SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2017

LG Display

Co., Ltd.

(Translation of Registrant’s name into English)

LG Twin Towers, 128 Yeoui-daero,

Yeongdeungpo-gu,

Seoul 07336, Republic of Korea

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1): ☐

Note: Regulation

S-T

Rule 101(b)(1) only permits the submission in paper of a Form

6-K

if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(7): ☐

Note: Regulation

S-T

Rule 101(b)(7) only permits the submission in paper of a Form

6-K

if submission to furnish a report or other document that the registration foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the

registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and if discussing a material event, has already

been the subject of a Form

6-K

submission or other Commission filing on EDGAR.

Indicate by check

mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of

1934.

Yes ☐ No

☒

Q2 ’17 Earnings Results

I. Performance in Q2 2017 – IFRS Consolidated Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unit: KRW B)

|

|

|

Item

|

|

Q2 17

|

|

|

Q1 17

|

|

|

Q4 16

|

|

|

QoQ

|

|

|

YoY

|

|

|

Quarterly Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

6,629

|

|

|

|

7,062

|

|

|

|

5,855

|

|

|

|

-6

|

%

|

|

|

13

|

%

|

|

Operating Income

|

|

|

804

|

|

|

|

1,027

|

|

|

|

44

|

|

|

|

-22

|

%

|

|

|

1,712

|

%

|

|

Income before Tax

|

|

|

832

|

|

|

|

858

|

|

|

|

11

|

|

|

|

-3

|

%

|

|

|

7,607

|

%

|

|

Net Income

|

|

|

737

|

|

|

|

679

|

|

|

|

-84

|

|

|

|

8

|

%

|

|

|

N/A

|

|

II. IR Event of Q2 2017 Earnings Results

|

|

|

|

|

|

|

1. Provider of Information:

|

|

IR Team

|

|

|

|

2. Participants:

|

|

Investors, Securities analysts, etc.

|

|

|

|

3. Purpose:

|

|

To present Q2 17 Earnings Results of LG Display

|

|

|

|

4. Date & Time:

|

|

10:00 (KST) on July 26, 2017

|

|

|

|

5. Venue & Method:

|

|

Earnings release conference call in Korean/English

|

|

|

|

|

|

- Please refer to the IR homepage of LG Display Co.,

Ltd. at www.lgdisplay.com

|

|

|

6. Contact Information

Heeyeon Kim, Vice President, IR Division

(82-2-3777-1010)

|

|

2)

|

Main Contact for Disclosure-related Matters:

|

Wes Han, Senior Manager, IR Team

(82-2-3777-1447)

|

|

3)

|

Relevant Team: IR Team

(82-2-3777-1010)

|

|

|

i.

|

Please note that the presentation material for Q2 17 Earnings Results is accessible on

|

IR

homepage of LG Display Co., Ltd. at

www.lgdisplay.com.

|

|

ii.

|

Please note that the financial data included are prepared on a consolidated IFRS basis

|

|

|

iii.

|

Financial data for Q2 17 are unaudited. They are provided for the convenience of investors and can be subject to change.

|

Attached: Press Release

FOR IMMEDIATE RELEASE

LG Display Reports Second Quarter 2017 Results

and Announces OLED Investment Plans

SEOUL, Korea (July. 25, 2017) – LG Display reported today unaudited earnings results based on consolidated

K-IFRS

(International Financial Reporting Standards) for the three-month period ending June 30, 2017.

|

|

•

|

|

Revenues in the second quarter of 2017 increased by 13% to KRW 6,629 billion from KRW 5,855 billion in the second quarter of 2016 and decreased by 6% from KRW 7,062 billion in the first quarter of 2017.

|

|

|

•

|

|

Operating profit in the second quarter of 2017 recorded KRW 804 billion, a

year-on-year

increase of 1,712% from the operating profit

of KRW 44 billion in the second quarter of 2016 and a

quarter-on-quarter

decrease of 22% from the operating profit of KRW 1,027 billion in the first quarter of

2017.

