Current Report Filing (8-k)

July 07 2017 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 6, 2017

ADVAXIS, INC.

(Exact name of Registrant as Specified in its

Charter)

|

Delaware

|

|

000-28489

|

|

02-0563870

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

305 College Road East

Princeton, New Jersey, 08540

|

|

(Address of Principal Executive Offices)

|

(609) 452-9813

(Registrant’s telephone number, including

area code)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On July 6, 2017, Advaxis,

Inc. (the “Company”) announced that Daniel J. O’Connor has resigned as President and Chief Executive Officer

and as a member of the Board of Directors of the Company, effective today. Anthony Lombardo has assumed the role of interim Chief

Executive Officer to continue driving the Company’s development and commercialization plans forward during this transition.

In connection with Mr.

O’Connor’s departure, the Company and Mr. O’Connor have entered into a separation agreement (“Separation

Agreement”), pursuant to which Mr. O’Connor will receive: (i) cash payments in a total gross amount of $560,000,

payable over a 12 month period, (ii) a one-time gross cash payment of $280,000, payable on or about July 13, 2017, and (iii) continued

vesting on his equity in the Company. The Separation Agreement also contains a continuation of certain medical insurance benefits

and other customary provisions. The foregoing description of the Separation Agreement does not purport to be complete and is qualified

in its entirety by reference to the full text of this document, which is filed hereto as Exhibit 10.1, and is incorporated herein

by reference.

Mr. Lombardo, 70, currently

serves as the Chief Business Officer and Senior Vice President of the Company. He is an accomplished industry veteran with nearly

30 years of leadership experience in the life sciences industry. Prior to joining Advaxis in April 2017, Mr. Lombardo was a Partner

at The Channel Group, where, from 2014 to 2017 he provided strategic advisory services to biotechnology, pharma and med-tech companies.

Previously, beginning in 2000, he was President and CEO of E-Z-EM Inc., which was sold to Bracco Diagnostics in 2008, where Mr.

Lombardo remained and oversaw business operations for six years as the Chief Operating Officer. Prior to joining E-Z-EM, Lombardo

served as the President of ALI Imaging Systems, Inc., which was sold to McKesson in 2002. He has also held leadership roles at

General Electric Medical Systems, Philips Medical Systems, Loral/Lockheed Martin Corp. and Sony Corporation.

No

family relationships exist between Mr. Lombardo and any of the Company’s directors or other executive officers. There are

no arrangements between Mr. Lombardo and any other person pursuant to which Mr. Lombardo was selected as an officer, nor are there

any transactions to which the Company is or was a participant and in which Mr. Lombardo has a material interest subject to disclosure

under Item 404(a) of Regulation S-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is filed as part of this

report:

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Separation Agreement by and between Advaxis, Inc. and Daniel J. O’Connor, dated July 6, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ADVAXIS, INC.

|

|

Date: July 6, 2017

|

|

|

|

|

By:

|

/s/ Sara Bonstein

|

|

|

|

Sara Bonstein

|

|

|

|

Executive Vice President and

Chief Financial Officer

|

INDEX TO EXHIBITS

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Confidential Separation Agreement by and between Advaxis, Inc. and Daniel J. O’Connor, dated July 6, 2017.

|

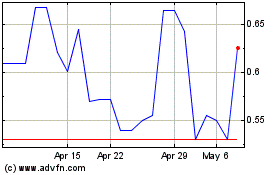

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Apr 2023 to Apr 2024