs were incurred in cost of goods sold, and for the three and

six months ended June 30, 2017, $2.6 million and $3.5 million,

respectively, of integration costs were incurred in marketing,

general & administrative expenses.

Molson Coors Brewing Company and

SubsidiariesCorporate Results of

Operations

($ In millions) (Unaudited)

Three Months Ended Six Months Ended

June 30, 2017 June 30, 2016 June 30,

2017 June 30, 2016

Financial volume in hectoliters

— — — — Sales $ 0.3 $ 0.2 $ 0.6 $ 0.6

Excise taxes — — — — Net sales 0.3 0.2

0.6 0.6 Cost of goods sold (23.5 ) 12.4 39.5 15.2

Gross profit (23.2 ) 12.6 40.1 15.8 Marketing, general and

administrative expenses (56.2 ) (47.1 ) (111.9 ) (89.3 ) Special

items, net(1) — — (0.1 ) — Operating income

(loss) (79.4 ) (34.5 ) (71.9 ) (73.5 ) Interest expense, net (90.2

) (41.4 ) (187.8 ) (89.5 ) Other income (expense), net 0.4

(33.2 ) (7.3 ) (50.9 ) Income (loss) from continuing operations

before income taxes $ (169.2 ) $ (109.1 ) $ (267.0 ) $ (213.9 )

Add/(less): Special items, net(1) — — 0.1 — Acquisition and

integration related costs(2) 11.2 64.7 24.6 118.4 Unrealized

mark-to-market (gains) and losses(3) 23.4 (13.0 ) (39.7 )

(15.3 ) Non-GAAP: Underlying pretax income (loss) $ (134.6 ) $

(57.4 ) $ (282.0 ) $ (110.8 ) Add: Interest expense (income), net

90.2 41.4 187.8 89.5 Add: Depreciation and amortization 1.0 1.1 1.9

2.1 Adjustments to arrive at underlying EBITDA(4) — (13.3 )

— (33.7 ) Non-GAAP: Underlying EBITDA $ (43.4 ) $ (28.2 ) $

(92.3 ) $ (52.9 )

(1) See Part I—Item 1. Financial Statements,

Note 6, "Special Items" of the Form 10-Q for detailed discussion of

special items. (2) In connection with the acquisition, for

the three and six months ended June 30, 2017, we have recorded

$11.2 million and $24.6 million, respectively, of

transaction-related costs within marketing, general &

administrative expenses. For the three and six months ended June

30, 2016, we recorded $19.6 million and $34.5 million,

respectively, of transaction-related costs within marketing,

general & administrative expenses, $31.8 million and $50.2

million, respectively, of financing costs in other income

(expense), and $13.3 million and $33.7 million, respectively, of

net interest expense in interest income (expense). The interest

income (expense) is included in our adjustments to arrive at

underlying EBITDA. (3) The unrealized changes in fair value

on our commodity swaps, which are economic hedges, are recorded as

cost of goods sold within our Corporate business activities. As the

exposure we are managing is realized, we reclassify the gain or

loss to the segment in which the underlying exposure resides,

allowing our segments to realize the economic effects of the

derivative without the resulting unrealized mark-to-market

volatility. (4) Represents adjustments to remove amounts

related to interest, depreciation and amortization included in the

adjustments to non-GAAP underlying income above, as these items are

added back as adjustments to net income attributable to MCBC from

continuing operations.

Balance Sheet

Condensed

Consolidated Balance Sheets

($ In millions, except par value) (Unaudited)

As of June 30, 2017 December 31, 2016

Assets Current assets: Cash and cash equivalents $ 502.9 $

560.9 Accounts receivable, net 962.9 669.5 Other receivables, net

113.8 135.8 Inventories, net 633.7 592.7 Other current assets, net

275.7 210.7 Total current assets 2,489.0 2,169.6

Properties, net 4,585.2 4,507.4 Goodwill 8,391.2 8,250.1 Other

intangibles, net 14,199.6 14,031.9 Other assets 453.6 382.5

Total assets $ 30,118.6 $ 29,341.5

Liabilities and equity Current liabilities: Accounts payable

and other current liabilities $ 2,616.6 $ 2,467.7 Current portion

of long-term debt and short-term borrowings 686.6 684.8

Discontinued operations 4.9 5.0 Total current

liabilities 3,308.1 3,157.5 Long-term debt 11,185.1 11,387.7

Pension and postretirement benefits 1,124.8 1,196.0 Deferred tax

liabilities 1,865.2 1,699.0 Other liabilities 317.2 267.0

Discontinued operations 12.4 12.6 Total liabilities

17,812.8 17,719.8 Molson Coors Brewing Company stockholders' equity

Capital stock: Preferred stock, $0.01 par value (authorized: 25.0

shares; none issued) — — Class A common stock, $0.01 par value per

share (authorized: 500.0 shares; issued and outstanding: 2.6 shares

and 2.6 shares, respectively) — — Class B common stock, $0.01 par

value per share (authorized: 500.0 shares; issued: 204.6 shares and

203.7 shares, respectively) 2.0 2.0 Class A exchangeable shares, no

par value (issued and outstanding: 2.9 shares and 2.9 shares,

respectively) 107.7 108.1 Class B exchangeable shares, no par value

(issued and outstanding: 14.7 shares and 15.2 shares, respectively)

