Freeport-McMoRan Inc. (NYSE: FCX):

- Net income attributable to

common stock totaled $268 million, $0.18 per share, for

second-quarter 2017. After adjusting for net gains of $27 million,

$0.01 per share, second-quarter 2017 adjusted net income

attributable to common stock totaled $241 million, $0.17 per

share.

- Consolidated sales totaled 942

million pounds of copper, 432 thousand ounces of gold and 25

million pounds of molybdenum for second-quarter 2017.

- Consolidated sales for the year

2017 are expected to approximate 3.7 billion pounds of copper, 1.6

million ounces of gold and 93 million pounds of molybdenum,

including 940 million pounds of copper, 375 thousand ounces of gold

and 22 million pounds of molybdenum for third-quarter 2017.

- Average realized prices were

$2.65 per pound for copper, $1,243 per ounce for gold and $9.58 per

pound for molybdenum for second-quarter 2017.

- Average unit net cash costs were

$1.20 per pound of copper for second-quarter 2017 and are expected

to average $1.19 per pound of copper for the year 2017.

- Operating cash flows totaled

$1.0 billion (including $144 million in working capital sources and

changes in tax payments) for second-quarter 2017 and $1.8 billion

(including $322 million in working capital sources and changes in

tax payments) for the first six months of 2017. Based on current

sales volume and cost estimates, and assuming average prices of

$2.65 per pound for copper, $1,250 per ounce for gold and $7.50 per

pound for molybdenum for the second half of 2017, operating cash

flows for the year 2017 are expected to approximate $3.8 billion

(including $0.6 billion in working capital sources and changes in

tax payments).

- Capital expenditures totaled

$362 million (including approximately $210 million for major mining

projects) for second-quarter 2017 and $706 million for the first

six months of 2017 (including approximately $420 million for major

mining projects). Capital expenditures for the year 2017 are

expected to approximate $1.6 billion, including $0.7 billion for

underground development activities in the Grasberg minerals

district in Indonesia, which depends on a resolution of PT Freeport

Indonesia's (PT-FI) long-term operating rights.

- At June 30, 2017, consolidated

cash totaled $4.7 billion and consolidated debt totaled

$15.4 billion, compared with $4.2 billion of consolidated cash and

$16.0 billion of consolidated debt at December 31, 2016. FCX had no

borrowings and $3.5 billion available under its revolving credit

facility at June 30, 2017.

Freeport-McMoRan Inc. (NYSE: FCX) reported net income

attributable to common stock of $268 million ($0.18 per share) for

second-quarter 2017 and $496 million ($0.34 per share) for the

first six months of 2017, compared with net losses attributable to

common stock of $479 million ($0.38 per share) for second-quarter

2016 and $4.7 billion ($3.70 per share) for the first six months of

2016. After adjusting for net gains (losses) of $27 million ($0.01

per share) for second-quarter 2017 and $(452) million ($(0.36) per

share) for second-quarter 2016, adjusted net income (loss)

attributable to common stock totaled $241 million ($0.17 per share)

for second-quarter 2017 and $(27) million ($(0.02) per share) for

second-quarter 2016. Additionally, FCX's second-quarter 2017 sales

from its mining operations to affiliated smelters resulted in the

deferral of $51 million ($0.04 per share) of net income

attributable to common stock, which will be recognized in future

periods. Refer to the supplemental schedules, "Adjusted Net Income

(Loss)," beginning on page VII, and "Deferred Profits," on page X,

which are available on FCX's website, "fcx.com," for additional

information.

Richard C. Adkerson, President and Chief Executive Officer,

said, "We are successfully executing our strategy of building

values in our large-scale, industry-leading portfolio of copper

assets. Our strong management of costs and ongoing capital

discipline combined with improved copper prices are providing free

cash flow to strengthen our company’s financial position. We remain

focused on protecting our past investments and supporting our

long-term investment plans at the high-grade, long-lived mineral

deposits in the Grasberg minerals district in Papua,

Indonesia. We are encouraged by recent progress in our active

negotiations with the Indonesian government to resolve issues

involving our contractual rights and by multiple opportunities to

build long-term future values for our shareholders from our

high-quality copper assets in the Americas."

SUMMARY FINANCIAL DATA

Three Months EndedJune

30,

Six Months EndedJune 30,

2017 2016 2017 2016 (in

millions, except per share amounts) Revenuesa,b $ 3,711 $ 3,334 $

7,052 $ 6,576 Operating income (loss)a $ 669 $ 18 $ 1,249 $ (3,854

) Net income (loss) from continuing operations $ 326 $ (229 ) $ 594

$ (4,326 ) Net income (loss) from discontinued operations $ 9 c $

(181 ) $ 47 c $ (185 ) Net income (loss) attributable to common

stockd,e $ 268 $ (479 ) $ 496 $ (4,663 ) Diluted net income (loss)

per share of common stock: Continuing operations $ 0.18 $ (0.23 ) $

0.31 $ (3.54 ) Discontinued operations — (0.15 ) 0.03

(0.16 ) $ 0.18 $ (0.38 ) $ 0.34 $ (3.70 ) Diluted

weighted-average common shares outstanding 1,453 1,269 1,453 1,260

Operating cash flowsf $ 1,037 $ 874 $ 1,829 $ 1,614 Capital

expenditures $ 362 $ 833 $ 706 $ 1,815 At June 30: Cash and cash

equivalents $ 4,667 $ 330 $ 4,667 $ 330 Total debt, including

current portion $ 15,354 $ 19,220 $ 15,354 $ 19,220

a. For segment financial results, refer to

the supplemental schedules, "Business Segments," beginning on page

X, which are available on FCX's website, "fcx.com."

b. Includes (unfavorable) favorable

adjustments to provisionally priced concentrate and cathode copper

sales recognized in prior periods totaling $(20) million ($(8)

million to net income attributable to common stock or $(0.01) per

share) in second-quarter 2017, $(28) million ($(15) million to net

loss attributable to common stock or $(0.01) per share) in

second-quarter 2016, $81 million ($35 million to net income

attributable to common stock or $0.02 per share) for the first six

months of 2017 and $5 million ($2 million to net loss attributable

to common stock or less than $0.01 per share) for the first six

months of 2016. For further discussion, refer to the supplemental

schedule, "Derivative Instruments," on page X, which is available

on FCX's website, "fcx.com."

c. Primarily reflects adjustments to the

fair value of the potential $120 million in contingent

consideration related to the November 2016 sale of FCX's interest

in TF Holdings Limited (TFHL), which totaled $55 million at June

30, 2017, and in accordance with accounting guidelines, will

continue to be adjusted through December 31, 2019.

d. Includes net gains (charges) of $27

million ($0.01 per share) in second-quarter 2017, $(452) million

($(0.36) per share) in second-quarter 2016, $34 million ($0.02 per

share) for the first six months of 2017 and $(4.4) billion ($(3.53)

per share) for the first six months of 2016 that are described in

the supplemental schedule, "Adjusted Net Income (Loss)," beginning

on page VII, which is available on FCX's website, "fcx.com."

e. FCX defers recognizing profits on

intercompany sales until final sales to third parties occur. For a

summary of net impacts from changes in these deferrals, refer to

the supplemental schedule, "Deferred Profits," on page X, which is

available on FCX's website, "fcx.com."

f. Includes net working capital sources

and changes in tax payments of $144 million in second-quarter 2017,

$278 million in second-quarter 2016, $322 million for the first six

months of 2017 and $466 million for the first six months of

2016.

