UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☒

|

Soliciting Material Under Rule 14a-12

|

|

PEREGRINE PHARMACEUTICALS, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

RONIN TRADING, LLC

JOHN S. STAFFORD, III

SWIM PARTNERS LP

SW INVESTMENT MANAGEMENT LLC

STEPHEN WHITE

GREGORY P. SARGEN

BRIAN W. SCANLAN

SAIID ZARRABIAN

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Ronin Trading, LLC and

SW Investment Management LLC, together with the other participants named herein (collectively, “Ronin”), intend to

make a preliminary filing with the Securities and Exchange Commission of a proxy statement and accompanying proxy card to be used

to solicit votes for the election of Ronin’s slate of three highly qualified director nominees to the Board of Directors

of Peregrine Pharmaceuticals, Inc., a Delaware corporation (the “Company”), at the Company’s upcoming 2017 annual

meeting of stockholders, or any other meeting of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings

or continuations thereof.

On July 13, 2017,

Ronin issued the following press release:

RONIN

TRADING AND SW INVESTMENT MANAGEMENT ISSUE LETTER TO STOCKHOLDERS OF PEREGRINE PHARMACEUTICALS

Believe

Change is Desperately Needed to Peregrine’s Board Given Current Strategy, Poor Corporate Governance, Apparent Misalignment

of Interests with Stockholders and Constant Dilution

Announces

Nomination of Gregory P. Sargen, Brian W. Scanlan and Saiid Zarrabian for Election at Upcoming 2017 Annual Meeting

CHICAGO,

IL, July 13, 2017 – Ronin Trading, LLC and SW Investment Management LLC (together with the other participants in their solicitation,

“Ronin”), collectively the second largest stockholder of Peregrine Pharmaceuticals, Inc. (“Peregrine” or

the “Company”) (NASDAQ:PPHM), with aggregate beneficial ownership of approximately 8.8% of the Company’s outstanding

shares of common stock, today issued a letter to Peregrine’s stockholders. In the letter, Ronin announced that it has formally

nominated three independent, highly-qualified candidates, Gregory P. Sargen, Brian W. Scanlan and Saiid Zarrabian, for election

to the Company’s Board of Directors (the “Board”) at the Company’s upcoming 2017 annual meeting of stockholders.

As explained in the letter, Ronin believes that there are opportunities to increase stockholder value; however, Ronin is concerned

that stockholders will continue to suffer unless the Board is reconstituted with directors who will represent stockholders’

best interests. The full text of the letter follows:

July

13, 2017

Dear

Fellow Peregrine Stockholders:

Ronin

Trading, LLC and SW Investment Management LLC (together, “we”) collectively beneficially own approximately 8.8% of

the outstanding shares of Peregrine Pharmaceuticals, Inc. (“Peregrine” or the “Company”), making us the

Company’s second largest stockholder.

1

As we have discussed on several

occasions with the Company’s management, we are extremely concerned by Peregrine’s current strategy, the continuous

dilution of stockholders and the Company’s exceptionally weak corporate governance.

Both

publicly and in our private conversations with management, we were shocked that neither Steven W. King nor Paul J. Lytle, Peregrine’s

Chief Executive Officer and Chief Financial Officer, respectively, could articulate any long-term strategy for addressing the capital

needs of the Company, curing the outstanding going concern notice or rectifying the Company’s corporate governance shortcomings,

including the apparent interest misalignment of directors and other problems associated with Peregrine’s Board of Directors

(the “Board”).

Now,

well over a year after another clinical failure of bavituximab (the Company’s immunotherapy drug candidate), instead of addressing

the core problems of the Company, the Board relies on tangential, counterfactual, and straw-man arguments to justify their positions,

in desperate attempts to externalize the problems they have created. We believe immediate changes are necessary to stop Peregrine’s

reckless spending and equity dilution in order to put the Company on the path towards creating value for stockholders and stability

for employees.

1

Source: Peregrine’s Form 8-K filed on July 7, 2017, disclosing approximately 45 million shares outstanding

(315 million pre-split).

