AAN INVESTORS NOTICE: Lieff Cabraser Reminds Investors of Deadline in Class Action Against Aaron’s, Inc.

July 17 2017 - 3:01PM

Business Wire

The law firm of Lieff Cabraser Heimann & Bernstein, LLP

reminds investors of the upcoming deadline to move for appointment

as lead plaintiff in securities class litigation brought on behalf

of investors who purchased the common stock of Aaron’s, Inc.

(“Aaron’s” or the “Company”) (NYSE: AAN) between February 6, 2015

and October 29, 2015, inclusive (the “Relevant Period”).

If you purchased Aaron’s common stock during the Relevant

Period, you may move the Court for appointment as lead plaintiff by

no later than August 18, 2017. A lead plaintiff is a representative

party who acts on behalf of other class members in directing the

litigation. Your share of any recovery in the action will not be

affected by your decision of whether to seek appointment as lead

plaintiff. You may retain Lieff Cabraser, or other attorneys, as

your counsel in the action.

Aaron’s investors who wish to learn more about the litigation

and how to seek appointment as lead plaintiff should click here or

contact Sharon M. Lee of Lieff Cabraser toll-free at

1-800-541-7358.

Aaron’s, headquartered in Atlanta, Georgia, engages in the sales

and lease ownership and specialty retailing of furniture, consumer

electronics, home appliances and accessories. The complaint filed

in the action alleges that throughout the Class Period, defendants

made material misrepresentations about the strong revenue and sales

growth generated by Progressive Finance Holdings, LLC

(“Progressive”), Aaron’s most profitable subsidiary, and

Progressive’s proprietary algorithm, which it used to determine

which customers meet leasing qualifications. Unbeknownst to

investors, Aaron’s experienced software issues related to the

Progressive algorithm, including the loss of critical data, which

undermined Progressive’s ability to determine which customers met

leasing qualifications.

On October 30, 2015, Aaron’s admitted that Progressive had lost

two critical data feeds in February. The Company acknowledged that

the loss of data caused it to experience “higher bad debt expense

and merchandise write offs” and delayed the Company’s “ability to

identify and begin collections on certain delinquent accounts.”

Aaron’s senior executives admitted that the Company had discovered

the data loss in February, nearly nine months earlier. Following

this news, the price of Aaron’s stock plummeted $8.88 per share, or

26.47%, from a close of $33.55 per share on October 29, 2015, to

close at $24.67 per share on October 30, 2015, on highly elevated

trading volume.

About Lieff Cabraser

Lieff Cabraser Heimann & Bernstein, LLP, with offices in San

Francisco, New York, Nashville, and Seattle, is a nationally

recognized law firm committed to advancing the rights of investors

and promoting corporate responsibility.

The National Law Journal has recognized Lieff Cabraser as one of

the nation’s top plaintiffs’ law firms for fourteen years. In

compiling the list, the National Law Journal examines recent

verdicts and settlements and looked for firms “representing the

best qualities of the plaintiffs’ bar and that demonstrated unusual

dedication and creativity.” Law360 has selected Lieff Cabraser as

one of the Top 50 law firms nationwide for litigation, highlighting

our firm’s “laser focus” and noting that our firm routinely finds

itself “facing off against some of the largest and strongest

defense law firms in the world.” In late 2016, Benchmark Litigation

named Lieff Cabraser one of the “Top 10 Plaintiffs’ Firms in

America.”

For more information about Lieff Cabraser and the firm’s

representation of investors, please visit

http://www.lieffcabraser.com.

This press release may be considered Attorney Advertising in

some jurisdictions under the applicable law and ethical rules.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170717006107/en/

Source/Contact for Media Inquiries OnlyLieff Cabraser

Heimann & Bernstein, LLPSharon M. Lee, 1-800-541-7358

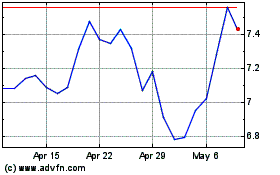

Aarons (NYSE:AAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

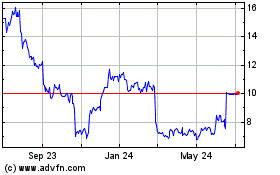

Aarons (NYSE:AAN)

Historical Stock Chart

From Apr 2023 to Apr 2024