SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2017

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

|

|

Second Quarter 2017 Results

July 27, 2017

Page

1

|

AMBEV REPORTS 2017 SECOND QUARTER RESULTS UNDER IFRS

São Paulo, July 27, 2017

– Ambev S.A. [BOVESPA: ABEV3; NYSE: ABEV] announces today its results for the 2017 second quarter. The following operating and financial information, unless otherwise indicated, is presented in nominal

Reais

and prepared according to International Financial Reporting Standards (IFRS), and should be read together with our quarterly financial information for the six-month period ended June 30

th

, 2017 filed with the CVM and submitted to the SEC.

|

Operating and Financial Highlights

|

Top line performance:

Top line was up 4.8% in 2Q17, driven by growth in all our international operations: Latin America South (LAS) (+36.2%), Central America and the Caribbean (CAC) (+6.9%) and Canada (+1.4%), partially impacted by Brazil (-4.1%). In Brazil, volumes declined by 4.7%, while NR/hl was up 0.7%. In CAC, organic volumes were up 1.6%, with a NR/hl growth of 4.2%, while reported volumes increased by 26.2% as a result of the swap of assets carried out with ABI and our operations in Panama. In LAS, volumes grew by a solid 12.2% and NR/hl was up 21.4%. In Canada, volumes were slightly down (-0.4%), while NR/hl grew by 1.8%.

Cost of Goods Sold (COGS):

Our COGS increased by 10.6% in the quarter and, on a per hectoliter basis, by 11.6%. Cash COGS (excluding depreciation and amortization) grew by 11.2% while, on a per hectoliter basis, by 12.2%, mainly due to inflationary pressures and unfavorable FX in Brazil and LAS.

Selling, General & Administrative (SG&A) expenses:

SG&A was up 1.3% in 2Q17 while cash SG&A

(excluding depreciation and amortization) up 1.7%, below our weighted average inflation (around 5.1%), due to efficiency gains in sales & marketing and cost savings in administrative expenses.

EBITDA, Gross margin and EBITDA margin:

Normalized EBITDA reached R$ 3,943.3 million (-0.7%) in 2Q17, with gross margin of 60.6% (-200bps) and EBITDA margin of 38.4% (-210bps).

Normalized Net Profit and EPS:

Normalized Net Profit was R$ 2,141.5 million in 2Q17, 2.4% lower than in 2Q16, as the EBITDA organic decline and the negative impact of currency translation due to the appreciation of the Brazilian Real were partially offset by the reduction of net financial expenses. Normalized EPS in the quarter was R$ 0.13.

Cash Generation and CAPEX:

Cash generated from operating activities in 2Q17 was 2,424.6 (+16.5%) while CAPEX reached 751 million (-34.8%). Year to date, cash generated from operating activities totaled R$ 4,409.1 million, compared to a negative balance of R$ 132.9 million in the same period of 2016. CAPEX year to date is R$ 1.3 billion (-29.5%).

Pay-out and Financial discipline:

Year to date, we have paid/announced R$ 3.6 billion in dividends. As of June 30th, 2017, our net cash position was R$ 3,821.4 million.

|

Financial highlights - Ambev consolidated

|

|

|

% As

|

%

|

|

|

% As

|

%

|

|

R$ million

|

2Q16

|

2Q17

|

Reported

|

Organic

|

YTD16

|

YTD17

|

Reported

|

Organic

|

|

Total volumes

|

35,667.8

|

35,660.3

|

0.0%

|

-1.1%

|

75,625.1

|

76,965.4

|

1.8%

|

0.8%

|

|

Net sales

|

10,377.2

|

10,268.0

|

-1.1%

|

4.8%

|

21,942.3

|

21,509.8

|

-2.0%

|

6.5%

|

|

Gross profit

|

6,482.6

|

6,219.8

|

-4.1%

|

1.4%

|

14,087.4

|

12,938.4

|

-8.2%

|

-0.2%

|

|

Gross margin

|

62.5%

|

60.6%

|

-190 bps

|

-200 bps

|

64.2%

|

60.2%

|

-400 bps

|

-410 bps

|

|

Normalized EBITDA

|

4,204.6

|

3,943.3

|

-6.2%

|

-0.7%

|

9,469.0

|

8,299.5

|

-12.4%

|

-4.6%

|

|

Normalized EBITDA margin

|

40.5%

|

38.4%

|

-210 bps

|

-210 bps

|

43.2%

|

38.6%

|

-460 bps

|

-450 bps

|

|

Profit

|

2,172.5

|

2,124.8

|

-2.2%

|

|

5,066.5

|

4,414.7

|

-12.9%

|

|

|

Normalized profit

|

2,194.7

|

2,141.5

|

-2.4%

|

|

5,095.0

|

4,457.5

|

-12.5%

|

|

|

EPS (R$/shares)

|

0.13

|

0.13

|

-1.7%

|

|

0.31

|

0.27

|

-12.5%

|

|

|

Normalized EPS

|

0.13

|

0.13

|

-1.7%

|

|

0.31

|

0.27

|

-12.1%

|

|

Note:

Earnings p

er share calculation is based on outstanding shares (total existing shares excluding shares held in treasury).

This press release segregates the impact of organic changes from those arising from changes in scope or currency translation. Scope changes represent the impact of acquisitions and divestitures, the start up or termination of activities or the transfer of activities between segments, curtailment gains and losses and year over year changes in accounting estimates and other assumptions that management does not consider as part of the underlying performance of the business.

Unless stated, p

ercentage changes in this press release are both organic and normalized in nature. Whenever used in this document, the term “normalized” refers to performance measures (EBITDA, EBIT, Profit, EPS) before special items adjustments. Special items are either income or expenses which do not occur regularly as part of the normal activities of the Company. They are presented separately because they are important for the understanding of the underlying sustainable performance of the Company due to their size or nature. Normalized measures are additional measures used by management and should not replace the measures determined in accordance with IFRS as indicators of the Company’s performance. Comparisons, unless otherwise stated, refer to the second quarter of 2016 (2Q16).

Values in this release may not add up due to rounding.

|

|

Second Quarter 2017 Results

July 27, 2017

Page

2

|

Consolidated top line increased by 4.8% in 2Q17 while EBITDA declined 0.7% in the same period. As anticipated, this was a bridge quarter, with our results in Brazil still affected by expected headwinds in our COGS that will dissipate in the second half of 2017.

In Beer Brazil, we have outperformed the industry for the second consecutive quarter in terms of volumes, amid a still challenging political and macroeconomic environment. In this context, w

e continued to focus on our five commercial platforms, activating the levers under our control,

al

ong with a strong emphasis on our operational excellence:

·

Elevate the Core

o

With Skol and Antarctica we expanded the traditional June Festivals of São João (Festas Juninas) from the Northeast to other regions of Brazil, creating a “new Carnival” and delivering breakthrough experiences to consumers.

o

Skol has been named by Millward Brown/BrandZ the most valuable brand in Latin America while Brahma, Antarctica and Bohemia were considered, respectively, the third, sixth and eighth most valuable brands in Brazil.

·

Accelerate Premium

o

Premium volumes increased by high teens in the quarter. Budweiser, which has proudly been brewed in an unique way for 140 years, with water, malt, rice, hops and aged over beechwood, continued to experience a good momentum, with a double digit volume growth and preference trending up.

o

Budweiser’s campaign that featured Oscar Schmidt received the Golden Lion in Cannes Festival. Oscar Schmidt was authentic and became a legend. Budweiser rewrote this story and, in partnership with ESPN and NBA, got Oscar to play his first NBA game at the age of 59.