It

is important you understand that, unlike the current Board, our interests are aligned with yours. Like you, we will only be able

to achieve a return on our investment upon the appreciation in value of Peregrine’s stock and we will lose our money if the

Company continues to perform poorly. We have histories of successful investments in biotech and pharmaceutical contract development

and manufacturing firms, and we believe it is obvious that the only path towards creating value for all stockholders begins with

electing a new group of highly qualified independent directors and a sensible change of strategy. We would like to take this opportunity

to explain the strategic changes that we believe are necessary to increase stockholder value and detail why we believe ALL stakeholders

– stockholders, employees and customers – would benefit from the election of our independent, highly qualified director

candidates at the upcoming 2017 Annual Meeting.

Suspend

All Clinical Development Activities

All

clinical development activities should be immediately halted and the Company’s cost structure must be adjusted accordingly.

In the last decade, we estimate that Peregrine has spent over $300 million cumulatively in research and development on clinical

development activities, which are almost entirely related to bavituximab, a drug which has been unsuccessful in numerous clinical

studies, most recently failing a Phase III SUNRISE trial in February 2016 for small cell lung cancer. It has shown similarly disappointing

results for breast cancer, hepatitis C, and pancreatic cancer. Given bavituximab’s poor performance in clinical trials, it

is

questionable

whether any further spending on its development

is warranted at all; however, given Peregrine’s financial condition and the emergence of its contract development and manufacturing

business, Avid Bioservices (“Avid”), squandering additional capital on further studies is objectively indefensible.

The profligate spending on risky clinical development has caused Peregrine to continually resort to myopic and harmful financing

solutions which have caused staggering stockholder dilution amounting to an astonishing 30% annually since fiscal year (“FY”)

2010. In its most recent Form 8-K filing on July 7, 2017, the Company revealed that the number of outstanding shares had risen

to 315 million (now split-adjusted to 45 million shares), bringing the total dilution in FY 2017 alone (plus the subsequent period

from April 30, 2017 through July 7, 2017) to an outrageous 45.6%. That management publicly laments its stock price and claims a

focus on creating value for all stockholders while simultaneously diluting stockholders at such an extraordinary (and accelerating)

rate shows a profound misunderstanding of

governance, management and

stockholder value.

This

chart should make investors shake their heads in utter disbelief –

THE DILUTION NEEDS TO STOP

! Peregrine must immediately

cease all clinical development activities, adjust its cost structure accordingly, and begin a process to monetize its intellectual

property, either through an outright sale or a contingent value right to a larger pharmaceutical firm that has the financial ability

to underwrite further studies. Peregrine’s losses are entirely attributed to its roughly $30 million in annual clinical development

activities. By stopping clinical development activities and monetizing the intellectual property, many of Peregrine’s problems

will automatically be solved, as it will no longer be deeply unprofitable or need to constantly dilute stockholders at such a rapid

rate. Furthermore, this will enable Peregrine to focus on profitably growing Avid, which will no longer have to internally compete

for capital with the extremely risky clinical development spending.

Refocus

on Contract Development and Manufacturing

Avid

is an extremely attractive business in a secularly growing market. Because of the growing demand for biologic and biosimilar drugs,

we are very optimistic about the outlook for biologics contract manufacturers, particularly smaller ones like Avid that have embraced

single-use bioreactor technology. Avid’s excellent regulatory track record and premier customer list are validation of the

quality of the business and its prospects for long-term growth with high returns on capital. However, Avid has entirely different

capital requirements, cash flow profiles, regulatory demands, scientific expertise and managerial needs than Peregrine’s

high-risk clinical development. It is illogical for Avid to be owned alongside Peregrine’s high risk clinical development

activities. No other public contract manufacturer has a large clinical development operation, let alone one that renders the whole

company massively unprofitable.

Management

has stated that only 10% of Peregrine’s employees are directly related to its clinical development operations.

2

Unfortunately for the other 90% of employees who work at Avid, the price of Peregrine’s stock is almost entirely driven by

clinical development activities and the massive losses and dilution it causes. We were shocked that management was totally unappreciative

of how misaligned the Company is with 90% of its own

employees

.

2

Source: Conversation with Steven W. King and Paul J. Lytle.

We

agree with management’s public comments about Avid being an excellent business whose value is not accurately reflected in

Peregrine’s stock price, but how can any investor confidently value the price of the stock when the dilution is both severe

and perpetual?

