Enterprise Bancorp, Inc. (the “Company”) (NASDAQ:EBTC), parent of

Enterprise Bank, announced net income for the three months ended

June 30, 2017 of $5.6 million, an increase of $824 thousand,

or 17%, compared to the same three-month period in 2016.

Diluted earnings per share were $0.48 for the three months ended

June 30, 2017, an increase of 7%, compared to the same

three-month period in 2016. Net income for the six months

ended June 30, 2017 amounted to $11.2 million, an increase of

$2.1 million, or 23%, compared to the six months ended

June 30, 2016. Diluted earnings per share were $0.96 for

the six months ended June 30, 2017, an increase of 12%,

compared to the six months ended June 30, 2016. Diluted

earnings per share for the second quarter and the first six months

of 2017 include the full dilutive impact of the Company’s equity

offering issued on June 23, 2016.

As previously announced on July 18, 2017, the Company

declared a quarterly dividend of $0.135 per share to be paid on

September 1, 2017 to shareholders of record as of

August 11, 2017. The 2017 dividend rate represents a

3.8% increase over the 2016 dividend rate.

Chief Executive Officer Jack Clancy commented, “The increase in

our 2017 earnings compared to 2016 has been positively impacted by

our growth over the last twelve months. Total assets, loans,

and customer deposits have increased 9%, 11%, and 7%, respectively,

as compared to June 30, 2016. This growth continues to

be driven by the collective efforts and contributions of our

dedicated Enterprise team, active community involvement,

relationship building and a customer-focused mindset, market

expansion, and ongoing enhancements to our state-of-the-art product

and service offerings.”

Mr. Clancy continued, “Strategically, our focus remains on

organic growth and continually planning for and investing in our

future. We look forward to opening our 24th branch in

Windham, NH in the next few weeks. The relocation of our

branch in Salem, NH to its new location is anticipated to occur in

mid-August. We expect the relocation of our Leominster branch

to be completed in early 2018. The relocation of our branches

in Salem, NH and Leominster, MA will provide improved and

state-of-the-art branches in those communities to better serve our

customers.”

Founder and Chairman of the Board George Duncan commented, “This

quarter represents our 111th consecutive profitable quarter.

Our ability to continually grow our franchise has been a key factor

in our success. Our strategic expansion has added key markets

to our franchise which has ultimately led to increased shareholder

value. As our assets under management have now exceeded $3.5

billion - a significant milestone for any financial institution -

we are extremely grateful for the support we have received from our

customers, shareholders, and the communities in which we

operate.”

Results of Operations

Net interest income for the three months ended June 30,

2017 amounted to $23.5 million, an increase of $2.2 million, or

11%, compared to the same period in 2016. Net interest income

for the six months ended June 30, 2017 amounted to $46.4

million, an increase of $4.0 million, or 9%, compared to the six

months ended June 30, 2016. The increase in net interest

income was due primarily to loan growth. Average loan

balances (including loans held for sale) increased $216.4 million

and $200.2 million for the quarter and six months ended

June 30, 2017, respectively, compared to the 2016 respective

period averages. Net interest margin was 3.90% for both the

three months ended June 30, 2017 and March 31, 2017,

while net interest margin was 4.02% for the three months ended

June 30, 2016. Net interest margin was 3.90% for the six

months ended June 30, 2017, compared to 4.02% for the six

months ended June 30, 2016.

For the three months ended June 30, 2017 and June 30,

2016, the provision for loan losses amounted to $280 thousand and

$267 thousand, respectively. For the six months ended

June 30, 2017 and June 30, 2016, the provision for loan

losses amounted to $405 thousand and $1.1 million,

respectively. The decrease in the provision for the six

months ended June 30, 2017, was due primarily to generally

improved credit quality metrics and underlying collateral values,

partially offset by increased loan growth compared to prior

year.

Contributing to the provision for loan losses were:

- Total non-performing loans as a percentage of total loans (a

measure of credit risk) amounted to 0.63% at June 30, 2017,

compared to 0.54% at June 30, 2016. Impacting the

current period, among other changes, were new impaired/non-accrual

status classification changes of two larger commercial

relationships totaling approximately $4.5 million, which, based on

a review of their individual business circumstances, management

determined that no reserves were necessary on these relationships

as of June 30, 2017.

- The balance of the allowance for loan losses allocated to

impaired and adversely classified loans decreased by $745 thousand

for the six months ended June 30, 2017, and increased $840

thousand during the six months ended June 30, 2016.