SUMMARY OPERATING DATA

Three Months EndedJune

30,

Six Months EndedJune 30,

2017 2016a 2017

2016a Copper (millions of recoverable pounds)

Production 883 1,011 1,734 1,998 Sales, excluding purchases 942 987

1,751 1,987 Average realized price per pound $ 2.65 $ 2.19 $ 2.65 $

2.17 Site production and delivery costs per poundb $ 1.64 $ 1.41 $

1.62 $ 1.45 Unit net cash costs per poundb $ 1.20 $ 1.33 $ 1.29 $

1.36

Gold (thousands of recoverable ounces) Production 353

166 592 350 Sales, excluding purchases 432 156 614 357 Average

realized price per ounce $ 1,243 $ 1,292 $ 1,242 $ 1,259

Molybdenum (millions of recoverable pounds) Production 23 19

46 39 Sales, excluding purchases 25 19 49 36 Average realized price

per pound $ 9.58 $ 8.34 $ 9.16 $ 7.99

a. Excludes the results of the Tenke

Fungurume (Tenke) mine, which was sold in November 2016 and is

reported as discontinued operations. Copper sales from the Tenke

mine totaled 124 million pounds in second-quarter 2016 and 247

million for the first six months of 2016.

b. Reflects per pound weighted-average

production and delivery costs and unit net cash costs (net of

by-product credits) for all copper mines, before net noncash and

other costs. For reconciliations of per pound unit costs by

operating division to production and delivery costs applicable to

sales reported in FCX's consolidated financial statements, refer to

the supplemental schedules, "Product Revenues and Production

Costs," beginning on page XIII, which are available on FCX's

website, "fcx.com."

Consolidated Sales Volumes

Second-quarter 2017 copper sales of 942 million pounds

were lower than the April 2017 estimate of 975 million pounds,

primarily reflecting the impact of worker absenteeism on mining and

milling rates in Indonesia. Second-quarter 2017 copper sales were

also lower than second-quarter 2016 sales of 987 million pounds,

primarily reflecting anticipated lower ore grades in North America

and lower leach production and recoveries in South America, partly

offset by higher volumes from Indonesia associated with higher ore

grades and the sale of concentrate in inventory produced in

first-quarter 2017.

Second-quarter 2017 gold sales of 432 thousand ounces

were slightly lower than the April 2017 estimate of 440 thousand

ounces, but were higher than second-quarter 2016 sales of 156

thousand ounces, primarily reflecting higher ore grades from

Indonesia.

Second-quarter 2017 molybdenum sales of 25 million pounds

were slightly higher than the April 2017 estimate of 24 million

pounds and were higher than second-quarter 2016 sales of 19 million

pounds.

Sales volumes for the year 2017 are expected to approximate 3.7

billion pounds of copper, 1.6 million ounces of gold and 93 million

pounds of molybdenum, including 940 million pounds of copper, 375

thousand ounces of gold and 22 million pounds of molybdenum in

third-quarter 2017. Estimated sales volumes for the year 2017 are

lower than April 2017 estimates by approximately 150 million pounds

of copper and 320 thousand ounces of gold, principally attributable

to lower mining rates in the Grasberg open pit associated with

reduced manpower levels and modifications to the ramp-up schedule

for the Deep Mill Level Zone (DMLZ) underground mine. These

shortfalls are expected to be recovered in future periods. Efforts

are under way to increase mining rates in the Grasberg open pit to

benefit from the high-grade ore currently available to be mined.

Refer to page 6 for a discussion of Indonesia Regulatory Matters,

which may have a significant impact on future results.

Consolidated Unit Costs

Consolidated average unit net cash costs (net of by-product

credits) for FCX's copper mines of $1.20 per pound of copper in

second-quarter 2017 were lower than unit net cash costs of $1.33

per pound in second-quarter 2016, primarily reflecting higher

by-product credits, partly offset by lower copper sales

volumes.

Assuming average prices of $1,250 per ounce of gold and $7.50

per pound of molybdenum for the second half of 2017 and achievement

of current sales volume and cost estimates, consolidated unit net

cash costs (net of by-product credits) for copper mines are

expected to average $1.19 per pound of copper for the year 2017.

The impact of price changes for the second half of 2017 on

consolidated unit net cash costs would approximate $0.015 per pound

for each $50 per ounce change in the average price of gold and

$0.01 per pound for each $2 per pound change in the average price

of molybdenum. Quarterly unit net cash costs vary with fluctuations

in sales volumes and realized prices, primarily for gold and

molybdenum.

MINING OPERATIONS

North America Copper Mines. FCX operates seven open-pit

copper mines in North America - Morenci, Bagdad, Safford, Sierrita

and Miami in Arizona, and Chino and Tyrone in New Mexico. In

addition to copper, molybdenum concentrate, gold and silver are

also produced by certain of FCX's North America copper mines.

All of the North America mining operations are wholly owned,

except for Morenci. FCX records its 72 percent undivided joint

venture interest in Morenci using the proportionate consolidation

method.

Operating and Development Activities. FCX has significant

undeveloped reserves and resources in North America and a portfolio

of potential long-term development projects. Future investments

will be undertaken based on the results of economic and technical

feasibility studies, and are dependent on market conditions. FCX

continues to evaluate opportunities to reduce the capital intensity

of its long-term development projects.

Through exploration drilling, FCX has identified a significant

resource at the Lone Star project located near the Safford

operation in eastern Arizona. Initial production from the Lone

Star oxide ores could begin in 2021 using existing infrastructure

to replace oxide production from Safford. FCX is seeking

regulatory approvals for this project and continues to evaluate

longer term opportunities available from the significant sulfide

potential in the Lone Star/Safford minerals district.

Operating Data. Following is summary consolidated operating data

for the North America copper mines for the second quarters and

first six months of 2017 and 2016:

Three Months EndedJune

30,

Six Months EndedJune 30,

2017 2016 2017 2016

Copper (millions of recoverable pounds) Production 384 469

776 956 Sales, excluding purchases 408 464 783 967 Average realized

price per pound $ 2.62 $ 2.18 $ 2.65 $ 2.17

Molybdenum (millions of recoverable pounds) Productiona 8 8

17 16

Unit net cash costs per pound of copperb

Site production and delivery, excluding adjustments $ 1.59 $ 1.40 $

1.56 $ 1.40 By-product credits (0.16 ) (0.11 ) (0.15 ) (0.10 )

Treatment charges 0.10 0.11 0.10 0.11

Unit net cash costs $ 1.53 $ 1.40 $ 1.51 $

1.41

a. Refer to summary operating data on page

3 for FCX's consolidated molybdenum sales, which includes sales of

molybdenum produced at the North America copper mines.

b. For a reconciliation of unit net cash

costs per pound to production and delivery costs applicable to

sales reported in FCX's consolidated financial statements, refer to

the supplemental schedules, "Product Revenues and Production

Costs," beginning on page XIII, which are available on FCX's

website, "fcx.com."

North America's consolidated copper sales volumes of 408 million

pounds in second-quarter 2017 were lower than second-quarter 2016

sales of 464 million pounds, primarily reflecting lower ore grades.

North America copper sales are estimated to approximate 1.5 billion

pounds for the year 2017, compared with 1.8 billion pounds in

2016.

Average unit net cash costs (net of by-product credits) for the

North America copper mines of $1.53 per pound of copper in

second-quarter 2017 were higher than unit net cash costs of $1.40

per pound in second-quarter 2016, primarily reflecting lower sales

volumes, partly offset by higher by-product credits.

Average unit net cash costs (net of by-product credits) for the

North America copper mines are expected to approximate $1.54 per

pound of copper for the year 2017, based on achievement of current

sales volume and cost estimates and assuming an average molybdenum

price of $7.50 per pound for the second half of 2017. North

America's average unit net cash costs for the year 2017 would

change by approximately $0.02 per pound for each $2 per pound

change in the average price of molybdenum.