·

Near Beer

o

Near beer continues to be an important platform. As a consumer-centric organization, we see this as an opportunity to be closer to our consumers in non-traditional beer occasions, enhancing the equity of our mother brands.

·

In Home

o

The 300ml returnable glass bottles volumes grew once again double digits year over year, as we continued to evolve in its execution in the off-trade channel, enhancing shoppers’ experience. This is an important initiative to drive affordability to consumers in a profitable way.

·

Out of Home

o

We have been strengthening our position in the on-trade channel with our complete portfolio of brands coupled with our initiatives to step up our service level and be even closer to our customers.

In CSD&NANC Brazil, while we underperformed the industry with our overall volumes declining 14.1%, we posted a healthy NR/hl increase of 6.6% driven by revenue management initiatives implemented during the quarter. Further, the non-traditional CSD business delivered a solid volume growth with Lipton, Fusion and Do Bem. Year to date, CSD&NANC volumes are outperforming the industry.

Finally, we are very pleased with the remarkable performance of our international operations in 2Q17. In CAC, EBITDA went up close to 30%, with a robust EBITDA margin expansion, benefiting from solid volumes, a strong revenue management strategy and phasing of sales & marketing and administrative expenses. In LAS, while we continued to be pressured on costs due to FX in Argentina, we had a significant volume growth, delivering top line and EBITDA increase of more than 30%. And,

in Canada, we continue to have momentum in the pursuit of balanced share and profitability, with the highest quarterly market share in 19 years and a solid NR/hl that, along with our cost management initiatives, led to another quarter of EBITDA growth and margin expansion.

|

|

Second Quarter 2017 Results

July 27, 2017

Page

3

|

Still with respect to our international operations, it is important to highlight that our reported results include our operations in Panama and exclude our former operations in Colombia, Peru and Ecuador, which are treated as a scope in our CAC as LAS divisions, respectively.

Looking at our divisional performance highlights in more detail:

·

Brazil

. Net revenue in Brazil was down 4.1% in 2Q17 and EBITDA down 15.7% to R$ 2,087

.2

million, with a margin of 39.2% (-540bps).

o

In

Beer Brazil

,

top line declined by 3.3% in the quarter.

§

The beer industry fell by 2.7% in 2Q17, according to Nielsen. Although we have been able to deliver volumes performance ahead of the industry, our volumes declined by 1.3%, as the mainstream segment continued to be pressured by the adverse and volatile macroeconomic and political environments. Premium, on the other hand, grew high teens year over year.

§

NR/hl was down 2.0% year over year, driven, among other factors, by a negative mix, as we continued to use our full portfolio of packs and brands to drive affordability to consumers, including the 300ml returnable glass bottles in the off-trade channel, that grew double digits in the quarter. On a sequential basis, NR/hl was slightly down (-0,2%), in line with the usual trend of NR/HL variation from the first to the second quarter.

o

In

CSD&NANC Brazil

, net revenue was down 8.5% in 2Q17. According to Nielsen, the CSD industry declined by 9.7% while our overall volumes decreased by 14.1%, as consumers continued to be pressured by a depressed disposable income, trading down to B brands, powder juices or even to tap water. NR/hl in CSD&NANC was up 6.6%, driven by revenue management initiatives implemented during the quarter.

o

Brazil cash COGS

was up 4.6% while, on a per hectoliter basis, up 9.8%, mainly due to FX impacts and inflation. In the first half of 2017, cash COGS/hl increased by 22.3%, in line with our guidance of double digits growth.

o

Brazil cash SG&A

was down 2.8%, due to (i) flattish distribution expenses, and (ii) a decline in administrative and sales & marketing expenses, as a result of cost savings in our non-working money

as well as phasing and

efficiency gains in our working money.

·

Central America and the Caribbean (CAC)

. In 2Q17, EBITDA in CAC reached R$ 431.9 million (+29,7%), supported by a strong top line performance (+6.9%) and EBITDA margin expansion (+770bps) to 38.3%. In US dollars, reported EBITDA grew close to 35%.

o

We continued to deliver solid results in the region. Organic volumes went up 1.6% on a tough comparable of +8.8% in 2Q16. On a reported basis, volumes increased by 26.2%, benefiting from the recent swap of assets carried out with ABI and our operations in Panama. In Dominican Republic, we further expanded the Presidente brand execution with micro events activations that more than doubled year to date when compared to the same period of 2016. And in Guatemala, we continued with the Busch Light campaign and also launched the new VBI of Brahva, creating a consistent commercial communication of the brand.

o

We also benefited from our solid financial discipline in the region, leveraging both costs and expenses savings, as well as from phasing of sales & marketing and administrative expenditures, leading to expansion of EBITDA margin for another quarter.

Latin America South (LAS)

.

In 2Q17, net revenue was up 36.2% while EBITDA in the region reached R$ 806.7 million (+33.9%), with an EBITDA margin compression of 60bps to 38.7%.

o

Volumes were up 12.2%, primarily driven by (i) Argentina, where we had a very strong volume performance, especially in beer that grew more than 20% year over year; (ii) Paraguay, where volumes continued to trend up as a result of the success of our 340ml returnable glass bottle strategy; and (iii) Uruguay, as execution improvements coupled with a favorable weather enabled us to deliver double digits volume growth in both beer and CSD businesses.

|

|

Second Quarter 2017 Results

July 27, 2017

Page

4

|

o

EBITDA margin in LAS compressed 60bps in the quarter, mainly due to a 50.2% cash COGS increase (+33.9% on a hectoliter basis), impacted by FX in Argentina.

·

Canada

.

Top line increased by 1.4% in the quarter with an EBITDA of R$ 617.6 million (+3.9%) and EBITDA margin expansion of 90bps to 35.7%. NR/hl was up 1.8%.

o

Volumes were slightly down (-0.4%), driven by industry softness due to unfavorable weather, almost fully offset by share performance from our diversified portfolio. Our main brands performed particularly well, led by (i) Bud Light being the fastest growing brand in 2Q17 in Canada, and (ii) the high end, with growth from

Stella Artois and the craft portfolio helping us to achieve the highest quarterly market share figure recorded in 19 years.

o

During the quarter, our cost management discipline played once again an important role, translating topline growth into EBITDA margin expansion.

The Brazilian economy is recovering at a slow pace, still representing a challenge for the beer industry in the short term. We acknowledge the difficult reality, but we believe in our strategy, remaining cautiously optimistic for the second half of the year.

Further, as we will now begin cycling more favorable net revenue per hectoliter comps, while cash COGS/hl will be between a flattish and low single-digit increase, we expect to resume EBITDA growth.

With that in mind, we will continue to put efforts in our plan, focusing on our commercial platforms in Brazil and pursuing cost savings and efficiency gains to positively impact our profitability.

Finally, having operations outside of Brazil has already proved to be an important asset. Going forward, we continue to see significant top line and EBITDA margin expansion potential in our operations in CAC. In LAS, we remain confident in our ability to deliver solid top line and EBITDA, supported

by strong brands, in spite of the macro challenges in the region.

