Profit tumbles 77% as retailer pours funds into new warehouses,

data centers and Alexa

By Laura Stevens

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 28, 2017).

Amazon.com Inc. said quarterly profit fell 77% even as sales

jumped, a sign of the high cost of its increasing dominance of

retail.

The Seattle-based retailer eked out its smallest quarterly

profit in nearly two years. The company reported $197 million in

profit on $38 billion in sales in the second quarter as it spent on

new warehouses and delivery capacity for its retail business and

data centers for its cloud services business. The company also

poured funds into hiring engineers to work on its artificial

intelligence Alexa service as well as warehouse workers.

"We are continuing to invest in businesses that will achieve

four goals...Customers love them, they can grow to be large, they

have strong financial returns and they are durable and can last for

decades," Chief Financial Officer Brian Olsavsky said on a media

call. "That is, in essence, our investment philosophy."

Amazon's 25% sales growth comes at the expense of traditional

retailers, which are struggling with declining foot traffic and the

shift of consumer spending online. At a time when Amazon is

investing heavily and expanding, other retailers are saddled with

high debt loads and falling sales, forcing them to close stores and

cut jobs -- and extending Amazon's advantage.

"Amazon is a great disrupter in traditional retail," said Trip

Miller, founder and managing partner at Amazon investor Gullane

Capital LLC. "Everyone is pivoting and trying to change their game

to deal with Amazon. I would hate to be the competition in anything

they get involved in."

Amazon's stock price was down 2.3% in after-hour trading as the

company missed profit and guidance expectations, a tempered

reaction given that other retail stocks often drop in the double

digits when Amazon makes a move to compete in the same market.

Amazon shares, which finished Thursday at $1,046, were up about 39%

year-to-date at the close.

High expectations for Amazon temporarily made founder and Chief

Executive Jeff Bezos the world's richest person on Thursday.

Amazon's stock hit a record in the morning ahead of the results,

edging Mr. Bezos in front of Microsoft Corp. founder Bill Gates,

before closing down. According to Forbes, which tracks a list of

billionaires, Mr. Bezos reached a net worth of $90.6 billion as the

market opened.

Amazon is now making a big push into brick-and-mortar, something

expected to further hurt traditional retail competitors. Last

month, Amazon announced a $13.7 billion including debt acquisition

of Whole Foods Market Inc., immediately catapulting it into a major

player in brick-and-mortar retail and grocery. Whole Foods reported

Wednesday that comparable sales fell again in its latest quarter, a

trend it has promised to reverse by September.

Adding Whole Foods "will be a big boost for us as we expand our

offerings in consumables and grocery," Mr. Olsavsky said.

The shift from shopping in-store to online has left many

powerful brands unable to ignore Amazon, increasing the retailer's

dominance. Fifty-five percent of product searches now start at

Amazon, according to personalization platform company BloomReach,

compared with 28% on search engines. In recent weeks, Amazon has

become an official seller for Nike Inc. and Sears Holding Corp.'s

Kenmore brand of appliances.

Amazon has claimed more than 40 cents out of every dollar spent

online over the past year, according to receipt tracker Slice

Intelligence, which has an online shopping panel of more than 5

million. Wal-Mart Stores Inc., in comparison, claimed about 1.7% of

online spending over the same period.

Amazon is now the second-largest apparel seller behind Wal-Mart

after taking market share from Target Corp. and several department

stores, according to a research note published by Morgan Stanley in

April.

But the company's outsize retail muscle is raising concerns

about its growing size and influence. Amazon's acquisition of Whole

Foods has prompted roughly a dozen members of Congress to call for

a close review of the deal. The Consumer Watchdog group is lobbying

the Federal Trade Commission to block it on allegations that

Amazon's pricing discounts are misleading, assertions Amazon has

called "flat out wrong."

Mr. Olsavsky said Amazon isn't as dominant as it may appear.

"The businesses we're in are all very large market segments, with

lots of very serious competition," Mr. Olsavsky said. "Generally

the number one thing that we'll do at all times is align ourselves

with customers and continue to invent on their behalf."

Department stores are expected to post a 12% decline in earnings

when they report in coming weeks, according to FactSet, while

apparel retailers are forecast to see profits drop 8.5%.

Amazon said it will continue to spend heavily on its growth,

signaling a period of lower profit. That is particularly the case

in the third quarter, Mr. Olsavsky said, because Amazon bulks up on

warehouse staff and delivery capacity ahead of the all-important

holiday season. Amazon said its operating income could swing to a

loss in the next quarter.

One of the bigger costs for the quarter will come from hiring

new employees, part of its pledge to hire 130,000 U.S. workers

through mid-2018. The company said on Wednesday it plans to host a

giant job fair next week to hire for its 50,000 current U.S.

warehouse openings. Amazon said Thursday that its global workforce

rose by more than 31,000 in the second quarter to 382,400.

The company may also have to pay its new warehouse hires more

thanks to a tight labor market in many logistics hubs as retailers

and delivery companies compete for the same small pool of

workers.

Amazon's cloud-computing division continues to be the engine

behind the retail giant's profits. Amazon Web Services' operating

income of $916 million topped total operating income for the entire

company, which hit $628 million in the period. Even so, AWS, which

competes against Microsoft and Alphabet Inc.'s Google, marked the

fifth consecutive quarter of declining operating income growth,

which gained 28%.

--Jay Greene contributed to this article.

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

July 28, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

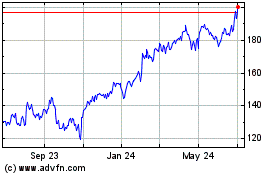

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

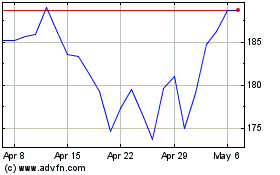

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024