South America Mining. FCX operates two copper mines in

South America - Cerro Verde in Peru (in which FCX owns a 53.56

percent interest) and El Abra in Chile (in which FCX owns a 51

percent interest). These operations are consolidated in FCX's

financial statements. In addition to copper, the Cerro Verde mine

produces molybdenum concentrate and silver.

Operating and Development Activities. The Cerro Verde expansion

project commenced operations in September 2015 and achieved

capacity operating rates during first-quarter 2016. Cerro Verde's

expanded operations benefit from its large-scale, long-lived

reserves and cost efficiencies. The project expanded the

concentrator facilities from 120,000 metric tons of ore per day to

360,000 metric tons of ore per day.

In the second half of 2015, FCX adjusted operations at its El

Abra mine to reduce mining and stacking rates by approximately 50

percent to achieve lower operating and labor costs, defer capital

expenditures and extend the life of the existing operations. El

Abra continues to operate at reduced rates.

FCX continues to evaluate a potential large-scale milling

operation at El Abra to process additional sulfide material and to

achieve higher recoveries. Exploration results at El Abra indicate

a significant sulfide resource, which could potentially support a

major mill project. Future investments will depend on technical

studies, economic factors and market conditions.

Operating Data. Following is summary consolidated operating data

for the South America mining operations for the second quarters and

first six months of 2017 and 2016:

Three Months EndedJune

30,

Six Months EndedJune 30,

2017 2016 2017 2016

Copper (millions of recoverable pounds) Production 300 334

604 669 Sales 287 327 596 650 Average realized price per pound $

2.67 $ 2.19 $ 2.65 $ 2.18

Molybdenum (millions of

recoverable pounds) Productiona 7 4 13 9

Unit net cash

costs per pound of copperb Site production and delivery,

excluding adjustments $ 1.55 $ 1.20 $ 1.52 $ 1.22 By-product

credits (0.13 ) (0.12 ) (0.16 ) (0.10 ) Treatment charges 0.22 0.23

0.22 0.23 Royalty on metals 0.01 — 0.01 0.01

Unit net cash costs $ 1.65 $ 1.31 $ 1.59

$ 1.36

a. Refer to summary operating data on page

3 for FCX's consolidated molybdenum sales, which includes sales of

molybdenum produced at Cerro Verde.

b. For a reconciliation of unit net cash

costs per pound to production and delivery costs applicable to

sales reported in FCX's consolidated financial statements, refer to

the supplemental schedules, "Product Revenues and Production

Costs," beginning on page XIII, which are available on FCX's

website, "fcx.com."

South America's consolidated copper sales volumes of 287 million

pounds in second-quarter 2017 were lower than second-quarter 2016

sales of 327 million pounds primarily reflecting lower mining

rates, ore grades and recoveries. Sales from South America mining

are expected to approximate 1.2 billion pounds of copper for the

year 2017, compared with 1.3 billion pounds of copper in 2016.

Average unit net cash costs (net of by-product credits) for

South America mining of $1.65 per pound of copper in second-quarter

2017 were higher than unit net cash costs of $1.31 per pound in

second-quarter 2016, primarily reflecting lower sales volumes and

higher maintenance costs. Average unit net cash costs (net of

by-product credits) for South America mining are expected to

approximate $1.65 per pound of copper for the year 2017, based on

current sales volume and cost estimates and assuming an average

price of $7.50 per pound of molybdenum for the second half of

2017.

Indonesia Mining. Through its 90.64 percent owned and

consolidated subsidiary PT-FI, FCX's assets include one of the

world's largest copper and gold deposits at the Grasberg minerals

district in Papua, Indonesia. PT-FI operates a proportionately

consolidated joint venture, which produces copper concentrate that

contains significant quantities of gold and silver.

Regulatory Matters. In January and February 2017, the Indonesian

government issued new regulations to address the export of

unrefined metals, including copper concentrate and anode slimes,

and other matters related to the mining sector. The new regulations

permit the continuation of copper concentrate exports for a

five-year period through January 2022, subject to various

conditions, including conversion from a contract of work to a

special operating license (known as an IUPK, which does not provide

the same level of fiscal and legal protections as PT-FI's Contract

of Work (COW), which remains in effect), a commitment to the

completion of smelter construction in five years and payment of

export duties to be determined by the Ministry of Finance. In

addition, the new regulations enable application for an extension

of operating rights five years before expiration of the IUPK and

require foreign IUPK holders to divest a 51 percent interest in the

licensed entity to Indonesian interests no later than the tenth

year of production. Export licenses would be valid for one-year

periods, subject to review every six months, depending on smelter

construction progress.

Following the issuance of the January and February 2017

regulations and discussions with the Indonesian government, PT-FI

advised the government that it was prepared to convert its COW to

an IUPK, subject to obtaining an investment stability agreement

providing contractual rights with the same level of legal and

fiscal certainty enumerated under its COW, and provided that the

COW would remain in effect until it is replaced by a mutually

satisfactory alternative. PT-FI also committed to commence

construction of a new smelter during a five-year time frame,

subject to approval of the extension of its long-term operating

rights.

In mid-February 2017, pursuant to the COW's dispute resolution

provisions, PTFI provided formal notice to the Indonesian

government of an impending dispute listing the government's

breaches and violations of the COW. PT-FI continues to reserve its

rights under these provisions.

As a result of the 2017 regulatory restrictions and

uncertainties regarding long-term investment stability, PT-FI has

taken actions to adjust its cost structure, slow investments in its

underground development projects and new smelter, and place certain

of its workforce on furlough programs.

In late March 2017, the Indonesian government amended the

regulations to enable PT-FI to retain its COW until replaced with

an IUPK accompanied by an investment stability agreement, and to

grant PT-FI a temporary IUPK through October 10, 2017, that would

allow concentrate exports to resume during this period. In April

2017, PT-FI entered into a Memorandum of Understanding with the

Indonesian government confirming that the COW would continue to be

valid and honored until replaced by a mutually agreed IUPK and

investment stability agreement. PT-FI agreed to continue to pay a

five percent export duty during this period.

On April 21, 2017, the Indonesian government issued a permit to

PT-FI that allows exports to resume for a six-month period, and

PT-FI commenced export shipments.

PT-FI and the Indonesian government are now engaged in active

negotiations on the conversion of PT-FI's COW to an IUPK

accompanied by an investment stability agreement with the objective

of providing a mutually acceptable long-term investment framework.

In addition to negotiating a stability agreement, the parties are

also discussing requirements for the construction of a new smelter

and the government's request for divestment.

PT-FI and the Indonesian government are working cooperatively

with the objective of reaching a mutually acceptable long-term

resolution during 2017 to secure PT-FI's long-term investments for

the benefit of all stakeholders.

Operating and Development Activities. PT-FI is currently mining

the final phase of the Grasberg open pit, which contains high

copper and gold ore grades. PT-FI expects to mine high-grade ore

over the next several quarters prior to transitioning to the

Grasberg Block Cave underground mine in early 2019.

PT-FI has several projects in the Grasberg minerals district

related to the development of its large-scale, long-lived,

high-grade underground ore bodies. In aggregate, these underground

ore bodies are expected to produce large-scale quantities of copper

and gold following the transition from the Grasberg open pit. As a

result of regulatory uncertainty, PT-FI has slowed investments in

its underground development projects in 2017. Assuming an agreement

is reached to support PT-FI's long-term investment plans, estimated

annual capital spending on these projects would average $1.0

billion per year ($0.8 billion per year net to PT-FI) over the next

five years. Considering the long-term nature and size of these

projects, actual costs could vary from these estimates. In response

to market conditions and Indonesian regulatory uncertainty, timing

of these expenditures continues to be reviewed. If PT-FI is unable

to reach agreement with the Indonesian government on its long-term

mining rights, FCX intends to reduce or defer investments

significantly in its underground development projects and pursue

arbitration under its COW.