In Canada, we remain optimistic that that we have the right portfolio that, along with our operational discipline, will continue to yield sustainable growth across the country.

|

|

Second Quarter 2017 Results

July 27, 2017

Page 5

|

|

Ambev Consolidated Income Statement

|

|

Consolidated income statement

|

2Q16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

2Q17

|

Reported

|

Organic

|

|

Net revenue

|

10,377.2

|

117.8

|

(723.9)

|

496.9

|

10,268.0

|

-1.1%

|

4.8%

|

|

Cost of goods sold (COGS)

|

(3,894.6)

|

(21.6)

|

273.1

|

(405.0)

|

(4,048.2)

|

3.9%

|

10.6%

|

|

Gross profit

|

6,482.6

|

96.2

|

(450.9)

|

91.8

|

6,219.8

|

-4.1%

|

1.4%

|

|

Selling, general and administrative (SG&A)

|

(3,492.9)

|

(61.1)

|

228.0

|

(45.4)

|

(3,371.4)

|

-3.5%

|

1.3%

|

|

Other operating income

|

331.1

|

(3.9)

|

(0.3)

|

(104.4)

|

222.6

|

-32.8%

|

-31.6%

|

|

Normalized operating income

(normalized EBIT)

|

3,320.8

|

31.2

|

(223.2)

|

(57.9)

|

3,070.9

|

-7.5%

|

-1.7%

|

|

Exceptional items above EBIT

|

(22.2)

|

0.5

|

5.6

|

(15.9)

|

(32.1)

|

44.4%

|

73.3%

|

|

Net finance results

|

(899.9)

|

|

|

|

(698.8)

|

-22.3%

|

|

|

Share of results of associates

|

0.4

|

|

|

|

5.3

|

nm

|

|

|

Income tax expense

|

(226.6)

|

|

|

|

(220.5)

|

-2.7%

|

|

|

Profit

|

2,172.5

|

|

|

|

2,124.8

|

-2.2%

|

|

|

Attributable to Ambev holders

|

2,046.2

|

|

|

|

2,013.1

|

-1.6%

|

|

|

Attributable to non-controlling interests

|

126.4

|

|

|

|

111.7

|

-11.6%

|

|

|

Normalized profit

|

2,194.7

|

|

|

|

2,141.5

|

-2.4%

|

|

|

Attributable to Ambev holders

|

2,068.4

|

|

|

|

2,028.4

|

-1.9%

|

|

|

|

|

|

|

|

|

|

|

|

Normalized EBITDA

|

4,204.6

|

39.6

|

(272.1)

|

(28.9)

|

3,943.3

|

-6.2%

|

-0.7%

|

|

Consolidated income statement

|

YTD16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

YTD17

|

Reported

|

Organic

|

|

Net revenue

|

21,942.3

|

253.6

|

(2,097.0)

|

1,410.8

|

21,509.8

|

-2.0%

|

6.5%

|

|

Cost of goods sold (COGS)

|

(7,854.9)

|

(49.6)

|

767.8

|

(1,434.5)

|

(8,571.3)

|

9.1%

|

18.5%

|

|

Gross profit

|

14,087.4

|

204.0

|

(1,329.3)

|

(23.7)

|

12,938.4

|

-8.2%

|

-0.2%

|

|

Selling, general and administrative (SG&A)

|

(7,089.6)

|

(120.8)

|

607.0

|

(249.0)

|

(6,852.3)

|

-3.3%

|

3.6%

|

|

Other operating income

|

723.5

|

9.4

|

(0.3)

|

(219.1)

|

513.4

|

-29.0%

|

-30.3%

|

|

Normalized operating income

(normalized EBIT)

|

7,721.3

|

92.6

|

(722.5)

|

(491.9)

|

6,599.5

|

-14.5%

|

-6.3%

|

|

Exceptional items above EBIT

|

(28.5)

|

(6.1)

|

10.1

|

(36.2)

|

(60.8)

|

113.5%

|

129.4%

|

|

Net finance results

|

(2,071.2)

|

|

|

|

(1,571.4)

|

-24.1%

|

|

|

Share of results of associates

|

7.8

|

|

|

|

6.3

|

-19.6%

|

|

|

Income tax expense

|

(563.0)

|

|

|

|

(559.0)

|

-0.7%

|

|

|

Profit

|

5,066.5

|

|

|

|

4,414.7

|

-12.9%

|

|

|

Attributable to Ambev holders

|

4,813.0

|

|

|

|

4,212.3

|

-12.5%

|

|

|

Attributable to non-controlling interests

|

253.5

|

|

|

|

202.4

|

-20.2%

|

|

|

Normalized profit

|

5,095.0

|

|

|

|

4,457.5

|

-12.5%

|

|

|

Attributable to Ambev holders

|

4,841.5

|

|

|

|

4,238.5

|

-12.5%

|

|

|

|

|

|

|

|

|

|

|

|

Normalized EBITDA

|

9,469.0

|

110.7

|

(847.8)

|

(432.4)

|

8,299.5

|

-12.4%

|

-4.6%

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

6

|

|

Ambev Consolidated Results

|

The combination of Ambev’s operations in Latin America North (LAN), LAS and Canada’s business units, eliminating intercompany transactions, comprises our consolidated financial statements. The figures shown below are on an as-reported basis.

|

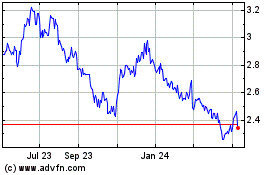

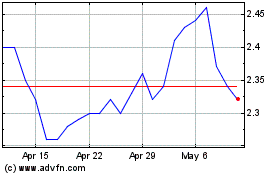

Volume (million hectoliters)

|

|

|

|

|

Net revenues per HL (R$)

|

COGS per HL (R$)

|

|

|

|

|

|

|

Normalized EBITDA (R$ MM)

|

Normalized EBITDA margin (%)

|

|

|

|

|

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

7

|

We delivered during the quarter R$ 10,268.0 million of net revenue (+4.8%) and R$ 3,943.3 million of Normalized EBITDA (-0.7%).

|

Ambev results

|

2Q16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

2Q17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

35,667.8

|

377.2

|

|

(384.8)

|

35,660.3

|

0.0%

|

-1.1%

|

|

Net revenue

|

10,377.2

|

117.8

|

(723.9)

|

496.9

|

10,268.0

|

-1.1%

|

4.8%

|

|

Net revenue/hl

|

290.9

|

0.2

|

(20.3)

|

17.1

|

287.9

|

-1.0%

|

5.9%

|

|

COGS

|

(3,894.6)

|

(21.6)

|

273.1

|

(405.0)

|

(4,048.2)

|

3.9%

|

10.6%

|

|

COGS/hl

|

(109.2)

|

0.5

|

7.7

|

(12.5)

|

(113.5)

|

4.0%

|

11.6%

|

|

COGS excl. deprec.&amort.

|

(3,337.7)

|

(19.1)

|

242.4

|

(367.8)

|

(3,482.1)

|

4.3%

|

11.2%

|

|

COGS/hl excl. deprec. &amort

|

(93.6)

|

0.5

|

6.8

|

(11.3)

|

(97.6)

|

4.4%

|

12.2%

|

|

Gross profit

|

6,482.6

|

96.2

|

(450.9)

|

91.8

|

6,219.8

|

-4.1%

|

1.4%

|

|

Gross margin

|

62.5%

|

|

|

|

60.6%

|

-190 bps

|

-200 bps

|

|

SG&A excl. deprec.&amort.

|

(3,166.1)

|

(55.3)

|

209.9

|

(54.0)

|

(3,065.4)

|

-3.2%

|

1.7%

|

|

SG&A deprec.&amort.

