Comcast Profit and Revenue Beat Analysts' Expectations -- Update

July 27 2017 - 11:55AM

Dow Jones News

By Austen Hufford

Comcast Corp.'s entertainment unit surged in the second quarter,

helped by the strong box-office performance of "The Fate of the

Furious," lifting profit and revenue even as cable video subscriber

losses ticked up.

At the NBCUniversal media division, revenue rose 17% to $8.33

billion. Revenue in the filmed entertainment division jumped 60%,

thanks to the latest installment of the "Fast and the Furious"

franchise, which offset disappointing results from "The Mummy"

reboot.

Comcast shares rose 1.5% to $39.94 in morning trading.

The cable networks and broadcast TV units grew revenue and

earnings due to increases in subscription fees from pay TV

providers, but both also saw a decline in ad sales because of

ratings softness. Cable networks' ad revenues declined 0.9% to $906

million, while broadcast TV ad revenue declined 1.2% to $1.27

billion.

In the cable business, the company lost 45,000 residential

television customers, compared with a loss of 21,000 in the same

quarter last year.

Comcast has generally managed to withstand the turmoil in cable

TV from cord-cutting better than some peers in pay television. In a

tough environment, with consumers gravitating to streaming services

such as Netflix, Amazon, Hulu and Sling TV, the company has added

net video subscribers in five of the past seven quarters. The

cord-cutting has taken a toll on TV ratings, however, for

NBCUniversal's channels just like those of many other media

companies.

To help prevent customers from dropping its services, Comcast

recently started offering wireless service, adding a fourth pillar

to the typical television-phone-internet bundles. The mobile

service is only for customers who subscribe to at least its

internet service already.

The cable operator is relying on a five-year-old network-resale

agreement with Verizon Communications to offer its mobile service.

Comcast, along fellow cable provider Charter Communications Inc.,

has explored a deal with Sprint Corp. that could provide an

alternative reseller arrangement, potentially with better terms,

people familiar with the matter have said.

On a call with analysts, executives implied the company was

unlikely to pursue a large deal in the wireless industry. Comcast

Chief Executive Brian Roberts said the company is happy with its

plan of being a reseller and noted that it is still early days for

Xfinity Mobile.

"We really feel we're not missing anything," Mr. Roberts said.

"No disrespect to wireless. It's a tough business."

Comcast and industry analysts point to its investment in X1, a

cloud-based, set-top box system, as a reason its video business has

held up. The company said that 55% of its residential video

customers now have X1, up from nearly 40% in the same quarter last

year.

Comcast said that over-the-top streaming services are "not all

that material" to its business.

"We're skeptical that it's going to be a very large business or

profitable business for the people that are in it and they're off

to a relatively slow start," Steve Burke, CEO of Comcast's

NBCUniversal, said on the call.

Meanwhile, Comcast and other cable providers stand to benefit on

the internet access side of their business as streaming TV

subscriptions and usage increase. Comcast added 140,000 residential

internet customers in the second quarter, down from 176,000

additions in the year-earlier period.

Total revenue per customer relationship, Comcast's unit revenue

figure for its cable division, increased 2.2% to an average of

$151.19 a month.

Comcast lost 50,000 residential voice customers in the quarter,

compared with an addition of 35,000 in the year-ago quarter.

Overall revenue for Comcast's cable division, which makes up

more than 60% of the company's total revenue, rose 5.5% to $13.12

billion.

In all, net income rose to $2.51 billion, or 52 cents a share,

up from about $2.03 billion, or 41 cents a share, a year ago.

Revenue grew 9.8% to $21.17 billion.

Revenue and profit exceeded estimates from analysts, who were

projecting earnings of 48 cents a share on $20.86 billion in

revenue, according to Thomson Reuters.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 27, 2017 11:40 ET (15:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

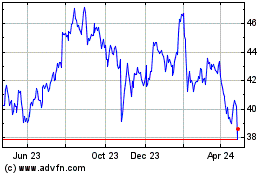

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

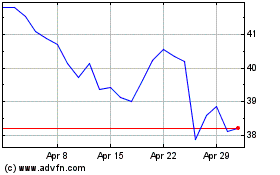

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024