Operating Data. Following is summary consolidated operating data

for the Indonesia mining operations for the second quarters and

first six months of 2017 and 2016:

Three Months EndedJune

30,

Six Months EndedJune 30,

2017 2016 2017 2016

Copper (millions of recoverable pounds) Production 199 208

354 373 Sales 247 196 372 370 Average realized price per pound $

2.67 $ 2.20 $ 2.64 $ 2.17

Gold (thousands of

recoverable ounces) Production 348 158 580 336 Sales 427 151 604

346 Average realized price per ounce $ 1,243 $ 1,292 $ 1,242 $

1,260

Unit net cash costs per pound of coppera

Site production and delivery, excluding adjustments $ 1.80 b $ 1.77

$ 1.91 b $ 1.99 Gold and silver credits (2.21 ) (1.05 ) (2.10 )

(1.27 ) Treatment charges 0.26 0.29 0.27 0.30 Export duties 0.11

0.08 0.11 0.08 Royalty on metals 0.17 0.11 0.17

0.12 Unit net cash costs $ 0.13 $ 1.20

$ 0.36 $ 1.22

a. For a reconciliation of unit net cash

costs per pound to production and delivery costs applicable to

sales reported in FCX's consolidated financial statements, refer to

the supplemental schedules, "Product Revenues and Production

Costs," beginning on page XIII, which are available on FCX's

website, "fcx.com."

b. Excludes fixed costs charged directly

to production and delivery costs totaling $82 million ($0.33 per

pound of copper) for second-quarter 2017 and $103 million ($0.28

per pound of copper) for the first six months of 2017 associated

with workforce reductions.

Beginning in mid-April 2017, PT-FI experienced a high level of

worker absenteeism, which has unfavorably impacted mining and

milling rates. During May 2017, a significant number of employees

and contractors participated in an illegal strike and did not

respond to PT-FI's multiple summons to return to work. As a result,

these workers were deemed to have voluntarily resigned pursuant to

Indonesian laws and regulations. During second-quarter 2017, PT-FI

took steps to mitigate the impacts of worker absenteeism, including

producing from available mine and mill stockpiles and selling

concentrate in inventory produced in first-quarter 2017. PT-FI is

also taking steps to increase its workforce in order to restore

normal operating rates.

In June 2017, production from the DMLZ underground mine, which

is currently being developed, was impacted by mining-induced

seismic activity. Mining-induced seismic activity is not uncommon

in block cave mining. To mitigate the impact of these events, PT-FI

has adjusted the DMLZ mine plans while it evaluates the appropriate

start-up schedule. PT-FI expects DMLZ to ramp up to full capacity

of 80,000 metric tons of ore per day in 2021, but at a slower pace

than previous estimates.

PT-FI is also evaluating opportunities to mine a section of

high-grade ore from the Grasberg open pit in 2018 and 2019

currently planned to be mined in future periods from the Grasberg

Block Cave underground mine. These plans are expected to be

evaluated through the remainder of 2017.

Indonesia's consolidated sales of 247 million pounds of copper

and 427 thousand ounces of gold in second-quarter 2017 were higher

than second-quarter 2016 sales of 196 million pounds of copper and

151 thousand ounces of gold, primarily reflecting the sale of

concentrate in inventory and higher ore grades, partly offset by

lower mill rates.

Assuming achieving planned operating rates for the second half

of 2017, consolidated sales volumes from Indonesia mining are

expected to approximate 1.0 billion pounds of copper and 1.6

million ounces of gold for the year 2017, compared with 1.1 billion

pounds of copper and 1.1 million ounces of gold for the year

2016.

A significant portion of PT-FI's costs are fixed and unit costs

vary depending on production volumes and other factors. Indonesia's

unit net cash costs (including gold and silver credits) of $0.13

per pound of copper in second-quarter 2017 were lower than unit net

cash costs of $1.20 per pound in second-quarter 2016, primarily

reflecting higher gold and silver credits.

Assuming an average gold price of $1,250 per ounce for the

second half of 2017 and achievement of current sales volume and

cost estimates, unit net cash costs (net of gold and silver

credits) for Indonesia mining are expected to approximate $0.13 per

pound of copper for the year 2017. Indonesia mining's unit net cash

credits for the year 2017 would change by approximately $0.05 per

pound for each $50 per ounce change in the average price of gold.

Because of the fixed nature of a large portion of Indonesia's

costs, unit costs vary from quarter to quarter depending on copper

and gold volumes.

Indonesia mining's projected sales volumes are dependent on a

number of factors, including operational performance, workforce

productivity, the timing of shipments and its ability to continue

to export copper concentrate.

Molybdenum Mines. FCX has two wholly owned molybdenum

mines in North America - the Henderson underground mine and the

Climax open-pit mine, both in Colorado. The Henderson and Climax

mines produce high-purity, chemical-grade molybdenum concentrate,

which is typically further processed into value-added molybdenum

chemical products. The majority of molybdenum concentrate produced

at the Henderson and Climax mines, as well as from FCX's North

America and South America copper mines, is processed at FCX's

conversion facilities.

Operating and Development Activities. In response to market

conditions, the Henderson molybdenum mine continues to operate at

reduced rates. Production from the Molybdenum mines totaled 8

million pounds of molybdenum in second-quarter 2017 and 7 million

pounds in second-quarter 2016. Refer to summary operating data on

page 3 for FCX's consolidated molybdenum sales, which includes

sales of molybdenum produced at the Molybdenum mines, and from

FCX's North America and South America copper mines.

Average unit net cash costs for the Molybdenum mines of $7.81

per pound of molybdenum in second-quarter 2017 approximated

second-quarter 2016 costs. Based on current sales volume and cost

estimates, unit net cash costs for the Molybdenum mines are

expected to average approximately $7.85 per pound of molybdenum for

the year 2017.

For a reconciliation of unit net cash costs per pound to

production and delivery costs applicable to sales reported in FCX's

consolidated financial statements, refer to the supplemental

schedules, "Product Revenues and Production Costs," beginning on

page XIII, which are available on FCX's website, "fcx.com."

Mining Exploration Activities. FCX's mining exploration

activities are generally associated with its existing mines,

focusing on opportunities to expand reserves and resources to

support development of additional future production capacity.

Exploration results continue to indicate opportunities for

significant future potential reserve additions in North America and

South America. Exploration spending continues to be constrained by

market conditions and is expected to approximate $70 million for

the year 2017, compared to $44 million in 2016.

CASH FLOWS, CASH and DEBT

Operating Cash Flows. FCX generated operating cash flows of $1.0

billion (including $144 million in working capital sources and

changes in tax payments) in second-quarter 2017 and $1.8 billion

(including $322 million in working capital sources and changes in

tax payments) for the first six months of 2017.

Based on current sales volume and cost estimates, and assuming

average prices of $2.65 per pound of copper, $1,250 per ounce of

gold and $7.50 per pound of molybdenum for the second half of 2017,

FCX's consolidated operating cash flows are estimated to

approximate $3.8 billion for the year 2017 (including $0.6 billion

in working capital sources and tax payments). The impact of price

changes during the second half of 2017 on operating cash flows

would approximate $180 million for each $0.10 per pound change in

the average price of copper, $40 million for each $50 per ounce

change in the average price of gold and $40 million for each $2 per

pound change in the average price of molybdenum. Refer to page 6

for discussion of Indonesian Regulatory Matters, which may have a

significant impact on future results.