|

(326.9)

|

(5.8)

|

18.2

|

8.6

|

(306.0)

|

-6.4%

|

-2.7%

|

|

SG&A total

|

(3,492.9)

|

(61.1)

|

228.0

|

(45.4)

|

(3,371.4)

|

-3.5%

|

1.3%

|

|

Other operating income

|

331.1

|

(3.9)

|

(0.3)

|

(104.4)

|

222.6

|

-32.8%

|

-31.6%

|

|

Normalized EBIT

|

3,320.8

|

31.2

|

(223.2)

|

(57.9)

|

3,070.9

|

-7.5%

|

-1.7%

|

|

Normalized EBIT margin

|

32.0%

|

|

|

|

29.9%

|

-210 bps

|

-210 bps

|

|

Normalized EBITDA

|

4,204.6

|

39.6

|

(272.1)

|

(28.9)

|

3,943.3

|

-6.2%

|

-0.7%

|

|

Normalized EBITDA margin

|

40.5%

|

|

|

|

38.4%

|

-210 bps

|

-210 bps

|

|

Ambev results

|

YTD16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

YTD17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

75,625.1

|

760.2

|

|

580.1

|

76,965.4

|

1.8%

|

0.8%

|

|

Net revenue

|

21,942.3

|

253.6

|

(2,097.0)

|

1,410.8

|

21,509.8

|

-2.0%

|

6.5%

|

|

Net revenue/hl

|

290.1

|

0.4

|

(27.2)

|

16.1

|

279.5

|

-3.7%

|

5.6%

|

|

COGS

|

(7,854.9)

|

(49.6)

|

767.8

|

(1,434.5)

|

(8,571.3)

|

9.1%

|

18.5%

|

|

COGS/hl

|

(103.9)

|

0.4

|

10.0

|

(17.9)

|

(111.4)

|

7.2%

|

17.4%

|

|

COGS excl. deprec.&amort.

|

(6,741.0)

|

(43.2)

|

688.7

|

(1,362.7)

|

(7,458.3)

|

10.6%

|

20.5%

|

|

COGS/hl excl. deprec. &amort

|

(89.1)

|

0.3

|

8.9

|

(17.0)

|

(96.9)

|

8.7%

|

19.3%

|

|

Gross profit

|

14,087.4

|

204.0

|

(1,329.3)

|

(23.7)

|

12,938.4

|

-8.2%

|

-0.2%

|

|

Gross margin

|

64.2%

|

|

|

|

60.2%

|

-400 bps

|

-410 bps

|

|

SG&A excl. deprec.&amort.

|

(6,455.8)

|

(109.0)

|

560.9

|

(261.8)

|

(6,265.8)

|

-2.9%

|

4.1%

|

|

SG&A deprec.&amort.

|

(633.7)

|

(11.7)

|

46.1

|

12.8

|

(586.5)

|

-7.4%

|

-2.1%

|

|

SG&A total

|

(7,089.6)

|

(120.8)

|

607.0

|

(249.0)

|

(6,852.3)

|

-3.3%

|

3.6%

|

|

Other operating income

|

723.5

|

9.4

|

(0.3)

|

(219.1)

|

513.4

|

-29.0%

|

-30.3%

|

|

Normalized EBIT

|

7,721.3

|

92.6

|

(722.5)

|

(491.9)

|

6,599.5

|

-14.5%

|

-6.3%

|

|

Normalized EBIT margin

|

35.2%

|

|

|

|

30.7%

|

-450 bps

|

-430 bps

|

|

Normalized EBITDA

|

9,469.0

|

110.7

|

(847.8)

|

(432.4)

|

8,299.5

|

-12.4%

|

-4.6%

|

|

Normalized EBITDA margin

|

43.2%

|

|

|

|

38.6%

|

-460 bps

|

-450 bps

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

8

|

|

Latin America North (LAN)

|

Our LAN region includes Beer Brazil, CSD&NANC Brazil and CAC operations. LAN EBITDA for the quarter totaled R$ 2,519.1 million (-10.1%).

|

LAN results

|

2Q16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

2Q17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

26,471.4

|

576.7

|

|

(1,104.2)

|

25,943.9

|

-2.0%

|

-4.2%

|

|

Net revenue

|

6,533.8

|

198.8

|

(119.7)

|

(159.7)

|

6,453.3

|

-1.2%

|

-2.4%

|

|

Net revenue/hl

|

246.8

|

2.1

|

(4.6)

|

4.4

|

248.7

|

0.8%

|

1.8%

|

|

COGS

|

(2,504.4)

|

(77.0)

|

50.9

|

(100.7)

|

(2,631.3)

|

5.1%

|

4.0%

|

|

COGS/hl

|

(94.6)

|

(0.8)

|

2.0

|

(7.9)

|

(101.4)

|

7.2%

|

8.4%

|

|

COGS excl. deprec.&amort.

|

(2,093.3)

|

(67.8)

|

43.5

|

(90.9)

|

(2,208.5)

|

5.5%

|

4.3%

|

|

COGS/hl excl. deprec. &amort

|

(79.1)

|

(0.8)

|

1.7

|

(6.9)

|

(85.1)

|

7.6%

|

8.7%

|

|

Gross profit

|

4,029.3

|

121.8

|

(68.8)

|

(260.4)

|

3,822.0

|

-5.1%

|

-6.5%

|

|

Gross margin

|

61.7%

|

|

|

|

59.2%

|

-250 bps

|

-260 bps

|

|

SG&A excl. deprec.&amort.

|

(1,962.1)

|

(96.9)

|

18.4

|

100.2

|

(1,940.5)

|

-1.1%

|

-5.1%

|

|

SG&A deprec.&amort.

|

(236.4)

|

(10.8)

|

3.5

|

18.3

|

(225.4)

|

-4.7%

|

-7.8%

|

|

SG&A total

|

(2,198.6)

|

(107.7)

|

21.8

|

118.5

|

(2,165.9)

|

-1.5%

|

-5.4%

|

|

Other operating income

|

352.5

|

(3.5)

|

0.6

|

(135.2)

|

214.4

|

-39.2%

|

-38.3%

|

|

Normalized EBIT

|

2,183.3

|

10.6

|

(46.3)

|

(277.0)

|

1,870.5

|

-14.3%

|

-12.7%

|

|

Normalized EBIT margin

|

33.4%

|

|

|

|

29.0%

|

-440 bps

|

-350 bps

|

|

Normalized EBITDA

|

2,830.9

|

30.6

|

(57.3)

|

(285.1)

|

2,519.1

|

-11.0%

|

-10.1%

|

|

Normalized EBITDA margin

|

43.3%

|

|

|

|

39.0%

|

-430 bps

|

-340 bps

|

|

LAN results

|

YTD16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

YTD17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

55,472.1

|

1,149.7

|

|

(391.5)

|

56,230.3

|

1.4%

|

-0.7%

|

|

Net revenue

|

13,809.4

|

417.4

|

(353.9)

|

(67.6)

|

13,805.4

|

0.0%

|

-0.5%

|

|

Net revenue/hl

|

248.9

|

2.3

|

(6.3)

|

0.5

|

245.5

|

-1.4%

|

0.2%

|

|

COGS

|

(4,989.3)

|

(163.6)

|

154.8

|

(761.5)

|

(5,759.7)

|

15.4%

|

14.8%

|

|

COGS/hl

|

(89.9)

|

(1.1)

|

2.8

|

(14.2)

|

(102.4)

|

13.9%

|

15.6%

|

|

COGS excl. deprec.&amort.

|

(4,154.3)

|

(143.3)

|

134.1

|

(748.9)

|

(4,912.4)

|

18.3%

|

17.4%

|

|

COGS/hl excl. deprec. &amort

|

(74.9)

|

(1.0)

|

2.4

|

(13.8)

|

(87.4)

|

16.7%

|

18.2%

|

|

Gross profit

|

8,820.2

|

253.8

|

(199.2)

|

(829.1)

|

8,045.7

|

-8.8%

|

-9.1%

|

|

Gross margin

|

63.9%

|

|

|

|

58.3%

|

-560 bps

|

-570 bps

|

|

SG&A excl. deprec.&amort.

|

(4,003.3)

|

(192.0)

|

70.8

|

79.6

|

(4,044.8)

|

1.0%

|

-1.9%

|

|

SG&A deprec.&amort.