- The Company recorded net recoveries of $211 thousand for the

six months ended June 30, 2017, compared to net recoveries of

$220 thousand for the six months ended June 30,

2016.

- Loan growth for the six months ended June 30, 2017 was

$91.7 million, compared to $39.2 million during the six months

ended June 30, 2016.

The allowance for loan losses to total loans ratio was 1.51% at

June 30, 2017, 1.55% at December 31, 2016 and 1.60% at

June 30, 2016.

Non-interest income for the three months ended June 30,

2017 amounted to $3.9 million, an increase of $357 thousand, or

10%, compared to the same quarter last year. Non-interest

income for the six months ended June 30, 2017 amounted to $8.1

million, an increase of $1.3 million, or 19%, compared to the six

months ended June 30, 2016. The quarter and year-to-date

increases were due primarily to increases in net gains on the sales

of investment securities and deposit and interchange

fees.

Non-interest expense for the quarter ended June 30, 2017

amounted to $18.8 million, an increase of $1.2 million, or 7%,

compared to the same quarter in the prior year. For the six

months ended June 30, 2017, non-interest expense amounted to

$38.2 million, an increase of $3.8 million, or 11%, over the six

months ended June 30, 2016. Increases in expenses over

the same periods in the prior year primarily related to the

Company’s strategic growth and market expansion initiatives,

particularly increases in salaries and benefits expenses.

In the first quarter of 2017, the Company adopted a new

accounting standard, ASU No. 2016-09 “Compensation-Stock

Compensation (Topic 718) Improvements to Employee Share-Based

Payment Accounting,” which among other aspects relates to the tax

treatment of employee and director equity compensation. The

adoption of this standard reduced the provision for income taxes

and increased earnings by approximately $788 thousand for the six

months ended June 30, 2017.

Key Financial Highlights

- Total assets amounted to $2.66 billion at June 30, 2017,

compared to $2.53 billion at December 31, 2016, an increase of

$130.3 million, or 5%. Since March 31, 2017, total

assets have increased $84.2 million, or 3%.

- Total loans amounted to $2.11 billion at June 30, 2017,

compared to $2.02 billion at December 31, 2016, an increase of

$91.7 million, or 5%. Since March 31, 2017, total loans

have increased $49.5 million, or 2%.

- Customer deposits (total deposits excluding brokered deposits)

were $2.27 billion at June 30, 2017, compared to $2.21 billion

at December 31, 2016, an increase of $56.8 million, or

3%. Since March 31, 2017, customer deposits have

increased $50.8 million, or 2%. Brokered deposits were $87.5

million at June 30, 2017, compared to $59.4 million at

March 31, 2017 and December 31, 2016.

- Investment assets under management amounted to $781.1 million

at June 30, 2017, compared to $725.3 million at

December 31, 2016, an increase of $55.7 million, or 8%.

Since March 31, 2017, investment assets under management have

increased $33.6 million, or 4%.

- Total assets under management amounted to $3.52 billion at

June 30, 2017, compared to $3.33 billion at December 31,

2016, an increase of $188.3 million, or 6%. Since

March 31, 2017, total assets under management have increased

$118.4 million, or 3%.

Enterprise Bancorp, Inc. is a Massachusetts corporation that

conducts substantially all of its operations through Enterprise

Bank and Trust Company, commonly referred to as Enterprise

Bank. The Company is principally engaged in the business of

attracting deposits from the general public and investing in

commercial loans and investment securities. Through

Enterprise Bank and its subsidiaries, the Company offers a range of

commercial, residential and consumer loan products, deposit

products and cash management services, as well as investment

advisory and wealth management, trust, and insurance

services. The Company’s headquarters and the Bank’s main

office are located at 222 Merrimack Street in Lowell,

Massachusetts. The Company’s primary market area is the

Greater Merrimack Valley and North Central regions of Massachusetts

and Southern New Hampshire. Enterprise Bank has 23

full-service branches located in the Massachusetts communities of

Lowell, Acton, Andover, Billerica, Chelmsford, Dracut, Fitchburg,

Lawrence, Leominster, Methuen, Tewksbury, Tyngsborough and Westford

and in the New Hampshire communities of Derry, Hudson, Nashua,

Pelham and Salem. The Company also anticipates that the

Windham, NH branch will open in the next few weeks.

This earnings release contains statements about future events

that constitute forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by references to a

future period or periods or by the use of the words “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “assume,” “will,”

“should,” “plan,” and other similar terms or expressions.