Capital Expenditures. Capital expenditures totaled $362 million

for second-quarter 2017 (including approximately $210 million for

major mining projects) and $706 million for the first six months of

2017 (including approximately $420 million for major mining

projects). Capital expenditures are expected to approximate $1.6

billion for the year 2017, including $0.9 billion for major mining

projects, primarily for underground development activities at

Grasberg.

As a result of regulatory uncertainty, PT-FI has slowed

investments in its underground development projects. If PT-FI is

unable to reach an agreement with the Indonesian government on its

long-term mining rights, FCX intends to reduce or defer investments

significantly in underground development projects and pursue

arbitration under its COW.

Cash. Following is a summary of the U.S. and international

components of consolidated cash and cash equivalents available to

the parent company, net of noncontrolling interests' share, taxes

and other costs at June 30, 2017 (in billions):

Cash at domestic companies $ 3.8 Cash at

international operations 0.9 Total consolidated cash and

cash equivalents 4.7 Noncontrolling interests' share (0.2 ) Cash,

net of noncontrolling interests' share 4.5 Withholding taxes and

other (0.1 )

Net cash available $ 4.4

Debt. Following is a summary of total debt and the related

weighted-average interest rates at June 30, 2017 (in billions,

except percentages):

Weighted- Average

Interest Rate Senior Notes $ 13.9 4.4% Cerro Verde credit

facility 1.5 3.1% Total debt $ 15.4 4.3%

In June 2017, the Cerro Verde credit facility was amended to

increase the commitment by $225 million to $1.5 billion, modify the

amortization schedule and to extend the maturity date to June 2022.

All other terms, including interest rates, remain the same.

At June 30, 2017, FCX had no borrowings, $37 million in

letters of credit issued and $3.5 billion available under its

revolving credit facility.

FINANCIAL POLICY

In December 2015, FCX's common stock dividend was suspended. The

declaration of dividends is at the discretion of the Board of

Directors (Board) and will depend upon FCX’s financial results,

cash requirements, future prospects and other factors deemed

relevant by the Board.

WEBCAST INFORMATION

A conference call with securities analysts to discuss FCX's

second-quarter 2017 results is scheduled for today at 10:00 a.m.

Eastern Time. The conference call will be broadcast on the Internet

along with slides. Interested parties may listen to the conference

call live and view the slides by accessing “fcx.com.” A replay of

the webcast will be available through Friday, August 25,

2017.

FCX is a leading international mining company with headquarters

in Phoenix, Arizona. FCX operates large, long-lived, geographically

diverse assets with significant proven and probable reserves of

copper, gold and molybdenum. FCX is the world's largest publicly

traded copper producer. FCX’s portfolio of assets includes the

Grasberg minerals district in Indonesia, one of the world's largest

copper and gold deposits; and significant mining operations in the

Americas, including the large-scale Morenci minerals district in

North America and the Cerro Verde operation in South America.

Additional information about FCX is available on FCX's website at

"fcx.com."

Cautionary Statement and Regulation G Disclosure: This

press release contains forward-looking statements in which FCX

discusses its potential future performance. Forward-looking

statements are all statements other than statements of historical

facts, such as projections or expectations relating to ore grades

and milling rates, production and sales volumes, unit net cash

costs, operating cash flows, capital expenditures, exploration

efforts and results, development and production activities and

costs, liquidity, tax rates, the impact of copper, gold and

molybdenum price changes, the impact of deferred intercompany

profits on earnings, reserve estimates, future dividend payments,

and share purchases and sales. The words “anticipates,” “may,”

“can,” “plans,” “believes,” “estimates,” “expects,” “projects,”

"targets," “intends,” “likely,” “will,” “should,” “to be,”

”potential" and any similar expressions are intended to identify

those assertions as forward-looking statements.

FCX cautions readers that forward-looking statements are not

guarantees of future performance and actual results may differ

materially from those anticipated, projected or assumed in the

forward-looking statements. Important factors that can cause FCX's

actual results to differ materially from those anticipated in the

forward-looking statements include supply of and demand for, and

prices of, copper, gold and molybdenum; mine sequencing; production

rates; potential effects of cost and capital expenditure reductions

and production curtailments on financial results and cash flow;

potential inventory adjustments; potential impairment of long-lived

mining assets; the outcome of negotiations with the Indonesian

government regarding PT-FI's COW; the potential effects of violence

in Indonesia generally and in the province of Papua; industry

risks; regulatory changes (including adoption of financial

assurance regulations as proposed by the U.S. Environmental

Protection Agency under CERCLA for the hard rock mining industry);

political risks; labor relations; weather- and climate-related

risks; environmental risks; litigation results (including the final

disposition of the unfavorable Indonesian Tax Court ruling relating

to surface water taxes); and other factors described in more detail

under the heading “Risk Factors” in FCX's Annual Report on Form

10-K for the year ended December 31, 2016, filed with the U.S.

Securities and Exchange Commission (SEC) as updated by FCX's

subsequent filings with the SEC. With respect to FCX's operations

in Indonesia, such factors include whether PT-FI will be able to

resolve complex regulatory matters in Indonesia.

Investors are cautioned that many of the assumptions upon which

FCX's forward-looking statements are based are likely to change

after the forward-looking statements are made, including for

example commodity prices, which FCX cannot control, and production

volumes and costs, some aspects of which FCX may not be able to

control. Further, FCX may make changes to its business plans that

could affect its results. FCX cautions investors that it does not

intend to update forward-looking statements more frequently than

quarterly notwithstanding any changes in its assumptions, changes

in business plans, actual experience or other changes, and FCX

undertakes no obligation to update any forward-looking

statements.

This press release also contains certain financial measures such

as unit net cash costs per pound of copper and molybdenum, which

are not recognized under U.S. generally accepted accounting

principles. As required by SEC Regulation G, reconciliations of

these measures to amounts reported in FCX's consolidated financial

statements are in the supplemental schedules of this press release,

which are also available on FCX's website, "fcx.com."

FREEPORT-McMoRan INC. SELECTED OPERATING DATA

Three Months Ended June 30,

MINING OPERATIONS: Production Sales

COPPER (millions of recoverable pounds) 2017

2016 2017 2016 (FCX's net interest in %)

North

America

Morenci (72%)a 187 224 196 221 Bagdad (100%) 43 44 43 45 Safford

(100%) 37 53 42 52 Sierrita (100%) 40 41 42 40 Miami (100%) 5 6 5 7

Chino (100%) 58 80 63 78 Tyrone (100%) 14 19 17 19 Other (100%) —

2 — 2 Total North America 384

469 408 464

South

America

Cerro Verde (53.56%) 260 278 244 270 El Abra (51%) 40 56

43 57 Total South America 300 334

287 327

Indonesia

Grasberg (90.64%)b 199 208 247 196

Consolidated - continuing operations 883 1,011

942 c

987 c Discontinued operations - Tenke Fungurume

(Tenke) (56%)d — 122 — 124

Total

883 1,133 942 1,111 Less noncontrolling

interests 159 229 158 226

Net

724 904 784 885

Average realized price per pound (continuing

operations) $ 2.65 $ 2.19

GOLD

(thousands of recoverable ounces)

(FCX's net interest in %) North America (100%) 5 8 5 5 Indonesia

(90.64%)b 348 158 427 151

Consolidated 353 166 432

156 Less noncontrolling interests 32 14

40 14

Net 321 152

392 142 Average realized

price per ounce $ 1,243 $ 1,292

MOLYBDENUM (millions of recoverable

pounds)

