A.M. Best Comments on Credit Ratings of Markel Corp. Following Announced Acquisitions of State National Companies, Inc. & Cos...

July 26 2017 - 5:25PM

Business Wire

A.M. Best has commented that the Long-Term Issuer Credit

Rating (Long-Term ICR) of “bbb+” of Markel Corporation

(Markel) [NASDAQ:MKL] (Glen Allen, VA) is unchanged following the

announcement today of the company’s planned acquisitions of

State National Companies, Inc. [NASDAQ:SNC] (State National)

and Costa Farms, a non-insurance entity being acquired by Markel’s

Markel Ventures subsidiary. All Long-Term Issue Credit Ratings of

Markel and all Financial Strength Ratings and Long-Term ICRs of

Markel’s insurance subsidiaries also are unchanged. The outlook of

these Credit Ratings (ratings) is stable.

The acquisition of State National adds to the diversity of

Markel’s insurance product offerings and enhances its revenue

stream through the inclusion of State National’s insurance

operations and fee-based services. State National will continue to

operate as a separate business unit following the close of the

transaction, with its current management team remaining in

place.

State National is the largest provider of fronting services in

the United States, and the company has demonstrated an ability to

manage the associated credit risk over a period of many years.

State National also is a leading provider of collateral protection

services to financial institutions, primarily covering automobile

physical damage. Markel currently does not have a presence in

either of these product categories, limiting any correlation

between them and its current books of business.

Markel will acquire all of State National’s common stock at a

price of $21 per share in cash, or approximately $919 million, to

be financed with cash balances on hand. Markel will assume State

National’s net debt of approximately $44 million. The transaction

is expected to close during the fourth quarter of 2017, pending

regulatory and shareholder approvals and customary closing

conditions.

Costa Farms, a privately held grower and distributor of

ornamental plants, is being acquired by Markel Ventures, a

subsidiary of Markel that invests in non-insurance businesses. The

Markel Ventures operations provide an additional revenue source and

long-term capital growth, enhancing the strength of Markel’s

balance sheet. Markel Ventures is acquiring an 81% interest in

Costa Farms. Cash consideration is currently estimated at

approximately $255 million. Total consideration will include

contingent and additional cash consideration and will reflect

actual conditions to be determined upon closing. The transaction is

expected to close during the third quarter of 2017, following

completion of customary closing conditions.

Subsequent to the completion of these acquisitions, Markel’s

debt-to-total capital ratio is expected to remain within A.M.

Best’s guidelines for the current rating. The debt-to-tangible

capital ratio will be elevated from its recent levels, reflecting

the increase in goodwill and intangible assets associated with

these transactions. However, concerns regarding the increase in

debt-to-tangible capital are offset by the solid cash flows

associated with the businesses being acquired. Cash coverage ratios

also are forecast to remain well within the guidelines for the

current rating.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings. For information on the proper media use of Best’s

Credit Ratings and A.M. Best press releases, please view

Guide for Media - Proper Use of Best’s Credit Ratings and A.M.

Best Rating Action Press Releases.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2017 by A.M. Best Rating

Services, Inc. and/or its subsidiaries. ALL RIGHTS

RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170726006423/en/

A.M. BestJennifer Marshall, CPCU, ARM, +1 908 439

2200, ext.

5327Directorjennifer.marshall@ambest.comorMichael J.

Lagomarsino, CFA, FRM, +1 908 439 2200, ext. 5810Senior

Directormichael.lagomarsino@ambest.comorChristopher Sharkey,

+1 908 439 2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,+1 908

439 2200, ext. 5644Director, Public

Relationsjames.peavy@ambest.com

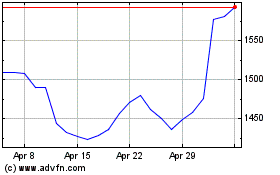

Markel (NYSE:MKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

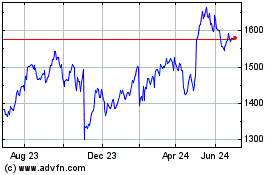

Markel (NYSE:MKL)

Historical Stock Chart

From Apr 2023 to Apr 2024