|

(454.4)

|

(21.8)

|

9.9

|

19.2

|

(447.1)

|

-1.6%

|

-4.0%

|

|

SG&A total

|

(4,457.7)

|

(213.8)

|

80.8

|

98.8

|

(4,492.0)

|

0.8%

|

-2.1%

|

|

Other operating income

|

779.1

|

7.9

|

1.2

|

(285.6)

|

502.7

|

-35.5%

|

-36.3%

|

|

Normalized EBIT

|

5,141.5

|

47.9

|

(117.2)

|

(1,015.8)

|

4,056.4

|

-21.1%

|

-19.6%

|

|

Normalized EBIT margin

|

37.2%

|

|

|

|

29.4%

|

-780 bps

|

-720 bps

|

|

Normalized EBITDA

|

6,431.0

|

90.0

|

(147.9)

|

(1,022.0)

|

5,351.1

|

-16.8%

|

-15.7%

|

|

Normalized EBITDA margin

|

46.6%

|

|

|

|

38.8%

|

-780 bps

|

-720 bps

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

9

|

In 2Q17, we delivered R$ 2,087.2 million (-15.7%) of Normalized EBITDA in Brazil, with an EBITDA margin of 39.2% (-540bps). Net revenue was down 4.1%, with volumes declining by 4.7% and NR/hl increasing by 0.7%. Cash COGS was up 4.6%, driven by volume decline and a 9.8% increase in cash COGS/hl. SG&A (excluding depreciation and amortization) was down 2.8% in the quarter.

|

Ambev Brazil results

|

2Q16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

2Q17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

24,121.9

|

|

|

(1,143.0)

|

22,979.0

|

-4.7%

|

-4.7%

|

|

Net revenue

|

5,552.6

|

|

|

(227.6)

|

5,325.0

|

-4.1%

|

-4.1%

|

|

Net revenue/hl

|

230.2

|

|

|

1.5

|

231.7

|

0.7%

|

0.7%

|

|

COGS

|

(2,064.2)

|

|

|

(77.7)

|

(2,141.9)

|

3.8%

|

3.8%

|

|

COGS/hl

|

(85.6)

|

|

|

(7.6)

|

(93.2)

|

8.9%

|

8.9%

|

|

COGS excl. deprec.&amort.

|

(1,703.3)

|

|

|

(78.5)

|

(1,781.9)

|

4.6%

|

4.6%

|

|

COGS/hl excl. deprec. &amort

|

(70.6)

|

|

|

(6.9)

|

(77.5)

|

9.8%

|

9.8%

|

|

Gross profit

|

3,488.4

|

|

|

(305.3)

|

3,183.1

|

-8.8%

|

-8.8%

|

|

Gross margin

|

62.8%

|

|

|

|

59.8%

|

-300 bps

|

-300 bps

|

|

SG&A excl. deprec.&amort.

|

(1,726.2)

|

|

|

49.1

|

(1,677.1)

|

-2.8%

|

-2.8%

|

|

SG&A deprec.&amort.

|

(207.7)

|

|

|

18.8

|

(189.0)

|

-9.0%

|

-9.0%

|

|

SG&A total

|

(1,934.0)

|

|

|

67.9

|

(1,866.1)

|

-3.5%

|

-3.5%

|

|

Other operating income

|

354.3

|

|

|

(133.1)

|

221.2

|

-37.6%

|

-37.6%

|

|

Normalized EBIT

|

1,908.7

|

|

|

(370.5)

|

1,538.2

|

-19.4%

|

-19.4%

|

|

Normalized EBIT margin

|

34.4%

|

|

|

|

28.9%

|

-550 bps

|

-550 bps

|

|

Normalized EBITDA

|

2,477.3

|

|

|

(390.1)

|

2,087.2

|

-15.7%

|

-15.7%

|

|

Normalized EBITDA margin

|

44.6%

|

|

|

|

39.2%

|

-540 bps

|

-540 bps

|

|

Ambev Brazil results

|

YTD16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

YTD17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

50,930.0

|

|

|

(456.6)

|

50,473.5

|

-0.9%

|

-0.9%

|

|

Net revenue

|

11,810.7

|

|

|

(191.5)

|

11,619.2

|

-1.6%

|

-1.6%

|

|

Net revenue/hl

|

231.9

|

|

|

(1.7)

|

230.2

|

-0.7%

|

-0.7%

|

|

COGS

|

(4,077.2)

|

|

|

(729.2)

|

(4,806.4)

|

17.9%

|

17.9%

|

|

COGS/hl

|

(80.1)

|

|

|

(15.2)

|

(95.2)

|

19.0%

|

19.0%

|

|

COGS excl. deprec.&amort.

|

(3,365.5)

|

|

|

(713.9)

|

(4,079.4)

|

21.2%

|

21.2%

|

|

COGS/hl excl. deprec. &amort

|

(66.1)

|

|

|

(14.7)

|

(80.8)

|

22.3%

|

22.3%

|

|

Gross profit

|

7,733.5

|

|

|

(920.7)

|

6,812.8

|

-11.9%

|

-11.9%

|

|

Gross margin

|

65.5%

|

|

|

|

58.6%

|

-690 bps

|

-690 bps

|

|

SG&A excl. deprec.&amort.

|

(3,520.7)

|

|

|

21.9

|

(3,498.9)

|

-0.6%

|

-0.6%

|

|

SG&A deprec.&amort.

|

(405.0)

|

|

|

27.8

|

(377.2)

|

-6.9%

|

-6.9%

|

|

SG&A total

|

(3,925.7)

|

|

|

49.7

|

(3,876.0)

|

-1.3%

|

-1.3%

|

|

Other operating income

|

774.2

|

|

|

(272.9)

|

501.3

|

-35.2%

|

-35.2%

|

|

Normalized EBIT

|

4,582.0

|

|

|

(1,143.9)

|

3,438.1

|

-25.0%

|

-25.0%

|

|

Normalized EBIT margin

|

38.8%

|

|

|

|

29.6%

|

-920 bps

|

-920 bps

|

|

Normalized EBITDA

|

5,698.6

|

|

|

(1,156.4)

|

4,542.3

|

-20.3%

|

-20.3%

|

|

Normalized EBITDA margin

|

48.2%

|

|

|

|

39.1%

|

-910 bps

|

-910 bps

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

10

|

In 2Q17, EBITDA for Beer Brazil was R$ 1.855.6 million (-13.0%) with an EBITDA margin compression of 460bps to 40.8%.

Net revenue was down 3.3% in the quarter. The beer industry declined by 2.7%, according to Nielsen and, even though we have outperformed the industry, our volumes decreased by 1.3%, as the mainstream segment continued to be pressured by adverse and volatile macroeconomic and political environments. Premium, on the other hand, grew high teens in the quarter. NR/hl decreased by 2.0%, driven, among other factors, by a negative mix, as we continued to use our full portfolio of packs and brands to drive affordability to consumers, including the 300ml returnable glass bottles in the off-trade channel, that grew double digits in the quarter. On a sequential basis, NR/hl was slightly down (-0,2%), in line with the usual trend of NR/HL variation from the first to the second quarter.