(FCX's net interest in %) Henderson (100%) 3 3 N/A N/A Climax

(100%) 5 4 N/A N/A North America copper mines (100%)a 8 8 N/A N/A

Cerro Verde (53.56%) 7 4 N/A N/A

Consolidated

23 19 25 19

Less noncontrolling interests 3 2 3 2

Net 20 17 22

17 Average realized price per pound $ 9.58 $

8.34

U.S. OIL AND GAS OPERATIONS: Sales Volumes Sales

per Day Oil (thousand barrels, or MBbls) 468 8,654 5 95 Natural gas

(million cubic feet or MMcf) 4,281 18,795 47 207 Natural gas

liquids (NGLs) (MBbls) 62 596 1 6 Thousand barrels of oil

equivalents (MBOE) 1,244 12,382 14 136

a. Amounts are net of Morenci's undivided

joint venture partners' interest; effective May 31, 2016, FCX's

undivided interest in Morenci was prospectively reduced from 85

percent to 72 percent.

b. Amounts are net of Grasberg's joint

venture partner's interest, which varies in accordance with the

terms of the joint venture agreement.

c. Consolidated sales volumes exclude

purchased copper of 62 million pounds in second-quarter 2017 and 43

million pounds in second-quarter 2016.

d. On November 16, 2016, FCX completed the

sale of its interest in the Tenke mine.

FREEPORT-McMoRan INC. SELECTED OPERATING DATA

(continued) Six Months Ended June

30,

MINING OPERATIONS: Production Sales

Copper

(millions of recoverable pounds) 2017 2016 2017 2016 (FCX's net

interest in %)

North

America

Morenci (72%)a 368 456 368 459 Bagdad (100%) 83 92 81 95 Safford

(100%) 79 109 85 111 Sierrita (100%) 81 82 80 83 Miami (100%) 10 14

10 16 Chino (100%) 120 161 123 161 Tyrone (100%) 34 39 35 39 Other

(100%) 1 3 1 3 Total North America 776

956 783 967

South

America

Cerro Verde (53.56%) 522 550 512 526 El Abra (51%) 82 119

84 124 Total South America 604 669

596 650

Indonesia

Grasberg (90.64%)b 354 373 372 370

Consolidated - continuing operations 1,734

1,998 1,751 c

1,987 c Discontinued operations

- Tenke (56%)d — 232 — 247

Total

1,734 2,230 1,751 2,234 Less

noncontrolling interests 316 450 314 448

Net 1,418 1,780

1,437 1,786 Average realized

price per pound (continuing operations) $ 2.65 $ 2.17

Gold (thousands of recoverable ounces) (FCX's net interest

in %) North America (100%) 12 14 10 11 Indonesia (90.64%)b 580

336 604 346

Consolidated

592 350 614 357

Less noncontrolling interests 54 31 57

32

Net 538 319 557

325 Average realized price per ounce $

1,242 $ 1,259

Molybdenum (millions of recoverable

pounds) (FCX's net interest in %) Henderson (100%) 6 5 N/A N/A

Climax (100%) 10 9 N/A N/A North America (100%)a 17 16 N/A N/A

Cerro Verde (53.56%) 13 9 N/A N/A

Consolidated

46 39 49 36

Less noncontrolling interests 6 4 6 3

Net 40 35 43

33 Average realized price per pound $ 9.16 $

7.99

U.S. OIL AND GAS OPERATIONS: Sales Volumes Sales

per Day Oil (MBbls) 949 16,952 5 93 Natural gas (MMcf) 10,280

38,434 57 211 NGLs (MBbls) 151 1,170 1 6 MBOE 2,814 24,528 15 135

a. Amounts are net of Morenci's undivided

joint venture partners' interest; effective May 31, 2016, FCX's

undivided interest in Morenci was prospectively reduced from 85

percent to 72 percent.

b. Amounts are net of Grasberg's joint

venture partner's interest, which varies in accordance with the

terms of the joint venture agreement.

c. Consolidated sales volumes exclude

purchased copper of 120 million pounds for the first six months of

2017 and 70 million pounds for the first six months of 2016.

d. On November 16, 2016, FCX completed the

sale of its interest in the Tenke mine.

FREEPORT-McMoRan INC. SELECTED OPERATING

DATA (continued) Three

Months Ended June 30, Six Months Ended June 30, 2017 2016 2017 2016

100% North America Copper Mines

Solution

Extraction/Electrowinning (SX/EW) Operations

Leach ore placed in stockpiles (metric tons per day) 688,000

780,700 694,300 807,100 Average copper ore grade (percent) 0.29

0.33 0.28 0.32 Copper production (millions of recoverable pounds)

282 303 559 605

Mill

Operations

Ore milled (metric tons per day) 299,100 300,400 301,400 299,500

Average ore grades (percent): Copper 0.39 0.48 0.40 0.49 Molybdenum

0.03 0.03 0.03 0.03 Copper recovery rate (percent) 86.7 86.6 86.6

85.6 Production (millions of recoverable pounds): Copper 174 219

360 445 Molybdenum 8 8 17 16

100% South America

Mining

SX/EW

Operations

Leach ore placed in stockpiles (metric tons per day) 152,400

170,400 139,200 155,500 Average copper ore grade (percent) 0.36

0.39 0.39 0.40 Copper production (millions of recoverable pounds)

59 82 125 172

Mill

Operations

Ore milled (metric tons per day) 347,600 352,000 343,300 345,700

Average ore grades (percent): Copper 0.44 0.42 0.44 0.43 Molybdenum

0.02 0.02 0.02 0.02 Copper recovery rate (percent) 83.0 88.0 83.8

87.1 Production (millions of recoverable pounds): Copper 241 252

479 497 Molybdenum 7 4 13 9

100% Indonesia Mining Ore

milled (metric tons per day):a Grasberg open pit 88,600 110,200

71,200 108,000 Deep Ore Zone underground mine 27,300 36,700 26,800

40,500 Deep Mill Level Zone (DMLZ) underground mineb 3,800 4,900

3,500 4,500 Grasberg Block Cave underground mineb 3,800 2,600 3,200

2,400 Big Gossan underground mineb — 1,000 800

600 Total 123,500 155,400 105,500 156,000

Average ore grades: Copper (percent) 1.03 0.84 1.08 0.77 Gold

(grams per metric ton) 1.16 0.48 1.17 0.50 Recovery rates

(percent): Copper 91.8 90.4 92.0 89.9 Gold 85.3 80.0 85.1 80.3

Production (recoverable): Copper (millions of pounds) 221 226 393

409 Gold (thousands of ounces) 347 174 588 364

100%

Molybdenum Mines Ore milled (metric tons per day) 22,000 18,600

21,800 18,500 Average molybdenum ore grade (percent) 0.20 0.19 0.21

0.21 Molybdenum production (millions of recoverable pounds) 8 7 16

14

a. Amounts represent the approximate

average daily throughput processed at PT Freeport Indonesia's

(PT-FI) mill facilities from each producing mine and from

development activities that result in metal production.

b. Targeted production rates once the DMLZ

underground mine reaches full capacity are expected to approximate

80,000 metric tons of ore per day in 2021; production from the

Grasberg Block Cave underground mine is expected to commence in

early 2019, and production from the Big Gossan underground mine is

on care-and-maintenance.

