Trading Glitch Briefly Sets Apple, Amazon and Microsoft Stock Prices at $123.47 -- 2nd Update

July 04 2017 - 1:53AM

Dow Jones News

By Steven Russolillo

A flood of incorrect stock-market data briefly hit traders'

screens around the globe early Tuesday morning in Asia, showing

apparent huge moves in the Nasdaq-listed share prices of some of

the world's biggest companies including tech giants Apple Inc.,

Microsoft Corp. and Amazon.com Inc.

The faulty data on stock prices appeared on several platforms

including Yahoo Finance, Google Finance and on Bloomberg terminals

between 6 a.m. and 7 a.m. Hong Kong time, after U.S. markets had

closed early on Monday ahead of the annual Independence Day

holiday.

As a result of the glitch, which Nasdaq said was caused by

faulty test data being improperly disseminated by third-party

vendors including Bloomberg, several stocks briefly showed their

price to be $123.47--equivalent to a 14% drop in Apple's shares, an

87% plunge for Amazon and a 79% surge for Microsoft.

If the declines had actually occurred, it would have knocked

$104 billion off the market value of Apple, the world's most

valuable stock. Amazon's market cap would have dropped $396

billion, while Microsoft's would have risen $415 billion.

Joe Christinat, a Nasdaq spokesman, said no actual trades were

affected by the glitch.

"This is a vendor issue, not a Nasdaq issue," he said, noting

that others such as FactSet and even Nasdaq.com showed correct

pricing data.

A Bloomberg spokesperson said inquiries should be directed to

Nasdaq and didn't comment beyond that.

Stock markets in the U.S. were only open for half a day on

Monday and will be closed Tuesday for Independence Day. Aftermarket

hours on Nasdaq, during which stocks trade after the traditional

trading day has closed, usually last for four hours. The market

typically closes at 4 p.m. ET. But Nasdaq's Mr. Christinat said the

early close at 1 p.m. ET on Monday might have played a role in the

confusion that prompted the improper use and dissemination of test

data, which he said is sent out after every trading day.

"I've seen quite a few fat-finger incidents when you get a funny

price briefly," said Eric Moffett, a portfolio manager for the T.

Rowe Price Asia Opportunities Equity Fund in Hong Kong. "When I saw

the series of alerts, I figured something was up."

Mr. Moffett said he takes a long-term view on the stocks his

fund invests in, so any sharp moves in the market--fat finger or

not--likely won't prompt any significant trading activity. Even so,

he said the flurry of alerts related to the pricing issues caught

his attention.

"I immediately wondered with something like this if there was

some sort of cyberattack," Mr. Moffett said.

A slew of high-profile trading glitches have roiled markets in

recent years. In May 2010, the Dow Jones Industrial Average plunged

nearly 1000 points in a matter of minutes before rebounding quickly

in what widely became known as the "flash crash." In August 2013, a

technical glitch knocked out trading in all Nasdaq Stock Market

securities for three hours due to a problem with the data feed that

supplied trade information. In July 2015, a glitch forced the New

York Stock Exchange to halt trading for nearly four hours.

The difference this time is that no trades appear to have been

affected by the latest fiasco. A trader notice from Nasdaq said

"certain third parties improperly propagated test data that was

distributed as part of the normal evening test procedures." The

notice added: "All production data was completed by 5:16 p.m. ET as

expected per the early close of the markets. Any data messages

received post 5:16 p.m. should be deemed as test data and purged

from direct data recipient's databases."

A system status message posted on Nasdaq's website said "systems

are operating normally." But not all stock quotes appeared to be

accurate. Shares in Nasdaq-listed biotech giant Amgen Inc. were

still being incorrectly shown down 28% at $123.45 on Google Finance

by late morning Asia time. The stock actually closed Monday at

$172.80.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

July 04, 2017 01:38 ET (05:38 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

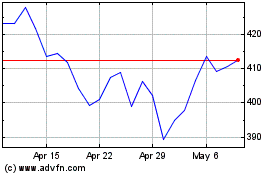

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024