|

|

|

•

|

|

EBITDA in the second quarter of 2017 was KRW 1,583 billion, compared with EBITDA of KRW 833 billion in the second quarter of 2016 and with EBITDA of KRW 1,743 billion in the first quarter of 2017.

|

|

|

•

|

|

Net income in the second quarter of 2017 increased 8% to KRW 737 billion, compared with net income of KRW 679 billion in the first quarter of 2017, and a

year-on-year

turnaround from a net loss of KRW 84 billion in the second quarter of 2016.

|

LG

Display recorded its 21

st

straight quarterly operating profit of KRW 804 billion despite the drastic decline in the exchange rate and the year’s

off-season,

which caused reduced shipments of mid- and small-size panels. The achievement was backed by the company’s differentiated technologies and its focus on profitability based on the product mix

for

large-size

Ultra HD TV panels and high-end IT panels.

The company also registered KRW 6,629 billion in

revenues in the second quarter of 2017, a

year-on-year

increase of 13% from KRW 5,855 billion. Panels for TVs accounted for 46% of the revenues in the second

quarter of 2017, mobile devices for 22%, desktop monitors for 17%, and tablets and notebook PCs for 15%.

With 82% in its liability-to-equity ratio, 147%

in its current ratio, and 17% in its net debt-to-equity ratio as of June 30, 2017, the financial structure of the company remains stable.

Along with

the earnings results of the Q2 2017, LG Display announced its investment plan for OLED, which was decided in a board of directors’ meeting held on the 25

th

. The company decided to make an

up-front

investment of KRW 2.8 trillion in a 10.5

th

generation (2,940mm X 3,370mm)

large-size

OLED production line at its

P10 plant in Paju, Korea, where LG Display’s display cluster is located. The company will also invest KRW 5 trillion in a new 6

th

generation (1,500mm X 1,850mm) plastic OLED (POLED)

production line in Paju. Adding these new investments of KRW 7.8 trillion onto its

on-going

investment in OLED, LG Display will invest a total of KRW 15 trillion into OLED production lines through 2020,

thereby making its Paju display cluster the company’s hub of OLED production.

LG Display’s decision on these large-scale investments came at a time when the company’s newly-launched

large-size

OLED panels for TVs such as Wallpaper OLED and Crystal Sound OLED (CSO) are earning popularity in global markets. Moreover, as the customer base for OLED TVs and signage displays is expanding,

alongside rapidly increasing OLED demand from the mobile and automotive markets, LG Display made its decision in a timely manner to actively respond to changing and growing markets.

In particular, LG Display’s decision to make an

up-front

investment in the 10.5

th

generation OLED production line prepares for the next-generation technology innovations in the fast-expanding

large-size

OLED market. The company’s 10.5

th

generation OLED production line will be the world’s first trial of this kind of facility; current 10.5

th

generation LCD production lines are

mainly invested in by Chinese players.

The size of mother glass produced in 10.5

th

generation

production lines is 1.8 times larger than that in 8

th

generation production lines, and the industrial standardization of extra-large size LCDs has not yet been set. Therefore, LG Display is moving

prudently on its new OLED production line. It will only begin mass production of OLED TVs after stabilizing the technology for producing extra-large size panels and oxide backplanes for the mother glass.

In addition, in order to respond to the fast-growing OLED TV demand in global markets, LG Display will invest in a new 8.5

th

generation (2,200mm X 2,500mm)

large-size

OLED production line in Guangzhou, China, where the company is already running an LCD panel production plant. To

this end, the company decided to establish a joint venture with total capital of KRW 2.6 trillion and will take a 70 percent share, worth KRW 1.8 trillion, in the joint venture.

LG Display’s LCD panel production plant in Guangzhou, which started mass production in 2014, has already secured high production efficiency and cost

competitiveness as its 8

th

generation LCD production center. As Guangzhou is an advantageous location in China, the largest TV market in the world, the company is well placed to respond to

fast-growing OLED TV demand by leveraging the Guangzhou cluster and to rapidly secure productivity for qualified products.