No one knows what share count to use

. This is such an obvious problem, but again, we were shocked that in

private conversations with management, they could not comprehend how the endless dilution has contributed to Peregrine’s

poor stock performance under their watch. It is clear to us that Avid is a great business and it should be a standalone company

with the right people and incentives in place in order to continue its growth for the long-run.

Poor

Corporate Governance Is to Blame – Changes Must Be Made

In

our opinion, underpinning Peregrine’s extreme losses, dilution, and stockholder value destruction are Peregrine’s three

independent directors,

Eric S. Swartz, Carlton M. Johnson and David H. Pohl, who we believe are primarily responsible for

Peregrine’s problems. With little-to-no interest alignment with stockholders, no experience with contract manufacturing,

track records of enormous stockholder losses and questionable public company dealings outside of Peregrine, we do not believe it

is appropriate for these individuals to continue serving as directors of Peregrine. We believe that radical changes to Peregrine’s

Board are urgently needed to ensure that stockholders’ best interests are appropriately represented in the boardroom.

Severe Interest Misalignment

with Stockholders

Messrs. Swartz and Johnson

have each served as directors since 1999, while Mr. Pohl has served as a director since 2004. Despite their unusually long tenures,

these three independent directors collectively outright own less than 0.22% of the shares outstanding. Although these directors

have been granted hundreds of thousands of stock options, most of these options are deep out-of-the-money, meaning they don’t

have much of a vested financial interest in the Company. More telling as to just how little skin in the game these directors have

is that no independent director has personally made an open market purchase of Peregrine shares in over nine years,

3

and Mr. Pohl has not purchased a single Peregrine share in his nearly 13 years on the Board, and owns just 286 shares outright.

|

Director

|

Shares Owned

|

% Outstanding

|

Options Awarded

|

Last Open Market Purchase

|

|

Eric S. Swartz

|

96,017

|

0.213%

|

274,215

|

2008

|

|

David H. Pohl

|

286

|

0.001%

|

274,215

|

Never

|

|

Carlton M. Johnson

|

1,095

|

0.002%

|

274,215

|

2007

|

|

Source: SEC filings; adjusted for reverse split.

|

|

Despite Peregrine’s abysmal

stock price performance during their tenure, the continuous dilution of stockholders and repeated clinical failures, these three

directors have collectively earned over $10 million in total compensation since the start of FY 2010, and that is not even counting

whatever they have received after April 30, 2016!

4

3

Excludes indirect purchases made by Highlight Fund, LLC reported on Form 4 filings by Eric S. Swartz given no relationship is explained.

4

Source: Peregrine’s SEC filings.

|

Director

|

Average 5 Year Compensation

|

Last Fiscal Year Compensation

|

|

|

|

|

Eric S. Swartz

|

$512,099

|

$518,038

|

|

|

David H. Pohl

|

$499,699

|

$488,038

|

|

|

Carlton M. Johnson

|

$560,099

|

$548,038

|

|

|

Source: SEC filings.

|

|

|

|

The average director compensation

for LARGE pharmaceutical firms Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, Eli Lilly and Company and AbbVie Inc.

is approximately $301,000 per year, with only one of such company’s average director compensation being higher than $300,000.

5

As disclosed in Peregrine’s proxy statement for the 2016 Annual Meeting, the Company’s independent directors each received

an average of over $518,000 in total compensation, over 72% higher than the average compensation received by directors of the aforementioned

highly successful large-cap pharmaceutical companies.

With immaterial stock ownership

and unjustifiably high compensation, there is effectively no interest alignment between the Board and Peregrine’s stockholders.

We have little doubt that this interest misalignment has played a key role in the relentless dilution which has led to the destruction

of stockholder value.

The interest misalignment also

appears to extend to Peregrine’s management team. Steven W. King (CEO) and Paul J. Lytle (CFO) have each been at the Company

for 20 years. Despite their long tenure, combined they own outright less than 0.14% of the Company. Peregrine’s five named

executive officers (“NEO’s”) own outright a combined 93,467 shares of the Company, a mere 0.21% stake!