Forward-looking statements should not be relied on because they

involve known and unknown risks, uncertainties and other factors,

some of which are beyond the control of the Company. These

risks, uncertainties and other factors may cause the actual

results, performance, and achievements of the Company to be

materially different from the anticipated future results,

performance or achievements expressed or implied by the

forward-looking statements. Factors that could cause such

differences include, but are not limited to, general economic

conditions, changes in interest rates, regulatory considerations,

competition, and the receipt of required regulatory

approvals. For more information about these factors, please

see our reports filed with or furnished to the Securities and

Exchange Commission (the “SEC”), including our most recent Annual

Report on Form 10-K on file with the SEC, including the sections

entitled “Risk Factors” and “Management's Discussion and Analysis

of Financial Condition and Results of Operations.” Any

forward-looking statements contained in this press release are made

as of the date hereof, and we undertake no duty, and specifically

disclaim any duty, to update or revise any such statements, whether

as a result of new information, future events or otherwise, except

as required by applicable law.

| |

| ENTERPRISE BANCORP, INC. |

| Consolidated Balance Sheets |

| (unaudited) |

| |

|

(Dollars in thousands) |

|

June 30, 2017 |

|

December 31, 2016 |

|

June 30, 2016 |

| Assets |

|

|

|

|

|

|

| Cash and

cash equivalents: |

|

|

|

|

|

|

| Cash and

due from banks |

|

$ |

51,714 |

|

|

$ |

33,047 |

|

|

$ |

99,013 |

|

|

Interest-earning deposits |

|

24,049 |

|

|

17,428 |

|

|

42,849 |

|

| Total

cash and cash equivalents |

|

75,763 |

|

|

50,475 |

|

|

141,862 |

|

|

Investment securities at fair value |

|

388,005 |

|

|

374,790 |

|

|

319,503 |

|

| Federal

Home Loan Bank stock |

|

4,364 |

|

|

2,094 |

|

|

1,879 |

|

| Loans

held for sale |

|

856 |

|

|

1,569 |

|

|

1,971 |

|

| Loans,

less allowance for loan losses of $31,958 at June 30, 2017, |

|

|

|

|

|

|

|

|

|

|

$31,342 at December 31, 2016, and $30,345 at June 30, 2016 |

|

2,082,442 |

|

|

1,991,387 |

|

|

1,868,841 |

|

| Premises

and equipment, net |

|

35,162 |

|

|

33,540 |

|

|

34,140 |

|

| Accrued

interest receivable |

|

9,157 |

|

|

8,792 |

|

|

7,838 |

|

| Deferred

income taxes, net |

|

14,924 |

|

|

17,020 |

|

|

11,506 |

|

|

Bank-owned life insurance |

|

29,118 |

|

|

28,765 |

|

|

28,400 |

|

| Prepaid

income taxes |

|

1,784 |

|

|

1,344 |

|

|

776 |

|

| Prepaid

expenses and other assets |

|

9,316 |

|

|

10,837 |

|

|

10,681 |

|

|

Goodwill |

|

5,656 |

|

|

5,656 |

|

|

5,656 |

|

| Total

assets |

|

$ |

2,656,547 |

|

|

$ |

2,526,269 |

|

|

$ |

2,433,053 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

Deposits |

|

$ |

2,353,782 |

|

|

$ |

2,268,921 |

|

|

$ |

2,184,430 |

|

| Borrowed

funds |

|

44,255 |

|

|

10,671 |

|

|

671 |

|

|

Subordinated debt |

|

14,841 |

|

|

14,834 |

|

|

14,828 |

|

| Accrued

expenses and other liabilities |

|

15,794 |

|

|

16,794 |

|

|

20,374 |

|

| Accrued

interest payable |

|

218 |

|

|

263 |

|

|

252 |

|

| Total

liabilities |

|

2,428,890 |

|

|

2,311,483 |

|

|

2,220,555 |

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

| Preferred

stock, $0.01 par value per share; 1,000,000 shares authorized; no

shares issued |

|

— |

|

|

— |

|

|

— |

|

| Common

stock $0.01 par value per share; 40,000,000 shares authorized;