Cash COGS/hl increased by 7.1%, driven by overall inflation and FX negative impact, partially offset by commodities prices. Cash SG&A was down 3.8% as a result of (i) flattish distribution expenses, and (ii) a decline in administrative and sales & marketing expenses.

|

Beer Brazil results

|

2Q16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

2Q17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

17,659.7

|

|

|

(229.5)

|

17,430.2

|

-1.3%

|

-1.3%

|

|

Net revenue

|

4,701.6

|

|

|

(155.2)

|

4,546.4

|

-3.3%

|

-3.3%

|

|

Net revenue/hl

|

266.2

|

|

|

(5.4)

|

260.8

|

-2.0%

|

-2.0%

|

|

COGS

|

(1,634.0)

|

|

|

(87.3)

|

(1,721.3)

|

5.3%

|

5.3%

|

|

COGS/hl

|

(92.5)

|

|

|

(6.2)

|

(98.8)

|

6.7%

|

6.7%

|

|

COGS excl. deprec.&amort.

|

(1,335.5)

|

|

|

(76.2)

|

(1,411.7)

|

5.7%

|

5.7%

|

|

COGS/hl excl. deprec. &amort

|

(75.6)

|

|

|

(5.4)

|

(81.0)

|

7.1%

|

7.1%

|

|

Gross profit

|

3,067.6

|

|

|

(242.5)

|

2,825.0

|

-7.9%

|

-7.9%

|

|

Gross margin

|

65.2%

|

|

|

|

62.1%

|

-310 bps

|

-310 bps

|

|

SG&A excl. deprec.&amort.

|

(1,514.7)

|

|

|

57.4

|

(1,457.3)

|

-3.8%

|

-3.8%

|

|

SG&A deprec.&amort.

|

(179.5)

|

|

|

9.2

|

(170.3)

|

-5.1%

|

-5.1%

|

|

SG&A total

|

(1,694.2)

|

|

|

66.6

|

(1,627.6)

|

-3.9%

|

-3.9%

|

|

Other operating income

|

282.5

|

|

|

(104.2)

|

178.3

|

-36.9%

|

-36.9%

|

|

Normalized EBIT

|

1,655.8

|

|

|

(280.1)

|

1,375.7

|

-16.9%

|

-16.9%

|

|

Normalized EBIT margin

|

35.2%

|

|

|

|

30.3%

|

-490 bps

|

-490 bps

|

|

Normalized EBITDA

|

2,133.8

|

|

|

(278.2)

|

1,855.6

|

-13.0%

|

-13.0%

|

|

Normalized EBITDA margin

|

45.4%

|

|

|

|

40.8%

|

-460 bps

|

-460 bps

|

|

Beer Brazil results

|

YTD16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

YTD17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

37,527.2

|

|

|

452.2

|

37,979.4

|

1.2%

|

1.2%

|

|

Net revenue

|

10,011.4

|

|

|

(94.6)

|

9,916.8

|

-0.9%

|

-0.9%

|

|

Net revenue/hl

|

266.8

|

|

|

(5.7)

|

261.1

|

-2.1%

|

-2.1%

|

|

COGS

|

(3,233.4)

|

|

|

(601.8)

|

(3,835.2)

|

18.6%

|

18.6%

|

|

COGS/hl

|

(86.2)

|

|

|

(14.8)

|

(101.0)

|

17.2%

|

17.2%

|

|

COGS excl. deprec.&amort.

|

(2,633.0)

|

|

|

(580.5)

|

(3,213.4)

|

22.0%

|

22.0%

|

|

COGS/hl excl. deprec. &amort

|

(70.2)

|

|

|

(14.4)

|

(84.6)

|

20.6%

|

20.6%

|

|

Gross profit

|

6,778.0

|

|

|

(696.4)

|

6,081.6

|

-10.3%

|

-10.3%

|

|

Gross margin

|

67.7%

|

|

|

|

61.3%

|

-640 bps

|

-640 bps

|

|

SG&A excl. deprec.&amort.

|

(3,091.6)

|

|

|

57.6

|

(3,033.9)

|

-1.9%

|

-1.9%

|

|

SG&A deprec.&amort.

|

(338.6)

|

|

|

0.6

|

(338.0)

|

-0.2%

|

-0.2%

|

|

SG&A total

|

(3,430.2)

|

|

|

58.2

|

(3,371.9)

|

-1.7%

|

-1.7%

|

|

Other operating income

|

619.2

|

|

|

(218.2)

|

401.1

|

-35.2%

|

-35.2%

|

|

Normalized EBIT

|

3,967.1

|

|

|

(856.4)

|

3,110.7

|

-21.6%

|

-21.6%

|

|

Normalized EBIT margin

|

39.6%

|

|

|

|

31.4%

|

-820 bps

|

-820 bps

|

|

Normalized EBITDA

|

4,906.2

|

|

|

(835.6)

|

4,070.5

|

-17.0%

|

-17.0%

|

|

Normalized EBITDA margin

|

49.0%

|

|

|

|

41.0%

|

-800 bps

|

-800 bps

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

1

1

|

In Brazil CSD&NANC, EBITDA was R$ 231.6 million (-32.6%) in the 2Q17, with an EBITDA margin of 29.7% (-1070bps).

Net revenue was down 8.5%. According to Nielsen, the CSD&NANC industry declined by 9.7% while our volumes decreased by 14.1%, as consumers continued to be pressured by a depressed disposable income, trading down to B brands, powder juices or even to tap water. NR/hl was up 6.6%, driven by our revenue management initiatives implemented during the quarter.

Cash COGS/hl increased by 17.2%, impacted by inflation, FX and commodity prices. Cash SG&A was up 3.9%, led by an increase in sales & marketing and higher distribution expenses, due to the revision of cost allocation between the Beer and CSD&NANC businesses to better reflect the CSD&NANC operations.

|

CSD&Nanc Brazil results

|

2Q16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

2Q17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

6,462.2

|

|

|

(913.5)

|

5,548.7

|

-14.1%

|

-14.1%

|

|

Net revenue

|

851.0

|

|

|

(72.4)

|

778.6

|

-8.5%

|

-8.5%

|

|

Net revenue/hl

|

131.7

|

|

|

8.6

|

140.3

|

6.6%

|

6.6%

|

|

COGS

|

(430.2)

|

|

|

9.6

|

(420.6)

|

-2.2%

|

-2.2%

|

|

COGS/hl

|

(66.6)

|

|

|

(9.2)

|

(75.8)

|

13.9%

|

13.9%

|

|

COGS excl. deprec.&amort.

|

(367.8)

|

|

|

(2.3)

|

(370.2)

|

0.6%

|

0.6%

|

|

COGS/hl excl. deprec. &amort

|

(56.9)

|

|

|

(9.8)

|

(66.7)

|

17.2%

|

17.2%

|

|

Gross profit

|

420.8

|

|

|

(62.8)

|

358.1

|

-14.9%

|

-14.9%

|

|

Gross margin

|

49.5%

|

|

|

|

46.0%

|

-350 bps

|

-350 bps

|

|

SG&A excl. deprec.&amort.

|

(211.5)

|

|

|

(8.3)

|

(219.8)

|

3.9%

|

3.9%

|

|

SG&A deprec.&amort.

|

(28.3)

|

|

|

9.5

|

(18.7)

|

-33.8%

|

-33.8%

|

|

SG&A total

|

(239.8)

|

|

|

1.3

|

(238.5)

|

-0.5%

|

-0.5%

|

|

Other operating income

|

71.8

|

|

|

(28.9)

|

42.9

|

-40.3%

|

-40.3%

|

|

Normalized EBIT

|

252.9

|

|

|

(90.4)

|

162.5

|

-35.8%

|

-35.8%

|

|

Normalized EBIT margin

|

29.7%

|

|

|

|

20.9%

|

-880 bps

|

-880 bps

|

|

Normalized EBITDA

|

343.5

|

|

|

(111.9)

|

231.6

|

-32.6%

|

-32.6%

|

|

Normalized EBITDA margin

|

40.4%

|

|

|

|

29.7%

|

-1070 bps

|

-1070 bps

|

|

CSD&Nanc Brazil results

|

YTD16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

YTD17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

13,402.8

|

|

|

(908.8)

|

12,494.1

|

-6.8%

|

-6.8%

|

|

Net revenue

|

1,799.3

|

|

|

(96.9)

|

1,702.4

|

-5.4%

|

-5.4%

|

|

Net revenue/hl

|

134.2

|

|

|

2.0

|

136.3

|

1.5%

|

1.5%

|

|

COGS

|

(843.8)

|

|

|

(127.4)

|

(971.2)

|

15.1%

|

15.1%

|

|

COGS/hl

|

(63.0)

|

|

|

(14.8)

|

(77.7)

|

23.5%

|

23.5%

|

|

COGS excl. deprec.&amort.