FREEPORT-McMoRan INC. CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited)

Three Months Ended Six Months Ended June 30,

June 30, 2017 2016 2017 2016 (In Millions, Except Per Share

Amounts) Revenuesa $ 3,711 $ 3,334 $ 7,052 $ 6,576 Cost of sales:

Production and deliveryb 2,495 c 2,956 4,695 c 5,455 Depreciation,

depletion and amortization 450 632 839 1,294 Impairment of oil and

gas properties — 291 — 4,078 Total cost

of sales 2,945 3,879 5,534 10,827 Selling, general and

administrative expensesd 107 c 160 260 c 298 Mining exploration and

research expenses 19 15 34 33 Environmental obligations and

shutdown costs (19 ) 11 8 21 Net gain on sales of assetse (10 )

(749 ) (33 ) (749 ) Total costs and expenses 3,042 3,316

5,803 10,430 Operating income (loss) 669 18

1,249 (3,854 ) Interest expense, netf (162 ) (196 ) (329 ) (387 )

Net (loss) gain on exchanges and early extinguishment of debt (4 )

39 (3 ) 36 Other income, net 10 25 34 64

Income (loss) from continuing operations before income taxes

and equity in affiliated companies' net (losses) earnings 513 (114

) 951 (4,141 ) Provision for income taxesg (186 ) (116 ) (360 )

(193 ) Equity in affiliated companies' net (losses) earnings (1 ) 1

3 8 Net income (loss) from continuing

operations 326 (229 ) 594 (4,326 ) Net income (loss) from

discontinued operationsh 9 (181 ) 47 (185 ) Net

income (loss) 335 (410 ) 641 (4,511 ) Net income attributable to

noncontrolling interests: Continuing operations (66 ) (47 ) (141 )

(109 ) Discontinued operations (1 ) (12 ) (4 ) (22 ) Preferred

dividends attributable to redeemable noncontrolling interest —

(10 ) — (21 ) Net income (loss) attributable to FCX

common stocki $ 268 $ (479 ) $ 496 $ (4,663 )

Basic and diluted net income (loss) per share attributable to

common stock: Continuing operations $ 0.18 $ (0.23 ) $ 0.31 $ (3.54

) Discontinued operations — (0.15 ) 0.03 (0.16 ) $

0.18 $ (0.38 ) $ 0.34 $ (3.70 )

Weighted-average common shares outstanding: Basic 1,447

1,269 1,447 1,260 Diluted 1,453 1,269

1,453 1,260

a. Includes adjustments to

provisionally priced concentrate and cathode copper sales

recognized in prior periods, which are summarized in the

supplemental schedule, "Derivative Instruments," on page X.

b. Includes oil and gas net (credits)

charges primarily associated with drillship settlements, inventory

adjustments and asset impairment, which are summarized in the

supplemental schedule, “Adjusted Net Income (Loss),” beginning on

page VII.

c. Includes net charges at mining

operations primarily for workforce reductions at PT-FI, which are

summarized in the supplemental schedule, "Adjusted Net Income

(Loss)," beginning on page VII.

d. Includes oil and gas net (credits)

charges for contract termination and restructuring, which are

summarized in the supplemental schedule, "Adjusted Net Income

(Loss)," beginning on page VII.

e. Refer to the supplemental

schedule, "Adjusted Net Income (Loss)," beginning on page VII, for

a summary of net gain on sales of assets.

f. Consolidated interest expense,

excluding capitalized interest, totaled $192 million in

second-quarter 2017, $218 million in second-quarter 2016, $387

million for the first six months of 2017 and $436 million for the

first six months of 2016.

g. Refer to the supplemental

schedule, "Income Taxes," on page IX for a summary of FCX's

provision for income taxes.

h. Refer to the supplemental

schedule, “Adjusted Net Income (Loss),” beginning on page VII for a

summary of gains (losses) on discontinued operations.

i. FCX defers recognizing profits on

intercompany sales until final sales to third parties occur. Refer

to the supplemental schedule, "Deferred Profits," on page X for a

summary of net impacts from changes in these deferrals.

FREEPORT-McMoRan INC. CONSOLIDATED BALANCE

SHEETS (Unaudited) June 30, December 31,

2017 2016 (In Millions) ASSETS Current assets: Cash and cash

equivalents $ 4,667 $ 4,245 Trade accounts receivable 802 1,126

Income and other tax receivables 632 879 Inventories: Mill and

leach stockpiles 1,359 1,338 Materials and supplies, net 1,264

1,306 Product 1,019 998 Other current assets 211 199 Held for sale

463 344 Total current assets 10,417 10,435 Property,

plant, equipment and mine development costs, net 23,067 23,219 Oil

and gas properties, subject to amortization, less accumulated

amortization and impairments 48 74 Long-term mill and leach

stockpiles 1,554 1,633 Other assets 1,957 1,956 Total

assets $ 37,043 $ 37,317 LIABILITIES AND

EQUITY Current liabilities: Accounts payable and accrued

liabilities $ 1,880 $ 2,393 Current portion of debt 2,216 1,232

Current portion of environmental and asset retirement obligations

379 369 Accrued income taxes 196 66 Held for sale 273 205

Total current liabilities 4,944 4,265 Long-term debt, less

current portion 13,138 14,795 Deferred income taxes 3,870 3,768

Environmental and asset retirement obligations, less current

portion 3,512 3,487 Other liabilities 1,586 1,745

Total liabilities 27,050 28,060 Equity: Stockholders'

equity: Common stock 158 157 Capital in excess of par value 26,734

26,690 Accumulated deficit (16,043 ) (16,540 ) Accumulated other

comprehensive loss (456 ) (548 ) Common stock held in treasury

(3,720 ) (3,708 ) Total stockholders' equity 6,673 6,051

Noncontrolling interests 3,320 3,206 Total equity

9,993 9,257 Total liabilities and equity $ 37,043

$ 37,317

FREEPORT-McMoRan INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

Six Months Ended June 30, 2017 2016 (In

Millions) Cash flow from operating activities: Net income (loss) $

641 $ (4,511 ) Adjustments to reconcile net income (loss) to net

cash provided by operating activities: Depreciation, depletion and

amortization 839 1,374 Impairment of oil and gas properties — 4,078

Non-cash drillship settlements/idle rig costs and other oil and gas

adjustments (33 ) 694 Net gain on sales of assets (33 ) (749 )

Stock-based compensation 44 42 Net charges for environmental and

asset retirement obligations, including accretion 87 107 Payments

for environmental and asset retirement obligations (59 ) (116 ) Net

loss (gain) on exchanges and early extinguishment of debt 3 (36 )

Deferred income taxes 55 169 (Gain) loss on disposal of

discontinued operations (38 ) 177 Decrease (increase) in long-term

mill and leach stockpiles 80 (99 ) Oil and gas contract settlement

payments (70 ) — Other, net (9 ) 18 Changes in working capital and

tax payments, excluding amounts from dispositions: Accounts

receivable 589 259 Inventories (101 ) 190 Other current assets (2 )

(53 ) Accounts payable and accrued liabilities (267 ) 44 Accrued

income taxes and changes in other tax payments 103 26

Net cash provided by operating activities 1,829 1,614

Cash flow from investing activities: Capital expenditures:

North America copper mines (67 ) (76 ) South America (45 ) (293 )

Indonesia (457 ) (453 ) Molybdenum mines (2 ) (1 ) Other, including

oil and gas operations (135 ) (992 ) Net proceeds from the sale of

additional interest in Morenci — 996 Net proceeds from sales of

other assets 4 290 Other, net (8 ) (6 ) Net cash used in investing

activities (710 ) (535 ) Cash flow from financing

activities: Proceeds from debt 598 2,811 Repayments of debt (1,242

) (3,649 ) Net proceeds from sale of common stock — 32 Cash

dividends paid: Common stock (2 ) (5 ) Noncontrolling interests (39

) (39 ) Stock-based awards net payments (8 ) (5 ) Debt financing

costs and other, net (11 ) (18 ) Net cash used in financing

activities (704 ) (873 ) Net increase in cash and cash

equivalents 415 206 Decrease (increase) in cash and cash

equivalents in assets held for sale 7 (53 ) Cash and cash

equivalents at beginning of year 4,245 177 Cash and

cash equivalents at end of period $ 4,667 $ 330

FREEPORT-McMoRan INC.