11,582,344 shares |

|

|

|

|

|

|

|

|

|

|

issued and outstanding at June 30, 2017 (including 126,770 shares

of unvested participating |

|

|

|

|

|

|

|

|

|

|

restricted awards), 11,475,742 shares issued and outstanding at

December 31, 2016 (including |

|

|

|

|

|

|

|

|

|

|

141,580 shares of unvested participating restricted awards), and

11,420,426 shares issued and |

|

|

|

|

|

|

|

|

|

|

outstanding at June 30, 2016 (including 143,671 shares of unvested

participating restricted awards) |

|

116 |

|

|

115 |

|

|

114 |

|

|

Additional paid-in capital |

|

86,628 |

|

|

85,421 |

|

|

82,387 |

|

| Retained

earnings |

|

138,049 |

|

|

130,008 |

|

|

123,313 |

|

|

Accumulated other comprehensive income/ (loss) |

|

2,864 |

|

|

(758 |

) |

|

6,684 |

|

| Total

stockholders’ equity |

|

227,657 |

|

|

214,786 |

|

|

212,498 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

2,656,547 |

|

|

$ |

2,526,269 |

|

|

$ |

2,433,053 |

|

| |

| ENTERPRISE BANCORP, INC. |

| Consolidated Statements of Income |

| (unaudited) |

| |

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

(Dollars in thousands, except per share data) |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Interest and dividend