6

While the NEO’s have been granted over 1 million options,

7

only a fraction of those options are in-the-money,

leaving them with a minimal vested financial interest.

5

Source: SEC filings from Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, Eli Lilly and Company and AbbVie Inc.

6

Source: Peregrine’s SEC filings and Form 4 filings made by the NEOs. 93,467 figure is adjusted for reverse split and even includes 1,071 shares that could be acquired upon conversion of Series E Preferred Stock owned by NEO Mark R. Ziebell.

7

Source: Peregrine’s SEC filings and Form 4 filings made by the NEOs. Adjusted for reverse split.

Most recently, on April 28,

2017, Messrs. King and Lytle and Joseph S. Shan (Vice President) each filed Form 4’s indicating purchases of 19,941 shares,

37,389 shares and 39,177 shares, respectively.

8

Even though these shares were purchased on April 28

th

,

a day on which Peregrine’s stock closed at $0.6156 per share, these insiders purchased their shares for $0.2712 per share,

giving them an instant gain of over 125%. How was this possible?

Messrs. King, Lytle and Shan

purchased their shares through Peregrine’s Employee Stock Purchase Plan, which gives certain insiders a six month look-back

window (the two windows ending October 31

st

and April 30

th

) to purchase stock at 85% of the fair market value

on either the first or last day of the window. With April 28

th

being the final trading day of the window, insiders were

allowed to purchase stock at 85% of the price of Peregrine’s shares on either April 28, 2017 or November 1, 2016. Accordingly,

despite the price of Peregrine’s stock rising materially from its close of $0.319 per share on November 1, 2016, Peregrine

insiders were able to purchase stock

from the Company

on April 28, 2017 at 85% of the price of Peregrine shares six

months ago (i.e. $0.2712 per share).

Peregrine’s Employee

Stock Purchase Plan, which allows management to profit at the direct expense of stockholders, is yet another example of the misalignment

of interests and the cultural leadership plague that has harmed Peregrine’s stockholders. Management being allowed to profit

directly at stockholders’ expense is insulting. We believe these purchases are unfair, dilutive and fail to properly incentivize

management.

Independent

Directors Lack Relevant Experience

It

appears that not one of the three independent directors possess ANY experience, no matter how tangential, in either contract manufacturing

or biotechnology.

Mr.

Pohl is a semi-retired attorney who serves as Of Counsel for Herold & Sager, a small law firm based in California. Although

his area of practice for Herold & Sager is not described, his bio for Peregrine notes that he previously worked as general

counsel for large financial services companies. He has served as a director on one other public board – a company without

any revenues in its history that has unsuccessfully attempted to license semiconductor technology. Mr. Pohl does not appear to

have any experience whatsoever with biotechnology or contract manufacturing.

Mr.

Swartz is a financier who was most recently registered as a broker for NMS Capital Advisors LLC for one year, ending in 2016, according

to FINRA records. We were unable to find any recent activity with the various investment entities that he owns and manages (as

described further in the section below). Mr. Swartz does not appear to have any experience of any kind with biotechnology or contract

manufacturing, nor does he have any public board experience outside of Peregrine.

Mr.

Johnson is a self-employed attorney, although he is also described as having been a stockholder of the law firm of Smith, Sauer,

DeMaria, Johnson out of Florida. Although various websites describe this firm’s specialty as “elder care,” oddly,

no website exists for the firm. None of Mr. Johnson’s biographical information suggests any background in biotechnology or

contract manufacturing. He has served on three other public company boards, none of which relate to biotechnology or contract manufacturing.

8

Number of shares and purchase prices not adjusted to reflect 1-for-7 reverse stock split that became effective on July 7, 2017 in discussion regarding Employee Stock Purchase Plan.

Despite

their apparent lack of relevant experience, these directors somehow annually make hundreds of thousands of dollars more for their

service on Peregrine’s Board than their counterparts who serve as directors of the hundred-billion dollar pharmaceutical

firms noted above.

Independent

Directors Have Records of Value Destruction and Questionable Dealings

In

addition to the severe interest misalignment with stockholders and absence of relevant experience to Peregrine’s businesses,

the involvement with public companies that Messrs. Johnson, Pohl and Swartz do have is characterized by shockingly consistent failure

and stockholder value destruction that should deeply concern all Peregrine stockholders.