ADJUSTED NET INCOME (LOSS)

Adjusted net income (loss) is intended to

provide investors and others with information about FCX's recurring

operating performance. This information differs from net income

(loss) attributable to common stock determined in accordance with

U.S. generally accepted accounting principles (GAAP) and should not

be considered in isolation or as a substitute for measures of

performance determined in accordance with U.S. GAAP. FCX's adjusted

net income (loss) follows, which may not be comparable to similarly

titled measures reported by other companies (in millions, except

per share amounts).

Three Months Ended June 30, 2017 2016

Pre-tax After-tax Per Share Pre-tax

After-tax Per Share

Net income (loss)

attributable to common stock N/A $ 268

$ 0.18 N/A $ (479

) $ (0.38 ) Mining charges:

PT-FI net charges for workforce reductions $ (87 ) a $ (46 ) $

(0.03 ) $ — $ — $ — Inventory adjustments and asset impairment (9 )

(9 ) (0.01 ) (2 ) (2 ) — Oil and gas charges: Drillship

settlement/idle rig credits (costs) 6 b 6 — (639 ) (639 ) (0.50 )

Inventory adjustments and asset impairment — — — (53 ) (53 ) (0.04

) Other contract termination credits 4 4 — — — — Restructuring

charges (4 ) (4 ) — (37 ) (37 ) (0.03 ) Impairment of oil and gas

properties — — — (291 ) (291 ) (0.23 ) Net adjustments to

environmental obligations and related litigation reserves 30 30

0.02 — — — Net gain on sales of assetsc 10 10 0.01 749 744 0.59 Net

(loss) gain on exchanges and early extinguishment of debt (4 ) (4 )

— 39 39 0.03 Net tax credits (charges)d N/A 32 0.02 N/A (36 ) (0.03

) Gain (loss) on discontinued operationse 10 8 —

(177 ) (177 ) (0.14 ) $ (44 ) $ 27 $ 0.01 $

(411 ) $ (452 ) $ (0.36 ) f

Adjusted net income (loss)

attributable to common stock N/A $ 241

$ 0.17 N/A $ (27 )

$ (0.02 )

a. Includes $82 million in production

and delivery costs and $5 million in selling, general and

administrative expenses.

b. Reflects adjustments to the fair

value of the contingent payments related to the 2016 drillship

settlements. The 12-month contingency period associated with the

drillship settlements ended June 30, 2017, and no additional

amounts were paid.

c. Net gains in second-quarter 2017

primarily reflect an adjustment of $13 million to assets held for

sale, partly offset by a net charge of $2 million to adjust the

estimated fair value of the potential $150 million in contingent

consideration related to the December 2016 onshore California sale,

which totaled $21 million at June 30, 2017, and in accordance with

accounting guidelines, will continue to be adjusted through

December 31, 2020. Second-quarter 2016 reflects gains associated

with the sales of a 13 percent undivided interest in the Morenci

unincorporated joint venture and an interest in the Timok

exploration project in Serbia.

d. Refer to “Income Taxes,” on page IX,

for further discussion of net tax charges.

e. The second-quarter 2017 gain primarily

reflects an adjustment to the estimated fair value of the potential

$120 million in contingent consideration related to the November

2016 sale of FCX’s interest in TFHL, which totaled $55 million at

June 30, 2017, and in accordance with accounting guidelines, will

continue to be adjusted through December 31, 2019. Second-quarter

2016 reflects the estimated loss on the sale of FCX’s interest in

TFHL.

f. Per share amount does not foot down

because of rounding.

FREEPORT-McMoRan INC.

ADJUSTED NET INCOME (LOSS)

(continued)

Six Months Ended June 30, 2017 2016 Pre-tax After-tax

Per Share Pre-tax After-tax Per Share

Net income

(loss) attributable to common stock N/A $

496 $ 0.34 N/A $

(4,663 ) $ (3.70 ) Mining

charges: PT-FI net charges for workforce reductions $ (108 ) a $

(57 ) $ (0.04 ) $ — $ — $ — Inventory adjustments and asset

impairment (28 ) (28 ) (0.02 ) (7 ) (7 ) (0.01 ) Oil and gas

charges: Drillship settlements/idle rig credits (costs) 26 b 26

0.02 (804 ) (804 ) (0.64 ) Inventory adjustments and asset

impairment — — — (88 ) (88 ) (0.07 ) Other contract termination

charges (17 ) (17 ) (0.01 ) — — — Restructuring charges (5 ) (5 ) —

(39 ) (39 ) (0.03 ) Impairment of oil and gas properties — — —

(4,078 ) (4,078 ) (3.24 ) Net adjustments to environmental

obligations and related litigation reserves 11 11 0.01 — — — Net

gain on sales of assetsc 33 33 0.02 749 744 0.59 Net (loss) gain on

exchanges and early extinguishment of debt (3 ) (3 ) — 36 36 0.03

Net tax credits (charges)d N/A 31 0.02 N/A (36 ) (0.03 ) Gain

(loss) on discontinued operationse 51 43 0.03

(177 ) (177 ) (0.14 ) $ (40 ) $ 34 $ 0.02 f $ (4,408

) $ (4,449 ) $ (3.53 ) f

Adjusted net income (loss)

attributable to common stock N/A $ 462

$ 0.32 N/A $ (214 )

$ (0.17 )

a. Includes $103 million in

production and delivery costs and $5 million in selling, general

and administrative expenses.

b. Reflects adjustments to the fair

value of the contingent payments related to the 2016 drillship

settlements. The 12-month contingency period associated with the

drillship settlements ended June 30, 2017, and no additional

amounts were paid.

c. Net gains for the first six

months of 2017 primarily reflect adjustments of $32 million

associated with oil and gas transactions and an adjustment of $13

million to assets held for sale, partly offset by a net charge of

$12 million to adjust the estimated fair value of the potential

$150 million in contingent consideration related to the December

2016 onshore California sale, which totaled $21 million at June 30,

2017, and in accordance with accounting guidelines, will continue

to be adjusted through December 31, 2020. The first six months of

2016 reflects gains associated with the sales of a 13 percent

undivided interest in the Morenci unincorporated joint venture and

an interest in the Timok exploration project in Serbia.

d. Refer to “Income Taxes,” on page

IX, for further discussion of net tax charges.

e. The gain for the first six months

of 2017 primarily reflects an adjustment to the estimated fair

value of the potential $120 million in contingent consideration

related to the November 2016 sale of FCX’s interest in TFHL, which

totaled $55 million at June 30, 2017, and in accordance with

accounting guidelines, will continue to be adjusted through

December 31, 2019. The first six months of 2016 reflects the

estimated loss on the sale of FCX’s interest in TFHL.

f. Per share amount does not foot

down because of rounding.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170725005750/en/

Freeport-McMoRan Inc.Financial Contacts:Kathleen L. Quirk,

602-366-8016orDavid P. Joint, 504-582-4203orMedia Contact:Eric E.

Kinneberg, 602-366-7994

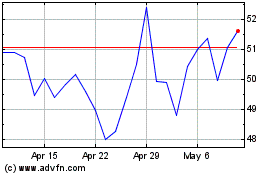

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024