CIAU Trading Signals VERY BULLISH After Pullback From 900% Increase Indicating Big Bounce Potential

July 11 2017 - 2:15PM

InvestorsHub NewsWire

New York, NY - July

11, 2017 - InvestorsHub NewsWire - Wall Street Corner

Report

Ciao Group, Inc. (USOTC:

CIAU) technical trading indicators are currently

signaling VERY BULLISH according to Stock

Technical Analysis (www.stockta.com/)

even though the PPS has trended substantially down over the past

week of trading. In the 30 days prior to the last week PPS decline,

CIAU stock went up 900% from $0.05 to a high of $0.50. During the

historically market lite July 4th vacation week, the PPS

has retraced on a lower volume of trading down to a PPS of $0.12 by

$0.14. Mind you, this PPS is still over 100% higher than the where

it started 30 days ago. While a 900% increase is exciting, it’s

unlikely to continue without periodic profit taking. With big

swings up, one should expect big swings down. Even after a

big swing down, CIAU is still well in the profit zone after its

previous run. With the trading indicators signaling VERY

BULLISH, CIAU could well be preparing to run again. CIAU

could experience a number of big up and down swings until it finds

its sweet spot. This could be a great opportunity to profit

on the swings.

Ciao Group recently announced a refreshed business plan to

concentrate on developing locally sourced technology and

telecommunication services within frontier and emerging economic

markets. The Company is in the process of changing its name to

NuMelo Technology as part of the business plan refresh. The

Company has recently hired Henryk Dabrowski, the exiting CEO from

Alternet Systems, (ALYI)

to lead the Companies introduction of its own digital coin.

The Company has also engaged to assit North American Cannabis

Holdings, Inc. (USMJ)

in the introduction of a digial coin for the marijuana market.

http://www.wallstreetcornerreport.com/more-news/

https://twitter.com/WallStCornerRpt

This press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended

(the "Exchange Act"), and as such, may involve risks and

uncertainties. These forward looking statements relate to, amongst

other things, current expectation of the business environment in

which the company operates, potential future performance,

projections of future performance and the perceived opportunities

in the market. The company's actual performance, results and

achievements may differ materially from the expressed or implied in

such forward-looking statements as a result of a wide range of

factors.

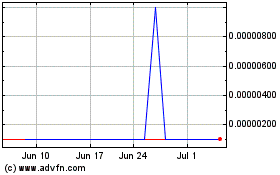

North American Cannabis (CE) (USOTC:USMJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

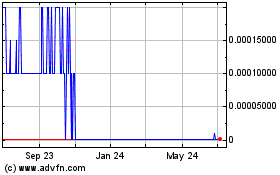

North American Cannabis (CE) (USOTC:USMJ)

Historical Stock Chart

From Apr 2023 to Apr 2024