Mr.

Pohl currently serves on the advisory board of Max Sound Corp. (OTC: MAXD) (“Max Sound”), a $2.0 million market cap

company with a stock price of roughly $0.002 per share and no revenue in the company’s history.

9

Mr. Pohl joined

Max Sound’s advisory board in August 2014 with a grandiose press release describing him as a “famed attorney”

joining Max Sound’s self-proclaimed “prestigious” advisory board. Mr. Pohl joined the advisory board despite

possessing no identifiable background in the type of audio “disruptive technology” that Max Sound claims to own (and

has unsuccessfully tried to sue companies like Google for royalties). Shares of Max Sound have lost nearly 99% of their value since

Mr. Pohl joined the company.

Mr.

Pohl’s only other public company experience was serving as a director of Patriot Scientific Corp. (OTC: PTSC) (“Patriot

Scientific”), a $5.6 million market cap company with a stock price of roughly $0.014 per share,

10

from 2001-2008,

while also serving as its CEO from 2005-2007. Patriot Scientific (where Mr. Johnson has also served as a director since 2001),

like Max Sound, is a failed intellectual property company that has not generated any material revenue in the life of the company

and has had zero revenues since 2010. Since 2001, Patriot Scientific’s stock has lost roughly 94% of its value.

Mr.

Swartz is the founder, principal and/or manager of several financial firms including Roswell Capital Partners, LLC, Equiplace Securities,

LLC, Swartz Investments, LLC, BridgePointe Master Fund Ltd. and Centurion Private Equity, LLC (collectively, the “Roswell

entities”). These are a mix of related finance and investment vehicles managed by Mr. Swartz, and they have been involved

with raising capital for questionable pink sheet stocks since the mid-1990s.

According

to his Peregrine biography, Mr. Johnson worked for Mr. Swartz since at least 1996, acting as in-house legal counsel for Roswell

Capital affiliated entities until becoming “self-employed” in 2013. Mr. Johnson has also served as a director of Patriot

Scientific since August 2001 (where Mr. Pohl previously served as a director and CEO as noted above), during which time its fully

diluted share count has increased by roughly 650% while its stock has lost approximately 94% of its value. Mr. Johnson previously

served as a director of Cryoport, Inc. (NASDAQ: CYRX) from 2009-2012,

11

during which time the stock lost 84% of its

value while the fully diluted share count increased by over 800%. He also previously served as a director of ECOtality, Inc. (formerly

OTC:ECTYQ) from 2009-2011,

12

during which time the stock lost 90% of its value while the fully diluted share count

increased by over 500%, with the company later filing for bankruptcy in 2013.

9

Max Sound share price and market cap as of July 12, 2017.

10

Patriot Scientific share price and market cap as of July 12, 2017.

11

Served as a director of Cryoport, Inc. from May 4, 2009 to March 1, 2012. Source: SEC filings; Bloomberg

12

Served as a director of ECOtality, Inc. from October 30, 2009 to December 15, 2011. Source: SEC filings; Bloomberg

Unfortunately,

Messrs. Swartz’s and Johnson’s track record with failed and highly questionable companies at the Roswell entities is

so long that for the sake of brevity we are limited to providing a partial list of the penny stock companies and a very brief description

of the relevant outcomes for stockholders. According to public records, below is a limited list of public companies which Messrs.

Swartz and Johnson have provided (or attempted to provide) financing to and have generally been involved with.

|

|

Date of Announcement

|

Split-Adjusted Stock Price at Time of First Involvement

|

Announced Capital Investment

|

Stock Performance (Rounded)