554.4 571.2 Paid-in capital 6,658.5 6,635.3 Retained earnings

6,467.0 6,119.0 Accumulated other comprehensive income (loss)

(1,222.3 ) (1,545.5 ) Class B common stock held in treasury at cost

(9.5 shares and 9.5 shares, respectively) (471.4 ) (471.4 ) Total

Molson Coors Brewing Company stockholders' equity 12,095.9 11,418.7

Noncontrolling interests 209.9 203.0 Total equity

12,305.8 11,621.7 Total liabilities and equity $

30,118.6 $ 29,341.5

Cash Flow Statement

Condensed

Consolidated Statements of Cash Flows

($ In millions) (Unaudited)

Six Months

Ended June 30, 2017 June 30, 2016 Cash

flows from operating activities: Net income (loss) including

noncontrolling interests $ 536.2 $ 337.4 Adjustments to reconcile

net income (loss) to net cash provided by operating activities:

Depreciation and amortization 396.0 137.7 Amortization of debt

issuance costs and discounts 11.2 35.5 Share-based compensation

31.6 11.5 (Gain) loss on sale or impairment of properties and other

assets, net (4.3 ) (79.8 ) Equity income in MillerCoors — (323.2 )

Distributions from MillerCoors — 323.2 Equity in net (income) loss

of other unconsolidated affiliates 4.7 2.4 Unrealized (gain) loss

on foreign currency fluctuations and derivative instruments, net

(40.5 ) (5.2 ) Income tax (benefit) expense 187.6 37.9 Income tax

(paid) received 23.5 (109.1 ) Interest expense, excluding interest

amortization 177.6 95.5 Interest paid (175.4 ) (95.1 ) Pension

expense (benefit) (14.1 ) 4.0 Pension contributions paid (72.1 )

(10.4 ) Change in current assets and liabilities (net of impact of

business combinations) and other (242.5 ) (82.2 ) (Gain) loss from

discontinued operations (1.0 ) 2.3 Net cash provided by

(used in) operating activities 818.5 282.4 Cash flows

from investing activities: Additions to properties (354.0 ) (121.6

) Proceeds from sales of properties and other assets 46.1 144.6

Investment in MillerCoors — (810.6 ) Return of capital from

MillerCoors — 731.1 Other 6.0 (4.1 ) Net cash provided by

(used in) investing activities (301.9 ) (60.6 ) Cash flows from

financing activities: Proceeds from issuance of common stock, net —

2,525.9 Exercise of stock options under equity compensation plans

1.1 5.4 Dividends paid (176.6 ) (176.5 ) Debt issuance costs (4.6 )

(15.0 ) Payments on debt and borrowings (2,201.5 ) (17.9 ) Proceeds

on debt and borrowings 1,536.0 31.7 Net proceeds from (payments on)

revolving credit facilities and commercial paper 282.0 2.5 Change

in overdraft balances and other (29.6 ) (17.5 ) Net cash provided

by (used in) financing activities (593.2 ) 2,338.6 Cash and

cash equivalents: Net increase (decrease) in cash and cash

equivalents (76.6 ) 2,560.4 Effect of foreign exchange rate changes

on cash and cash equivalents 18.6 (1.0 ) Balance at beginning of

year 560.9 430.9 Balance at end of period $ 502.9

$ 2,990.3

Reconciliations to Nearest U.S. GAAP

Measures by Line Item

Second Quarter 2017 Three

Months Ended June 30, 2017

($ In millions, except per share

data)(Unaudited)

Net sales

Cost of

goodssold(1)

Gross profit

Marketing,general

andadministrativeexpenses(2)

Special

items,net(3)

Operatingincome (loss)

Reported (U.S. GAAP) $ 3,091.3 $ (1,756.1 ) $ 1,335.2 $

(781.2 ) $ (16.5 ) $ 537.5 Adjustments to arrive at underlying:

Special items, net Employee-related charges — — — — 0.4 0.4

Impairments or asset abandonment charges — — — — 16.1 16.1 Non-Core

items Acquisition and integration related costs — 5.0 5.0 13.9 —

18.9 Unrealized mark-to-market (gains) losses — 23.4

23.4 — —

23.4

Underlying (Non-GAAP) $ 3,091.3 $

(1,727.7 ) $ 1,363.6 $ (767.3 ) $ —

$ 596.3

Second Quarter 2017 Three

Months Ended June 30, 2017

($ In millions, except per share

data)(Unaudited)

Interestincome(expense),net

Otherincome(expense),net

Income

(loss)fromcontinuingoperationsbefore

incometaxes

Income

taxbenefit(expense)