Thanks to its investment in

plastic OLED (POLED), LG Display will attain an additional production capacity of 30,000 input sheets per month, expanding its capacity to 65,000 input sheets per month based on the 6

th

generation

lines in Paju and Gumi, a city in the southern part of Korea. This capacity is enough to produce 120 million

6-inch

smartphone displays per year. Based on this increased capacity, LG Display will expand

its leading position in newly-growing markets such as auto displays as well as smartphones by unveiling various forms of flexible display products.

With the smartphone display market continually shifting toward POLED, the POLED market size for smartphones is

expected by the industry to be 120 million units in 2017, rapidly increasing to 370 million units in 2020. Additionally, the flexible OLED market will also show CAGR of 63.2%, reaching 389 million units in 2020.

“We’re clearly seeing the possibilities the OLED business offers, not only in the global TV segment, but also in the smartphone and automotive

markets,” said Dr. Sang-Beom Han, CEO and Vice Chairman of LG Display. “We plan to actively respond to customers’ demands by expanding OLED capacity in a timely manner and developing diversified flexible displays that are fit for

various applications.”

###

Earnings Conference Call

LG Display will hold a

bilingual conference call in English and Korean on July 26, 2017 starting at 10:00 a.m. Korea Standard Time to announce the first quarter of 2017 earnings results.

Investors can listen to the conference call or watch webcast of the conference via the company website at

http://www.lgdisplay.com/eng/investor/irSchedule

after registration. If you wish to

call-in

the conference call, please visit

https://events.arkadin.com/ev/APAC/kr/lgd17q2audio

and

follow the instructions to

pre-register.

If you want the webcast only, please visit

https://events.arkadin.com/ev/APAC/kr/lgd17q2webcast

and follow the instructions to

pre-register.

About LG Display

LG Display Co., Ltd. [NYSE: LPL, KRX: 034220] is the world’s leading innovator of display technologies, including thin-film transistor liquid crystal

(TFT-LCD)

and OLED displays, as well as the global pioneer in OLED lightning. The company manufactures display panels in a broad range of sizes and specifications primarily for use in TVs, notebook computers,

desktop monitors, and various other applications, including tablets and mobile devices. It also produces a wide range of OLED light panels for the automotive and interior design sectors. LG Display currently operates manufacturing facilities in

Korea and China, and

back-end

assembly facilities in Korea, China and Poland. The company has approximately 49,000 employees operating worldwide. For more news and information about display products, please

visit

www.lgdisplay.com.

Forward-Looking Statement Disclaimer

This press release contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are

forward-looking statements. These statements are based on current plans, estimates and projections, and therefore you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ

materially from those contained in any forward-looking statement. Additional information as to factors that may cause actual results to differ materially from our forward-looking statements can be found in our filings with the United States

Securities and Exchange Commission.

Investor Relations Contact:

Heeyeon Kim, Head of Investor Relations

Tel:

+822-3777-1010

Email:

ir@lgdisplay.com

Media Contact:

Young-Jun

Son, Head of Public Relations

Tel:

+822-3777-0974

Email:

yjson21@lgdisplay.com

Jean Lee, Manager

Tel:

+822-3777-1689

Email:

jean.lee@lgdisplay.com

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

LG Display Co., Ltd.

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date: July 25, 2017

|

|

By:

|

|

/s/ Heeyeon Kim

|

|

|

|

|

|

(Signature)

|

|

|

|

Name:

|

|

Heeyeon Kim

|

|

|

|

Title:

|

|

Head of IR / Vice President

|

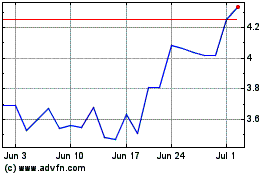

LG Display (NYSE:LPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

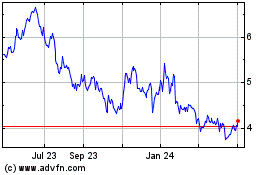

LG Display (NYSE:LPL)

Historical Stock Chart

From Apr 2023 to Apr 2024