|

|

|

|

Note

|

|

Company

|

|

Alternate Energy Holdings

|

November 2010

|

$0.690

|

$150 million

|

-100%

|

Bankrupt; CEO and CFO convicted of fraud

|

|

MabCure

|

January 2011

|

$0.430

|

$10 million

|

-100%

|

Trades for $0.003 per share

|

|

Medisafe 1 Technologies

|

February 2011

|

$0.170

|

$5 million

|

-100%

|

Delisted

|

|

Diadem Resources

|

March 2011

|

$0.090

|

$8 million

|

-100%

|

Delisted

|

|

Minerco Resources Inc

|

December 2010

|

$0.009

|

$5 million

|

-100%

|

Trades for $0.0022 per share

|

|

Clean Power Concepts

|

April 2011

|

$0.110

|

$7.2 million

|

-100%

|

Trades for $0.0001 per share

|

|

Amarantus BioSciences Inc

|

October 2011

|

$0.161

|

$30 million

|

-100%

|

Trades for $0.05 per share

|

|

Green EnviroTech Holdings

|

March 2011

|

$0.640

|

$10 million

|

-100%

|

Trades for $0.05 per share

|

|

DC Brands International

|

February 2011

|

$0.075

|

$5 million

|

-100%

|

Delisted

|

|

Prominex Resource Corp

|

February 2011

|

$0.060

|

$20 million

|

-100%

|

Delisted

|

|

Conway Resources

|

March 2011

|

$0.080

|

5 million CAD

|

-100%

|

Delisted

|

|

WinSonic Digital Media

|

August 2010

|

$0.040

|

$10 million

|

-100%

|

Delisted

|

|

ICP Solar Technologies

|

June 2008

|

$0.670

|

$5 million

|

-100%

|

Delisted

|

|

Gopher Protocall

|

June 2011

|

$0.120

|

$10 million

|

-100%

|

Delisted

|

|

LI3 Energy Inc

|

December 2010

|

$0.230

|

$10 million

|

-91%

|

$10 million market cap

|

|

Novation Holdings Inc

|

August 2011

|

$0.570

|

$30 million

|

-100%

|

Trades for $0.0001 per share

|

Source:

SEC filings; press releases.

While

the value destruction speaks for itself, even more troubling is that many of these companies appear to follow a disturbing pattern:

pink sheet stocks trading for pennies, no history of revenues or business activities, large reverse-splits, frequent changes to

the company’s name, a flurry of highly promotional press releases and paid promotional campaigns and stocks which collapsed

in a short amount of time after raising capital, eventually being delisted. We have been hard-pressed to find a single stock which

the Roswell entities raised capital for that did not resemble one of these extremely troubling fact patterns.

Typically,

the Roswell entities provided “equity funding facilities” that allowed highly questionable companies to issue soon-to-be-worthless

stock to the general public. Importantly, the Roswell entities were merely acting as a conduit to raise money for such companies,

and were not actually investing capital into them. In fact, most of these equity funding facilities permitted the Roswell entities

to short the stocks before purchasing discounted shares from the company, effectively allowing the Roswell entities to lock in

a profit at the expense of the public without making any investment in the companies. There is no shortage of other unsettling

public company dealings from the Roswell entities, which we can detail in future communications.

We

believe it is EXTREMELY inappropriate to allow people who appear to be consistently associated with stockholder value destruction

to be entrusted as fiduciaries in ANY capacity at ANY public company. The stockholders of Peregrine deserve a Board comprised of

highly-qualified independent directors with relevant industry experience and track records of creating stockholder value. Instead,

the current Board consists of individuals with track records of value destruction and questionable dealings that cast immense doubt

on their ability to act in stockholders’ best interests.

ISS

Has Previously Recommended WITHHOLD Votes Against ALL Independent Directors

Based

on the results from last year’s annual meeting, where every independent director received at least 30% WITHHOLD votes with

respect to their re-election, it is clear that we are not the only ones who are extremely displeased with the composition of the

Board and ready for immediate change. In addition, leading independent proxy advisory firm Institutional Shareholder Services (ISS)

recommended a WITHHOLD vote with respect to each of Peregrine’s directors, stating:

“

WITHHOLD

votes are warranted for compensation committee members Carlton M. Johnson Jr., David H. Pohl, and Eric S. Swartz due to continued

problematic pay practices and the board's failure to adequately respond to shareholder concerns

.”

In

fact, ISS has recommended WITHHOLD votes against ALL independent directors at each of the past THREE annual meetings. While change

is desperately needed at Peregrine, the incumbents appear committed to a pattern of entrenchment. In fact, we are concerned that

the Company may have deliberately taken action to frustrate our nomination of director candidates, including by closing its transfer

books for an extended period of time.