Net income (loss)attributable

toMCBC fromcontinuingoperations

Net income (loss)attributable

toMCBC fromcontinuingoperations

perdiluted share

Reported (U.S. GAAP) $ (89.2 ) $ 1.5 $ 449.8 $ (123.0 ) $

321.7 $ 1.49 Adjustments to arrive at underlying: Special items,

net Employee-related charges — — 0.4 — 0.4 — Impairments or asset

abandonment charges — — 16.1 — 16.1 0.07 Non-Core items Acquisition

and integration related costs — — 18.9 — 18.9 0.09 Unrealized

mark-to-market (gains) losses — — 23.4 — 23.4 0.11 Tax effects on

special and non-GAAP items — — —

(21.6 ) (21.6 ) (0.10 )

Underlying

(Non-GAAP) $ (89.2 ) $ 1.5 $ 508.6

$ (144.6 ) $ 358.9 $ 1.66

(1)

Adjustments relate to the following segments: U.S. segment $0.7

million, Canada segment $2.8 million, Europe segment $0.1 million,

International segment $1.4 million, Corporate segment $23.4

million. (2) Adjustments relate to the following segments:

U.S. segment $0.1 million, International segment $2.6 million,

Corporate segment $11.2 million. (3) Adjustments relate to

the following segments: U.S. segment $12.6 million, Canada segment

$1.0 million, Europe segment $2.6 million, International segment

$0.3 million.

YTD Second Quarter

2017 Six Months Ended June 30, 2017

($ In millions, except per share

data)(Unaudited)

Net sales

Cost of

goodssold(1)

Gross profit

Marketing,general

andadministrativeexpenses(2)

Special

items,net(3)

Operatingincome (loss)

Reported (U.S. GAAP) $ 5,540.0 $ (3,129.0 ) $ 2,411.0 $

(1,484.0 ) $ (20.3 ) $ 906.7 Adjustments to arrive at underlying:

Special items, net Employee-related charges — — — — (1.6 ) (1.6 )

Impairments or asset abandonment charges — — — — 21.9 21.9 Non-Core

items Acquisition and integration related costs — 5.7 5.7 32.2 —

37.9 Unrealized mark-to-market (gains) losses — (39.7

) (39.7 ) — — (39.7 )

Underlying (Non-GAAP) $ 5,540.0 $ (3,163.0 )

$ 2,377.0 $ (1,451.8 ) $ —

$ 925.2

YTD Second Quarter 2017

Six Months Ended June 30, 2017

($ In millions, except per share

data)(Unaudited)

Interestincome(expense),net

Otherincome(expense),net

Income

(loss)fromcontinuingoperationsbefore

incometaxes

Income

taxbenefit(expense)

Net income (loss)attributable

toMCBC fromcontinuingoperations

Net income (loss)attributable

toMCBC fromcontinuingoperations

perdiluted share

Reported (U.S. GAAP) $ (185.8 ) $ 1.9 $ 722.8 $ (187.6 ) $

523.6 $ 2.42 Adjustments to arrive at underlying: Special items,

net Employee-related charges — — (1.6 ) — (1.6 ) (0.02 )

Impairments or asset abandonment charges — — 21.9 — 21.9 0.10

Non-Core items

Acquisition and integration related

costs

— — 37.9 — 37.9 0.18 Unrealized mark-to-market (gains) losses — —

(39.7 ) — (39.7 ) (0.18 ) Other non-core items — (8.1 ) (8.1 ) —

(8.1 ) (0.04 ) Tax effects on special and non-GAAP items —

— — (9.5 ) (9.5 )

(0.04 )

Underlying (Non-GAAP) $ (185.8 ) $ (6.2 )

$ 733.2 $ (197.1 ) $ 524.5

$ 2.42

(1) Adjustments relate to the following

segments: U.S. segment $1.2 million, Canada segment $2.8 million,

Europe segment $0.3 million, International segment $1.4 million,

Corporate segment ($39.7) million. (2) Adjustments relate to

the following segments: U.S. segment $4.1 million, International

segment $3.5 million, Corporate segment $24.6 million. (3)

Adjustments relate to the following segments: U.S. segment $15.1

million, Canada segment $(0.7) million, Europe segment $5.2

million, International segment $0.6 million, Corporate $0.1

million.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170802005248/en/

Molson Coors Brewing CompanyNews

MediaColin Wheeler, 303-927-2443orInvestor RelationsDave Dunnewald,

303-927-2334orKevin Kim, 303-927-2515

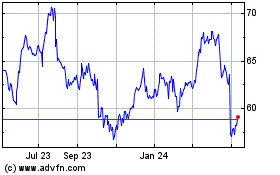

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

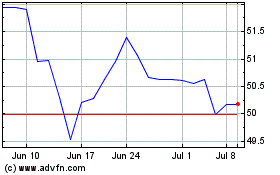

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Apr 2023 to Apr 2024