|

(732.5)

|

|

|

(133.4)

|

(865.9)

|

18.2%

|

18.2%

|

|

COGS/hl excl. deprec. &amort

|

(54.7)

|

|

|

(14.7)

|

(69.3)

|

26.8%

|

26.8%

|

|

Gross profit

|

955.5

|

|

|

(224.3)

|

731.2

|

-23.5%

|

-23.5%

|

|

Gross margin

|

53.1%

|

|

|

|

43.0%

|

-1010 bps

|

-1010 bps

|

|

SG&A excl. deprec.&amort.

|

(429.2)

|

|

|

(35.7)

|

(464.9)

|

8.3%

|

8.3%

|

|

SG&A deprec.&amort.

|

(66.4)

|

|

|

27.2

|

(39.2)

|

-41.0%

|

-41.0%

|

|

SG&A total

|

(495.5)

|

|

|

(8.5)

|

(504.1)

|

1.7%

|

1.7%

|

|

Other operating income

|

155.0

|

|

|

(54.7)

|

100.3

|

-35.3%

|

-35.3%

|

|

Normalized EBIT

|

614.9

|

|

|

(287.5)

|

327.4

|

-46.8%

|

-46.8%

|

|

Normalized EBIT margin

|

34.2%

|

|

|

|

19.2%

|

-1500 bps

|

-1500 bps

|

|

Normalized EBITDA

|

792.5

|

|

|

(320.7)

|

471.8

|

-40.5%

|

-40.5%

|

|

Normalized EBITDA margin

|

44.0%

|

|

|

|

27.7%

|

-1630 bps

|

-1630 bps

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

1

2

|

|

Central America and the Caribbean (CAC)

|

Our operations in the Central America and the Caribbean delivered an EBITDA of R$ 431.9 million (+29.7%) in the quarter, with an EBITDA margin of 38.3% (+770 bps).

Our top line increased by 6.9% in 2Q17, explained by a 1.6% volume organic growth coupled with a NR/hl increase of 4.2%. On a reported basis, volumes were up 26.2%, benefitting from the recent swap of assets carried out with ABI and our operations in Panama. In Dominican Republic, we further expanded the Presidente brand execution through new coolers and marketing materials along with micro events activation that more than doubled year to date when compared to the same period of 2016. In Guatemala, we continued with the Busch Light campaign and also launched the new VBI of Brahva, creating a consistent commercial communication of the brand.

EBITDA performance was also driven by our solid cost management discipline, with cash SG&A declining 21.6%, due to both costs and expenses savings, as well as

to

phasing of sales & marketing and administrative expenditures.

The scope change in CAC refers to the beginning of our operations in Panama as a result of the swap of assets carried out with ABI on December 31

st

, 2016.

|

CAC results

|

2Q16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

2Q17

|

Reported

|

Organic

|

|

Volume total ('000 hl)

|

2,349.5

|

576.7

|

|

38.7

|

2,965.0

|

26.2%

|

1.6%

|

|

Net revenue

|

981.2

|

198.8

|

(119.7)

|

68.0

|

1,128.3

|

15.0%

|

6.9%

|

|

Net revenue/hl

|

417.6

|

(14.4)

|

(40.4)

|

17.6

|

380.5

|

-8.9%

|

4.2%

|

|

COGS

|

(440.3)

|

(77.0)

|

50.9

|

(23.0)

|

(489.4)

|

11.2%

|

5.2%

|

|

COGS/hl

|

(187.4)

|

10.6

|

17.2

|

(5.5)

|

(165.1)

|

-11.9%

|

2.9%

|

|

COGS excl. deprec.&amort.

|

(390.0)

|

(67.8)

|

43.5

|

(12.4)

|

(426.6)

|

9.4%

|

3.2%

|

|

COGS/hl excl. deprec. &amort

|

(166.0)

|

9.6

|

14.7

|

(2.1)

|

(143.9)

|

-13.3%

|

1.3%

|

|

Gross profit

|

540.9

|

121.8

|

(68.8)

|

44.9

|

638.9

|

18.1%

|

8.3%

|

|

Gross margin

|

55.1%

|

|

|

|

56.6%

|

150 bps

|

70 bps

|

|

SG&A excl. deprec.&amort.

|

(235.9)

|

(96.9)

|

18.4

|

51.1

|

(263.4)

|

11.7%

|

-21.6%

|

|

SG&A deprec.&amort.

|

(28.7)

|

(10.8)

|

3.5

|

(0.4)

|

(36.4)

|

27.0%

|

1.4%

|

|

SG&A total

|

(264.6)

|

(107.7)

|

21.8

|

50.6

|

(299.8)

|

13.3%

|

-19.1%

|

|

Other operating income/expenses

|

(1.8)

|

(3.5)

|

0.6

|

(2.0)

|

(6.7)

|

nm

|

115.2%

|

|

Normalized EBIT

|

274.6

|

10.6

|

(46.3)

|

93.5

|

332.3

|

21.0%

|

34.1%

|

|

Normalized EBIT margin

|

28.0%

|

|

|

|

29.5%

|

150 bps

|

710 bps

|

|

Normalized EBITDA

|

353.6

|

30.6

|

(57.3)

|

105.0

|

431.9

|

22.2%

|

29.7%

|

|

Normalized EBITDA margin

|

36.0%

|

|

|

|

38.3%

|

230 bps

|

770 bps

|

|

CAC results

|

YTD16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

YTD17

|

Reported

|

Organic

|

|

Volume total ('000 hl)

|

4,542.1

|

1,149.7

|

|

65.0

|

5,756.9

|

26.7%

|

1.4%

|

|

Net revenue

|

1,998.8

|

417.4

|

(353.9)

|

124.0

|

2,186.2

|

9.4%

|

6.2%

|

|

Net revenue/hl

|

440.1

|

(15.6)

|

(61.5)

|

16.7

|

379.8

|

-13.7%

|

3.8%

|

|

COGS

|

(912.1)

|

(163.6)

|

154.8

|

(32.3)

|

(953.3)

|

4.5%

|

3.5%

|

|

COGS/hl

|

(200.8)

|

11.8

|

26.9

|

(3.5)

|

(165.6)

|

-17.5%

|

1.7%

|

|

COGS excl. deprec.&amort.

|

(788.8)

|

(143.3)

|

134.1

|

(35.1)

|

(833.1)

|

5.6%

|

4.4%

|

|

COGS/hl excl. deprec. &amort

|

(173.7)

|

9.9

|

23.3

|

(4.2)

|

(144.7)

|

-16.7%

|

2.4%

|

|

Gross profit

|

1,086.6

|

253.8

|

(199.2)

|

91.6

|

1,232.9

|

13.5%

|

8.4%

|

|

Gross margin

|

54.4%

|

|

|

|

56.4%

|

200 bps

|

110 bps

|

|

SG&A excl. deprec.&amort.

|

(482.5)

|

(192.0)

|

70.8

|

57.8

|

(546.0)

|

13.1%

|

-12.0%

|

|

SG&A deprec.&amort.