The

status quo, as evidenced by the outrageous equity dilution and abysmal corporate governance practices, has proven untenable, which

is why we have formally nominated three independent, highly-qualified candidates, Gregory P. Sargen, Brian W. Scanlan and Saiid

Zarrabian, for election at the upcoming 2017 Annual Meeting. In the 16 months since bavituximab’s failure of its Phase III

SUNRISE trial, the Board has failed to address the Company’s problems, and instead, stockholders continue to be diluted at

a preposterous rate. We believe the individuals we have nominated possess the financial, operational and strategic acumen the Board

urgently needs to enhance stockholder value.

Our

Director Nominees: Qualified, Successful, Independent

Gregory

P. Sargen

(“Greg”) is the former Chief Financial Officer and currently the Executive Vice President of Corporate

Development of Cambrex Corp. (NYSE: CBM) (“Cambrex”), a $1.9 billion market capitalization contract manufacturing organization

headquartered in Rutherford, New Jersey. In 2017, Cambrex received 24 awards at the CMO Leadership Awards, for capabilities compatibility,

development, expertise, quality, and reliability. During the period of Greg’s role as CFO (February 2007 – January

2017), Cambrex’s stock price increased approximately 408%, a 17.7% annualized return for stockholders over a 10-year period.

As CFO, Greg played a key role in overseeing Cambrex’s revenue growth of over 94% and its earnings per share growth of over

625%. Greg has a track record of executive leadership, strong stockholder returns, and excellent experience within the advanced

pharmaceutical ingredients (API) contract manufacturing industry. Greg received a bachelor’s degree from Penn State University

and an MBA from the Wharton School of the University of Pennsylvania.

Brian

W. Scanlan

(“Brian”) is Managing Partner of Freedom Bioscience Partners, LLC, a pharmaceutical services business

advisory firm providing direct, dedicated senior leadership support, strategic direction and industry expertise. Brian also currently

serves as a director of Callery, LLC, a spin-off of BASF that is a global leader in highly reactive chemistries. From March 2011

to October 2013, Brian served as President and Chief Executive Officer of Cambridge Major Laboratories, Inc. (“CML”)

(n/k/a Alcami Corporation), a leading global chemistry outsourcing provider of integrated drug development and manufacturing services

to the pharmaceutical and biotechnology industries. Brian initially joined CML in 2002 and held various leadership positions prior

to becoming President and Chief Executive Officer, including Chief Business Officer, Vice President – Corporate Development,

Vice President – Business Development and Director – Sales & Marketing. He also served on the Board of Directors

of CML from 2007 to June 2014. Prior to joining CML, Brian served as Manager of Business Development at Rhodia ChiRex Inc., a multinational

technology and custom pharmaceutical development and manufacturing firm, from 2000 to 2002. From 1998 to 2000, Brian served as

Manager of Sales & Marketing at Universal Pharma Technologies, LLC, a premiere innovator, developer and supplier of pharmaceutical

manufacturing equipment and technologies focused on accelerating drug development. Brian began his career in 1991 as a Research

Chemist at UOP LLC (n/k/a Honeywell UOP), the leading international supplier and technology licensor for the petroleum refining,

gas processing, petrochemical production and major manufacturing industries, after which he led marketing efforts for UOP’s

Specialty Chemicals Group from 1995 to 1998. Brian earned his MBA from the Illinois Institute of Technology and a B.S. in Chemistry

from Northern Illinois University.

Saiid

Zarrabian

(“Saiid”) has nearly 40 years of board and executive/operational experience in multiple industries, including

23 years experience in the biotech, pharmaceutical & instrumentation industries. He currently serves as an advisor to Redline

Capital Partners, S.A., a Luxembourg based biotechnology and pharmaceuticals focused investment firm. Saiid has been involved in

multiple turnaround situations, including most recently as Chairman of the Board of La Jolla Pharmaceutical Company (NASDAQ: LJPC)

during the company’s transition from an OTC-traded penny stock company to a NASDAQ-listed company with a successful phase

three drug. He previously served as CEO, President and a director of Cyntellect, Inc. (2010 – 2012), a stem cell processing

and visualization instrumentation company, where he led the company’s annual revenue growth from $800,000 to $11 million,

culminating in a sale of the company in 2012. Some of Saiid’s notable engagements include serving as a consultant/acting