income: |

|

|

|

|

|

|

|

| Loans and

loans held for sale |

$ |

23,281 |

|

|

$ |

21,032 |

|

|

$ |

45,652 |

|

|

$ |

41,913 |

|

|

Investment securities |

1,964 |

|

|

1,551 |

|

|

3,884 |

|

|

3,091 |

|

| Other

interest-earning assets |

93 |

|

|

49 |

|

|

166 |

|

|

93 |

|

| Total

interest and dividend income |

25,338 |

|

|

22,632 |

|

|

49,702 |

|

|

45,097 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

Deposits |

1,380 |

|

|

1,099 |

|

|

2,608 |

|

|

2,187 |

|

| Borrowed

funds |

192 |

|

|

14 |

|

|

253 |

|

|

77 |

|

|

Subordinated debt |

231 |

|

|

230 |

|

|

459 |

|

|

461 |

|

| Total

interest expense |

1,803 |

|

|

1,343 |

|

|

3,320 |

|

|

2,725 |

|

| Net

interest income |

23,535 |

|

|

21,289 |

|

|

46,382 |

|

|

42,372 |

|

| Provision for loan

losses |

280 |

|

|

267 |

|

|

405 |

|

|

1,117 |

|

| Net

interest income after provision for loan losses |

23,255 |

|

|

21,022 |

|

|

45,977 |

|

|

41,255 |

|

| Non-interest

income: |

|

|

|

|

|

|

|

|

Investment advisory fees |

1,267 |

|

|

1,327 |

|

|

2,492 |

|

|

2,431 |

|

| Deposit

and interchange fees |

1,522 |

|

|

1,276 |

|

|

2,862 |

|

|

2,518 |

|

| Income on

bank-owned life insurance, net |

177 |

|

|

191 |

|

|

353 |

|

|

382 |

|

| Net gains

on sales of investment securities |

229 |

|

|

63 |

|

|

769 |

|

|

65 |

|

| Gains on

sales of loans |

138 |

|

|

105 |

|

|

271 |

|

|

194 |

|

| Other

income |

606 |

|

|

620 |

|

|

1,326 |

|

|

1,198 |

|

| Total

non-interest income |

3,939 |

|

|

3,582 |

|

|

8,073 |

|

|

6,788 |

|

| Non-interest

expense: |

|

|

|

|

|

|

|

| Salaries

and employee benefits |

11,792 |

|

|

11,025 |

|

|

24,484 |

|

|

21,510 |

|

| Occupancy

and equipment expenses |

1,945 |

|

|

1,781 |

|

|

3,884 |

|

|

3,594 |

|

|

Technology and telecommunications expenses |

1,606 |

|

|

1,548 |

|

|

3,188 |

|

|

2,971 |

|

|

Advertising and public relations expenses |

797 |

|

|

817 |

|

|

1,416 |

|

|

1,496 |

|

| Audit,

legal and other professional fees |

314 |

|

|

375 |

|

|

677 |

|

|

832 |

|

| Deposit

insurance premiums |

376 |

|

|

324 |

|

|

759 |

|

|

650 |

|

| Supplies

and postage expenses |

245 |

|

|

258 |

|

|

478 |

|

|

487 |

|

| Other

operating expenses |

1,679 |

|

|

1,414 |

|

|

3,288 |

|

|

2,871 |

|

| Total

non-interest expense |

18,754 |

|

|

17,542 |

|

|

38,174 |

|

|

34,411 |

|

| Income before income

taxes |

8,440 |

|

|

7,062 |

|

|

15,876 |

|

|

13,632 |

|

| Provision for income

taxes |

2,845 |

|

|

2,291 |

|

|

4,709 |

|

|

4,548 |

|

| Net

income |

$ |

5,595 |

|

|

$ |

4,771 |

|

|

$ |

11,167 |

|

|

$ |

9,084 |

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

share |

$ |

0.48 |

|

|

$ |

0.45 |

|

|

$ |

0.97 |

|

|

$ |

0.87 |

|

| Diluted earnings per

share |

$ |

0.48 |

|

|

$ |

0.45 |

|

|

$ |

0.96 |

|

|

$ |

0.86 |

|

| |

|

|

|

|

|

|

|

| Basic weighted average

common shares outstanding |

11,572,430 |

|

|

10,561,680 |

|

|

11,540,796 |

|

|

10,483,396 |

|

| Diluted weighted

average common shares outstanding |

11,652,689 |

|

|

10,629,900 |

|

|

11,625,712 |

|

|

10,550,842 |

|

| |

| ENTERPRISE BANCORP, INC. |

| Selected Consolidated Financial Data and Ratios |

| (unaudited) |

| |

|

(Dollars in thousands, except per share

data) |

|

At or for the six months ended June 30,

2017 |

|

At or for the year ended December 31,

2016 |

|

At or for the six months ended June 30,

2016 |

|

| |

|

|

|

|

|

|

|

| BALANCE SHEET

AND OTHER DATA |

|

|

|

|

|

|

|

| Total assets |

|

$ |

2,656,547 |

|

|

$ |

2,526,269 |

|

|

$ |

2,433,053 |

|

|

| Loans serviced for

others |

|

83,268 |

|

|

80,996 |

|

|

77,648 |

|

|

| Investment assets under

management |

|

781,052 |

|

|

725,338 |

|

|

683,884 |

|

|

| Total assets under

management |

|

$ |

3,520,867 |

|

|

$ |

3,332,603 |

|

|

$ |

3,194,585 |

|

|

| |

|

|

|

|

|

|

|

| Book value per

share |

|

$ |

19.66 |

|

|

$ |

18.72 |

|

|

$ |

18.61 |

|

|

| Dividends paid per

common share |

|

$ |

0.27 |

|

|

$ |

0.52 |

|

|

$ |

0.26 |

|

|

| Total capital to risk

weighted assets |

|

11.76 |

% |

|

11.79 |

% |

|

11.93 |

% |

|

| Tier 1 capital to risk

weighted assets |

|

9.80 |

% |

|

9.80 |

% |

|

9.91 |

% |

|

| Tier 1 capital to

average assets |

|

8.40 |

% |

|

8.34 |

% |

|

8.69 |

% |

|

| Common equity tier 1

capital to risk weighted assets |

|

9.80 |

% |

|

9.80 |

% |

|

9.91 |

% |

|

| Allowance for loan

losses to total loans |

|

1.51 |

% |

|

1.55 |

% |

|

1.60 |

% |

|

| Non-performing

assets |

|

$ |

13,276 |

|

|

$ |

9,485 |

|

|

$ |

10,271 |

|

|

| Non-performing assets

to total assets |

|

0.50 |

% |

|

0.38 |

% |

|

0.42 |

% |

|

| |

|

|

|

|

|

|

|

| INCOME

STATEMENT DATA (annualized) |

|

|

|

|

|

|

|

| Return on average total

assets |

|

0.87 |

% |

|

0.78 |

% |

|

0.80 |

% |

|

| Return on average

stockholders’ equity |

|

10.22 |

% |

|

9.33 |

% |

|

9.75 |

% |

|

| Net interest margin

(tax equivalent) |

|

3.90 |

% |

|

3.94 |

% |

|

4.02 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

Contact Info: James A. Marcotte, Executive Vice President, Chief Financial Officer and Treasurer (978) 656-5614

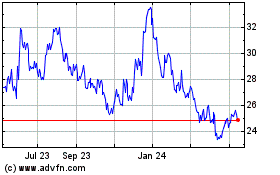

Enterprise Bancorp (NASDAQ:EBTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

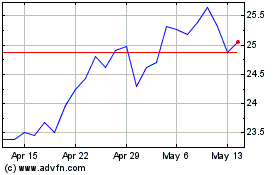

Enterprise Bancorp (NASDAQ:EBTC)

Historical Stock Chart

From Apr 2023 to Apr 2024