|

(49.4)

|

(21.8)

|

9.9

|

(8.7)

|

(70.0)

|

41.6%

|

17.5%

|

|

SG&A total

|

(532.0)

|

(213.8)

|

80.8

|

49.1

|

(615.9)

|

15.8%

|

-9.2%

|

|

Other operating income/expenses

|

4.9

|

7.9

|

1.2

|

(12.7)

|

1.3

|

-72.7%

|

nm

|

|

Normalized EBIT

|

559.6

|

47.9

|

(117.2)

|

128.0

|

618.2

|

10.5%

|

22.9%

|

|

Normalized EBIT margin

|

28.0%

|

|

|

|

28.3%

|

30 bps

|

440 bps

|

|

Normalized EBITDA

|

732.3

|

90.0

|

(147.9)

|

134.4

|

808.8

|

10.4%

|

18.4%

|

|

Normalized EBITDA margin

|

36.6%

|

|

|

|

37.0%

|

40 bps

|

420 bps

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

1

3

|

|

Latin America South (LAS)

|

LAS EBITDA increased by 33.9% in 2Q17 to R$ 806.7 million, with an EBITDA margin decrease of 60 bps, to 38.7%.

Our volumes grew by 12.2%, mainly driven by (i) Argentina, where we had a very strong volume performance, especially in beer that grew more than 20% year over year; (ii) Paraguay, where volumes continued to trend up as a result of the success of our 340ml returnable glass bottle strategy; and (iii) Uruguay as execution improvements coupled with a favorable weather enabled us to deliver double digits volume growth in both beer and CSD businesses. Top line was up 36.2% with a NR/hl increase of 21.4%.

Cash COGS grew by 50.2% while, on a hectoliter basis, by 33.9%, mainly driven by higher inflation and negative currency impact. Cash SG&A increased by 28.8%, adversely impacted by inflationary pressures mainly in Argentina.

The scope change in LAS refers to the termination of our operations in Colombia, Peru and Ecuador as a result of the swap of assets carried out with ABI on December 31

st

, 2016.

|

LAS results

|

2Q16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

2Q17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

6,201.8

|

(202.5)

|

|

730.5

|

6,729.8

|

8.5%

|

12.2%

|

|

Net revenue

|

1,813.4

|

(81.7)

|

(273.0)

|

627.3

|

2,086.0

|

15.0%

|

36.2%

|

|

Net revenue/hl

|

292.4

|

(3.7)

|

(40.6)

|

61.9

|

310.0

|

6.0%

|

21.4%

|

|

COGS

|

(728.1)

|

55.9

|

115.6

|

(304.6)

|

(861.2)

|

18.3%

|

45.3%

|

|

COGS/hl

|

(117.4)

|

5.3

|

17.2

|

(33.1)

|

(128.0)

|

9.0%

|

29.5%

|

|

COGS excl. deprec.&amort.

|

(621.3)

|

49.2

|

100.2

|

(286.9)

|

(758.8)

|

22.1%

|

50.2%

|

|

COGS/hl excl. deprec. &amort

|

(100.2)

|

4.8

|

14.9

|

(32.3)

|

(112.7)

|

12.6%

|

33.9%

|

|

Gross profit

|

1,085.4

|

(25.8)

|

(157.4)

|

322.7

|

1,224.8

|

12.8%

|

30.5%

|

|

Gross margin

|

59.9%

|

|

|

|

58.7%

|

-120 bps

|

-260 bps

|

|

SG&A excl. deprec.&amort.

|

(511.6)

|

41.8

|

77.6

|

(135.3)

|

(527.5)

|

3.1%

|

28.8%

|

|

SG&A deprec.&amort.

|

(70.8)

|

5.0

|

11.2

|

(7.9)

|

(62.6)

|

-11.6%

|

12.0%

|

|

SG&A total

|

(582.4)

|

46.8

|

88.8

|

(143.2)

|

(590.1)

|

1.3%

|

26.7%

|

|

Other operating income/expenses

|

(15.7)

|

(0.4)

|

(0.7)

|

23.6

|

6.9

|

-143.9%

|

-147.2%

|

|

Normalized EBIT

|

487.3

|

20.6

|

(69.3)

|

203.1

|

641.6

|

31.7%

|

40.0%

|

|

Normalized EBIT margin

|

26.9%

|

|

|

|

30.8%

|

390 bps

|

80 bps

|

|

Normalized EBITDA

|

664.9

|

9.0

|

(95.9)

|

228.7

|

806.7

|

21.3%

|

33.9%

|

|

Normalized EBITDA margin

|

36.7%

|

|

|

|

38.7%

|

200 bps

|

-60 bps

|

|

LAS results

|

YTD16

|

|

Currency Translation

|

Organic Growth

|

|

% As

|

%

|

|

R$ million

|

Scope

|

YTD17

|

Reported

|

Organic

|

|

Volume ('000 hl)

|

15,218.8

|

(399.8)

|

|

1,000.3

|

15,819.4

|

3.9%

|

6.8%

|

|

Net revenue

|

4,787.3

|

(169.5)

|

(1,186.4)

|

1,418.6

|

4,850.0

|

1.3%

|

30.7%

|

|

Net revenue/hl

|

314.6

|

(2.9)

|

(75.0)

|

70.0

|

306.6

|

-2.5%

|

22.5%

|

|

COGS

|

(1,772.3)

|

116.9

|

439.5

|

(705.3)

|

(1,921.1)

|

8.4%

|

42.6%

|

|

COGS/hl

|

(116.5)

|

4.7

|

27.8

|

(37.5)

|

(121.4)

|

4.3%

|

33.6%

|

|

COGS excl. deprec.&amort.

|

(1,562.4)

|

102.9

|

394.3

|

(657.6)

|

(1,722.9)

|

10.3%

|

45.1%

|

|

COGS/hl excl. deprec. &amort

|

(102.7)

|

4.2

|

24.9

|

(35.3)

|

(108.9)

|

6.1%

|

35.9%

|

|

Gross profit

|

3,015.0

|

(52.5)

|

(746.8)

|

713.3

|

2,928.9

|

-2.9%

|

24.1%

|

|

Gross margin

|

63.0%

|

|

|

|

60.4%

|

-260 bps

|

-330 bps

|

|

SG&A excl. deprec.&amort.

|

(1,180.8)

|

86.9

|

276.8

|

(308.3)

|

(1,125.5)

|

-4.7%

|

28.2%

|

|

SG&A deprec.&amort.

|

(141.1)

|

10.1

|

33.0

|

(24.9)

|

(123.0)

|

-12.9%

|

19.0%

|

|

SG&A total

|

(1,322.0)

|

97.0

|

309.7

|

(333.2)

|

(1,248.4)

|

-5.6%

|

27.2%

|

|

Other operating income/expenses

|

(43.4)

|

0.9

|

(1.1)

|

51.9

|

8.3

|

-119.2%

|

-122.2%

|

|

Normalized EBIT

|

1,649.6

|

45.4

|

(438.2)

|

432.0

|

1,688.8

|

2.4%

|

25.5%

|

|

Normalized EBIT margin

|

34.5%

|

|

|

|

34.8%

|

30 bps

|

-150 bps

|

|

Normalized EBITDA

|

2,000.6

|

21.2

|

(516.4)

|

504.6

|

2,010.0

|

0.5%

|

25.0%

|

|

Normalized EBITDA margin

|

41.8%

|

|

|

|

41.4%

|

-40 bps

|

-190 bps

|

|

|

Second Quarter 2017 Results

July 27, 2017

Page

1

4

|

In Canada, we delivered R$ 617.6 million of EBITDA (+3.9%), while our EBITDA margin increased 90bps to 35.7%.