Current Report Filing (8-k)

July 10 2017 - 6:17AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July

3, 2017

Textmunication Holdings Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-21202

|

|

58-1588291

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

|

1940

Contra Costa Blvd.

Pleasant

Hill, CA

|

|

94523

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code:

925-777-2111

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

SECTION

1 – REGISTRANT’S BUSINESS AND OPERATIONS

Item

1.01 Entry into a Material Definitive Agreement

Effective

July 3, 2017, our company and Auctus Fund, LLC (“Auctus”) entered into a Settlement Agreement and Mutual General Release

(the “Settlement Agreement”). Pursuant to the Settlement Agreement, the parties agreed as follows:

|

|

●

|

We

agreed to issue 550,000,000 shares of our common stock (the “Shares”) to Auctus in settlement of a Securities

Purchase Agreement with Auctus dated July 22, 2016;

|

|

|

|

|

|

|

●

|

The

Shares are subject to a Leak-Out Agreement, which provides that Auctus may publicly sell daily the greater of 4,910,714 shares

or 20% of the average daily trading volume over the prior 10-day trading period; and

|

|

|

|

|

|

|

●

|

Upon

receipt of the Shares and an irrevocable letter of instruction to our transfer agent, which was executed on July 3, 2017,

the parties agreed to release each other from all claims.

|

The

foregoing description is intended only as a summary of the material terms of the Settlement Agreement and Leak-Out Agreement and

is qualified in its entirety by reference to the full Settlement Agreement and Leak-Out Agreement, copies of which are attached

as Exhibits 10.1 and 10.2 to this Form 8-K and are hereby incorporated by reference herein.

Item

1.02 Termination of a Material Definitive Agreement

The

information provided in Item 1.01 concerning the termination of a material definitive agreement is incorporated by reference in

this Item 1.02.

SECTION

9 – FINANCIAL STATEMENTS AND EXHIBITS

Item

9.01 Financial Statements and Exhibits

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Settlement

Agreement, dated June 23, 2017

|

|

10.2

|

|

Leak-Out

Agreement, dated June 23, 2017

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Textmunication

Holdings.

|

/s/ Wais Asefi

|

|

|

Wais

Asefi

|

|

|

Chief

Executive Officer

|

|

|

Date:

July 10, 2017

|

|

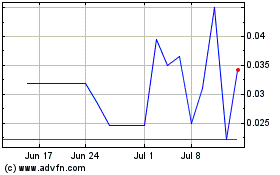

Resonate Blends (PK) (USOTC:KOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Resonate Blends (PK) (USOTC:KOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024