COO for SciTegic, Inc. (2002 – 2004), an informatics company with 10X revenue growth culminating in a sale of the company

at >35X invested capital within 2.5 years of his engagement; a director of eMolecules, Inc. (2009-2011), a chemistry eCommerce

portal whose revenues grew from less than $500,000 to over $20 million; and a director of Penwest Pharmaceuticals Co. (2010) (formerly

NASDAQ:PPCO), where he was a director nominee of an activist investor and the company was sold at ~3x its share price in less than

1 year. Saiid’s professional experience also includes serving as an executive of Intrexon Corporation (NYSE: XON), Senomyx,

Inc. (NASDAQ: SNMX), Pharmacopeia, Inc., Molecular Simulations, Inc., Symbolics, Inc. and Computervision Corporation. Additional

directorships he has held in the industry include Immune Therapeutics, Inc. (OTC:IMUN), Exemplar Pharma, LLC and Ambit Biosciences

Corporation.

We strongly believe that the

Company’s stockholders will benefit from the addition of Messrs. Sargen, Scanlan and Zarrabian to the Board and we look forward

to providing stockholders with an alternative to the status quo at the upcoming 2017 Annual Meeting.

Regards,

John S. Stafford III

RONIN TRADING, LLC

Stephen White

SW INVESTMENT MANAGEMENT LLC

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Ronin Trading, LLC, together with the other

participants named herein (collectively, “Ronin”), intends to file a preliminary proxy statement and an accompanying

proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its

slate of three highly qualified director nominees at the 2017 annual meeting of stockholders Peregrine Pharmaceuticals, Inc., a

Delaware corporation (the “Company”).

RONIN STRONGLY ADVISES ALL STOCKHOLDERS OF

THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the solicitation are Ronin

Trading, LLC (“Ronin Trading”), John S. Stafford, III, SWIM Partners LP (“SWIM Partners”), SW Investment

Management LLC (“SW Management”), Stephen White, Gregory P. Sargen, Brian W. Scanlan and Saiid Zarrabian.

As of the date hereof, Ronin Trading directly

beneficially owned 3,310,651 shares of the Company’s common stock, $0.001 par value per share (“Common Stock”),

including 137,260 shares of Common Stock that may be acquired upon the conversion of 115,299 shares of the Company’s 10.50%

Series E Convertible Preferred Stock, $0.001 par value per share (“Series E Preferred Stock”). Mr. Stafford, as the

Manager of Ronin Trading, may be deemed to beneficially own the 3,310,651 shares of Common Stock beneficially owned directly by

Ronin Trading. As of the date hereof, SWIM Partners directly beneficially owned 469,308 shares of Common Stock, including 10,333

shares of Common Stock that may be acquired upon the conversion of 8,680 shares of Series E Preferred Stock. As of the date hereof,

an account separately managed by SW Management (the “SW Account”) held 172,487 shares of Common Stock, including 3,714

shares of Common Stock that may be acquired upon the conversion of 3,120 shares of Series E Preferred Stock. SW Management, as

the general partner and investment adviser of SWIM Partners and the investment adviser of the SW Account, may be deemed to beneficially

own the 641,795 shares of Common Stock beneficially owned in the aggregate by SWIM Partners and held in the SW Account. Mr. White,

as the Manager of SW Management, may be deemed to beneficially own the 641,795 shares of Common Stock beneficially owned in the

aggregate by SWIM Partners and held in the SW Account. As of the date hereof, Messrs. Sargen, Scanlan and Zarrabian did not beneficially

own any securities of the Company.

Investor Contact:

Stephen White

SW Investment Management LLC

(312) 765-7033

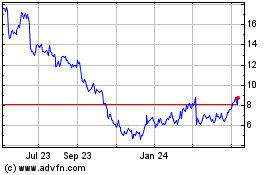

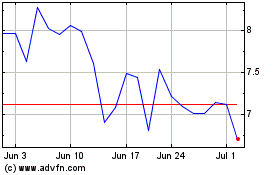

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Apr 2023 to Apr 2024